How interest on a loan is calculated and how to apply it

Hello! When I took a mortgage, I decided to thoroughly figure out how interest is calculated, how best to pay in advance, and so on. I myself am an economist. In general, I share, I hope it will be useful.

The loan payment consists of two parts - interest to the bank and repayment of the principal.

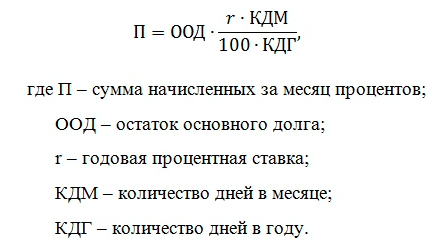

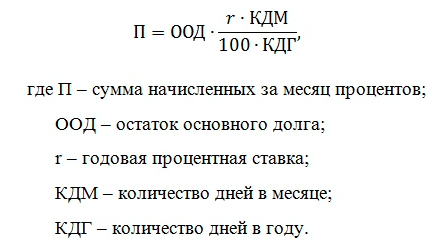

At the same time, monthly accrued interest is calculated by the formula:

')

Based on this:

I will give calculations for each item.

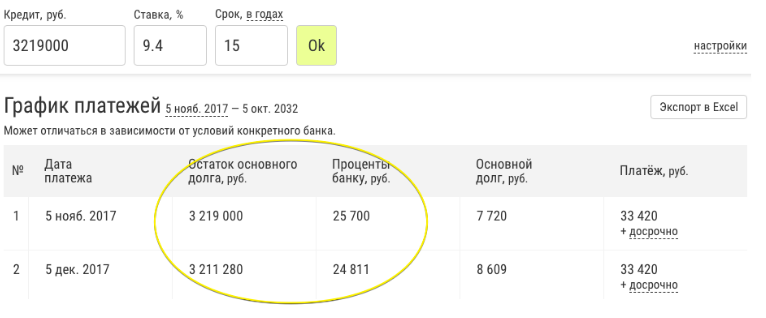

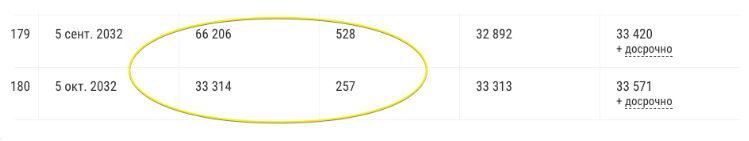

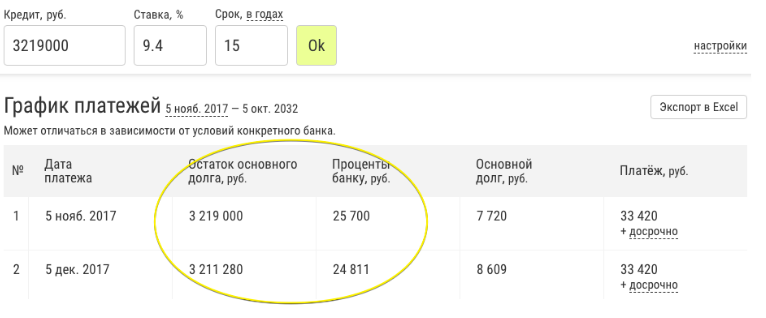

1. The biggest interest at the beginning

Beginning of term

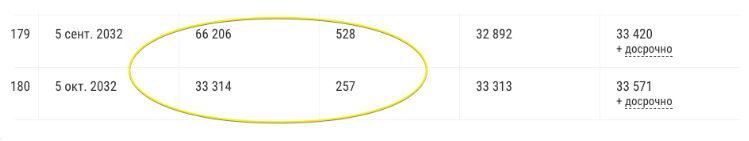

End of term

2. The amount of interest depends on the number of days in the month.

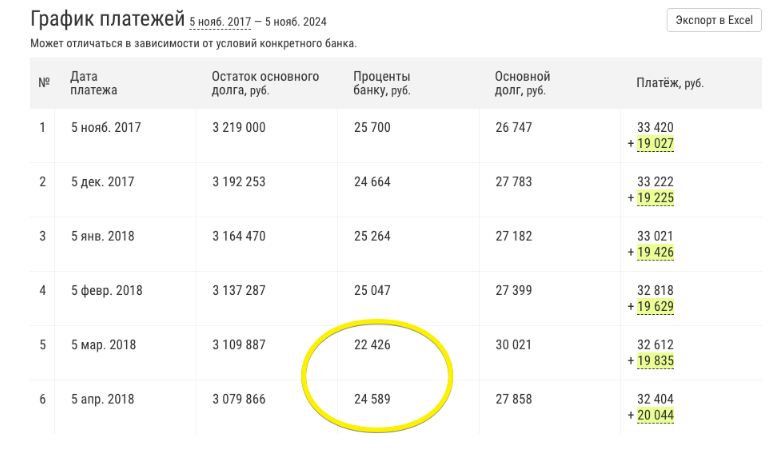

For February (ie, for 28 days) in March, 22 thousand were credited, and for March (that is, for 31 days) in April - 25 thousand.

We count 3 options.

Option 1

Option 2

We received that with a term of 15 years overpayment is 1.6 million more.

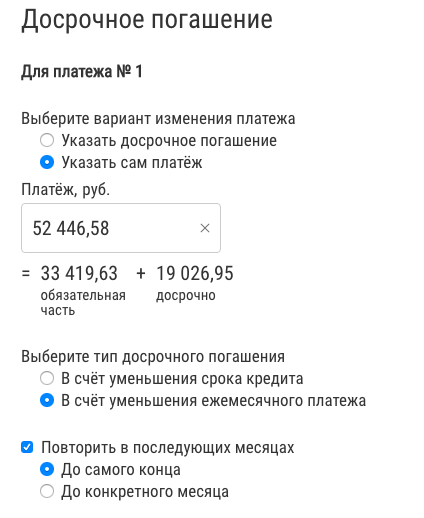

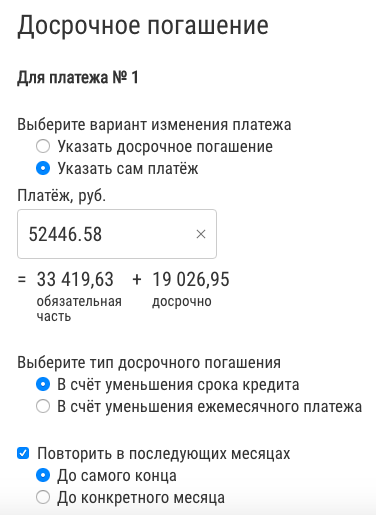

Now we set the early repayment such that the payment is received, as at 7 years.

We fix the payment of 52 thousand until the end of the term

We went to the same overpayment of 1.2 million and the same term - 7 years:

Option 3

comparison table

4. Equally profitable to make early repayment with a reduction in the term and payment

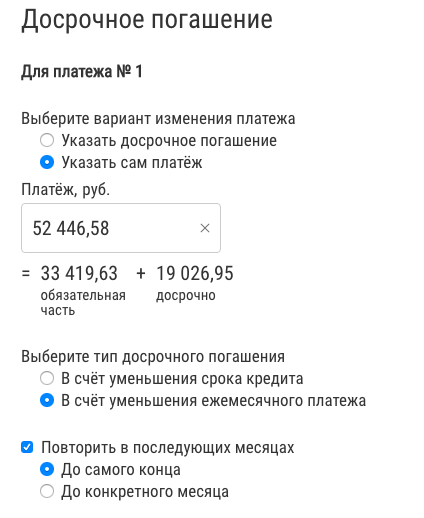

In the previous paragraph, early repayments were made with a shorter period. Now we calculate them with a reduction in payment.

We fix the payment of 52 thousand until the end of the term with a decrease in payment

comparison table

The main conclusion is that the overpayment amount is determined solely by the size of the monthly payment (mandatory part + early repayment), and not by the initial loan term, type of early repayment, etc., since the monthly interest charged depends only on the balance of the principal debt. My tactic - it is better to err a little, taking for a longer time and put out with a decrease in payment, but each month to make early. Morally easier, and the overpayment is the same.

The loan payment consists of two parts - interest to the bank and repayment of the principal.

At the same time, monthly accrued interest is calculated by the formula:

')

Based on this:

- The amount of monthly accrued interest is the largest at the beginning, because at the beginning the largest balance of the principal debt. As it declines, so do the percentages.

- The amount of interest "jumps" from month to month, because it depends on the number of days in a month.

- The term of the loan in the calculation of monthly accrued interest does not appear, which means that no matter for how long to take a mortgage - the overpayment will be the same if the monthly payments are the same.

- If you make a partial early repayment with a decrease in the monthly payment, the overpayment will be exactly the same as in the case of a reduction in the term, if you continue to pay the previous monthly payment rather than the reduced one.

I will give calculations for each item.

1. The biggest interest at the beginning

Beginning of term

End of term

2. The amount of interest depends on the number of days in the month.

For February (ie, for 28 days) in March, 22 thousand were credited, and for March (that is, for 31 days) in April - 25 thousand.

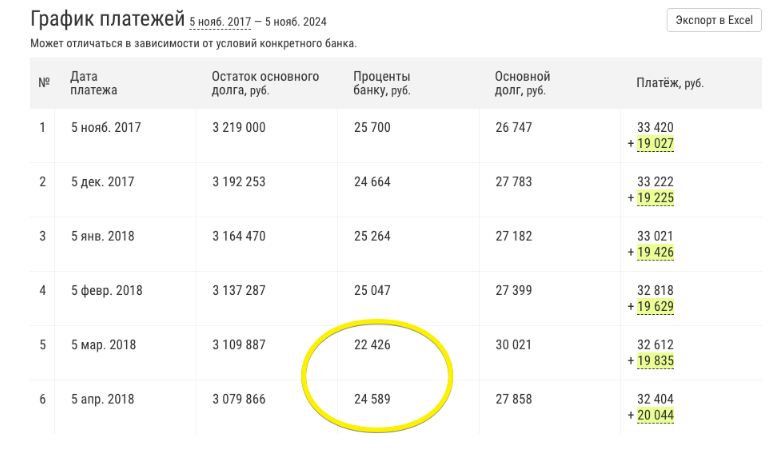

3. Overpayment is the same for different initial terms.

We count 3 options.

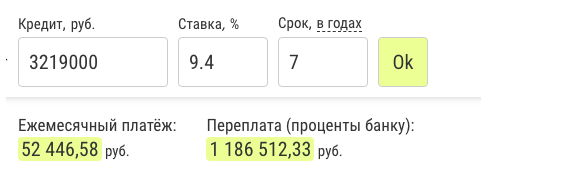

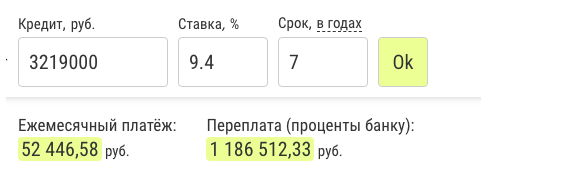

- Mortgage for 7 years.

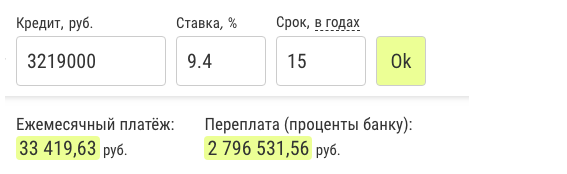

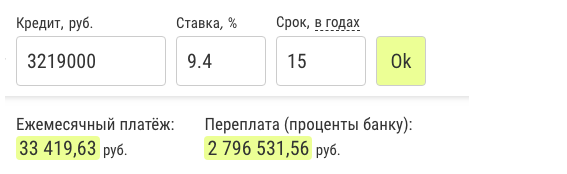

- Mortgage for 15 years.

- Mortgage for 15 years with early repayment.

Option 1

Option 2

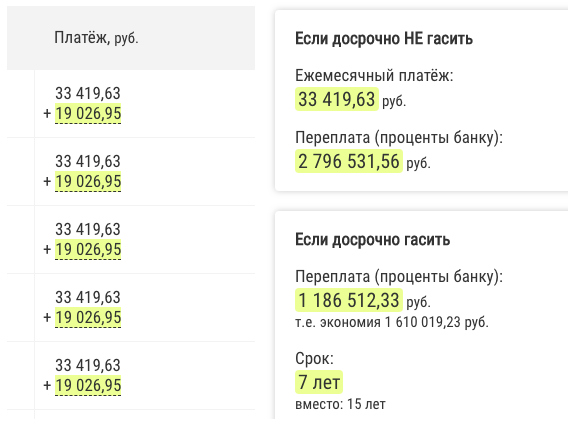

We received that with a term of 15 years overpayment is 1.6 million more.

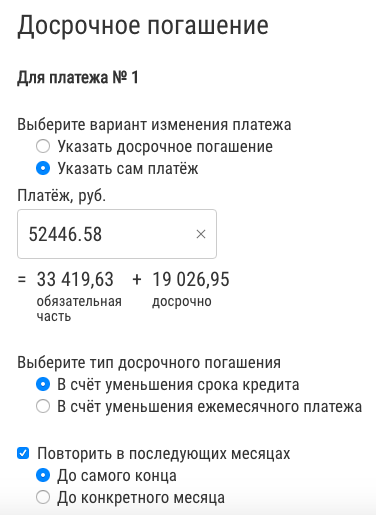

Now we set the early repayment such that the payment is received, as at 7 years.

We fix the payment of 52 thousand until the end of the term

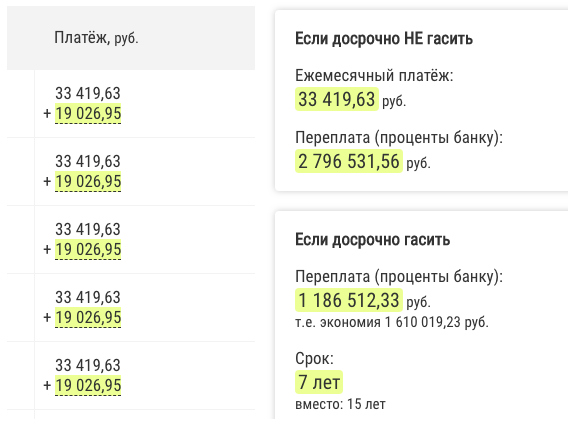

We went to the same overpayment of 1.2 million and the same term - 7 years:

Option 3

comparison table

| Term, years | Monthly payment, rub. | Overpayment, million | Reference to the calculation |

|---|---|---|---|

| 7 | 52 thousand | 1.2 | Payment |

| 15 | 33 thousand | 2.8 | Payment |

| 15 → 7 | 33 thousand obligatory + 19 thousand ahead of schedule | 1.2 | Payment |

4. Equally profitable to make early repayment with a reduction in the term and payment

In the previous paragraph, early repayments were made with a shorter period. Now we calculate them with a reduction in payment.

We fix the payment of 52 thousand until the end of the term with a decrease in payment

comparison table

| Early repayment type | Mandatory payment, rub. | Early repayment, rub. | Total monthly payment, rub. | Overpayment, million | Reference to the calculation |

|---|---|---|---|---|---|

| Shorter term | 33 thousand | 19 thousand | 52 thousand | 1.2 | Payment |

| Payment reduction | 33 thousand → 0.4 thousand | 19 thousand → 52 thousand | 52 thousand | 1.2 | Payment |

The main conclusion is that the overpayment amount is determined solely by the size of the monthly payment (mandatory part + early repayment), and not by the initial loan term, type of early repayment, etc., since the monthly interest charged depends only on the balance of the principal debt. My tactic - it is better to err a little, taking for a longer time and put out with a decrease in payment, but each month to make early. Morally easier, and the overpayment is the same.

Source: https://habr.com/ru/post/456696/

All Articles