Derivatives on carrots

Derivatives are derivative financial instruments. They are derived because they are based on some other asset. Derivatives in themselves are dummies, their value is determined by the price of the underlying asset — product, security, currency, debt obligation — that is, what they are derived from.

Derivatives are derivative financial instruments. They are derived because they are based on some other asset. Derivatives in themselves are dummies, their value is determined by the price of the underlying asset — product, security, currency, debt obligation — that is, what they are derived from.Why use derivatives? Their first purpose is to hedge risks, that is, risk redistribution, safety net. All derivative transactions are in the future. The safety net is that you freeze a certain, already familiar and, in principle, you like the situation today in order to apply it in an unreliable tomorrow.

The second value of derivatives is a tool of speculation.

')

The main types of derivatives are:

- forwards (futures);

- options;

- swaps.

Forward - insure

Imagine that I am a manufacturer. Lizka Carrot Enterprise. I produce carrots. Now, conditionally, March, I spend the sowing. Prices - well, let it be 60 rubles per kilogram of carrots. I like this price: I cover my costs, I even get a little profit. But now there is a crisis around, and I don’t know what will happen in August, when I will harvest and intend to sell my wonderful carrot. The price may be 70 rubles per kilo - and I will win. The price may be 50 rubles per kilo - and I strongly lose. Well, okay, I agree not to get 70 rubles, which do not necessarily shine for me, but I’ll definitely get my 60 rubles that suits me. Just not to get only 50, which I will not live.

Therefore, I am looking for some little man who already now, in March, is interested in buying a carrot from me in August. Let's say it will be Lena Rabbit Production. Massively breeds rabbits. Lena also does not know what will happen in August. If the price in August is 50 rubles per kg of carrots - she will buy more carrots for rabbits, they will grow fat, give a lot of valuable fur and 3-4 kg of dietary meat. If the price is 70 rubles per kg of carrot, then Lena will not buy a lot of carrots and half of the rabbits will die a terrible starvation. But if the price is 60 rubles per kg of carrot - this is normal.

Hooray, we found each other. Our interests coincided. I agree to sell my carrot in August for 60 rubles, and Lena agree to buy my carrot for 60 rubles. We both realize that maybe in August one of us could conclude an agreement on the best conditions for ourselves. But we are also aware that someone could conclude an agreement in August on much worse conditions. No one wants to lose a lot. So, we conclude a forward contract in March in order to hedge against the August risks. Goods and payment will also be transferred in August.

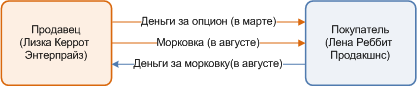

In cubes and arrows, what we agreed on looks like this:

On a straight time, the whole agreement looks like this:

There are delivery forwards and non-deliverable. The delivery forward is the above example - when a manufacturer (in this case it’s better illustrated by the seller) really hedges its risks and then really transfers a completely real carrot.

A non-deliverable forward is purely a tool of speculation. There are no producers of real carrots, no carrot is transmitted anywhere. You can, for example, make a non-deliverable forward on currency. In that case, in March I will conclude an agreement with Lena that in August I will sell her $ 1 for 24 rubles. And I will have to sell her in August 1 dollar for 24 rubles. And if in August 1 dollar will cost 76 rubles, then guess which one of us screwed up and received less money on the forward than he could without him, and who won, and received more money on the forward than he could without him.

For a snack : what's the difference between forward and futures? Yes, no. Only futures are called forward concluded on the exchange. A forward is futures, but out of the exchange.

Option - choose

An option is an advanced form of a forward. I'm still the same “Lizka Carrot Enterprise” that produces carrots. And this time, having broken my teeth on unsuccessful forwards, I think: “Why should I conclude an agreement in August, when the market price (70 rubles) can be much more convenient for me than according to the forward (60 rubles)?

Then I go, looking for Lena and offer her a new, improved forward. I invite her to conclude an agreement today in March that in August I, by choice, will sell or not sell her a carrot for 60 rubles. My choice will depend on what the price of carrots on the market.

But Lena is also not a blunder. What is this: I will choose whether to sell me or not, and Lenk will depend entirely on my decision? Therefore, she also hedges her risks. For the opportunity to choose whether to sell or not to sell, I pay Lena a coin back in March, which will cover her lost profits if I decide not to sell. Thus, in March I buy an option from Lena for the sale of carrots in August.

If in August I choose to sell, then in a square-arrow form it all looks like this:

If in August I choose not to sell, then in a square-arrow form, it looks like this (the dotted lines indicate the relations included in the option):

On the timeline, all our actions are as follows:

An inquisitive reader must have noticed that the number of arrows from me to Lena and from Lena to me in the first scheme does not match: I have a lot more. Twice. Right. And all because of the pleasure of patting the nerves, too, must pay. In addition, it ensures the interests of Lena: I already give her money today, which means that the less likely that I will throw her tomorrow.

For a snack : there are put options, there are call options. Put option - I choose whether to sell or not to sell (remember this: “I put it on the market”). It is like in the considered example. A call option - I choose whether to buy or not to buy (remember this: “I call from the market.” Stupidly, but associatively). This is the case opposite to the above. Here Lena, the buyer, pays me, the seller, money in March for the opportunity to choose in August to buy or not to buy. And the rest is all the same.

Swap - change

Even cooler. We continue to evolve.

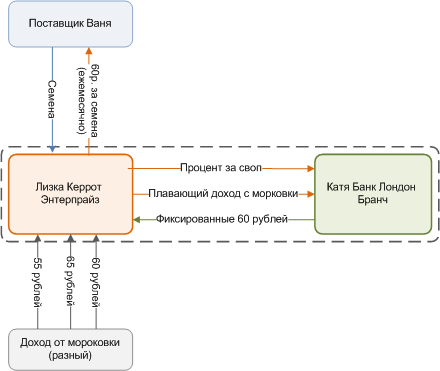

I'm still Lizka Carrot Enterprises, still producing carrots. For the production of carrots, I buy seeds from some Vanya. I pay stably, always 60 rubles per month. And my carrot production brings me 55, then 50, then 60, then 70, then 65. In general, my costs are fixed and my income is floating.

In principle, it suits me when a carrot brings me an income of 60 rubles - this covers my expenses for seeds. But when a carrot brings 55 or 50 - that's bad. When a carrot brings 70 rubles - this is very good, but it would be better if it always brought me 60, than it is thick, then empty.

And then I go and look for someone who will help me to make sure that I always have 60, and not that thick or empty. Let's leave Lena alone, we already have her nerves ruffled. We will find someone new, for example, Katya Bank London Branch.

I suggest that Kate give her her floating income from the carrot in exchange for her regular payments to me in the amount of 60 rubles.

Let us turn to such favorite squares and arrows (the dotted line indicates the relations included in the swap):

Maybe the other way around, when my income is stable, and the expense (or payments on debt) is floating. I can change anything floating on anything fixed and vice versa. How it works in the market. Usually there are more than two participants. Often one needs to exchange floating

bet on a fixed one, and another one needs to change a fixed one to a floating one. In this case, they find an intermediary (all the same “Katya Bank”), who, however, actively delays interest for their services.

Let's go to the squares and arrows. Dotted line - one swap relationship. The colored dotted line is how inside Katya Bank money of one client goes to service another client.

Let's take a repo for a snack - like a thing very similar to swaps.

Repo - round trip

Here you will have to change a little the sphere of activity and operate not with a carrot, but with stocks, because repos are held with securities. But, by the way, you can imagine the stock in the form of a carrot, if so clearer.

That means I have a stock. Well, I have and I have. But human greed knows no bounds, and now I think how to attach them so that not only dividends and management in the company, but also to raise some kind of left-wing money. Moreover, I need to raise the left-hand money right now (well, the carrot mafia twists its arms), and then someday I, in principle, agree to lose. But the big score I need now.

Then I go to Kate and offer her the following: I sell you (yes, the property, absolutely the property) my shares for a reasonable price, and then you sell me the same shares back and also to the property. Not necessarily the same ones. The main thing - the same issue.

That is, this is one operation consisting of two transactions - selling there and selling back. Cycle dough in nature.

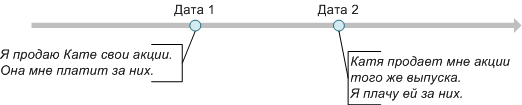

First, the space-time continuum:

Now the squares and arrows:

We note that once I transfer the shares to Kate as a property, she can manage anything with them: receive dividends, sell, etc. At the same time, under English law, I can conclude an agreement with Katya that she will vote on my instructions, and that even those with whom she may sell my shares will also vote on my instructions. You can conclude an agreement that all dividends (well, minus interest) are transferred to me.

Thus, it turns out that, having lost ownership of shares, I retain all the positive aspects of the ownership of shares, including the dividend. At the same time, on Date 1, I receive an additional bonus — a payment for the purchase of shares, which I need exactly on Date 1. But on Date 2, I lose this jackpot, because I am already paying for purchasing shares of Katya. But it is not scary, as I needed the left money on Date 1.

In addition, given that I sell shares on Date 1, when the price was one, and I bought on Date 2, when the price is different, I can play it well.

I hope it was interesting and understandable.

Liza Romanova

Source: https://habr.com/ru/post/60141/

All Articles