An inside look: graduate school at EPFL. Part 4.2: the financial side

Visiting any country, it is important not to confuse tourism with emigration.

Popular wisdom

Today I would like to consider, perhaps, the most burning issue - the balance of finances when studying, living and working abroad. If in the previous four parts ( 1 , 2 , 3 , 4.1 ) I tried as best I could to avoid this topic, then in this article we will put a bold line under the long-term statistics of the balance of wages and expenses.

Disclaimer: The topic is delicate, and very few are ready to cover it openly, but I will try. All that is described below is an attempt to reflect on the surrounding reality, on the one hand, and also to set some reference points for those who are seeking to go to Switzerland, on the other.

Country as a tax system

The tax system in Switzerland works the same way as a Swiss watch: clearly and punctually. Do not pay quite difficult, although there are different schemes. There are a lot of tax deductions and exemptions (for example, there is a deduction for using public transport, meals at work, buying representative things, if they are required for work, etc.).

As I mentioned in the previous part , in Switzerland there is a graduated taxation system of three levels: federal (the same tariff for all), cantonal (the same for all within the canton) and municipal (the same for all within the commune aka village / city). In principle, taxes are lower than in neighboring countries, however, additional, actually obligatory, payments eat up this difference, but this is at the very end of the article.

')

But all this is good, until you decide to start a family - taxes are sharply low here, but they increase. This is explained by the fact that you are now a “cell of society”, your income is summed up (hello, progressive scale), that the family will consume more, and the child still has to be born, and then kindergartens-universities, many of which are on the state balance, but for which you still have to pay somewhere more, somewhere less. Locals often live in a civil marriage, because the economy must be economical, or live in cantons with low taxes (for example, Zug ), and work in “fatty” cantons (for example, Zurich - 30 minutes by train from Zug). A couple of years ago there were attempts to rectify the situation and, at least, not to raise taxes for families compared to single people - it didn’t work.

The ups and downs of the referendum

Often, under the pretext of useful referendums, they try to push through some muddy decisions and proposals. In principle, a sensible idea is to reduce taxes for married people, and especially with children; support for this idea was at first very high. However, the Christian party that launched the referendum at the same time decided to push through the definition of marriage as a “union of a man and a woman” - alas, they lost the support of the majority. Tolerance.

However, when you have a child, or even two, taxes are somewhat reduced, as now you have a new member of society dependent on you. And if only one of the spouses works, then you can count on various subsidies and concessions, particularly in terms of health insurance.

If you wanted to manipulate and - God forbid - to avoid taxes, then in life there is one and only one chance to be caught in tax frauds and be forgiven. That is, you can retroactively fix the situation and tarnished reputation, of course, paying all the outstanding taxes. Next - the court, poverty, lantern, lumpen-awning in front of the palace of Ryumin in Lausanne.

"Lumpen-tent": selected places of local "intellectuals" - opposite the museum and library ...

For those who are planning to move and pay taxes on their own (for example, through the opening of their own company), it is more detailed here .

From the pleasant - the tax declaration can not be filled until your income exceeds ~ 120k per year, and the company supports the practice “taxe a la source”, and the permit - B (temporary). As soon as I received a C, or my salary has passed for ~ 120k, please pay taxes yourself (at least in the canton of Vaud you need to fill out a declaration). As Graphite notes, in German-speaking cantons, like Zurich, Schwyz, Zug or St. Galen, this has to be done. Or if you need to submit documents for deduction (see above + third pension pillar), then you also need to fill out a declaration (you can use a simplified scheme).

It is clear that for the first time it is difficult to do this, so for 50-100 francs a good uncle-food-industry ( aka trihender, German. Treuhänder, on the other side of östigraben ) with refined movements will fill it for you (the main thing is to trust, but to check!). And next year you can do it yourself in the image and likeness.

However, Switzerland is a con federation, and therefore taxes vary from canton to canton, from city to city and from village to village. In the last part I mentioned that you can win on taxes by moving to a village. The network has a calculator that clearly shows how much a person will save or lose from moving from Lausanne, say, to Ekublan (a suburb where the EPFL is located).

Panorama of Lake Leman near Vevey to brighten tax sadness

Air taxes

In Switzerland, there are in-kind taxes "on the air."

Billag or Serafe from 01/01/2019. This is the most favorite tax by many - the tax on the potential to watch television and listen to the radio. That is, in our world - on the air. Of course, the Internet also comes in here, and since the phone (read - a smartphone) is now almost everyone, it’s very, very difficult to get rid of it.

Previously, there was a division into radio (~ 190 CHF per year) and TV (~ 260 CHF per year) for each household (yes, the country shalle is another household), then after a recent referendum the amount was unified (~ 365 CHF per year, franc each day), regardless of whether the radio or TV, and at the same time obliged to pay all households, regardless of the availability of the receiver. In fairness it should be noted that students, retirees and - suddenly - an employee of the RTS do not pay this tax. By the way, for non-payment of a fine - up to 5,000 francs, which is sobering in a special way. Although I know a couple of examples where a person did not pay this tax in principle for several years and was not fined.

Well, the

If you want to have a pet, pay tax (up to 100-150 francs in the city and almost to zero in the village). Do not pay, did not chip an animal - fine-fine! It is ridiculous: the police stop the Portuguese with dogs while patrolling the streets and try to solder them a fine.

And again, dialectically, I note that this amount includes bags, in which the owners of the animals are required to clean the wards of their wards, specialized areas for walking large dogs with the appropriate infrastructure, as well as street cleaning and the almost complete absence of stray pets in the cities (yes and villages too). Clean and safe!

In general, it is difficult to come up with a type of activity that would not be subject to taxation, but taxes go to the goals for which they are going: social, social, dog, canine, and garbage, garbage ... By the way, about garbage!

Garbage sorting

To begin with, every household in Switzerland pays a fee for garbage collection (this is a base fee such as tax). However, this does not mean that you can now throw away any garbage, wherever you want. To do this, you have to buy special packages at an average cost of 1 franc for 17 liters. Until recently, they were not only in the cantons of Geneva and Valais, but since 2018 they have also joined. That is why all Swiss people “love” to sort garbage: paper, plastic (including PET), glass, compost, oil, batteries, aluminum, iron, etc. The most basic are the first four. Sorting helps to significantly save on packages for general garbage.

There is a garbage police who can selectively check what you throw out with paper, compost or ordinary garbage. If there are violations (for example, they threw out plastic packaging with paper or a Li-battery in ordinary garbage), then people can find and write a fine for evidence in the garbage itself. In some cases, you can also get a receipt to pay for the hourly work of the garbage detectives themselves, that is, to get to the full. The scale is progressive, and after 3-4 fines a person can be blacklisted, which is fraught with.

Similarly, if there is a desire to throw garbage in a regular bag in a public place or put it in someone's trash can.

Insurance - as taxes, but only insurance

In Switzerland, a lot of all kinds of insurance: unemployment, pregnancy, medical (similar to our compulsory health insurance and voluntary medical insurance), in tours abroad (usually done with OMC), insurance for a dentist, disability, accident, pension insurance, fire and natural disasters ( ECA ), for renting a rented apartment (RCA), to protect against damage to someone else's property (yes, this is different than RCA), life insurance, REGA (evacuation from the mountains, actual in the summer on haikas and in winter on skis), legal (for easy and easy communication in the courts) and this is far from complete list For those who have cars, there is also a whole series: local OSAGO, KASKO, technical assistance call ( TCS ) and so on.

The average citizen thinks that insurance is such a poorhouse where everything is for free. I hasten to disappoint: insurance is a business, and business must generate income in Africa and Switzerland. Conventionally: the amount of fees - the amount of payments - the amount of RFP and overhead costs, which, of course, more than 0 (at least the same advertising and payment of premiums to insurance agents for new customers), should be noticeably positive value. Notice, not equal, not less, but strictly more.

More Swiss Nature: A Glimpse of Montreux from the opposite bank.

Here's an example of an honest kidalov out of the blue.

How CSS students threw in 2014

So, it was 2014, did not touch anyone. As part of a routine audit, the Swiss authorities revealed that one of the largest insurance companies, CSS, illegally received compensation from the budget of 200-300k francs each year from the budget to cover the OMS costs for students. Damage over 10 years amounted to 3 million francs. And cho, great business!

Just at this time, PhD-students were taken out from under the action of student insurance and forced to pay in full as a working adult (they imposed a qualification on income for the year).

What made CSS ?! Repent, compensated for something, helped somehow? No, I just sent a notice that since such a number, a respected student is no longer covered by their insurance, and at least the grass does not grow. All the rest is your problem, gentlemen!

Details here .

Just at this time, PhD-students were taken out from under the action of student insurance and forced to pay in full as a working adult (they imposed a qualification on income for the year).

What made CSS ?! Repent, compensated for something, helped somehow? No, I just sent a notice that since such a number, a respected student is no longer covered by their insurance, and at least the grass does not grow. All the rest is your problem, gentlemen!

Details here .

Medical insurance: when it is too early to die, and it is too late to heal

And, since the conversation went about medical insurance, then it is worthwhile to stay separately, since the topic is extremely complex and very ambiguous.

In Switzerland, a system of co-financing of medical services operates, that is, every month the insured pays a certain amount, then the client pays up to the amount of the deductible on their own. The system is so tuned that increasing the franchise decreases in proportion to the monthly contribution, so if you do not plan to get sick and you do not have family / children, then feel free to take the maximum franchise. If the treatment is more expensive than the deductible, then the insurance begins to pay for it (in some cases, the client will be obliged to pay another 10%, but not more than 600-700 per year).

Total, the maximum that the insured pays out of pocket - 2500 + 700 + ~ 250-300x12 = 6200-6800 per year for an adult working person. I repeat: this is in fact a minimum wage without subsidies.

Firstly , if you are going to ride in ambulance carriages or lie in hospital for a long time - I advise you to attend to a separate insurance that will cover these costs.

For example, one of my friends fainted at work, compassionate colleagues called an ambulance. From the place of work to the hospital - 15 minutes on foot ( sic! ), But an ambulance is necessary to take a detour along the roads, which also takes about 10-15 minutes. In total, 15 minutes in the ambulance cost ~ 750-800 francs (something about 50k wooden) per call. So, even if you give birth - take a better taxi, it will cost 20 times cheaper. Ambulance here - only for really difficult cases.

For reference: a day in the hospital costs from 1,000 francs (depending on the procedures and department), which is comparable to a stay in the Montreux or Lauzan Palace (hotels of the level of 5 stars +).

Secondly , doctors are one of the highest paid professions, even if they do nothing. 1 minute of their time is worth x credits (each doctor has his own “rating” depending on his specialization and qualification), each credit costs 4-5-6 francs. Standard reception is 15 minutes, that's why everyone is so friendly and they ask about the weather, how they feel and so on. And since healing is a business (well, through insurance, naturally), and a business should be profitable - well, you understand, yes ?! - the price of insurance is growing at an average of 5-10% per year (there is almost no inflation in Switzerland, you can take a mortgage at 1-2%). For example, from 2018 to 2019, the difference was 306-285 = 21 francs or 7.3% for Assura for the simplest insurance.

And as another cherry on the cake, winning a dispute with local doctors who caused harm to the patient's health is an extremely costly and problematic social competition. Actually, for these purposes there is its own insurance - legal, which is inexpensive, but it completely covers the costs of lawyers and the courts. You don’t have to go far for an example : how can you mix up 98% acetic acid and diluted vinegar (try to open both bottles at your leisure) - I don’t even know.

About the death of the ex-head of Fiat (to put it mildly, not a poor man) in Zurich after a minor operation, I generally keep quiet.

Apples in the snow: the same haik, when we already began to consider how much our evacuation will cost, and to some people, medical assistance. Still, 32 km instead of 16 - it was a setup

Thirdly , the mediocre quality of basic medicine is quite mediocre (this is not when to collect arms and legs in one body after an accident, but to make a diagnosis and prescribe a treatment for a cold). It seems to me that the cold here for the disease is not considered - they say, it will pass by itself, but for now drink paracetamol.

It is necessary to search through familiar intelligent doctors (to the sensible record for 2-3 months in advance), and to transport drugs from the Russian Federation. For example, anesthetic / anti-inflammatory Nimesil or Nemulex costs 5 times more expensive, and in a pack it is often 2 times smaller than tablets, for some Mezim to digest fondue or raclette, I generally keep quiet.

Fourthly , stories about long queues in anticipation of medical care are more likely the prose of life than something unbelievable. In any hospital / hospital (an analogue of an ambulance) there is a system of priorities, that is, if you have a deep cut of your finger, but blood on a liter per hour does not lash, then you can wait for an hour and two, and three, and even four or five hours! Alive, breathe, life is not in danger - sit and wait. Similarly, an x-ray of a broken finger can be waited up to 3-4 hours , despite the fact that this procedure takes 1-2 minutes (put on a lead vest, the nurse set up the shooting, click and x-ray is already digitally displayed on the screen).

Fortunately, this does not apply to children. All “breakdowns” of children are usually eliminated out of turn, and the insurance itself is several times cheaper than in adults.

Private example

A small child broke his nose and was hospitalized. In total, treatment (including medicines) cost 14,000 francs, which the insurance has almost completely covered, while the parents gave 400 francs out of their pocket. Is it expensive or not? Write in the comments!

A spoon of honey. Despite the fact that this insurance should be profitable for its owners, there is good news - in Switzerland, it does a relatively good job with its function. For example, on the very eve of the new year, a misfortune happened - put a finger on a broken glass. We just went to celebrate the New Year in France, so we sewed up already in Annecy. They waited ~ 4 hours , 2 hours to the ward and 2 hours on the "operating table". The check was sent to the insurance with a brief description of the situation (there is a special form in EPFL). Formally, the 29th is ½ working day, which the professor gives us as a day off, i.e. accident insurance fully covers.

Collage from friends. Careful, tin - I warned

Pension system

I will not be afraid of this word and call the Swiss pension insurance system one of the most thoughtful and fair in the world. This is such a nationwide insurance. It rests on three pillars , or pillars.

The first pillar is an analogue of soc. pensions in the Russian Federation, which includes a disability pension, a pension for the loss of the breadwinner, and so on. Deductions for this type of pension are paid by all who have income of more than 500 francs per month. It is also worth noting that a non-working spouse with minor children takes into account the years of the first pillar, similarly to a working spouse.

The second pillar is the labor savings part of the pension. Mote motie (50/50) is paid by the employee and the employer at a salary of 20,000 to 85,000 francs per year. If the salary is above 85,000 francs ( in 2019 it is 85,320 francs 00 centimes) the insurance premium is not paid automatically and the responsibility is passed on to the employee himself (for example, he can contribute money to the third pillar).

The third pillar is a purely voluntary exercise in the accumulation of pension capital. Approximately 500 francs per month can be withdrawn from taxation, deferring to a special account.

It looks like this:

Three pillars of the Swiss pension system. A source

Good news for foreigners: when leaving the country for permanent residence in another country that did not sign an agreement with the Confederation on the pension system, you can take the 2nd and 3rd pillar almost completely, and the first partially. This is a huge advantage for foreign workers compared to other countries.

However, this does not apply to departure to EU countries or countries that have signed an agreement with the confederation on the pension system. Therefore, leaving Switzerland, it makes sense for a few months to move to their homeland.

Also, the second and third pillar can be used when starting a business, purchasing real estate and as a mortgage contribution. Very convenient mechanism.

As in the rest of the world, the retirement age in Switzerland is set at 62/65 years, despite the fact that retirement is possible from 60 to 65 years with a corresponding decrease in payments. However, now there is talk of letting the employee decide when to retire from 60 to 70 years. For example, Gratzel still works in the EPFL, although he is 75 years old.

To summarize: what does an employee pay in taxes?

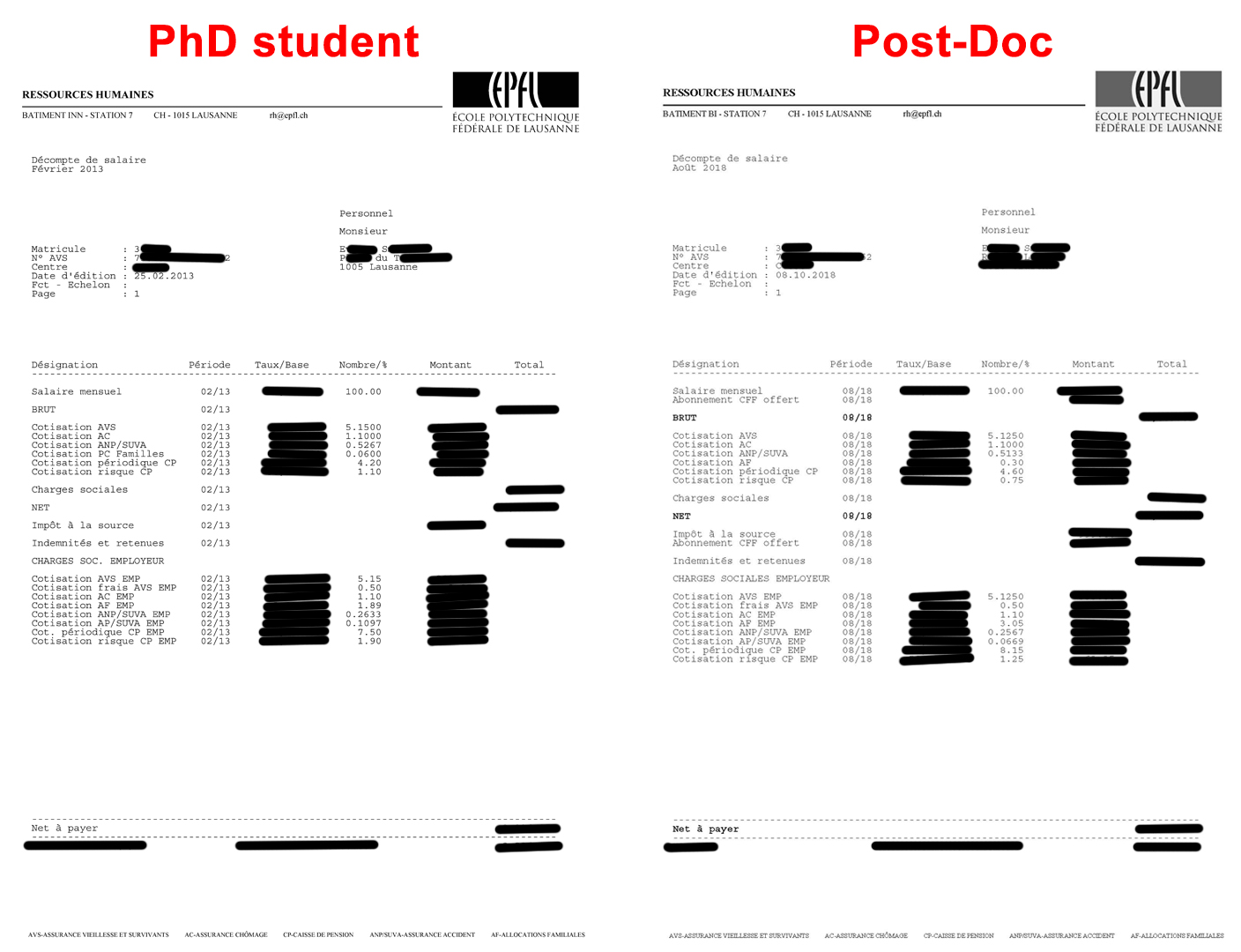

Below I give salary statements, which show exactly what and how much is deducted from a working employee, for example, in public institutions (EPFL):

Legend: AVS - Assurance-vieillesse et survivants (old age insurance aka first pillar), AC - unemployment insurance, CP - caisse de pension (pension fund aka second pillar), ANP / SUVA - assurance accident (accident insurance), AF - allocations familiales (a tax from which family benefits will be paid later).

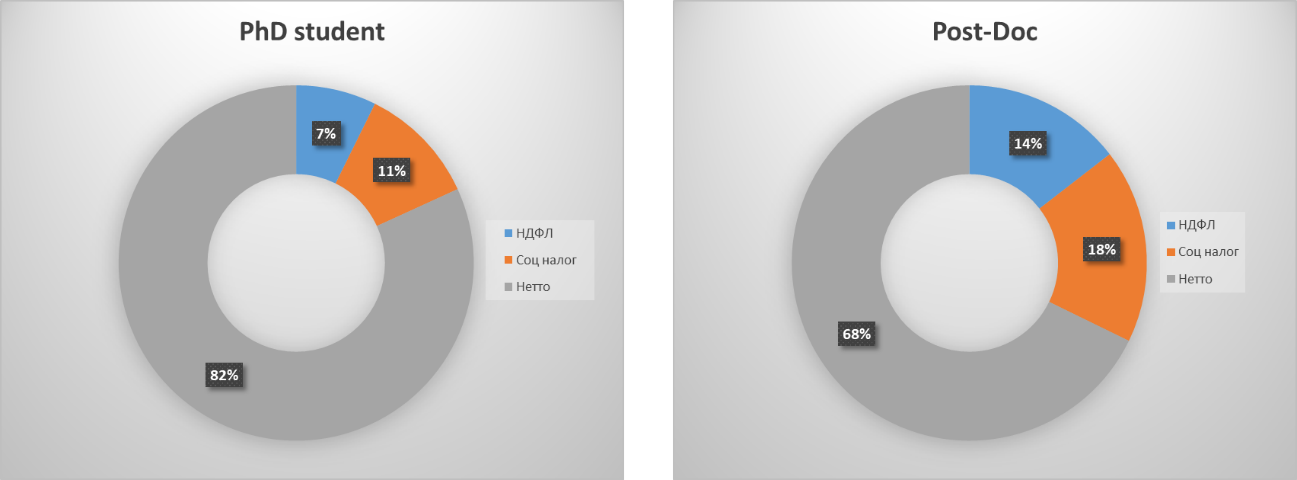

Total, the total tax burden is about 20-25%. It floats slightly from month to month (at least in the EPFL). An Argentine acquaintance tried to find out (an Argentinian with Jewish roots;)) and figure out how this happens, but it is unknown to anyone except those who are spinning in the EPFL accounting system. However, at a minimum the annual income tax rate and the progressive scale can be assessed in the second part of the document .

Plus, do not forget to add insurance of your choice, but the mandatory payments will be added at least another 500-600 francs. That is, the “total” tax, which includes all compulsory insurance and payments, has already exceeded 30%, and sometimes reaches 40%, such as that of post-graduate students. The post-dock salary is, of course, freer, although in percentage terms the post-dock also pays more.

The structure of the income of the PhD student and Post-Doc in the EPFL

Accommodation: rent and mortgage

Specially put into a separate topic, since the fattest item of expenditure in Switzerland is renting housing. Unfortunately, the shortage in the housing market is huge, housing itself is not cheap, so the amounts that have to be rented are sometimes space-based. However, the price per square meter is growing disproportionately to the increase in the area of housing.

For example, a studio of 30-35 m 2 in the center of Lausanne can cost both 1,100 and 1,300 francs, however, the average value is about 1,000 francs. I even saw a studio in the garage, but furnished, in Morge-St.Jean (not the most popular place, let's face it) for 1100 francs. Zurich or Geneva is still worse, so there are few who can afford an apartment or studio in the center.

This was my first

This is the new studio in Lausanne.

A one-room apartment (1.0 or 1.5 rooms is when the kitchen is formally separated from the living space, and for 0.5 it is considered the so-called living room or hall) of the same area will cost approximately 1100-1200, two-room (2.0 or 2.5 rooms in 40-50 m 2 ) - 1400-1600, three-bedroom and higher - an average of 2000-2500.

Naturally, it all depends on the area, livability, proximity to transport, is there a washing machine (usually one machine for the whole staircase, and in some old houses there is no such thing!) And a dishwasher and so on. Somewhere on the “outskirts” of an apartment I can cost 200-300 francs, but not many times cheaper.

It looks like a two-room apartment in Montreux

That is why “communal” housing is often common in Switzerland, as we would call it when one or two people rent a 4-5 room apartment for the conditional 3000 francs, and then 1-2 neighbors live in this apartment, plus one room - a common the hall. Total savings: 200-300 francs per month. And usually, large apartments have their own washing machine.

Well, the search for your own housing is also a lottery. In addition to salary extracts, permit (residence permits) and pursuit (absence of any debts), you must also be selected by the landlord (usually a company), which has a queue of sufferers, including Swiss. I know people who, like when looking for a job, write motivational letters for landlords. In general, the option with a communal apartment through friends and acquaintances of friends is not so bad.

Briefly about buying a home.It is quite natural that you can not even dream of buying your property in Switzerland to the position of full professor, because real estate can cost space money. And, accordingly, the permanent Permite C. Although Graphite corrects: “ L - only the purchase of the main housing, in which you will actually live (you cannot register and then move out - check). B - one unit of the main and one unit of “summer cottage” (chalet in the mountains, etc.). With or citizenship - purchase without restrictions. Mortgage on Perm give without any problems if you have a good permanent job. "

For example, a house on the beach in the rich village of St-Sulpice will cost 1.5-2-3 million francs. Prestige and Ponte more money! However, an apartment in a village near Montreux overlooking the lake and 100 meters from it, 300,000 - 400,000 (a studio can be found up to 300,000). And again we return to the previous article , where I mentioned that villages in Switzerland are in certain demand, when for the same 300-400-500k francs you can get a whole house with a house plot.

At the same time, as mentioned above, you can use pension money to buy real estate, and the “pleasant” bonus to this is payment for a mortgage loan, which may be 500, and 1,000, and 1,500 francs per month, i.e. comparable to rental. It is profitable for banks to have - in every sense of the word - a mortgagee, since property in Switzerland only grows in value.

Repair in the apartment according to Russian templates (to hire a brigade either from the Internet or from a neighboring construction site) is unlikely to succeed, since only specially trained people have access to electrics, ventilation, and heating. Most likely, these will all be different people, and the payment for each of them will be 100-150 francs per hour. Plus, it is necessary to obtain permits and approvals from the governing and supervisory authorities, for example, to rework the bathroom or replace batteries. In general, you can give another half the cost of housing only for its repair.

To make it a little more colorful and understandable in which habitat they live, I prepared a short video with a story about where I lived.

Part one about Lausanne:

Part two about Montreux:

Well, in fairness it is worth noting that students are often provided with hostels on the campus of the university. The rental price is reasonable, you can pay 700-800 francs per month for a studio.

Oh yes, and last, do not forget to add 50-100 francs per month to the amount of the rental itself, which includes electricity (about 50-70 per quarter) and hot water heating (everything else). Although heating and hot water are by and large all the same electricity or sometimes gas used in boilers installed in every home.

Family and kindergartens

Once again, family is not cheap in Switzerland, especially when there are children. If both work, the tax is taken from the total family income, i.e. higher, life in a two-room apartment is cheaper, you can save a little on food and entertainment, but in general it turns out to be a bash on a bash.

Everything changes abruptly when children appear in the family, since kindergarten in Switzerland is very expensive. At the same time, in order to get into it (we are talking about more or less accessible state-owned gardens), it is necessary to enroll almost the first weeks of pregnancy. And given the fact that the decree here lasts

In fairness, it is worth noting that almost all firms provide benefits, one-time payments, part-time work (80% of 42 hours per week, for example) and other buns to support newly minted parents. Even SNSF grants include the so-called family allowance and children allowance, that is, a small surcharge for the maintenance of the family and children, as well as a 120% program, when 42 hours for a working parent are considered 120% of the working time. It is very convenient to spend one extra day a week with your child.

However, the cheapest kindergarten, as far as I know, will cost parents 1500-1800 francs per month per child. In this case, most likely, children will eat, sleep and play in the same room, changing, so to speak, the surroundings. And yes, a kindergarten in Switzerland usually works up to 4 days, i.e. one parent will still have to work part-time.

In general, the break-even threshold of ~ 2-2.5 children, i.e. if there are 3 or more children in a family, then it is easier for one parent to stay at home than to work and pay for kindergarten and / or nanny. A nice bonus for parents: garden expenses are deducted from taxes, which makes a significant contribution to the budget. Plus, the state pays for each child 200-300 francs per month (depending on the canton), ranging from 3 to 18 years. This also applies to visiting expats with children.

And although in Switzerland there are many bonuses for families with children, such as allowances, tax breaks, practically free educational institutions, subsidies (for medical insurance or even garbage bags from the commune), the last rating speaks for itself.

Scrupulous summing up

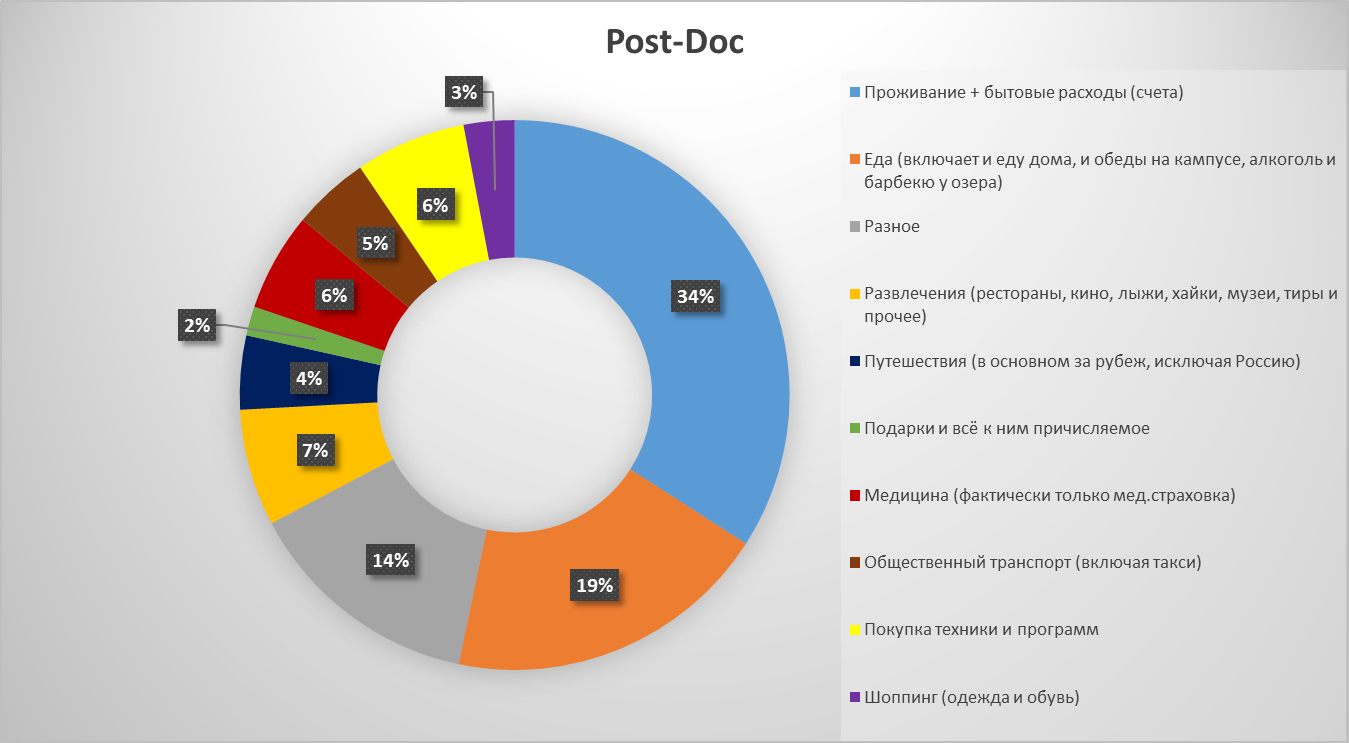

It seems that the balance of income and expenses was sorted out, now it’s time for a small statistic based on the results of almost 6 years in Switzerland.

During graduate school I didn’t have a goal to live as economically as possible, so that somewhere in the depths of Swiss banks to put off financial fat. However, the food, I think, could be cut by a third or a quarter.

EPFL postgraduate student expenses

structure Post-doc expenses structure in EPFL

In early 2017, after defending my thesis, I had to move to another application to calculate expenses, and therefore the categories changed somewhat, but they are colored in graphs in identical colors. For example, the categories of accommodation, household expenses and communications merged into one “Bills” (or accounts).

About mobile internet and traffic

Bills , - ( ). . - : : 01- 1, 02 — 2.5x, 03-3, 04 — 2, 05 -2, x=14.95 CHF 1 Gb . - - .

Returning to medicine and insurance, you can clearly see that if a graduate student spends about 4-5% of his income on medical insurance, then the post-doc spends already 6%, while his salary is higher.

In addition, with the increase in income (graduate student -> post-dock), the percentage ratio of the first two categories of expenses remained almost the same - ~ 36% and 20%, respectively. Truly, no matter how much you earn, you will spend it all the same!

Public transport is more an indicator of the cost of taxis and airplanes, since for 4 years the EPFL paid for a subscription throughout Switzerland, which I wrote about in the previous part .

Some fun facts:

- , 2013 , , 2 , . , 4K , ~1000 , 2000, 3000, 5 . , , Aliexpress : — , !

- ( aka ). , , (, ..). 2-3, 4 , ( — , «» ( sic! ) ).

- , .. — / .

That's all folks! I hope that my articles will answer the lion’s share of questions about relocation and living in Switzerland. Some aspects and moments will show and tell on YouTube .

PSRP taken from here.

PS: since this is the last article of this series, I would like to leave here two facts about Switzerland that did not appear in previous articles:

- In Switzerland, you can easily find coins until 1968, when the monetary reform took place, and the old, still silver francs were replaced with ordinary nickel coins.

- Lovers of apocalyptic investments who buy physical gold prefer special gold Swiss coins - they are associated with reliability.

PPS: For reading material, valuable comments and discussions, my big, very big thanks and appreciation to my friends and colleagues Anna, Albert ( qbertych ), Anton ( Graphite ), Stas, Roma, Yulia, Grisha.

Minute advertising. In connection with the latest trends of “fashion”, I would like to mention that MSU opens this year a permanent campus (and has been teaching for 2 years!) Of a joint university with Beijing Polytechnic University in Shenzhen. There is an opportunity to learn Chinese, as well as get 2 diplomas at once (IT-specialties from VMK MSU available). More information about the university, directions and opportunities for students can be found here .

Do not forget to subscribe to the blog : You are not difficult - I am pleased!

And yes, about the defects noted in the text, please write in the LAN.

Source: https://habr.com/ru/post/458508/

All Articles