First look at Facebook Libra

A detailed review from Binance Research is the long-awaited entry of Facebook into the cryptocurrency industry.

The translation is done by the project team INDEX Protocol. Now there is a lot of hype in the news around this project, with very little real data and good analyzes. The Binance Research team was able to prepare very high-quality, in our opinion, material that we translated. In the notes, we note the points that have been added over time, after the release of the report, or where we have a separate opinion. If you are interested, our previous translation was devoted to the architecture of decentralized exchanges . Translation is done with coolsiu

On June 18, 2019, Facebook published detailed information about Libra , a stable cryptocurrency operating on its own blockchain and supported by a basket of financial assets .

')

In this report, we will look at the details of this new, highly anticipated cryptocurrency, before delving into the technical details. We will also discuss how this will affect different perspectives on local and global markets.

The Libra project was first announced by Facebook at the beginning of this year and officially launched on June 18, 2019.

Libra is a new global cryptocurrency built on an open source blockchain called Libra Blockchain, with its own proof-of-stake protocol.

According to the official Whitepaper , Libra is supported by a non-profit organization called the Libra Association, which has two main functions:

Libra is supported by its own reserve (“ Libra Reserve ”), which consists of a basket of low volatility assets, structured in such a way as to keep their value relatively stable.

However, Libra is not intended to be a stable coin (according to current stablecoin definitions ), and its value is not tied to a single fiat currency. Instead, Libra will initially be supported by a basket of assets denominated in four fiat currencies: USD, GBP, EUR and JPY.

Although these currencies are included first, we expect that in the long term, other assets that meet the three basic criteria, regardless of their nature (cryptocurrency, fiat currency, etc.), can be included in the Libra reserve basket:

In addition to the high-level design and key parameters of the Libra ecosystem, then we look at the technical fundamentals of the Libra Network.

This section will discuss the consensus algorithm, as well as support for smart contracts and token design.

Libra will work on its native blockchain, the Libra Blockchain with the Proof-of-Stake (PoS) mechanism, in which the nodes managed by the consortium members are geographically distributed and meet fairly high technical requirements.

These nodes will be based on a new Byzantine-fault tolerant (BFT) consensus algorithm. The algorithm, called LibraBFT, is a variant of HotStuff, first published in 2018 by Maofan Yin and Dalia Malha of VMware Research. This may provide future compatibility with other BFT consensus-based blockchains, such as Tendermint and Binance Chain.

Note: HotStuff is a modified version of the well-known pBFT protocol in which the number of message exchange rounds is reduced, thus achieving consensus requires n + 2 rounds instead of 2n. Instead, this results in very tough and high requirements for the hardware platform of the validator nodes and channel capacity (recall that in BFT systems, each node must maintain connection with all the others). After the first analysis of the protocol, there are some doubts about the expediency of such an approach - for the sake of several improvements, the introduction of a new protocol and, most likely, the deliberate tearing up of the requirements for validators. The Tendermint Core is already a fairly mature solution, tested in combat by several projects, and many have invested dozens of person-years.

Quorum, a private blockchain created by JP Morgan, was previously widely discussed as another major initiative in the field of crypto-assets from a traditional (non-crypto) company.

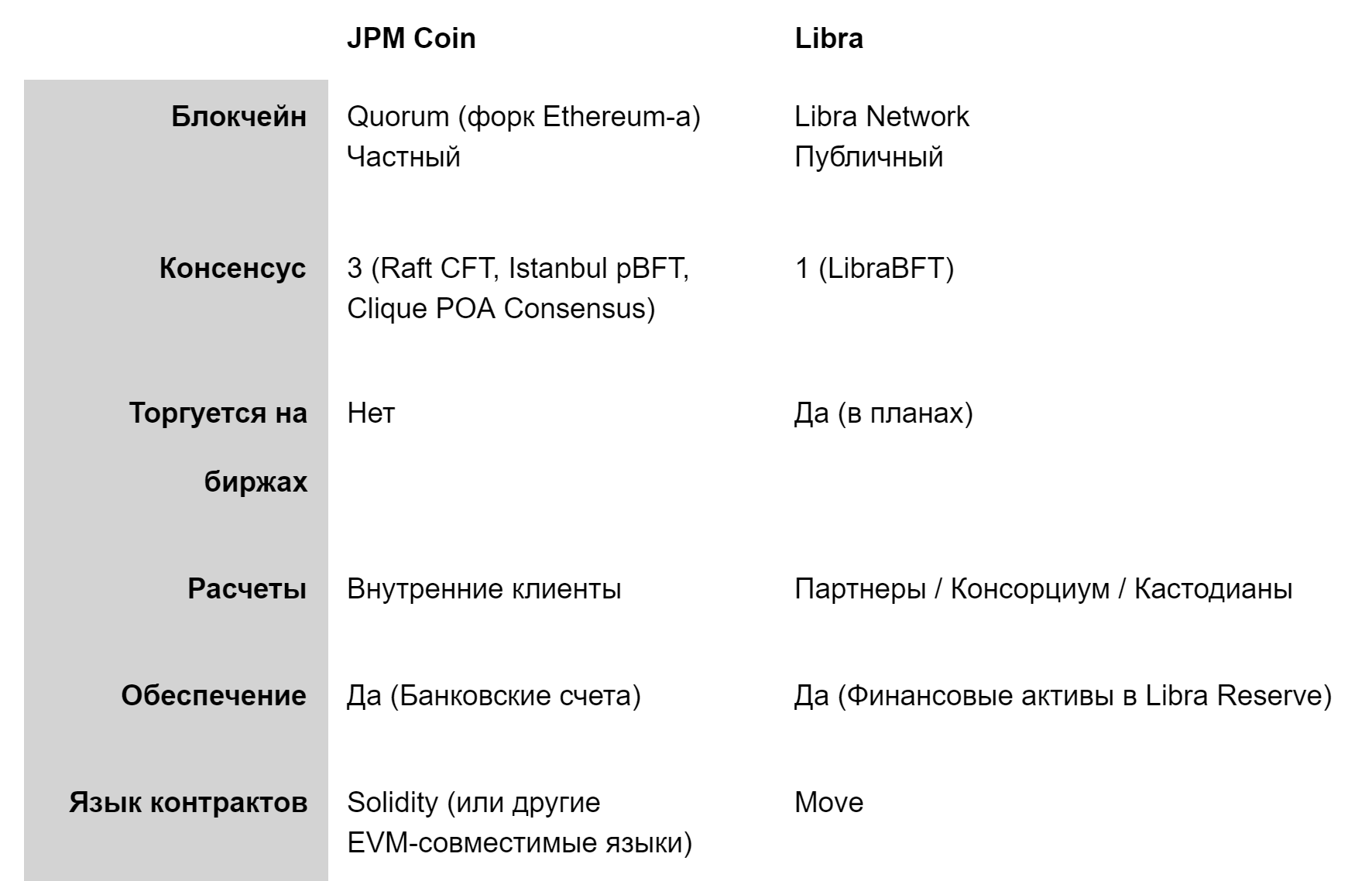

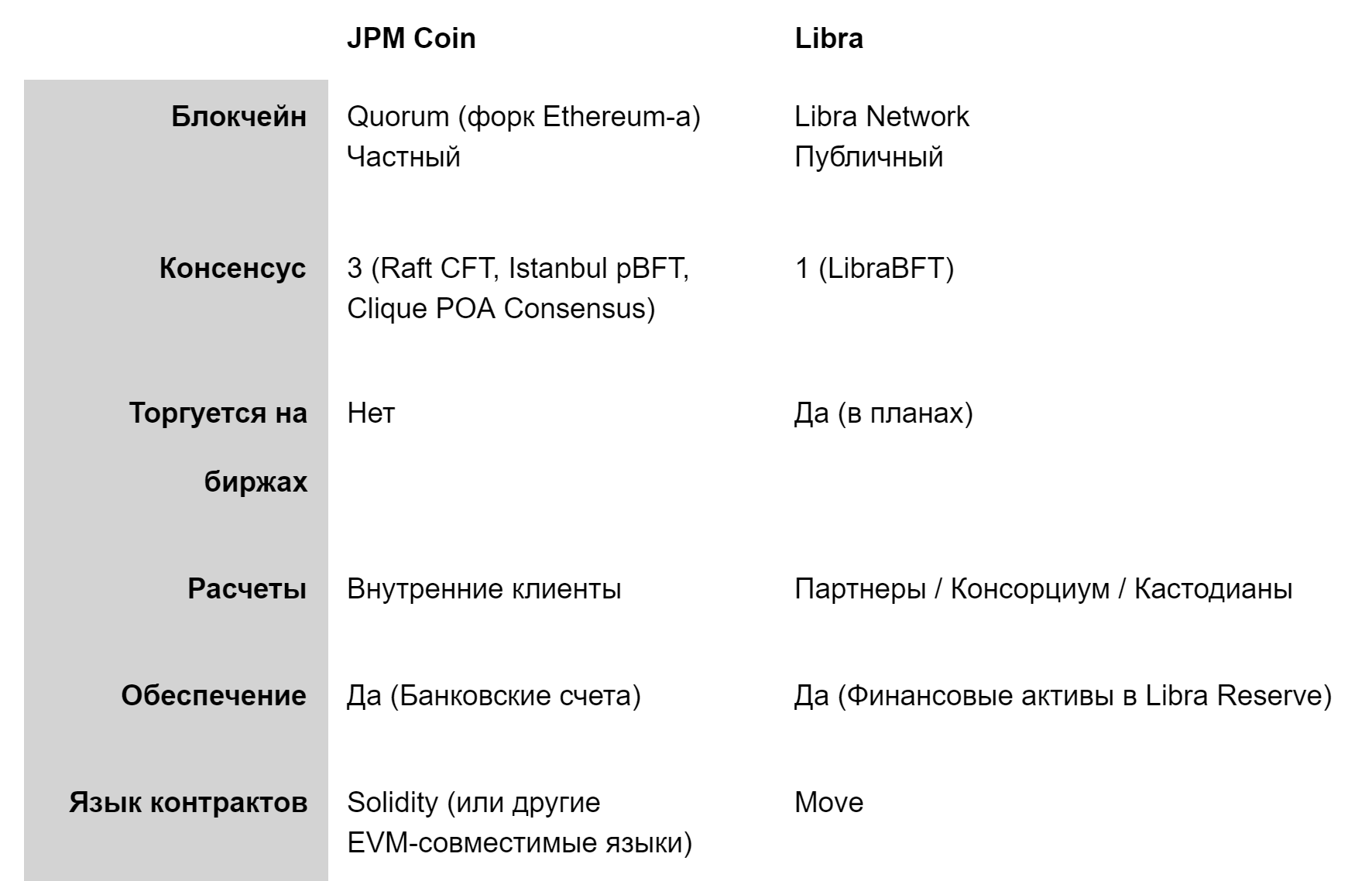

The following table illustrates the similarities and differences between the JPM Coin / Quorum and the Libra / Libra Network.

Smart contracts will be written in Move, a programming language created specifically for the Libra blockchain. According to the technical whitepaper of the Move language , it is “a language translated into executable bytecode used to implement user transactions and smart contracts”.

One of the current features of the private blockchain are ready-made smart contracts that are pre-approved for networking. Only these smart contracts will be involved during the launch of the network. Yes, such conditions limit the possibilities for users, but in return it also reduces the likelihood of any mistake, such as an incident with Ethereum Parity Wallet (note: this concerns the vulnerability of some versions of multi-signature wallets, which resulted in the loss of about 153,000 ETH ) . All the functions allowed to work are checked by both the consortium members and the community. You can already go to the site for developers to read the documentation and start experimenting with the code.

Since the Libre Network project is a consortium of more than 100 different participants, we were able to pre-study and identify the most frequent, necessary and useful use cases that formed the basis of the basic contracts.

Note: Such an approach, in our opinion, is not devoid of rationality, just look at the examples in the world - most of the contracts in Ethereum do not sparkle with a variety of algorithms and are usually based on the already tested and tested OpenZeppelin library, which allows it to be considered part of the standard library to work with Ethereum. Another similar option is BitShares, a public blockchain in which the source library of more than 70 basic contracts covers almost all options for using the network. Perhaps, if Libra claims the next standard of financial technology, this restriction is more than reasonable. However, there is no more information about the implemented contract options.

Like the MakerDao system, there are two tokens, MKR (management token) and DAI (stablecoin), and in other systems with two tokens, there will be a separate management token called Libra Investment Token (LIT) that will allow you to participate in network management. The value of this token is related to the cost of participation in this management or, possibly, with any income or remuneration paid to network-supporting members, and is not related to the daily market value or activity of the Libra token. Instead, the cost of the control token depends on the durability and usefulness of the tokens offered by the consortium.

However, it is important to note that non-profit organizations, NGOs and other organizations wishing to participate in management can get this opportunity without having a minimum amount of 10M USD. Due to the fact that many such organizations make international payments and transactions, Libra’s reduced barrier to entering such institutions can be a significant incentive for their adoption, as evidenced by the already announced participation of three main organizations that influence society: Kiva, Mercy Corps and Women's World Banking.

For ordinary enterprises that do not seek control, we will specify the conditions, whether they will be expressed in specific amounts of USD or as a percentage of ownership of the entire network (ie, 1%, provided no more than 100 validators).

In this section, we will discuss the impact from both a local and a global point of view in three different ways: short, medium and long term.

In 2019, Libra will be tested as part of a test network. This live sandbox will allow third-party developers and organizations to experiment with the new blockchain and its interface of smart contracts.

Based on the list of initial participants , one of the most interesting exceptions is the absence of financial institutions - banks. We have previously investigated this issue - non-financial companies are more likely to take risks than traditional financial companies, and they have more incentives to destroy the payment industry in order to be able to carry out their operations more quickly and cheaper.

Banks also test blockchains using XRP / Ripple and JPM Coin / Quorum .

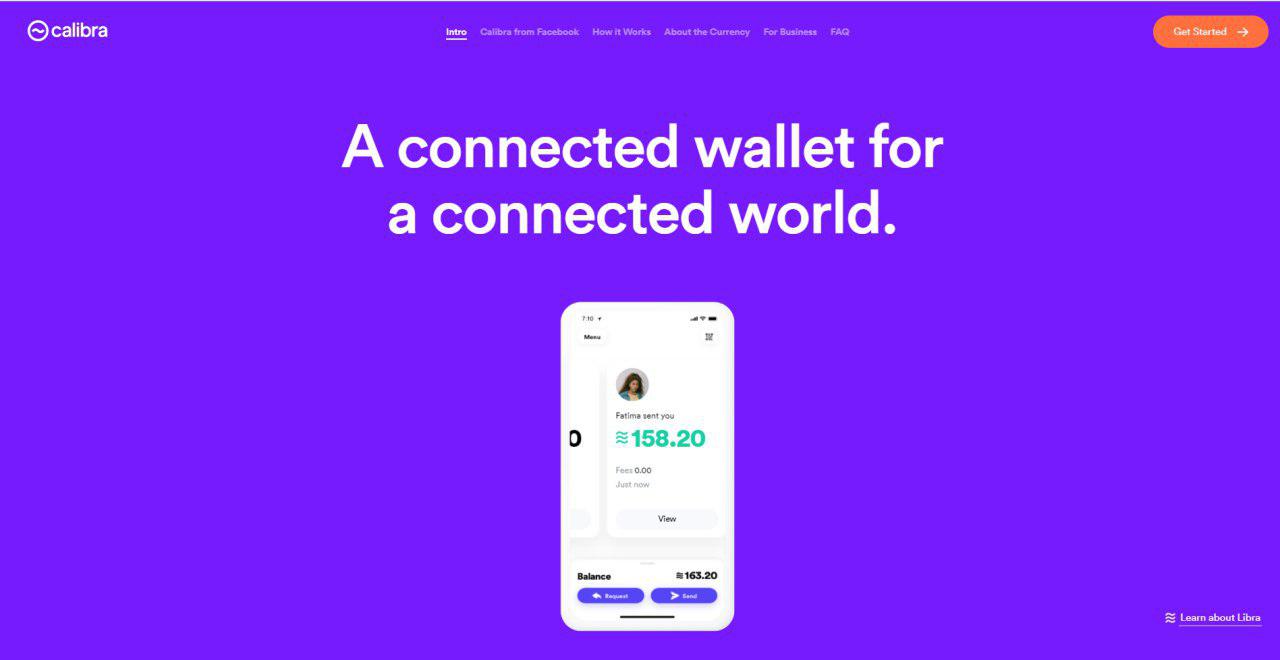

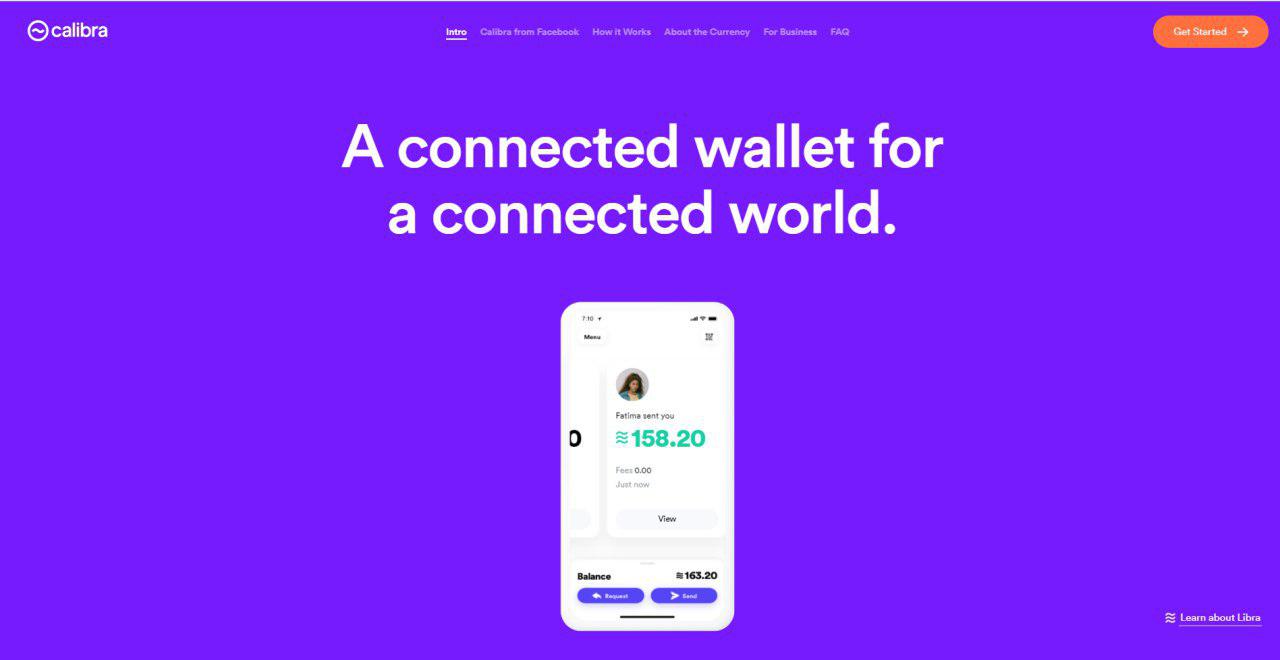

For Facebook, Whatsapp and Instagram users, Libra is likely to be used in everyday applications, starting with Calibra wallet.

Although the launch of the main network is expected in 2020, it is considered at this stage that there is no decent alternative to Libra, which will become a serious competitor of the same level and scale as the initial pool of Libra members, which includes most of the largest companies in the financial technology industry.

Compared to the initially licensing infrastructure of the private chain Quorum from JP Morgan, the gradual transition of the Libra Network from a controlled environment to a fully open one should be of interest for third-party projects to become pioneers and now begin to develop their solutions.

We expect a positive impact on both Facebook and the crypto industry in general.

In the past, Facebook has always allocated a significant amount of its resources to create infrastructure for the whole world.

Today, the world of cryptocurrency, despite the cumulative market capitalization of $ 283 billion ( at the time of this writing ), still faces obstacles to global implementation. However, the Libra ecosystem seems to have unique opportunities to expand the reach and impact of cryptocurrency by increasing accessibility for all:

The long-term effects of Libra are very different both economically and financially; Some potential macroeconomic implications include:

Although this initiative serves a long-term goal for individuals and consumers around the world, Libra as an ecosystem and cryptocurrency can also benefit major players and financial institutions around the world. Potential opportunities include:

Ultimately, in the long run, this initiative may hinder the growth of payment implementations in existing cryptocurrency projects, primarily the Lightning Network, if BTC is not included in Libra Reserve. However, in terms of the value, Libra (and other similar initiatives) can lead to the emergence of new opportunities in the industry, increasing investments in all cryptocurrencies and digital assets, and the assets themselves will remain to perform their functions that can coexist in parallel with Libra.

In short, Libra, in the long run, can help bridge the gap between the crypt and the traditional “off-chain” economy.

Facebook's Libra cryptocurrency initiative at the center of the project will have a significant impact on the financial industry and the global economy in both the medium and long term. With the support of a basket of fiat money assets in the initial release, Libra is the first attempt to create a global currency, regardless of blockchain, with daily use by billions of people and organizations around the world.

However, the scale of success will greatly depend on how Libra can convince regulators and financial institutions to cooperate with the consortium in creating a flexible structure that satisfies the need for decentralized management while respecting existing domestic and international regulatory standards.

Other important factors are the ability to scale the Libra user base and create a reliable alliance of financial institutions that support the storage of collateral reserves and provide two-way exchange functions (i.e. fiat currency deposit accounts). In addition, the ability of the Libra Foundation to operate independently of Facebook, just as there is a separation between monetary and fiscal policy in developed countries, will be a key factor for gaining public confidence.

Regardless of whether this is one of the greatest successes in the cryptoactive industry, Libra is likely to contribute to bridging the gap between the right to access basic financial services and individuals who do not have access to banking systems (for example : unbanking people ) .

However, there are still a number of questions to Libra, including:

Despite this uncertainty, Libra has already laid a vast and well thought out basis for blockchain and cryptocurrency technologies, which will be accepted by both traditional companies and individuals.

The translation is done by the project team INDEX Protocol. Now there is a lot of hype in the news around this project, with very little real data and good analyzes. The Binance Research team was able to prepare very high-quality, in our opinion, material that we translated. In the notes, we note the points that have been added over time, after the release of the report, or where we have a separate opinion. If you are interested, our previous translation was devoted to the architecture of decentralized exchanges . Translation is done with coolsiu

On June 18, 2019, Facebook published detailed information about Libra , a stable cryptocurrency operating on its own blockchain and supported by a basket of financial assets .

')

In this report, we will look at the details of this new, highly anticipated cryptocurrency, before delving into the technical details. We will also discuss how this will affect different perspectives on local and global markets.

Key points

- Libra is the Libra Network blockchain's internal cryptocurrency, developed and operated by a Swiss foundation and a consortium of companies led by Facebook.

- Cryptocurrency is provided by a basket of financial assets ( Libra Reserve ), which is provided by operators of nodes. The initial emission planned for 2020, Libra will be supported by assets denominated in four major currencies: USD, EUR, JPY and GBP.

- This new financial infrastructure relies on Proof-of-Stake (PoS) mechanisms and a 2-token system. At the bottom level, the network uses the BFT consensus algorithm and can support smart contracts in the future.

- Over the next 18 months, Libra will be included in the Facebook ecosystem, primarily in key products - FB Messenger, WhatsApp and the main website facebook.com (using Calibra wallet). This will allow to cover the entire cumulative audience of projects (almost 2.5 billion users) and involve it in work (transactions) with cryptoactive assets.

- This initiative is expected to have a significant impact on both local and global markets, changing the financial and economic landscape.

- In the medium term:

- Facebook has every chance to strengthen its position and the opportunity to become an open source service provider for applications, websites and e-commerce (note: financial services, similar to services that have been running for a long time, for example, authorization ).

- Libra can become a trigger for the growth of cryptocurrency capitalization due to the high level of access to both institutional players and ordinary users.

- Long term:

- Changes in the payment industry : A new type of player appears in the world that threatens the dominance of traditional banks as “payment intermediaries”.

- New financial services : New players will create innovative (note: rather, now non-existent or owned / controlled by banks ) services on top of the Libra Network, which will be immediately accessible globally to all network users.

- More freedom for money and capital constraints : Central banks will find it increasingly difficult to impede capital flight and maintain tight monetary policies (note: on this occasion, the governments and regulators of some countries have already vigorously responded, unusually quickly, indicating the reality and seriousness of the new global financial player market ).

- “ De-dollarization ”: If and when Libra gained global distribution, a new settlement system for world trade appears, therefore, dependence on the single currency (note: implied US dollar ) decreases as part of international trade turnover.

- The Libra project has every chance of becoming the first “everyday” crypto-embodiment of the ideology and theory underlying such a financial instrument as Special Drawing Rights ( SDR ) and other IMF / World Bank initiatives. As a result, you can get a world cryptocurrency system, combining acceptance by institutional players and the widest possible distribution among users.

Libra Overview

The Libra project was first announced by Facebook at the beginning of this year and officially launched on June 18, 2019.

Libra is a new global cryptocurrency built on an open source blockchain called Libra Blockchain, with its own proof-of-stake protocol.

According to the official Whitepaper , Libra is supported by a non-profit organization called the Libra Association, which has two main functions:

- Libra network management and supervision.

- Reserve management that maintains the value of Libra.

Libra is supported by its own reserve (“ Libra Reserve ”), which consists of a basket of low volatility assets, structured in such a way as to keep their value relatively stable.

However, Libra is not intended to be a stable coin (according to current stablecoin definitions ), and its value is not tied to a single fiat currency. Instead, Libra will initially be supported by a basket of assets denominated in four fiat currencies: USD, GBP, EUR and JPY.

Although these currencies are included first, we expect that in the long term, other assets that meet the three basic criteria, regardless of their nature (cryptocurrency, fiat currency, etc.), can be included in the Libra reserve basket:

- Individually uncorrelated : only free traded assets are allowed. Exchange rates should not have a tight relationship with each other or a fixed rate.

- The decision-making process must be tied either to public organizations (that is, to central banks) or to an freely available asset (for example, goods). (note: we are confident that this reservation is specifically for the possibility of including cryptocurrency in the future ).

- Prevalence : assets must be universally recognized in different jurisdictions in order to have software value. For example, Apple shares (AAPL) are traded in only one currency: USD. As a result, these shares do not have additional quotes to serve as a valuation method for other assets in various jurisdictions. Alternative assets, such as gold or bitcoin, could better serve this purpose, as they are traded in several markets around the world and are therefore more suitable for inclusion in the asset basket used to determine the value of Libra for end users around the world.

In addition to the high-level design and key parameters of the Libra ecosystem, then we look at the technical fundamentals of the Libra Network.

Technical Overview

This section will discuss the consensus algorithm, as well as support for smart contracts and token design.

Consensus algorithm

Libra will work on its native blockchain, the Libra Blockchain with the Proof-of-Stake (PoS) mechanism, in which the nodes managed by the consortium members are geographically distributed and meet fairly high technical requirements.

These nodes will be based on a new Byzantine-fault tolerant (BFT) consensus algorithm. The algorithm, called LibraBFT, is a variant of HotStuff, first published in 2018 by Maofan Yin and Dalia Malha of VMware Research. This may provide future compatibility with other BFT consensus-based blockchains, such as Tendermint and Binance Chain.

Note: HotStuff is a modified version of the well-known pBFT protocol in which the number of message exchange rounds is reduced, thus achieving consensus requires n + 2 rounds instead of 2n. Instead, this results in very tough and high requirements for the hardware platform of the validator nodes and channel capacity (recall that in BFT systems, each node must maintain connection with all the others). After the first analysis of the protocol, there are some doubts about the expediency of such an approach - for the sake of several improvements, the introduction of a new protocol and, most likely, the deliberate tearing up of the requirements for validators. The Tendermint Core is already a fairly mature solution, tested in combat by several projects, and many have invested dozens of person-years.

Quorum, a private blockchain created by JP Morgan, was previously widely discussed as another major initiative in the field of crypto-assets from a traditional (non-crypto) company.

The following table illustrates the similarities and differences between the JPM Coin / Quorum and the Libra / Libra Network.

Smart Contract Programming Language

Smart contracts will be written in Move, a programming language created specifically for the Libra blockchain. According to the technical whitepaper of the Move language , it is “a language translated into executable bytecode used to implement user transactions and smart contracts”.

One of the current features of the private blockchain are ready-made smart contracts that are pre-approved for networking. Only these smart contracts will be involved during the launch of the network. Yes, such conditions limit the possibilities for users, but in return it also reduces the likelihood of any mistake, such as an incident with Ethereum Parity Wallet (note: this concerns the vulnerability of some versions of multi-signature wallets, which resulted in the loss of about 153,000 ETH ) . All the functions allowed to work are checked by both the consortium members and the community. You can already go to the site for developers to read the documentation and start experimenting with the code.

Since the Libre Network project is a consortium of more than 100 different participants, we were able to pre-study and identify the most frequent, necessary and useful use cases that formed the basis of the basic contracts.

Note: Such an approach, in our opinion, is not devoid of rationality, just look at the examples in the world - most of the contracts in Ethereum do not sparkle with a variety of algorithms and are usually based on the already tested and tested OpenZeppelin library, which allows it to be considered part of the standard library to work with Ethereum. Another similar option is BitShares, a public blockchain in which the source library of more than 70 basic contracts covers almost all options for using the network. Perhaps, if Libra claims the next standard of financial technology, this restriction is more than reasonable. However, there is no more information about the implemented contract options.

System of two tokens

Like the MakerDao system, there are two tokens, MKR (management token) and DAI (stablecoin), and in other systems with two tokens, there will be a separate management token called Libra Investment Token (LIT) that will allow you to participate in network management. The value of this token is related to the cost of participation in this management or, possibly, with any income or remuneration paid to network-supporting members, and is not related to the daily market value or activity of the Libra token. Instead, the cost of the control token depends on the durability and usefulness of the tokens offered by the consortium.

However, it is important to note that non-profit organizations, NGOs and other organizations wishing to participate in management can get this opportunity without having a minimum amount of 10M USD. Due to the fact that many such organizations make international payments and transactions, Libra’s reduced barrier to entering such institutions can be a significant incentive for their adoption, as evidenced by the already announced participation of three main organizations that influence society: Kiva, Mercy Corps and Women's World Banking.

For ordinary enterprises that do not seek control, we will specify the conditions, whether they will be expressed in specific amounts of USD or as a percentage of ownership of the entire network (ie, 1%, provided no more than 100 validators).

Global and local influence

In this section, we will discuss the impact from both a local and a global point of view in three different ways: short, medium and long term.

Short term

In 2019, Libra will be tested as part of a test network. This live sandbox will allow third-party developers and organizations to experiment with the new blockchain and its interface of smart contracts.

Based on the list of initial participants , one of the most interesting exceptions is the absence of financial institutions - banks. We have previously investigated this issue - non-financial companies are more likely to take risks than traditional financial companies, and they have more incentives to destroy the payment industry in order to be able to carry out their operations more quickly and cheaper.

Banks also test blockchains using XRP / Ripple and JPM Coin / Quorum .

For Facebook, Whatsapp and Instagram users, Libra is likely to be used in everyday applications, starting with Calibra wallet.

Although the launch of the main network is expected in 2020, it is considered at this stage that there is no decent alternative to Libra, which will become a serious competitor of the same level and scale as the initial pool of Libra members, which includes most of the largest companies in the financial technology industry.

Compared to the initially licensing infrastructure of the private chain Quorum from JP Morgan, the gradual transition of the Libra Network from a controlled environment to a fully open one should be of interest for third-party projects to become pioneers and now begin to develop their solutions.

Medium term

We expect a positive impact on both Facebook and the crypto industry in general.

For Facebook, the next digital frontier

In the past, Facebook has always allocated a significant amount of its resources to create infrastructure for the whole world.

- Authentication for websites : Facebook for the first time offered its login credentials to login through Facebook on its developer portal, which lowered the initial barriers to creating social applications, games, websites and platforms. Today, even despite problems with data and confidentiality, many users everywhere use this opportunity to save a few clicks in the registration process on any new site.

- Mobile application development : in the past few years, Facebook has also developed an open platform React Native for developing applications on mobile and web platforms, again reducing the barrier to creating mobile / universal interfaces with the highest quality UI / UX. Now, many applications are created using React, which helps to consolidate the status of Facebook as a serious player in the mobile world.

- Digital payments : the main jewel of the entire open source infrastructure? An open source economic platform such as the Libra blockchain and the Move language will allow the company to be at the forefront again. If other companies, platforms and marketplaces accept this token as the default currency, Facebook may be a key player in the e-commerce of the future, while reducing costs for companies and individuals to set up and run a business.

For the world of cryptocurrency - General Accessibility

Today, the world of cryptocurrency, despite the cumulative market capitalization of $ 283 billion ( at the time of this writing ), still faces obstacles to global implementation. However, the Libra ecosystem seems to have unique opportunities to expand the reach and impact of cryptocurrency by increasing accessibility for all:

- Accepting Extensions : today, to enter a cryptocurrency requires access to intermediaries when working with fiat currencies or OTC platforms that have the appropriate licenses to work as an intermediary transaction. With Libra, initial accession to the world of cryptocurrencies and digital currencies can be possible even without the participation of ordinary money. For example, eBay or other marketplaces (for example, Mercado Libre) participating in the initial consortium can help in distributing Libra to the wallets of millions of people, allowing people to sell or offer their services and goods directly for cryptocurrency. Similar to the BitTorrent ecosystem tokenomics, which allows users with an Internet connection to provide resources for cryptocurrency earnings, the original token holders and Internet partners can act as "atomic swaps" (note: reliable intermediaries, this is not very correct, in our opinion the analogy with the concept atomic swaps, where the feasibility of the commitments of both sides controls unbiased algorithms and cryptography, and not arbitrarily large consortium, but still people) between the physical, real resources and qi rovymi tokens. The network effect allows unlimited scaling and finding the best deals for all market participants.

- Additional arbitrage opportunities : since Libra is trading against major cryptocurrencies, such as BTC, this creates arbitrage opportunities that can only be closed by trading a pair of quotes (in this case, BTC) against each of the components in the Libra backup basket. Such a multi-stage arbitration strategy can lead to an increase in trading volumes and liquidity for cryptocurrencies around the world. It may also attract new institutional groups to trade in cryptocurrencies, provided that they have access to trade in the currencies that make up the Libra reserve.

- Increased competition between the issuers of steyblokoinov : thanks to its access to local custodial partners in many jurisdictions to ensure the functionality of two-way exchange around the world, Libra can outrun other issuers. Existing issuers of steylcoin will be forced to maintain similar levels of transparency and emission control in order to offer a worthy tool for users of cryptocurrencies.

- Mass digital adoption : finally, with the potential to form a multitude of trading pairs on exchanges against fiat, cryptocurrency and other market assets, the Libra token itself has a unique position to become a truly mass instrument. This opens the way to engaging more end users, expanding familiarity with blockchain technology, aligning the learning curve of users of the new crypto ecosystem.

Long-term perspectives

The long-term effects of Libra are very different both economically and financially; Some potential macroeconomic implications include:

- Changes in the payment industry : a new arena with new entrants will appear in the digital world. In the course of the ongoing debate about who will eventually become the main provider of financial services in the mobile industry, the Libra ecosystem can lead to “ unbanking the banks ” (note: a difficult word play for me, essentially depriving banks of the basic financial functions that make their banks ).

- Growth in the supply of financial services : like DeFi (note: an abbreviation for any decentralized financial projects, protocols and solutions ), a programmable blockchain could lead to the creation of new decentralized services for crypto assets that would eventually increase competition with traditional finance. lower barriers to entry for individuals.

- Ensuring greater freedom of money and lowering capital constraints around the world : as a basket of world currencies and financial assets, the Libra cryptocurrency can contribute to providing new opportunities at times when people are seeking shelter for their assets. Having channels and markets from Libra, this may prevent central banks from adopting a capital policy based on monetary restrictions. Steklokinoi and cryptocurrency also perform this function in some countries, as evidenced by the trade with a large premium on the domestic stock exchanges in countries with capital constraints (note: meaning that now BTC in some countries, for example, Venezuela or Zimbabwe, is traded on local the exchanges are much higher than the average rate on world markets and this premium (difference in rates) is just an indicator of the desires of capital to flee the country).

- “ De-dollarization of the world ”, that is, the introduction of a new unit of account for global trade: if Libra were used throughout the world, it could (tentatively) lead to the creation of a new standard for global trade. “This global figure” can be considered as a functional and marketable version of SDR proposed by the IMF. However, Libra is currently more limited (because it does not include the Chinese yuan) as one component, but management will be more decentralized in the future. This will lead to a transition in the monetary economy from government officials to private corporations, which ultimately can violate consumer rights and lead to a new round of monopolization of world exports / imports.

Although this initiative serves a long-term goal for individuals and consumers around the world, Libra as an ecosystem and cryptocurrency can also benefit major players and financial institutions around the world. Potential opportunities include:

- A common currency to attract capital : for global companies that want to raise money through primary bond issuance, it may be interesting to collect money in a “neutral currency” such as Libra, instead of conducting multiple bond issuances in different local currencies.

- Settlement currency for world operations : in international affairs, a global (neutral) currency may be useful in facilitating the settlement of litigation between two parties in different jurisdictions, with different national currencies, etc.

Ultimately, in the long run, this initiative may hinder the growth of payment implementations in existing cryptocurrency projects, primarily the Lightning Network, if BTC is not included in Libra Reserve. However, in terms of the value, Libra (and other similar initiatives) can lead to the emergence of new opportunities in the industry, increasing investments in all cryptocurrencies and digital assets, and the assets themselves will remain to perform their functions that can coexist in parallel with Libra.

In short, Libra, in the long run, can help bridge the gap between the crypt and the traditional “off-chain” economy.

findings

Facebook's Libra cryptocurrency initiative at the center of the project will have a significant impact on the financial industry and the global economy in both the medium and long term. With the support of a basket of fiat money assets in the initial release, Libra is the first attempt to create a global currency, regardless of blockchain, with daily use by billions of people and organizations around the world.

However, the scale of success will greatly depend on how Libra can convince regulators and financial institutions to cooperate with the consortium in creating a flexible structure that satisfies the need for decentralized management while respecting existing domestic and international regulatory standards.

Other important factors are the ability to scale the Libra user base and create a reliable alliance of financial institutions that support the storage of collateral reserves and provide two-way exchange functions (i.e. fiat currency deposit accounts). In addition, the ability of the Libra Foundation to operate independently of Facebook, just as there is a separation between monetary and fiscal policy in developed countries, will be a key factor for gaining public confidence.

Regardless of whether this is one of the greatest successes in the cryptoactive industry, Libra is likely to contribute to bridging the gap between the right to access basic financial services and individuals who do not have access to banking systems (for example : unbanking people ) .

However, there are still a number of questions to Libra, including:

- What financial institutions will participate in this consortium

- More information on the stacking yield and cost / reward for participating in the network.

- How Facebook will use this project in tandem with the initiative of Internet.org to allow access to the Libra network without access to the Internet

- What dApps or tools can be built on top of the basic Libra functionality

- How the network can prioritize transactions between users instead of contract transactions that can overwhelm the entire network

Despite this uncertainty, Libra has already laid a vast and well thought out basis for blockchain and cryptocurrency technologies, which will be accepted by both traditional companies and individuals.

Source: https://habr.com/ru/post/457050/

All Articles