Payment systems, as an indicator of the maturity of the online market ...

In the course of his prof. studio activities (and even more often our seo department) constantly have to deal with the need to work with various payment systems. As we decided to try to put the settlements through these systems into the framework of the law and normal accounting ...

And that's what came out of it ...

Working with web technologies, still overseas, many years ago, unwittingly caught myself thinking, if not about the special “Slavic way” of development of our Russian web services, certainly, about incomprehensible and uncomfortable ways of monetization, financial transport and receptions in our online commerce.

Our entire transaction building model is continuously connected with merciless commissions when converting one web currency to another, depositing / withdrawing funds, connecting payment systems, etc ...

As in the whole of our state, even in the online sphere there is no single window system - at least convenient.

What is just an example of the formation of the price of gasoline - it is because of the tolling schemes generally does not depend on world oil prices (the average processing depth, in terms of the proportion of light fractions is generally a separate topic :-)).

“Under one window,” I mean not their number, but the consolidation of services in one place.

Such “one windows” can be any number - well, as many as the free market needs.

The idea of Internet commerce is such that by creating a convenient platform / showcase for services, the seller, in theory, gets a more profitable cost structure than the traditional trade for the service / product being sold.

')

But it is in theory. In practice, we have a little wrong ...

The trade engine (I’m not talking about advertising) is a CONVENIENT opportunity to pay for the purchased product / service.

Would you, in a real business, put up with a commission of a financial institution at 10-15% (and sometimes more) just when trying to pay?

Even introducing acquiring in retail banks are content with commissions from 0.9 to 2% (in the case of particularly greedy ones) - then you manage the loot in your p / s.

Conclusion: for many in commerce, it is easier to engage in the sale of intangibles, when the structure of the cost of services and the mass character of its consumption as it gets on with such commissions.

Let's see what happens in the fields of electronic “Slavic Commerce” in detail.

How are things going with the work of legal entities with virtual money systems?

When I tried to arrange everything adequately on the legal entity, it was boiling ... and decided to share my painful words with the studio blog (there’s a slightly more detailed version).

Legal entities can not have their wallets and even more so to replenish the wallets of individuals - i.e. The scheme of comfortable work of the lawn through this system is simply absent. ( http://money.yandex.ru/doc.xml?id=522764 Section 4.3.3.)

Well, okay, replenishing the physicists' wallets, the notorious NDFL appears, but beyond that, there are no opportunities to pay services to other legal entities and systems like Sape - which organizes input for physicists registered in it.

For legal entities, Ya.D. (abbreviation, by the way, is suitable :-)) is a dead tool in terms of profitability and ease of use. I do not say that it is impossible to use - in the framework of the absence of an alternative, one has to use what is and how it turns out ...

I really hope that Yasha will take measures to resolve this conflict point. For there is no home office in our country comparable to it in online opportunities.

Registration of a legal entity in the system was possible. Well, not even a legal entity, but only the organization of replenishment of the purse of a trusted and accredited physicist, through the settlement account Yurika. Next in the system works physicist.

But this is such ananal hardcore that it’s hard to imagine. I swear, open a p / s in an offline bank and it's easier.

So in detail - for the possibility of replenishing the wallet from the p / c jur. persons need:

But the funniest thing is not even this monstrous list, but the fact that each item appears sequentially (and all against the background of the fact that for every entrance to the protected zone of web money services it takes about three minutes. We did not find a normal FAQ for this procedure, .e. you just need to live on this site a couple of days to stupidly make yourself a guide to action.).

I am silent about how much time you need to kill in order to bring it all to life !!!

Purchase from a Russian-language site selling auction equipment from Japan (Yahoo.auction). The company is located on the island of Hokkaido.

There is a user who finds a product for himself, he is interested in him and even very much.

He is no longer young, but uses the Internet and knows how to surf the net.

Through thegreat corporation of evil :-) he finds this auction and the right product.

Payment methods WMZ, transfer to a Japanese bank (in our conditions it is generally something from the realm of fantasy - it’s easier to settle in a branch of your bank if you don’t run regular FEA, and the commission again bites - and then customs also add to the cost of goods + delivery) and a couple more including the most convenient (not for Russians) - PayPal (more about it later).

As a result, WMZ turns out to be the least expensive way to buy ... but it was not there.

The user is far from 24 \ 7 living on the Internet and it would be much easier for him to use his credit card to replenish a certain system (to pay directly with a credit card you must strongly believe the seller :-)) and pay for the goods without any conversions there.

The result is deplorable - the person found what he needed (that is, he is not a teapot who does not know which side to go to the computer and how to search on the Internet), has the desire and money to buy the found product - but making love with funny abbreviations wmz, wmr and a bunch of left-handed authorizations, which clients were unable to install on their computers on their computers, the goods were not purchased.

Conclusion:

It is not enough to be an advanced user - you also need to really want to buy goods to force yourself to find web money, to believe in them !!! (for non-advanced ones, it’s not easy to do it), to pinch your legs to where you actually get them, replenish your wallet, figure out how it works, put up with commission losses during conversions and order goods.

Transferring liquidity from one currency to another never promised its owner anything good.

There is an excellent example when, in times of unified Europe, researchers decided to drive through all European countries by choosing Germany as their starting point and Deutsche Mark. The condition of the experiment was the desire in each country to pay with its own currency.

The results of the experiment were very interesting - 70% of losses from liquidity were losses at exchange rates. Those. The experimenters paid twice more for the services of exchangers, but not for services purchased in the host countries.

Not far from this example, the situation with virtual money in our native web.

In order to buy something, we must first replenish the Internet wallet, then we may have to exchange the currency of one wallet for the currency of another, since many online stores / platforms accept only one type of currency, and then pay the bill, t. e. translation within the system.

If we consider in stages, then the total commission will consist of:

Fees for the replenishment of the Yandex.deg wallet or Webmoney via terminals - from 5% to 10%.

Commission for replenishment using prepaid cards:

for Webmoney - 4-15%

for Yandex Money - 4-10%

Commission for the use of currency exchange type roboxchange.com - at least 5%;

Commission for money transfer within systems:

Webmoney - 0.8%

Yandex. Money - 0,005%.

And for the seller, also unforgettable about the commission for withdrawal.

Total buying something in the network, we overpay from 5 to 20% of the real value of the goods \ ulug.

When buying the same links on the link exchanges, we also lose 5-10% plus on the commission of the system itself.

Personally, I don’t mind if those who like these commissions work according to this scheme. But there must be a healthy alternative.

Replenishing the account of your mobile phone you have many ways to do this both with losses and without losses in general - 100% of the amount to be credited to the balance.

Alas, but the degree of maturity of our web is such that it is still far from the ideas of web commerce and works as it works.

Do you need so many online currencies?

In my opinion, one but adequate system is enough. As a state, by and large, only one currency is needed, and the Internet community within this country does not need other currencies. The same PayPal from the participating countries quietly converts local currencies at the rate of the bank of the country of your credit card if you pay for the goods in the currency of another country. It is even more profitable than simply buying a currency in the exchanger, because the exchange rate from the card differs from the cash-selling rate on hand.

They say do not make yourself an idol, but in the presence of such here in the beloved fatherland fricosystems and state. restrictions, it's hard not to admire the convenience of working with Paypal + Verisign, especially if you had work experience with a full-featured account of this system.

Register an account and that's it, but for users of “selected countries” there is an excellent insurance scheme - in fact, a letter of credit (cash back is not just cool, this is megacut).

Deposit - directly from the bank account. If you don’t go into details, it feels like the mechanics of the operations, for a regular Paypal user, the same bank, even with offers for akakunt.

Commission and funnier. The only thing that the user loses when buying goods through Paypal is a meager commission comparable to the size of interest deductions in the case of ordinary acquiring in our retail.

But as they say well where we are not :-(

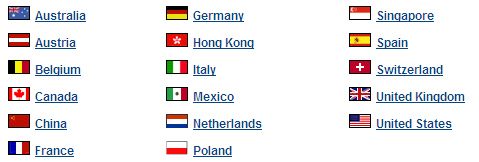

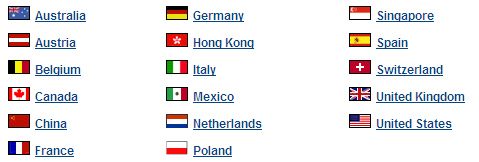

Let's see who our neighbors are in terms of opportunities within this magic system.

Proud Banana-Oil Neighborhood

Our capabilities are not great - only sending to other system participants. Those. As a full-fledged two-way online transaction tool for us, it does not work yet.

Not that the countries neighboring us on this list were something bad, but in my opinion, if we want to claim the successful development of online projects (and as such projects we have more than in these banana republics), then we need or your PayPal or just wait when he can make full money with us.

Because the current situation with online transactions is definitely not for the faint of heart ...

Who now can be considered lucky?

For these I am extremely happy ... they are very lucky

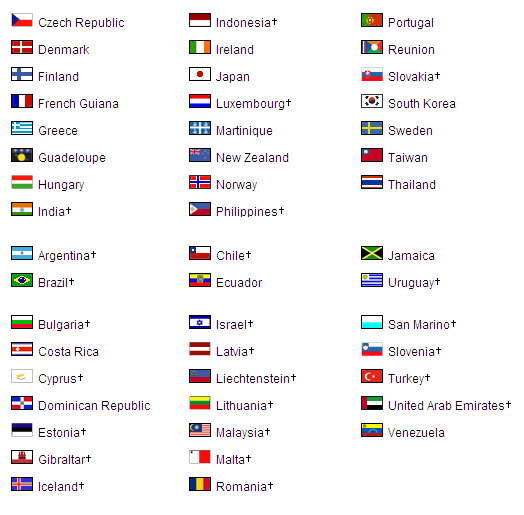

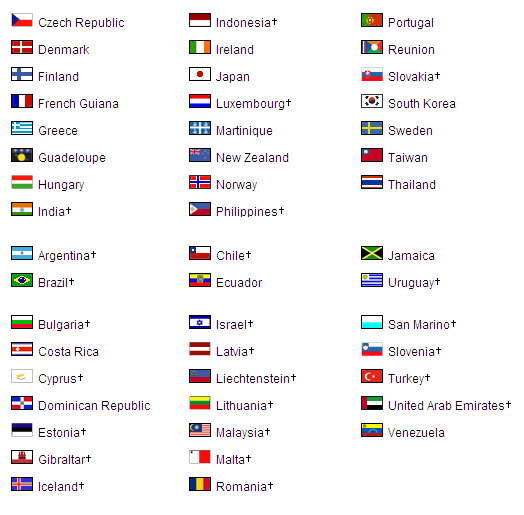

This is also lucky. Slightly less than the first group, but still basic things are available to them.

Almost lucky

We will also believe that soon there will be green light on our online street :-)

And that's what came out of it ...

Working with web technologies, still overseas, many years ago, unwittingly caught myself thinking, if not about the special “Slavic way” of development of our Russian web services, certainly, about incomprehensible and uncomfortable ways of monetization, financial transport and receptions in our online commerce.

Our entire transaction building model is continuously connected with merciless commissions when converting one web currency to another, depositing / withdrawing funds, connecting payment systems, etc ...

As in the whole of our state, even in the online sphere there is no single window system - at least convenient.

What is just an example of the formation of the price of gasoline - it is because of the tolling schemes generally does not depend on world oil prices (the average processing depth, in terms of the proportion of light fractions is generally a separate topic :-)).

“Under one window,” I mean not their number, but the consolidation of services in one place.

Such “one windows” can be any number - well, as many as the free market needs.

The idea of Internet commerce is such that by creating a convenient platform / showcase for services, the seller, in theory, gets a more profitable cost structure than the traditional trade for the service / product being sold.

')

But it is in theory. In practice, we have a little wrong ...

The trade engine (I’m not talking about advertising) is a CONVENIENT opportunity to pay for the purchased product / service.

Would you, in a real business, put up with a commission of a financial institution at 10-15% (and sometimes more) just when trying to pay?

Even introducing acquiring in retail banks are content with commissions from 0.9 to 2% (in the case of particularly greedy ones) - then you manage the loot in your p / s.

Conclusion: for many in commerce, it is easier to engage in the sale of intangibles, when the structure of the cost of services and the mass character of its consumption as it gets on with such commissions.

Let's see what happens in the fields of electronic “Slavic Commerce” in detail.

1. Convenience of payment:

How are things going with the work of legal entities with virtual money systems?

When I tried to arrange everything adequately on the legal entity, it was boiling ... and decided to share my painful words with the studio blog (there’s a slightly more detailed version).

1.1. Yandex. Money

Legal entities can not have their wallets and even more so to replenish the wallets of individuals - i.e. The scheme of comfortable work of the lawn through this system is simply absent. ( http://money.yandex.ru/doc.xml?id=522764 Section 4.3.3.)

Well, okay, replenishing the physicists' wallets, the notorious NDFL appears, but beyond that, there are no opportunities to pay services to other legal entities and systems like Sape - which organizes input for physicists registered in it.

For legal entities, Ya.D. (abbreviation, by the way, is suitable :-)) is a dead tool in terms of profitability and ease of use. I do not say that it is impossible to use - in the framework of the absence of an alternative, one has to use what is and how it turns out ...

I really hope that Yasha will take measures to resolve this conflict point. For there is no home office in our country comparable to it in online opportunities.

1.2 WebMoney (wmz, wmr ...):

Registration of a legal entity in the system was possible. Well, not even a legal entity, but only the organization of replenishment of the purse of a trusted and accredited physicist, through the settlement account Yurika. Next in the system works physicist.

But this is such an

So in detail - for the possibility of replenishing the wallet from the p / c jur. persons need:

- Create an account to get an R-wallet;

- Get a formal passport to access banking.webmoney.ru , which allows you to deposit and withdraw funds using bank payments:

- To do this, you must fill out a form with passport data and the TIN of the purse holder;

- Authorize wallet for physical. persons;

- To do this, you must fill in the same form as in clause 3, and attach passport scans nat. persons;

- Authorize a wallet for legal. faces. To do this, you must send an intermediary company www.guarantee.ru by e-mail:

- Organizational form (LLC, CJSC, PBOYUL, etc.)

- Company name

- Number, date and certificate issued by registration

- TIN, account number indicating the bank where it is open

- FULL NAME. CEO or SP

- Contact person: name, phone / fax, e-mail, URL, mailing address.

- Scanned pages of the passport of the owner of the WM-identifier

- WM-identifier number, R-wallet.

- Immediately specify that you are interested in "jur. person to enter "and not" jur. face to conclusion "

- In response, you will receive a proposal to start authorization and a link, after which you need to fill out a form. In which again indicate all passport data of the individual - the company's authorized representative, the general director, all bank details of the company, legal, postal addresses, plus attach again scans of the authorized representative's passport, scans of the certificate of state registration of legal entities, certificates of registration in the tax .

- As soon as you fill in the questionnaire (fill in IE, Mozilla does not send the questionnaire after filling in), you need to unsubscribe to the intermediary company by mail. They will send a contract that needs to be filled, stitched, numbered, hemmed to him “the act of acceptance and transfer of the ECP, which can be taken in the annex to the contract, all this should be sent in duplicate by registered mail. In addition to the contract in the letter should be:

- copy of your organization’s registration certificate (notarized);

- balance on the last reporting date;

- extract from the register (not more than 1 month);

- copy of the passport of the Director General;

- power of attorney for the contact person with the signature of the Director General and the seal of the organization.

- But before you do all this, you still need to get a personal certificate.

- To obtain a personal certificate, you need to download from the website and fill in the “application of the applicant for the certificate of the WebMoney Transfer system”, certify it at the notary, attach a copy of your passport, send it all by mail to the selected registrar, pay it from 5 to 150 wmz.

But the funniest thing is not even this monstrous list, but the fact that each item appears sequentially (and all against the background of the fact that for every entrance to the protected zone of web money services it takes about three minutes. We did not find a normal FAQ for this procedure, .e. you just need to live on this site a couple of days to stupidly make yourself a guide to action.).

I am silent about how much time you need to kill in order to bring it all to life !!!

2. As a result, what it turns into in practice:

2.1 Case1 - (based on a true story):

Purchase from a Russian-language site selling auction equipment from Japan (Yahoo.auction). The company is located on the island of Hokkaido.

There is a user who finds a product for himself, he is interested in him and even very much.

He is no longer young, but uses the Internet and knows how to surf the net.

Through the

Payment methods WMZ, transfer to a Japanese bank (in our conditions it is generally something from the realm of fantasy - it’s easier to settle in a branch of your bank if you don’t run regular FEA, and the commission again bites - and then customs also add to the cost of goods + delivery) and a couple more including the most convenient (not for Russians) - PayPal (more about it later).

As a result, WMZ turns out to be the least expensive way to buy ... but it was not there.

The user is far from 24 \ 7 living on the Internet and it would be much easier for him to use his credit card to replenish a certain system (to pay directly with a credit card you must strongly believe the seller :-)) and pay for the goods without any conversions there.

The result is deplorable - the person found what he needed (that is, he is not a teapot who does not know which side to go to the computer and how to search on the Internet), has the desire and money to buy the found product - but making love with funny abbreviations wmz, wmr and a bunch of left-handed authorizations, which clients were unable to install on their computers on their computers, the goods were not purchased.

Conclusion:

It is not enough to be an advanced user - you also need to really want to buy goods to force yourself to find web money, to believe in them !!! (for non-advanced ones, it’s not easy to do it), to pinch your legs to where you actually get them, replenish your wallet, figure out how it works, put up with commission losses during conversions and order goods.

2.2 Case2 - web currency conversion.

Transferring liquidity from one currency to another never promised its owner anything good.

There is an excellent example when, in times of unified Europe, researchers decided to drive through all European countries by choosing Germany as their starting point and Deutsche Mark. The condition of the experiment was the desire in each country to pay with its own currency.

The results of the experiment were very interesting - 70% of losses from liquidity were losses at exchange rates. Those. The experimenters paid twice more for the services of exchangers, but not for services purchased in the host countries.

Not far from this example, the situation with virtual money in our native web.

In order to buy something, we must first replenish the Internet wallet, then we may have to exchange the currency of one wallet for the currency of another, since many online stores / platforms accept only one type of currency, and then pay the bill, t. e. translation within the system.

If we consider in stages, then the total commission will consist of:

Fees for the replenishment of the Yandex.deg wallet or Webmoney via terminals - from 5% to 10%.

Commission for replenishment using prepaid cards:

for Webmoney - 4-15%

for Yandex Money - 4-10%

Commission for the use of currency exchange type roboxchange.com - at least 5%;

Commission for money transfer within systems:

Webmoney - 0.8%

Yandex. Money - 0,005%.

And for the seller, also unforgettable about the commission for withdrawal.

Total buying something in the network, we overpay from 5 to 20% of the real value of the goods \ ulug.

When buying the same links on the link exchanges, we also lose 5-10% plus on the commission of the system itself.

Personally, I don’t mind if those who like these commissions work according to this scheme. But there must be a healthy alternative.

Replenishing the account of your mobile phone you have many ways to do this both with losses and without losses in general - 100% of the amount to be credited to the balance.

Alas, but the degree of maturity of our web is such that it is still far from the ideas of web commerce and works as it works.

Do you need so many online currencies?

In my opinion, one but adequate system is enough. As a state, by and large, only one currency is needed, and the Internet community within this country does not need other currencies. The same PayPal from the participating countries quietly converts local currencies at the rate of the bank of the country of your credit card if you pay for the goods in the currency of another country. It is even more profitable than simply buying a currency in the exchanger, because the exchange rate from the card differs from the cash-selling rate on hand.

2.3 Case3 - Adequate Payment Systems - Paypal + Verisign.

They say do not make yourself an idol, but in the presence of such here in the beloved fatherland fricosystems and state. restrictions, it's hard not to admire the convenience of working with Paypal + Verisign, especially if you had work experience with a full-featured account of this system.

Register an account and that's it, but for users of “selected countries” there is an excellent insurance scheme - in fact, a letter of credit (cash back is not just cool, this is megacut).

Deposit - directly from the bank account. If you don’t go into details, it feels like the mechanics of the operations, for a regular Paypal user, the same bank, even with offers for akakunt.

Commission and funnier. The only thing that the user loses when buying goods through Paypal is a meager commission comparable to the size of interest deductions in the case of ordinary acquiring in our retail.

But as they say well where we are not :-(

Let's see who our neighbors are in terms of opportunities within this magic system.

Proud Banana-Oil Neighborhood

Our capabilities are not great - only sending to other system participants. Those. As a full-fledged two-way online transaction tool for us, it does not work yet.

Not that the countries neighboring us on this list were something bad, but in my opinion, if we want to claim the successful development of online projects (and as such projects we have more than in these banana republics), then we need or your PayPal or just wait when he can make full money with us.

Because the current situation with online transactions is definitely not for the faint of heart ...

Who now can be considered lucky?

For these I am extremely happy ... they are very lucky

This is also lucky. Slightly less than the first group, but still basic things are available to them.

Almost lucky

We will also believe that soon there will be green light on our online street :-)

Source: https://habr.com/ru/post/46206/

All Articles