We are launching a software business in Russia

There have been a lot of topics about startups, organizing teams, developing software and some other things that are inseparably connected with software or Internet business. In this article I want to tell you that I’ll be waiting for you now, wish you open your own software company (software, then software). For until full topics on this topic, I have not seen.

There have been a lot of topics about startups, organizing teams, developing software and some other things that are inseparably connected with software or Internet business. In this article I want to tell you that I’ll be waiting for you now, wish you open your own software company (software, then software). For until full topics on this topic, I have not seen.Why do you need this topic? So that after reading it was possible to unequivocally answer the questions “Do I need it?”, “Should I transfer the project to the category of a startup (or vice versa)?”, “How to make money on my work in Russia?” And on a number of others more specifically. And this is only about Russia (if everything goes well, then I’ll post a similar topic regarding the international software business).

Attention: all the information below is presented in terms of minimizing the time spent (and increasing the reliability of the event) and taking into account the absence of registration in the city of registration of legal entities. persons (and lack of work office).

')

Product and Team

Be sure to have at least something before the start. Anything that makes money. Without a cash flow (even if it costs 10-20 thousand rubles), it would be pointless to start it all (then it will be clear why, but the primary costs for processing all the red tape are about 30k rubles). Naturally, it is worth opening your legal entity and registering a business if you are going to grow. And not just to grow, but to grow very much . Having a turnover of 20-30 thousand rubles is possible without having any legal entity, and with an “illegal” turnover in the region of 100 thousand various problems with the state can already begin (and it may not work out nicely anymore).

So at the very beginning we should have a product. In principle, no matter what (if we are talking about a business that consists in selling software and related services). If a team is “attached” to this product, then it will be much easier to pick up the whole scheme: while you are running around the instances with packages of documents, sales can sore heavily, because there will be no one to serve them. Or will develop. Or something else. But be sure to ask. Keep this in mind.

So at the very beginning we should have a product. In principle, no matter what (if we are talking about a business that consists in selling software and related services). If a team is “attached” to this product, then it will be much easier to pick up the whole scheme: while you are running around the instances with packages of documents, sales can sore heavily, because there will be no one to serve them. Or will develop. Or something else. But be sure to ask. Keep this in mind.Well, it seems we have something to sell (even if it is the “Time Machine for Windows” utility). We have a couple of people who share responsibility for the company and are willing to work in the name of its success. What's next?

Next is the most interesting.

Choose a form of activity

Pro partners and agreements have already been a great article . In my opinion, the first should be a personal contract (it can be a legal paper) between several people: what they are willing to give and what they expect to receive in return. And a lot of trust between them. Otherwise, it still does not work. You can not paint everything on paper. If there is no trust, then sooner or later there will be loopholes for disputes and contradictions. If there is trust, then the paper is only an additional confirmation to it, but in no way a basis.

LLC in terms of the legal structure is even better for several reasons: the liability is limited to the authorized capital (at least 10 thousand rubles) and this is a full-fledged legal entity. a person (with all the statements and all the pros and cons, but working with legal entities is always easier on behalf of the legal entity and by bank transfer - so there is more trust for some reason). Next, it will be about the LLC (for the IP the situation is somewhat simpler, but a registration or temporary registration at the IP registration is needed). In addition, if you plan to grow, the PI for potential customers and partners will look disreputable. Make an LLC, you will not regret.

After selecting the form of activity, you need to decide on the activity codes (this is the most interesting here :). I don’t cite all codes (there is a very voluminous document, there are a hundred pages), but if we work with software, we immediately look towards section 72 (activities related to the use of computers and information technology). To develop software has its own code - 72.20. Nearby you can see a couple more. I advise you to enter a few (the first type of activity is the main, the rest is optional), as a reserve. Be careful with licensing (the development of software licenses does not require, but communication services are required).

Register a company

In your city (hereinafter referred to Moscow, but I do not think that there will be any big differences) there are a number of relevant offices involved in registration. It is better to search on the advice of acquaintances, because the shoals in this case can be badly hurt. The cost of opening a person (with all duties, documents and stamp) cost 10 thousand rubles in September 2009.

Legal address? Yes. Now this is also not a big problem. In fact, you need a lease agreement to issue a legal entity at the rented address. face. In Moscow, it is already automated, and this service cost 7 thousand. Additionally, in order not to stand in line on October 1 (the beginning of the reporting period), a thousand were paid - the tax was completed in just half an hour. Total: 18 thousand rubles.

In steps:

1) Find a registrar. Negotiate.

2) Choose activity codes, name, form of activity and tax scheme. Sign the papers.

3) Assure all papers at the notary. Theoretically, it is possible on the first visit to combine an agreement with the registrar, signing papers (including activity codes) and opening statements, notarizing the necessary documents (who can sit in the next room). In my case it took a week.

4) Visit the tax. Give the package of documents (including the original charter, which remains in the tax, and a copy, which then leaves you). It may take a whole day. Take heart.

5) Receipt of all documents from the registrar (it takes from two weeks to a month after the visit to the tax office: there are different cases, just check with the registrar when it will be possible to pick up).

After step 5, you are (most likely) the "happy" gene. director and chapters. an accountant in one person any jur. faces .

Total: two to six weeks for all-all.

Open a bank account

On this ordeal does not end. I advise in parallel with the registration of jur. first of all, find an accountant (it can be prompted by the registrar) who will keep all reports (if these are not your relatives, of course) and decide on the bank where the account will be held. persons (this is not the same as the physical account of the person!). If an accountant can tell (there are connections) where it is better to open an account, listen to it. Here, time is already playing against you (without an account, it is very problematic to conduct operational activities).

So, we have all the documents in our hands. We go to the bank. If we do not know which one, then it is better to choose not much. In my case, I made a mistake by contacting Alfa Bank immediately: I was refused. The visits to the bank will follow the following pattern:

1) Book time to open an account (usually it takes about an hour). Receive a package of documents

2) Fill out the documents, make a notarized copy of the statute (if you do not know whether they will do it in the bank, it is better to do it in advance, then run around and look for a notary a bit stressful). Sign all contracts.

3) Wait for about a week (at best) or a couple of days (at worst: if they report a refusal, then just go to the next bank on the list, it’s unsuccessful to open an account only once every six months in the same bank). Then you come and contribute the authorized capital (in my case it is 10 thousand rubles ).

4) If there is any Bank Client Online, then you will need to print the acceptance certificate, sign it and bring it to the bank.

5) Also, if you pay in the authorized capital before activating the Online Client, you will need to come again (pick up the transfer and acceptance certificate signed by the bank and receive a statement of the deposit in the authorized capital (and at the same time write off the service charge for the first month).

Service in the bank is about 1000-10000 rubles (varies greatly). This should be considered when calculating cash flow.

Total: another one to four weeks for all the red tape.

Accounting and cash flow

With accounting here is the easiest. You agree with the accountant about payment and once a month you give him the primary reporting (bills, acts of acceptance, and so on - ask the accountant to clearly list what he or she needs). Then once a month you can independently (or through an accountant by proxy) charge the salary and pay taxes on it.

Initially it is assumed that you choose a simplified taxation scheme (for software companies, IMHO, initially it is better to take 6% - then you can switch to 15%). According to it, taxes on gross sales can be paid once a quarter (do not forget to follow the balance!), But taxes related to salary (income and social) - every month. However, you can transfer money into dividends by paying the gene. Director minimum s / n. In this case, the tax time goes less (9% vs. 27%).

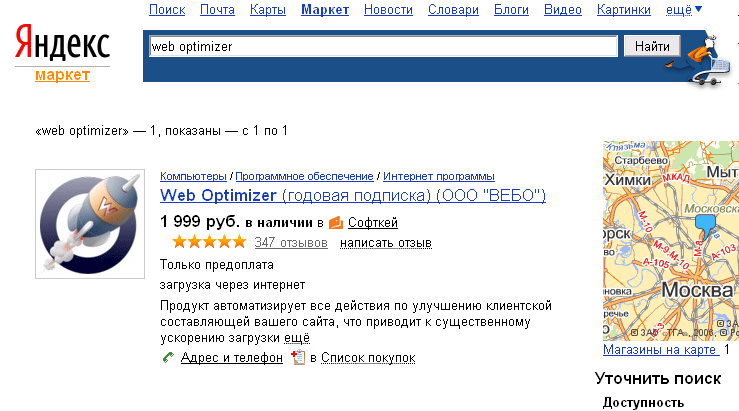

Since we are talking about a software company, the question is: how to sell? I do not know a better choice than the organization of sales through Sotfkey (or AllSoft ). First, you get a full-fledged platform for all sales (all reporting, all monetary systems + part of the promotion). As an example: automatic (?) Advertising of Softkey products on Yandex.Market:

The commission is around 20%, but here you need to understand that, firstly, you are using a promoted brand (it is quite difficult to persuade people to give their money to some kind of left-wing office, and if payment is made through well-known persons, then parting with the blood proceeds easier). Secondly, you remove all the headaches of withdrawal / withdrawal of funds: once a month you bill the goods sold, and the amount is transferred to your account (well, there may be a meager commission for transferring money). If a person in the team you have a little, then this is a great help.

Signing a contract with Softkey costs you nothing (well, just the time to agree on the details).

What's next?

And then you have - complete freedom of growth. You have a jur. the person, the scheme for receiving money, the product (yes, we started with the fact that the product already exists), communication with users (oh, there will be many, very many :) and “confidence” in the future (for how much and ate).

Dry residue: registration jur. persons will cost 25-30 thousand rubles + about 5-10 thousand for a monthly service (bank account + accountant services, if you yourself are the general director).

As a bonus: if you are still going to provide consulting services on your product, then now you can do it under a full-fledged contract. The most important thing here is to enlist literate blanks of contracts from a lawyer and learn how to invoice (yes, I was prompted to a free program for this - Business Pak ). You should already be able to do the rest (if you have and sell a product, and there is a team with whom you work side by side).

And the rest: good luck, and that there were only problems of growth, and not others are different.

Source: https://habr.com/ru/post/75771/

All Articles