IT history lawyer. Life is outsourced business. Part 3

The first and second part of this entertaining story is available at the link below:

IT history lawyer. Life is outsourced business. Part 1

IT history lawyer. Life is business outsourcing. Part 2

')

# Finding a solution

Sasha continued to look for a solution that would save him from an administrative fine for not declaring a CFC and would allow him to keep his personal income on the account of a foreign company without tax loss.

The lawyer explained to Sasha that it is impossible not to pay taxes. Even if the profit was not distributed from the Cyprus Offshore Ltd account, it would still be necessary to pay 13% of the total retained earnings.

Sasha did not differ in his love of compliance and continued to ask questions until he found out that PSP (Payment Service Providers) or EMI (Electronic Money Institutions) do not exchange tax information within the framework of the CRS protocol.

# Farewell, bank, hello, payment

Sasha instructed the lawyer to open a checking account in a payment order and from that moment his company would receive dividends to that checking account (instead of a bank account)

Motivation:

Sasha did not want to allow automatic exchange of financial data between a Cyprus bank and the tax authorities of the Russian Federation.

What helped to make a decision:

Sasha realized that in terms of reliability, the payments (PSP and EMI) are not inferior to the banks that serve such an outsourcing business.

The payment can make transfers SWIFT (in dollars) and SEPA (euro).

Sasha received a settlement account with full details, the same as that of the bank.

The speed of opening a current account in the payment takes a month, and compliance is not as hard as in banks.

*** From the author: the financial world is changing, the banks servicing business of non-residents in the future will perform the function of storing money (deposits, or the function of a “safe”), possibly giving loans. The function of calculating (servicing business transactions) will be taken over by “bills” (EMI, PSP and similar financial institutions) ***

# Startup

For business outsourcing is characterized by the presence of idle employees. Sasha and Igor decided to find an application for workers who “got to the bench”. At the conference in Kiev, Igor heard about a startup, in fact, this is another SaaS service for internet marketers, but with a number of distinctive UTP (unique trade offers). The startup guys were looking for development money, and Igor and Sasha offered to act as investors, but not to invest as much money as human resources, namely the time of the developers of their outsourcing company.

Startups with the confidence inherent in startups have already registered a company like C-Corp in Delaware, broke a piggy bank, flew to the US and opened (with difficulty) a bank account there. In addition, they managed to participate in a number of acceleration programs in the Netherlands. The acceleration program gave Startap a lot - knowledge, experience, mentors, but also took not a little in return, but more on that later.

*** From the author: there are no tax-free companies in Delaware. Federal tax - 21% of net profit (according to the formula income minus costs), tax at the state level - 8.7% (on its federal taxable income allocated and apportioned to Delaware). Many people register a company in Delaware thoughtlessly, and we love to ask the question: “why not register a business in Nevada or California?” ***

#Due diligence startup

Sasha and Igor attracted lawyers to conduct a startup audit and participate in project negotiations.

What the lawyers found:

- It turns out that a startup signed an unsuccessful Convertible Loan with a business incubator (which, by the way, is not uncommon), the incubator received excessive anti-dilution rights (the incubator share could under no circumstances be blurred lower than 8% of the total equity), and such a right as multiple liquidation preference (in case of liquidation they were the first-priority lender with the right to demand an amount four times the amount of the loan and the accrued interest on the loan).

- the trademark (logo) and the right to use the domain belong not to the delaware company, but directly to the funder

- intellectual property is not transferred to a delaware company

- The company has already violated the law, as it used on the site logos of non-profit organizations without the consent

*** From the author: not going into details of contracts is a common mistake not only for startups, but also for a “mature” business. It does not matter who made the contract - a British, Dutch or local lawyer of the counterparty. Contracts need to be checked and questioned.

A common mistake inherent in 90% + contracts in IT (for this particular place in hell is prepared for lawyers who admit this) - this is an incorrect transfer of ownership of the object of intellectual property (code, program, design, etc.). Look at your contracts, most likely you will find an act in which it is written that Vasya handed over the software, and Petya accepted the software, but you will not see the clear identification of the software, which will serve as proof in court. ***

#As agreed

Igor and Sasha could not “dive” into the deal, therefore Startappers had to look for a compromise and fix the jambs.

Made an agreement on the transfer of intellectual property rights in favor of the Delaware company

The owner of the domain was changed through the admin panel, but at the same time they insured, and recorded the transfer fact in the form of a receipt (it took 20 minutes, and in the US court will be accepted as evidence)

Startups “beat” the conditions with the accelerator. On the advice of a lawyer, it was stressed that no investor would enter the equity with the current conditions, and the project would surely not survive without the investor of the next round.

*** From the author: do not believe it, but here is the last point - this is a story from life. One Dutch accelerator signed an extremely unprofessional, incorrect contract with startups, which is easier to call Kabbalah ***

# Documents for buying a startup

Cost one document - shares purchase agreement.

By the way, on the basis of the final agreements, Sasha and Igor still invested some money. A startup selling shares on a cash-in basis. The money from the sale of shares belonged to the company.

#EU VAT AND US BACKUP WITHHOLDING TAX

After some time, and together, a new startup team brought the project to the market.

- Stripe was connected to a Delaware company to receive payments on the website and in the application.

- For European users implemented GDPR Compliance

- Opened PayPal account and passed full authorization

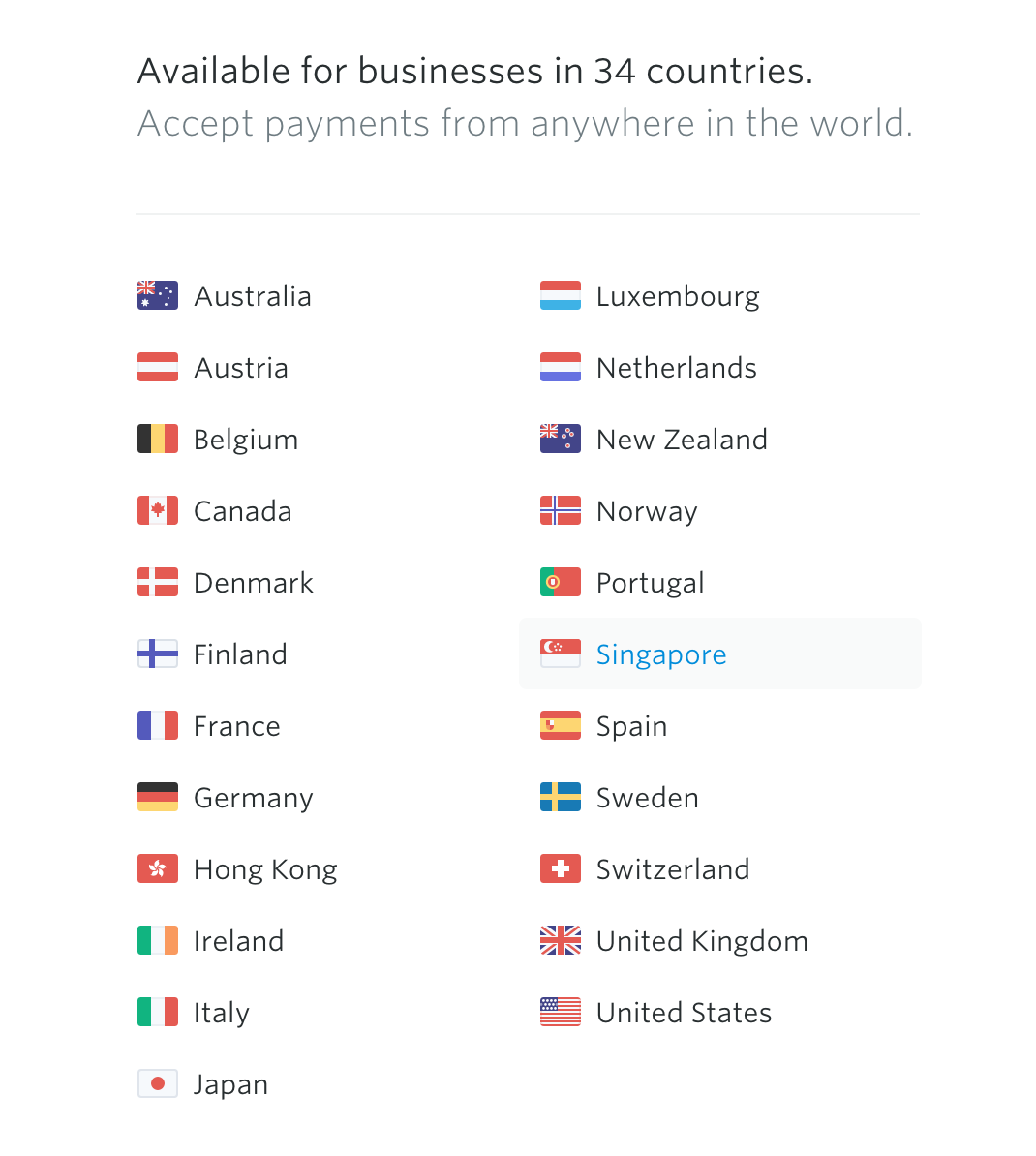

*** From the author: I remind you that Stripe connects only to the countries shown in the figure below.

But other PSPs that are not as popular as Stripe work with companies from other jurisdictions ***

- They learned about the existence of VAT (value added tax) and US backup withholding tax.

- Placed the application in Google Play and AppStore

*** From the author: EU VAT is the usual VAT for us, but be careful, because the rules in Europe are not like ours. In addition, there are features about which there is no information in official sources. For example, in 2019 if you conduct activities on behalf of a Dutch company, you need to get a VAT number. And without a real office in the Netherlands and the presence of local employees in the status of employees (such requirements are called - substance), the VAT number will not be given. Moreover, a substance is needed to apply double taxation avoidance agreements, and such a substance is quite costly for small businesses and startups, the implementation is estimated at about 40,000 EUR per year.

In addition, some services (marketplaces, bills) are required to receive EU VAT Collection Agent status and charge VAT on sales in the EU.

US BACKUP WITHHOLDING TAX is also an interesting phenomenon. The meaning of this tax is better to reveal on any example. Suppose there is a marketplace on which the authors place and sell intellectual property, for example, site templates. If the site template is bought by an American buyer, the marketplace must deduct 30% from the author’s fee (or less if the author is entitled to a preferential rate under the double taxation agreement between the United States and the place of registration of the author) of the sale tax and pay to the US treasury. The country in which the marketplace is registered does not matter, in any case, the marketplace will act as the US BACKUP WITHHOLDING TAX AGENT (the person responsible for withholding and paying taxes). The idea of US BACKUP WITHHOLDING TAX is that the whole world pays taxes on sales made in the United States, and the approach to determining the place was sold is not banal, but clearly spelled out in US law. ***

# ICO Era

The time has come for the next round of investment. And why not conduct an ICO, Startups thought.

To be continued...

The whole story is fictional. LAWBOOT Lawyers & Consultants lawyers worked on the text.

Source: https://habr.com/ru/post/456988/

All Articles