Why take loans profitable?

Everyone probably heard phrases like “Credits are the blood of business”. On the other hand, popular wisdom says: “You take someone else’s and for a while, and you give yours forever.”

Everyone probably heard phrases like “Credits are the blood of business”. On the other hand, popular wisdom says: “You take someone else’s and for a while, and you give yours forever.”If you have a mortgage or credit card, then you know in your own skin what a heavy load it is - and you may not understand why an entrepreneur wants to take out a loan from a bank when its money is enough. If you are worried about the words "startup" and "venture capital", then you also need to understand why we need other people's money.

Loan for business and loan for consumer - slightly different loans;)

')

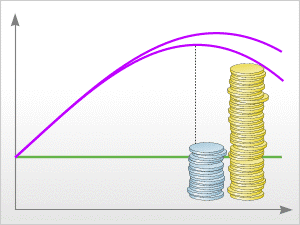

Under the cut - a simple example of the work of financial leverage. To many, it will seem too obvious, but, I hope, someone will find benefits for themselves.

How it works?

Suppose you were offered to participate in a business (or you yourself created such a business), which brings 40% of operating profit per year. Quite an ordinary business, good, but not super-profitable.

You also know that the bank in the next street offers loans at 30% per annum. Finally, the tax legislation of your country obliges you to pay income tax of 20% .

Numbers for example are taken round, clear, but they are close to real.

First year

You have 1000 full-bodied tugriks that you want to invest in a business. Fearing bad, you do not take loans - only equity. Now we count.

For a year of successful work, you will earn 400 MNT. There are no loans, you owe nothing to anyone, so they are yours ... except that the state paws the

The profitability of your capital - 32% , that is, on the invested Tugrik, you received on top 32 tugocent. And your capital is in place, it continues to work, and if you want, you can withdraw it back (remember, this is a spherical business in a vacuum).

Second year

Inspired by this situation, next year you also decided to invest one thousand, but this time only 700 MNT of your funds. The missing 300 you take in the bank.

A thousand of the money invested, again, brings 400 income tugriks, but now you need to pay interest on the loan. You willingly pay:

Last year it was more (320), but you invested more, so let's calculate the profitability:

Here's the thing: profitability was higher. You took out a loan, paid for it, and received more than 35 refreshers for each Tugrik. Capital can still be left; or you can withdraw it by returning the loan body to the bank - 300, and your own funds - 700.

Third year

Having been transported from success, now you decide to limit your participation to only two hundred tugriks (you can find the rest in the new business), and take 800 on credit. Calculations in the table:

| Year | 1st | 2nd | 3rd |

| Equity | 1000 | 700 | 200 |

| Borrowed capital | 0 | 300 | 800 |

| Total capital | 1000 | 1000 | 1000 |

| Operating profit | 400 | 400 | 400 |

| Loan interest | 0 | 90 | 240 |

| Profit after interest payment | 400 | 310 | 160 |

| Tax | 80 | 62 | 32 |

| Net profit | 320 | 248 | 128 |

| Profitability | 32.0% | 35.4% | 64.0% |

Total for each invested Tugrik you received as much as 64 Tugrocents!

If in the first year you, apart from your thousand, took another loan for 4000, you would have paid the loan and doubled your net profit.

Where is the catch?

So what prevents to make a cunning plan:

- don't invest your money at all

- immediately take a billion in the bank

- ...

- PROFIT!

The reason is simple: with the growth of the share of borrowed funds, the risk of the bank increases. A loan will require collateral, financial reports will be required. And if in the second year it is clear that in the event of a business failure, you will have enough of your own funds to repay the loan and interest, then in the third year it’s worse - if you go bankrupt, there will be nothing for the bank to take.

Therefore, the more loans you take, the more expensive they are: the bank will raise the interest rate as the risks increase, until a representative of the credit committee says: “Sorry, you have nothing to count on with such a capital structure”.

So what is the share of credit to stay?

Maintain the right, favorable ratio of own and borrowed funds - the task of the financial service of the enterprise, and the task is not easy. The exact figures depend on the conditions imposed at the beginning of the topic, and on the nature of the production, and on many other factors. Offhand, experts advise to focus on the ratio of financial leverage of about 50/50. But many enterprises in recent years, in the wake of affordable loans, have brought the share of borrowed capital to 70% or even higher; and this is one of the main reasons for the current crisis (which has already been written on Habré).

So take loans (if they give you, of course), but take it with great care. Success and prosperity to you!

PS: I apologize to the financiers for not very precise terminology.

PPS: a real tugrocent is called mungu ;)

Source: https://habr.com/ru/post/88537/

All Articles