We did it - online accounting for LLC

Six months ago, I made my first post on Habré, in which I talked about our online accounting project, designed to simplify the life of all small businesses. The concept is simple - an online accountant capable of replacing live and doing all the paper work - from calculating taxes to invoicing a client.

Six months ago, I made my first post on Habré, in which I talked about our online accounting project, designed to simplify the life of all small businesses. The concept is simple - an online accountant capable of replacing live and doing all the paper work - from calculating taxes to invoicing a client.Frankly, that post meant a lot to us, and it was an excellent reaction to Habré that breathed life into My Business: the first 100 active users, the first partner contacts, the first ideas about integration - we got all this thanks to Habr. Thanks to everyone who sent ideas to improve the service and found bugs in the beta version - thanks to you, we continue to move forward, wading through the idiocy of tax inspections and bureaucratic aspirations of our country.

Now we have gained weight, and although we have not attracted investments ( investors, ay ), we feel very confident. And with whom, like with Habrom, shares the main news for the last six months.

')

Beta version of MoeDelo.org accounting for LLC on USN is ready!

We went through more than ten different options for the presentation of all the UI problems in the UI and finally came to a solution.

Now only 20% of everything planned for LLC is implemented, but the concept has already been worked out and we invite all those interested to join the project - the new functionality will appear every 2 weeks and, I think, by the third quarter, the owners of the company will be able to dismiss their accountants and keep accounts independently.

Now, in a nutshell, what has been done and how the reporting for the LLC will develop further.

MoeDelo.org in LLC mode

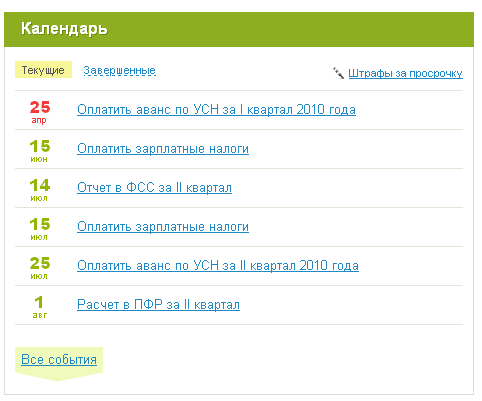

- will remind when what statements and where to take

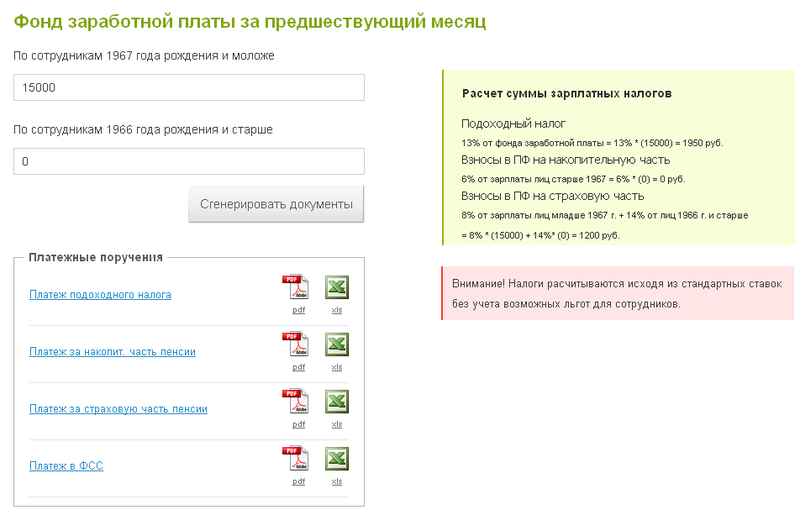

- will calculate payroll taxes at standard rates

- will calculate and generate payment orders for tax payment under the simplified tax system 6% or 15%

- generates all primary documentation - invoices, acts, invoices and contracts

The reporting calendar for an LLC looks much more powerful compared to the IP, this is due to the fact that there is always at least one employee in the LLC - the CEO. And he needs to pay a salary, and therefore all salary taxes.

So far, the calculation of taxes on salaries is made in a general form, but soon we will add the ability to detail salaries for each employee, plus take into account the unofficial salary.

By the third quarter, it will be possible to report to the Pension Fund and the Social Insurance Fund on the documents generated by our system. In the meantime, you can download templates for manual filling in the calendar.

Join and send your suggestions for improvements - we are always happy to see them.

Successes in business!

Ps. SP on the simplified tax system 15% is also supported as well as by 6%

Source: https://habr.com/ru/post/94673/

All Articles