Overview: how to buy shares of US companies from Russia

The idea of becoming the owner of shares of conditional Google or Facebook sounds quite tempting. But how to do that? I collected several ways to do this in one topic and wrote down the pros and cons. Go!

Method # 1: Open an account with a foreign broker

Despite the differences in legislation in different countries, when it comes to trading on the stock exchange, there are always a number of common points. One of the main things is that an individual cannot simply take and buy stocks or futures. On his instructions, investment operations should be carried out by a licensed broker - a brokerage company.

')

This means that for trading on a stock exchange in a particular country, you will need a brokerage account in a company from this country. For example, in the case of the United States and US stocks, you need to either open an account with a local broker, or with some foreign company that can provide access to the right market.

In principle, there are no bans on opening accounts by non-residents, but the process may take time and require the preparation of documents. Each broker can request different packages of papers, someone has enough electronic copies, somewhere you need to send originals, including information about a visa, etc.

There are a number of global brokers that provide access to international markets, among the most famous: Fidelity, E * TRADE, Charles Schwab and Interactive Brokers ( see Investopedia for this list ).

Here is a sample list of documents that these companies require to purchase US stocks:

- Social Security Number (SSN) or non-US citizen ID number;

- The name / name, address and telephone number of your employer;

- Account number in a bank or from a third-party broker for financing, as well as a routing number for check deposits.

From minuses of this method: you should deal with the taxation. Your conditional US broker will not be a tax agent for you in Russia, so you will need to fill out an income tax return.

There are subtleties with the calculation of taxes: there is an agreement on the avoidance of double taxation between the United States and Russia. According to him, in the United States, a tax of 10% will be withheld from your investment income. But since in Russia the tax rate is 13%, you will need to pay 3% difference.

Method # 2: Buying shares of international companies on foreign exchanges

The essence of this method is that the shares of the same American companies are traded far from only on the US exchanges. As well, by the way, Yandex shares can be bought not only on the Moscow Stock Exchange, but also on the Nasdaq.

In particular, this means that an account with a Russian brokerage company may be enough for you. For example, stocks of several dozen American companies are traded on the St. Petersburg Stock Exchange, including Apple, Google, Facebook and others. Details and terms of trade are described here .

What is convenient - here the Russian broker will be your tax agent, that is, he will calculate and pay taxes on investment income.

Method # 3: Invest through Russian brokers on foreign exchanges

Most large Russian brokers (and banks that have brokerage units) also provide access to trading on foreign exchanges. The process looks like trading on Russian sites: the broker also takes a commission, calculates taxes, etc.

The problem here is that in order to gain access to foreign markets you need to have the status of a qualified investor.

If you want to become a qualified investor, you need to meet one of the following requirements:

- The value of your assets or the value of your securities and funds in bank accounts is at least 6 million rubles.

- You have experience in a Russian or foreign company that has been making securities transactions and had the status of a qualified investor for at least two years.

- You have experience in making transactions on the stock exchange during 4 quarters, on average at least ten times per quarter and at least one transaction per month. The total volume of transactions must be at least 6 million rubles.

- You have an economic education or qualification certificate.

Method # 4: Purchase an ETF

You can buy not only stocks, but also the so-called Exchange-Traded Funds (ETF). These are financial instruments that are created by special index funds. Their essence is that it is a collection of stocks that are included in a particular index. For example, an ETF with a ticker SPY repeats the S & P500 index in composition.

An interesting point is that the composition of the ETF repeats the composition of the index up to the proportions of the securities within it.

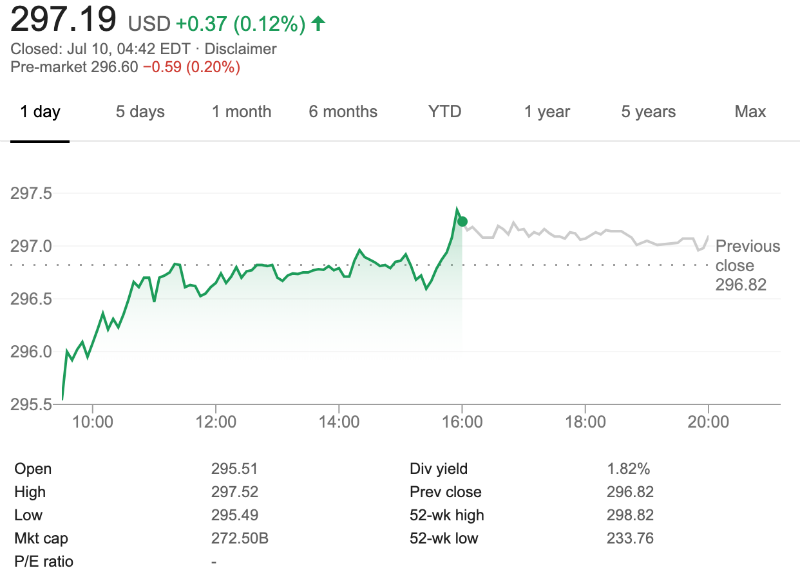

This is convenient in that the investment in the S & P500 index itself will cost significantly more - in order to buy all the papers included in it, in the right proportions, you will need hundreds and millions of dollars. At the same time, the cost of an ETF does not exceed three hundred dollars:

You can buy ETF through Russian brokers, for this you will need to open an account and install a trading terminal.

Conclusion: you need to hurry

The latest news about the activity of the Central Bank of Russia says that the agency is against the access of non-professional investors to the shares of Apple, Google and other foreign companies. According to journalists, consultations are in full swing, the results of which may impose restrictions on investments in foreign securities.

So if you wanted to try your hand at investing in global companies or simply want to buy yourself a piece of a conditional Apple, it makes sense to hurry.

Source: https://habr.com/ru/post/459582/

All Articles