Webmoney payment optimization through Paymer

I post an article about webmoney and payimer from my blog. Recently I replenished my balance through webmoney on a very popular site. It was extremely surprising to find out that the site administration had left the default settings in the merchant. The result - 0.8% of my money they did not reach. Moreover, they could have earned them twice if they had done accepting Paymer checks on their website correctly.

I post an article about webmoney and payimer from my blog. Recently I replenished my balance through webmoney on a very popular site. It was extremely surprising to find out that the site administration had left the default settings in the merchant. The result - 0.8% of my money they did not reach. Moreover, they could have earned them twice if they had done accepting Paymer checks on their website correctly.Paymer check, also known as wm-card, is the number and code for owning a certain amount of webmoney title characters. Consequently, its transfer from one subject to another is not subject to 0.8% per transaction. That is, if in an intelligent way, but in a simple way - I bought a wm-card and activated it not to myself, but to the seller. The benefit of all the tools for this.

But enough theory, let's move on to practice. And so we have a billing with the reception of payment WebMoney through the merchant.

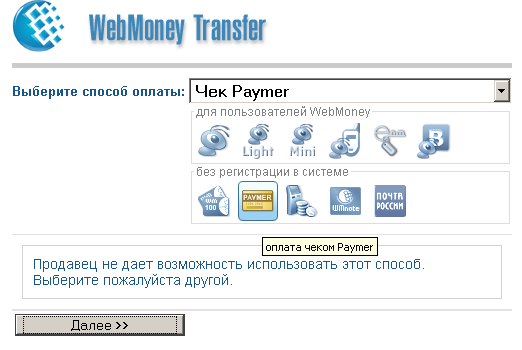

Check if the Paymer reception works.

We begin the process of payment, we reach the merchant, we choose a paymer or vm-card by the payment method.

And if we see this, then I wrote an article for you.

Quick way

Go to the settings of the wallet to which you accept payment. And we include the Acceptance of Paymer.com checks (WM-cards) or WM-notes .

All now your user will not have to spend the extra 0.8% to get the money to you.

:

. .Profitable way

Few people know that Paymer has its own merchant . So little that with its use in 2009, the average monthly number of payments was only 200. How it works:

- We are creating another version of the payment method on the site, for example, a WMR card;

- The user pays for the goods in the same way as in fast mode;

- In our special check-house, it is more to check;

:

. .Received checks can either be activated on any wallet (not necessarily your own), or get it with a number and code. Of course they will be different from those introduced by the buyer. In general, checks are convenient because they can be combined with each other, split into pieces, interrupt the number and code, create your own for 1% of the amount.

')

Personally, I do this - once a month, I immediately combine all the available checks and withdraw them from my local webmoney dealer with a commission that is 1% less than usual. An attentive reader will have a question, why 1%, and not 0.8%? Dealer sells WM-cards. And it is more profitable for him to buy from me a ready-made paymer that will create his own.

I hope this article will help you reduce the transaction costs of your business.

In conclusion , please, check the default values of your products to ensure that they will be optimal for end users.

Original source

Source: https://habr.com/ru/post/78688/

All Articles