Open PBXs occupy 18% of the North American telephony market

Posted by: John Malone on 02/28/2009

Sales of traditional office and PBX systems have declined in recent years. Experts attribute this to a number of factors. Companies, they said, simply longer exploit their telephone systems. A wave of equipment replacement for Y2K-safe flooded the market in the late 90s. Today, after almost 10 years, this equipment is still in working condition. Demand depends on the state of the economy, this is understandable. Of course, these considerations make sense, but they do not reflect the essence.

Companies Digium, Polycom, Aastra, Sangoma, as well as other vendors in the market of open PBXs, are watching from a different position and can argue with experts. And they will be, by and large, right. The market is changing, and these changes began with the arrival of open PBXs.

')

With the development of Asterisk and other open source telephony systems, the number of users has steadily increased. At first, these were units, gradually the number of followers grew, and, finally, these systems became the main direction of the telephony market. Now this is the main course, and not some run-down stream. And now we are not at the breaking point, we are already much further. Manufacturers of traditional communication systems are now, largely unknowingly, struggling to get a larger share of an ever-decreasing market. And the increase in sales is becoming increasingly difficult, even for the largest companies in the field of telephony, if they do not take the market share of other companies. Suppose that some traditional companies see what is happening, which could explain the acquisition of Pingtel by Nortel and the appearance of the new Nortel Software Communication System 500 solution. But this is only an exception, not the norm.

Since open office PBXs came into being as an amateur venture, they were cheap, but most people disapproved of them. But this is only the beginning.

Why are we seeing a growing commitment to open PBXs?

That's what recently caught my attention. Last year, I witnessed how three companies, in each of which I was a member of the board, made the replacement of traditional exchanges with open ones. The two companies went the usual way, while the third wanted a “clean” IP solution, not a hybrid or converged one. For me, it was interesting that if all three companies switched to systems of open PBXs and were satisfied with the result, as it turned out, this market apparently has more prospects than people can assume.

Why did they all choose Open Source? Not because I told them so, because I did not do that. And not due to the fact that all of them are technology companies, since they are all far from the sphere of technology and do not have a stake in Open Source. Each of them switched to open PBXs, since, according to them, this system is not inferior in quality to the best traditional communication systems and is more advantageous in price. It is not just cheaper, it is much cheaper. It is so cheaper that no traditional office or mini-PBX can even compare in value with an open PBX. Open office PBXs are usually 40 percent or more cheaper than traditional telephone systems.

Their decisions attracted my attention because price was the single most important factor in choosing a communications system since 1968, when the commission decided on a Carterfone switch. Price determines everything. Competition and the value of prices as a key parameter of the decision for the buyer, to a greater extent, explain the fact that prices for office PBXs decreased and continue to decline by 5-10 percent annually. And if nothing affects the price of open PBXs, then we will find a large market, which people did not even realize.

Since the research company Eastern Management Group has been analyzing the markets of traditional office systems and mini-PBXs for 30 years in its quarterly monitoring reports, we wanted to be the first to assess the market of open PBXs, and we had all the necessary tools for this.

Our main questions were the most obvious. What is the share of the total market of office and mini-PBX open PBX? Are all open PBXs small (some claim that they all include less than 30 endpoints) or is it possible to install them on 100 endpoints, or even 500? Do medium-sized enterprises use, say, banking, education, management and health care, open PBX systems, or are they only acquired by technology companies that can install these systems themselves? And would anyone buy a second such system?

An assessment of the size of the commercial market of open PBXs has never been done simply because it is difficult to do. Open source systems are free software. People periodically download it just like that, nothing better to do. Many systems are sent to laboratories. People who understand the technology, install them at home just because they know how. Others download numerous copies, trying to get the latest version, but never integrate them into their organization’s communication system. This applies to non-commercial use of systems and should be excluded from the total number of downloads of Open Source software available on the web. We also had to take all this into account when assessing the size of the commercial market of open PBXs.

To this end, we began three separate studies, during which more than 7,000 surveys were conducted.

The first survey consisted of two parts, during the first of which an analysis of the test / control group from the readers of the site “No Jitter” was conducted. Several hundred surveys were conducted, which allowed us to evaluate questions and answers. In the second part, we conducted a survey among 6734 IT professionals selected from a specialized database of more than 80,000 people.

The second survey consisted of telephone interviews with 51 largest providers of open PBX systems. The third study was a telephone survey of 100 VAR-companies (Value Added Resellers).

All survey data was integrated into the market models developed by the Eastern Management Group for several decades in order to track and make a forecast regarding the size of the institutional and mini-PBX market for our report.

What we found

After we took away those open PBXs that are not used daily as a communication system between company employees - and these non-commercial systems today represent the majority of downloads of open PBX systems - we were able to conclude that in 2008, 2.86 were installed million open source PBX. Nortel, the largest manufacturer of traditional commercial telephone systems, lost 8% to Open Source systems, selling 2.63 million lines. (Despite the recent problems of Nortel, its historical power in all market segments allowed the company to retain its primacy, at least until today, according to our calculations of the total market share of communication system providers). Next come Cisco and Avaya with 1.99 and 1.75 million lines, respectively.

The total market volume amounted to 15.88 million lines, while the open PBX owns a share equal to 18% of this market. Thus, the Open Source systems are far ahead of all manufacturers of office and mini-PBX (see Figure 1).

Figure 1: IP-PBX Market Shares

If there were no open PBXs, then the share of the market of traditional office and mini-PBX could be more than these 18%.

Companies using open PBXs cannot be reduced to a single class. In addition to technology companies that could use them, we see a high concentration of open PBX systems in a variety of vertical markets, especially in the areas of finance, education, management, health care, manufacturing (non-technological), retail and transport. Of the 22 studied industries that make up the main body of North American enterprises, we observed different degrees of application of open PBXs in each of them. Almost 40% of companies using open PBX systems had nothing to do with technology.

The size of the company does not affect whether it uses an open PBX to provide industrial communications. The hundreds of companies we have studied have more than 1,000 employees. Dozens of companies have a staff of more than 20,000 people. Two thirds of companies using open PBXs have several branches, but not always open PBXs are installed in each of them. This means that if companies using open PBXs are happy with the result, there are prerequisites for the introduction of additional systems in other branches. The study showed that 68% of enterprises have two or more branches, 13% have at least 11 branches, 3% have more than 100 branches (see table 1).

Table 1: Total number of branches of companies with open PBXs

More than half of the studied companies have more than one open PBX, often in the same enterprise install five or more systems.

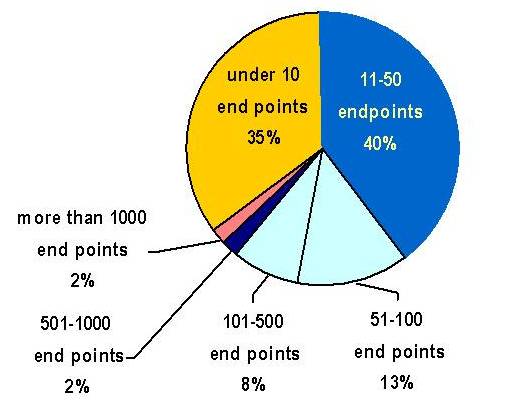

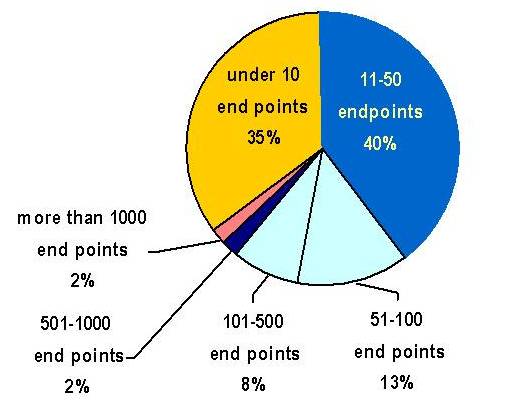

The study showed that the sizes of open PBX systems range from small, including up to 10 end points, to large, including hundreds of end points. 35% of systems have 1-10 endpoints, 40% have 11-50 endpoints, and 25% have more than 50 endpoints. Two percent of systems have more than 1,000 endpoints (see Figure 2).

Figure 2: The total number of branches of companies where at least one open PBX is installed

Asterisk is the most common open PBX system, whose share in the Open Source market is more than 85%. The roles of the company's competitors in the market, such as CallWeaver, FreeSWITCH, sipX / sipXecs and YATE, are constantly changing.

Customers often turn to the manufacturer to purchase and install an open PBX, because it's profitable. Almost half of this market belongs to Digium, but other companies are also represented on the market, including Fonality and Aastra.

It is not surprising that manufacturers of SIP-telephony products provide their products through systems based on open PBXs. Among them, we see high sales at Aastra, Linksys, Polycom, Grandstream and Snom. Polycom leads the way in using open PBXs compared to other manufacturers of SIP phones, with a market share of 11%.

Digium is the largest manufacturer of interface cards, but there are other players on the market, such as Cisco, Sangoma, AudioCodes, Dialogic, Grandstream, PIKA, Quintum and Rhino.

Few of the surveyed manufacturers of traditional PBXs consider open PBXs as a threat to their business. However, none of the manufacturers of traditional PBXs knew that the share of open PBXs in the general market was 18%. And this share continues to increase.

Perspectives

As for the success of the Open Source systems, it can be assumed that the largest VAR companies were quick to assess the opportunities of the emerging business. But that's not the point. We started to conduct interviews down the list of the largest VAR companies, starting with the most top names, but came to the conclusion that small VAR companies are more important for the development of the Open Source market. Thus, large VAR-companies for the most part turned out to be less important for the market of open PBXs.

In the future, a significant increase in the number of large VAR companies in the market of open PBXs is expected. This path will be followed by all clients of enterprises that need support in their implementation, as our research has shown, since these same clients have already switched to Open Source systems. Large VAR companies will inevitably follow a large customer. And this will contribute to the development of the market of open PBXs.

Conclusion

The economic climate over the next few years may be an advantage for the market and developers of open PBX systems. Many businesses have already decided to purchase one or more IP PBXs, and prices for open PBXs are so low that they attract the attention of a growing number of customers. Even if there is a weakening of the market for all systems, the demonstrated success of the market for open PBXs has already secured a solid foundation that guarantees the sustainability of this technology in any climate.

John Malone is President and Chairman of the Board of Eastern Management Group, a leading telecommunications consulting and research company. Open PBX systems are an area in which the company has been providing consulting services worldwide for over thirty years. The services of Eastern Management in the monitoring of institutional and mini-ATS include the compilation of quarterly reports on system batches for 25 years. Eastern Management's current research on Open Source systems is called the “Market for Open Source PBXs”. You can get acquainted with the results of this study by contacting representatives of the Eastern Management Group through the company's website: www.easternmanagement.com .

Translated from www.nojitter.com/showArticle.jhtml?articleID=212903167&pgno=1

Sales of traditional office and PBX systems have declined in recent years. Experts attribute this to a number of factors. Companies, they said, simply longer exploit their telephone systems. A wave of equipment replacement for Y2K-safe flooded the market in the late 90s. Today, after almost 10 years, this equipment is still in working condition. Demand depends on the state of the economy, this is understandable. Of course, these considerations make sense, but they do not reflect the essence.

Companies Digium, Polycom, Aastra, Sangoma, as well as other vendors in the market of open PBXs, are watching from a different position and can argue with experts. And they will be, by and large, right. The market is changing, and these changes began with the arrival of open PBXs.

')

With the development of Asterisk and other open source telephony systems, the number of users has steadily increased. At first, these were units, gradually the number of followers grew, and, finally, these systems became the main direction of the telephony market. Now this is the main course, and not some run-down stream. And now we are not at the breaking point, we are already much further. Manufacturers of traditional communication systems are now, largely unknowingly, struggling to get a larger share of an ever-decreasing market. And the increase in sales is becoming increasingly difficult, even for the largest companies in the field of telephony, if they do not take the market share of other companies. Suppose that some traditional companies see what is happening, which could explain the acquisition of Pingtel by Nortel and the appearance of the new Nortel Software Communication System 500 solution. But this is only an exception, not the norm.

Since open office PBXs came into being as an amateur venture, they were cheap, but most people disapproved of them. But this is only the beginning.

Why are we seeing a growing commitment to open PBXs?

That's what recently caught my attention. Last year, I witnessed how three companies, in each of which I was a member of the board, made the replacement of traditional exchanges with open ones. The two companies went the usual way, while the third wanted a “clean” IP solution, not a hybrid or converged one. For me, it was interesting that if all three companies switched to systems of open PBXs and were satisfied with the result, as it turned out, this market apparently has more prospects than people can assume.

Why did they all choose Open Source? Not because I told them so, because I did not do that. And not due to the fact that all of them are technology companies, since they are all far from the sphere of technology and do not have a stake in Open Source. Each of them switched to open PBXs, since, according to them, this system is not inferior in quality to the best traditional communication systems and is more advantageous in price. It is not just cheaper, it is much cheaper. It is so cheaper that no traditional office or mini-PBX can even compare in value with an open PBX. Open office PBXs are usually 40 percent or more cheaper than traditional telephone systems.

Their decisions attracted my attention because price was the single most important factor in choosing a communications system since 1968, when the commission decided on a Carterfone switch. Price determines everything. Competition and the value of prices as a key parameter of the decision for the buyer, to a greater extent, explain the fact that prices for office PBXs decreased and continue to decline by 5-10 percent annually. And if nothing affects the price of open PBXs, then we will find a large market, which people did not even realize.

Since the research company Eastern Management Group has been analyzing the markets of traditional office systems and mini-PBXs for 30 years in its quarterly monitoring reports, we wanted to be the first to assess the market of open PBXs, and we had all the necessary tools for this.

Our main questions were the most obvious. What is the share of the total market of office and mini-PBX open PBX? Are all open PBXs small (some claim that they all include less than 30 endpoints) or is it possible to install them on 100 endpoints, or even 500? Do medium-sized enterprises use, say, banking, education, management and health care, open PBX systems, or are they only acquired by technology companies that can install these systems themselves? And would anyone buy a second such system?

An assessment of the size of the commercial market of open PBXs has never been done simply because it is difficult to do. Open source systems are free software. People periodically download it just like that, nothing better to do. Many systems are sent to laboratories. People who understand the technology, install them at home just because they know how. Others download numerous copies, trying to get the latest version, but never integrate them into their organization’s communication system. This applies to non-commercial use of systems and should be excluded from the total number of downloads of Open Source software available on the web. We also had to take all this into account when assessing the size of the commercial market of open PBXs.

To this end, we began three separate studies, during which more than 7,000 surveys were conducted.

The first survey consisted of two parts, during the first of which an analysis of the test / control group from the readers of the site “No Jitter” was conducted. Several hundred surveys were conducted, which allowed us to evaluate questions and answers. In the second part, we conducted a survey among 6734 IT professionals selected from a specialized database of more than 80,000 people.

The second survey consisted of telephone interviews with 51 largest providers of open PBX systems. The third study was a telephone survey of 100 VAR-companies (Value Added Resellers).

All survey data was integrated into the market models developed by the Eastern Management Group for several decades in order to track and make a forecast regarding the size of the institutional and mini-PBX market for our report.

What we found

After we took away those open PBXs that are not used daily as a communication system between company employees - and these non-commercial systems today represent the majority of downloads of open PBX systems - we were able to conclude that in 2008, 2.86 were installed million open source PBX. Nortel, the largest manufacturer of traditional commercial telephone systems, lost 8% to Open Source systems, selling 2.63 million lines. (Despite the recent problems of Nortel, its historical power in all market segments allowed the company to retain its primacy, at least until today, according to our calculations of the total market share of communication system providers). Next come Cisco and Avaya with 1.99 and 1.75 million lines, respectively.

The total market volume amounted to 15.88 million lines, while the open PBX owns a share equal to 18% of this market. Thus, the Open Source systems are far ahead of all manufacturers of office and mini-PBX (see Figure 1).

Figure 1: IP-PBX Market Shares

If there were no open PBXs, then the share of the market of traditional office and mini-PBX could be more than these 18%.

Companies using open PBXs cannot be reduced to a single class. In addition to technology companies that could use them, we see a high concentration of open PBX systems in a variety of vertical markets, especially in the areas of finance, education, management, health care, manufacturing (non-technological), retail and transport. Of the 22 studied industries that make up the main body of North American enterprises, we observed different degrees of application of open PBXs in each of them. Almost 40% of companies using open PBX systems had nothing to do with technology.

The size of the company does not affect whether it uses an open PBX to provide industrial communications. The hundreds of companies we have studied have more than 1,000 employees. Dozens of companies have a staff of more than 20,000 people. Two thirds of companies using open PBXs have several branches, but not always open PBXs are installed in each of them. This means that if companies using open PBXs are happy with the result, there are prerequisites for the introduction of additional systems in other branches. The study showed that 68% of enterprises have two or more branches, 13% have at least 11 branches, 3% have more than 100 branches (see table 1).

Table 1: Total number of branches of companies with open PBXs

More than half of the studied companies have more than one open PBX, often in the same enterprise install five or more systems.

The study showed that the sizes of open PBX systems range from small, including up to 10 end points, to large, including hundreds of end points. 35% of systems have 1-10 endpoints, 40% have 11-50 endpoints, and 25% have more than 50 endpoints. Two percent of systems have more than 1,000 endpoints (see Figure 2).

Figure 2: The total number of branches of companies where at least one open PBX is installed

Asterisk is the most common open PBX system, whose share in the Open Source market is more than 85%. The roles of the company's competitors in the market, such as CallWeaver, FreeSWITCH, sipX / sipXecs and YATE, are constantly changing.

Customers often turn to the manufacturer to purchase and install an open PBX, because it's profitable. Almost half of this market belongs to Digium, but other companies are also represented on the market, including Fonality and Aastra.

It is not surprising that manufacturers of SIP-telephony products provide their products through systems based on open PBXs. Among them, we see high sales at Aastra, Linksys, Polycom, Grandstream and Snom. Polycom leads the way in using open PBXs compared to other manufacturers of SIP phones, with a market share of 11%.

Digium is the largest manufacturer of interface cards, but there are other players on the market, such as Cisco, Sangoma, AudioCodes, Dialogic, Grandstream, PIKA, Quintum and Rhino.

Few of the surveyed manufacturers of traditional PBXs consider open PBXs as a threat to their business. However, none of the manufacturers of traditional PBXs knew that the share of open PBXs in the general market was 18%. And this share continues to increase.

Perspectives

As for the success of the Open Source systems, it can be assumed that the largest VAR companies were quick to assess the opportunities of the emerging business. But that's not the point. We started to conduct interviews down the list of the largest VAR companies, starting with the most top names, but came to the conclusion that small VAR companies are more important for the development of the Open Source market. Thus, large VAR-companies for the most part turned out to be less important for the market of open PBXs.

In the future, a significant increase in the number of large VAR companies in the market of open PBXs is expected. This path will be followed by all clients of enterprises that need support in their implementation, as our research has shown, since these same clients have already switched to Open Source systems. Large VAR companies will inevitably follow a large customer. And this will contribute to the development of the market of open PBXs.

Conclusion

The economic climate over the next few years may be an advantage for the market and developers of open PBX systems. Many businesses have already decided to purchase one or more IP PBXs, and prices for open PBXs are so low that they attract the attention of a growing number of customers. Even if there is a weakening of the market for all systems, the demonstrated success of the market for open PBXs has already secured a solid foundation that guarantees the sustainability of this technology in any climate.

John Malone is President and Chairman of the Board of Eastern Management Group, a leading telecommunications consulting and research company. Open PBX systems are an area in which the company has been providing consulting services worldwide for over thirty years. The services of Eastern Management in the monitoring of institutional and mini-ATS include the compilation of quarterly reports on system batches for 25 years. Eastern Management's current research on Open Source systems is called the “Market for Open Source PBXs”. You can get acquainted with the results of this study by contacting representatives of the Eastern Management Group through the company's website: www.easternmanagement.com .

Translated from www.nojitter.com/showArticle.jhtml?articleID=212903167&pgno=1

Source: https://habr.com/ru/post/93128/

All Articles