Bank sues cyber fraud victim

An interesting precedent may appear after a trial in Texas. PlainsCapital , a local bank, sued its client, Hillary Machinery, a victim of cyber fraud.

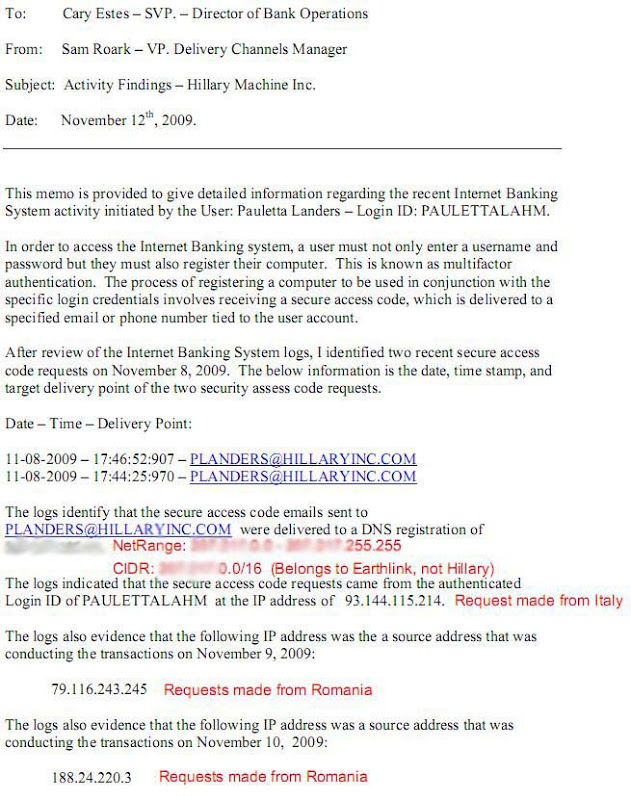

In November, hackers from Romanian and Italian IP addresses laid waste to Hillary Machinery’s bank account for $ 801,495. About $ 600 thousand of this amount was later compensated by the bank. The affected company demanded the reimbursement of the remaining amount. In the letter (scan under habrakat), the company argues its claims that the theft was made possible due to the lack of a reliable PlainsCapital security system.

In response, the bank filed a lawsuit and demanded an examination of its security systems. According to the plaintiff, their security procedures are “commercially reasonable.”

')

Theft of money was made using the valid bank details of the client. According to the bank, there was no reason to consider this fraud.

The client thinks otherwise. First, never before have money been transferred from this account abroad. Secondly, a large amount was withdrawn in several dozen transactions within two to three days, which also should have triggered the triggers in the security system, but this did not happen. Each transfer went to a new account, while Hillary Machinery has a limited set of counterparties with whom transactions are constantly conducted.

As part of the lawsuit, the bank does not require anything from Hillary Machinery, it simply asks to recognize its security system, as mentioned above, “commercially reasonable”. This is the first such lawsuit in the history of American justice, although several similar claims filed by bank customers are now pending in US courts, demanding to recognize the weakness of their banks' security systems and return the stolen money.

via Computerworld

In November, hackers from Romanian and Italian IP addresses laid waste to Hillary Machinery’s bank account for $ 801,495. About $ 600 thousand of this amount was later compensated by the bank. The affected company demanded the reimbursement of the remaining amount. In the letter (scan under habrakat), the company argues its claims that the theft was made possible due to the lack of a reliable PlainsCapital security system.

In response, the bank filed a lawsuit and demanded an examination of its security systems. According to the plaintiff, their security procedures are “commercially reasonable.”

')

Theft of money was made using the valid bank details of the client. According to the bank, there was no reason to consider this fraud.

The client thinks otherwise. First, never before have money been transferred from this account abroad. Secondly, a large amount was withdrawn in several dozen transactions within two to three days, which also should have triggered the triggers in the security system, but this did not happen. Each transfer went to a new account, while Hillary Machinery has a limited set of counterparties with whom transactions are constantly conducted.

As part of the lawsuit, the bank does not require anything from Hillary Machinery, it simply asks to recognize its security system, as mentioned above, “commercially reasonable”. This is the first such lawsuit in the history of American justice, although several similar claims filed by bank customers are now pending in US courts, demanding to recognize the weakness of their banks' security systems and return the stolen money.

via Computerworld

Source: https://habr.com/ru/post/82386/

All Articles