How to start receiving passive income or at least protect your money: 5 real ways

Hi, Habr! I often talk on the site about my experiments - for example, in the study of languages and their application in practice . One of the areas of my experiences in the last couple of years is the sphere of finance, because I want to understand it and find some ways to get passive income in addition to my main job.

Today I will talk about five options that I personally tried, and which allow if not to earn, then at least minimize the damage from inflation. And yes, at least in some of them the stock exchange is involved, active speculation on it is still too difficult for me, so all options are in the “for dummies” mode. Go!

')

Bank deposits

Despite everything, bank deposits remain the most popular financial instrument. This is the base from which everyone starts. It is clear that it is difficult to earn money directly from a deposit in Russia today, but at least you can save money from the effects of inflation.

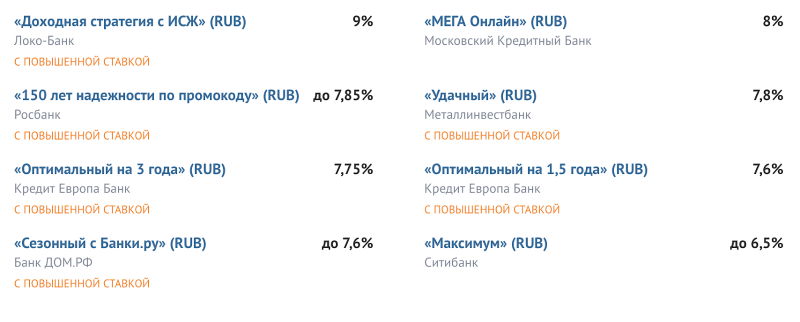

With the help of advisory services, like Banki.ru and Compared.ru, you can find good deposit options with a yield of 6.5% to 9%. At the same time, according to forecasts of the Central Bank, in 2019, inflation should not exceed 5.2%. There are also opinions that these forecasts are inaccurate due to a very free approach to collecting statistics, and real inflation may exceed 10% - but even in this case, a good deposit will at least help reduce the damage.

Screenshot: Banks.

The advantage of this option is high reliability, deposits up to 1.4 million rubles are insured by the state, and there have not yet been cases when depositors would not be refunded after bank failure.

Federal loan bonds

Another investment instrument that can be compared with a bank deposit in terms of its reliability is the purchase of federal loan bonds (OFZ) on the stock exchange. These are such securities that the state issues in order to attract additional money to the budget - and it pays a percentage for it.

The OFZ yield for June 2019 ranges from 7-7.9%, which is approximately equal to the rates on most deposits.

Data: Smart-lab.ru

It is important to understand that transactions on the stock exchange are not insured, as are the same deposits, but OFZs are an extremely reliable instrument. After all, these bonds are issued by the state, and if it does not pay off on them, it will mean a default with relevant events for the entire economy of the country and the banking sector as well.

IIS accounts

Another good option is “for dummies”, who have some money, but do not have the knowledge and skills to invest it wisely. An individual investment account is an attempt by the state to increase the financial literacy of the population and attract private investors to the exchange.

It works like this: when using an account, you can get two types of benefits. The first is a tax deduction (13%). To obtain it, you need to make money on the IIS, as well as to have official taxable income (PIT). For example, if you deposit 400 thousand rubles on an IIS, you can return 52 thousand in the form of a deduction as much as possible - this will require a salary of 33 thousand per month.

There is only one minus here - according to the rules, the money should lie on the IIS account for three years, you can withdraw them earlier, but then the deductions will have to be returned.

The second type of benefits when using IIS is the exemption from income tax on transactions on the exchange. This allows you to combine the IIS with the previous item and buy OFZ funds with the funds contributed. So you can get your 7% + percent and also take the deduction. At the same time, there is no need to make special gestures - open an account with a broker, buy OFZs and issue a deduction application.

Robot Editing

Like many innovations, including financial ones, this method came to Russia from the USA. There, financial companies have long ago thought of automating the work of financial advisers. Typically, such advisers are in the funds, they analyze the current market conditions and, in accordance with the parameters set by the investor, select options for investments.

There are a number of fairly successful systems in which money management is automated - for example, Wealthfront and Betterment. Initially, the service was needed to attract middle-class clients to the exchange trade - they trusted their pension savings systems.

Now similar systems appear in Russian brokers. I experimented with one of these systems . The point is simple; first, in a question-answer format, you need to give the system an introduction on the timing of the investment, the desired return and an acceptable level of risk. Then the robot selects one of the algorithms embedded in the system in order to select a stock portfolio, OFZ, etc.

If we tell the system about the reluctance to take unnecessary risks, then the proposed portfolio will mainly consist of OFZs - this is reliable, but it will not work to make millions. With more risk allowed, you can get a portfolio that potentially brings higher returns, but here you can lose money.

Plus - you can start experiments with a small amount (from 10 thousand rubles), which is quite convenient. It is also important to understand that the robot itself does not buy or sell anything - it gives advice, and then you can follow them or not. Once in a certain period, the system rebalances the portfolio and offers to buy some shares, and some to replace them with others - depending on the current market situation.

Dividends

The exchange is associated with a “bought / sold” type of process, but in fact stocks can be bought not for speculation, but with the aim of earning extra income. There are a number of companies that pay dividends.

Sites like Sravnit.ru publish collections of companies that regularly pay good dividends.

Important point: unlike operations on IIS, dividends are taxed at 13%. Therefore, the received income will be credited to the brokerage account already minus taxes.

That's all for today, thank you for your attention! What tools do you use passive or half-passive income?

Source: https://habr.com/ru/post/455912/

All Articles