Online ticket offices as a legal withdrawal of money from a business

Hello! I think many people know that from February 1, 2017, the cash register should send electronic versions of checks to the operator of fiscal data - the new rules are set in 54- of article 2 of paragraph 2.

EKLZ had to be replaced with a fiscal drive, the cash register was connected to the Internet, a contract was concluded with the fiscal data operator and the checks were sent electronically to the FTS through the fiscal data operator.

Naturally, parts of the business (not all were affected, many individual entrepreneurs were postponed until July 1, 2019) had to purchase a new cash register equipment, and put the old one in the warehouse or throw it away altogether.

')

The business has the following items of expenditure

Mandatory expenses:

Possible costs:

Prices:

I will give two examples from life for a more real understanding:

Example number one:

Recently, at the request of very good friends helped them with the installation of KCP.

They are entrepreneurs and they have a small business, they were obliged to install CCV from July 1, 2019.

The costs are as follows:

KKT + FN for 15 Months - 14500r (When you take KKT + FN so much cheaper, they have such a share)

Key EDS (For registration of CCP in tax) - 1 000 rub.

The contract with the OFD for 12 months - 3000r

SIM-card with mobile internet - 500r

Total: 19000r

But from January 1, 2018, some entrepreneurs are entitled to a tax deduction for the online cash register.

In their case, they are “lucky”. It remains to issue a tax deduction and from time to time to pay for the OFD, the Internet and the replacement of the FN. Constant annual costs.

Example number two:

The company I work for has a park of 20+ CCPs. We have several legal organizations.

In February 2017, it was necessary to install new CCPs.

I don’t remember the exact numbers, but today the manufacturer’s website has a “Price: from 26,000 rubles”. Calculate at today's prices.

The costs are “very roughly” the following:

CCV ~ 500000r

FN ~ 120000r

Contract with OFD for 12 Months ~ 60000r

EDS keys ~ 5000r

Total approximately: 685,000 p

In example number two, no tax deductions for legal entities are provided.

Take out and put half a million, and this is taking into account the fact that all registrations of CCV were carried out without intermediaries such as TEC, who would also take money for each device. And we are quite a small company, this is not any tape for you.

Summarizing all the above, we can say that in order to comply with the new legislation, the business was forced to spend a tidy sum.

And all this without taking into account the fact that many companies with a new law had a huge rework of the IT infrastructure.

The business was forced to be serviced at the OFD (Fiscal Data Operator). There are relatively few of them on the market and they are all accredited by the state, we all understand who they belong to. Who got there will not be allowed.

And business now must pay bribes to commercial companies annually.

Just think, 3000 a year for the OFD and 6-8 thousand for an FN for one CCP, and how many such CCPs are in the country, and what a huge amount of money, and, most importantly, money - permanent.

And all this is covered up with bravado about business withdrawal from the shadows, but in my opinion they came up with a brilliant legal business scheme, with a huge steady income, lobbied by the state.

The most interesting thing in this story is that the business thinks - they bought the ticket office, they installed it, you can sleep well, no matter how.

In 2017, our company bought 20+ CCPs from ATOL.

→ ATOL Official Website

→ ATOL on Habré

I just want to say that I didn’t want to poke a finger at a specific KKT manufacturer, but I’ll have to continue to understand why.

These CCPs have been accredited by the state as CCPs that comply with legal requirements.

Our lawmakers did not take long to wait and decided that the current FFD (format of fiscal documents) should be corrected.

CCP, I recall, were acquired in February 2017. And approximately in September 2017, the following changes were made in FFD:

Just imagine, there is a CCP, the table is used to program the type of payment

Field 1 - Payment Type - Cash

Field 2 - Type of payment - Electronic payments.

They took them, roughly speaking, changed places, or changed the field number, and now your CCP does not meet the requirements of the law, in order to fix it you need to flash all CCP with a new firmware.

September 4, 2017, a message appears on the ATOL company forum about the release of a new firmware.

“List of changes v.4555

, .

, - .

- - .

– , , DIP- , , .

– !

– .

, “” . , , .

, , , - , .

, ? , .

, , , .

– , .

, , .

“ …”

, , .

20%.

,

?

– .

1 2019 .

:

.

“” “”.

, .

, .

, . . . , , – . . — , .

:

“/10 as.atol.ru

= = — 8

10 ”

– , , .

1 2019 , “ ”

.

. -. , , . , - . . , - .

, , . « », . 49% , . -, …

, .

, , - .

.

.

:

20% , .

7.06

.

EKLZ had to be replaced with a fiscal drive, the cash register was connected to the Internet, a contract was concluded with the fiscal data operator and the checks were sent electronically to the FTS through the fiscal data operator.

Naturally, parts of the business (not all were affected, many individual entrepreneurs were postponed until July 1, 2019) had to purchase a new cash register equipment, and put the old one in the warehouse or throw it away altogether.

')

The business has the following items of expenditure

Mandatory expenses:

- Acquisition of KKT (Cash register equipment)

- Acquisition of FN (fiscal drive)

- Contract with CRF (Fiscal Data Operator)

Possible costs:

- Internet for CCT

- Integration into IT-Infrastructure

Prices:

- CCP price on average from 8500r to 30000r. (Depends on model, type of business and functionality)

- Price FN - from 6500r to 12000r (Terms of FN are different)

- Contracts with the OFD for 12 Months - ~ 3000r (Prices everywhere are plus or minus the same)

- Internet for CCT - we all know the prices of wired Internet for individual entrepreneurs and legal entities.

- It is possible that you can get by with a SIM card with mobile Internet and costs ~ 500-1000 r per year.

- All these are very average values, but I think the general essence is clear.

- It is difficult to calculate the costs, it all depends on the specific case. However, they are.

I will give two examples from life for a more real understanding:

Example number one:

Recently, at the request of very good friends helped them with the installation of KCP.

They are entrepreneurs and they have a small business, they were obliged to install CCV from July 1, 2019.

The costs are as follows:

KKT + FN for 15 Months - 14500r (When you take KKT + FN so much cheaper, they have such a share)

Key EDS (For registration of CCP in tax) - 1 000 rub.

The contract with the OFD for 12 months - 3000r

SIM-card with mobile internet - 500r

Total: 19000r

But from January 1, 2018, some entrepreneurs are entitled to a tax deduction for the online cash register.

In their case, they are “lucky”. It remains to issue a tax deduction and from time to time to pay for the OFD, the Internet and the replacement of the FN. Constant annual costs.

Example number two:

The company I work for has a park of 20+ CCPs. We have several legal organizations.

In February 2017, it was necessary to install new CCPs.

I don’t remember the exact numbers, but today the manufacturer’s website has a “Price: from 26,000 rubles”. Calculate at today's prices.

The costs are “very roughly” the following:

CCV ~ 500000r

FN ~ 120000r

Contract with OFD for 12 Months ~ 60000r

EDS keys ~ 5000r

Total approximately: 685,000 p

In example number two, no tax deductions for legal entities are provided.

Take out and put half a million, and this is taking into account the fact that all registrations of CCV were carried out without intermediaries such as TEC, who would also take money for each device. And we are quite a small company, this is not any tape for you.

Summarizing all the above, we can say that in order to comply with the new legislation, the business was forced to spend a tidy sum.

And all this without taking into account the fact that many companies with a new law had a huge rework of the IT infrastructure.

The business was forced to be serviced at the OFD (Fiscal Data Operator). There are relatively few of them on the market and they are all accredited by the state, we all understand who they belong to. Who got there will not be allowed.

And business now must pay bribes to commercial companies annually.

Just think, 3000 a year for the OFD and 6-8 thousand for an FN for one CCP, and how many such CCPs are in the country, and what a huge amount of money, and, most importantly, money - permanent.

And all this is covered up with bravado about business withdrawal from the shadows, but in my opinion they came up with a brilliant legal business scheme, with a huge steady income, lobbied by the state.

The most interesting thing in this story is that the business thinks - they bought the ticket office, they installed it, you can sleep well, no matter how.

In 2017, our company bought 20+ CCPs from ATOL.

→ ATOL Official Website

→ ATOL on Habré

I just want to say that I didn’t want to poke a finger at a specific KKT manufacturer, but I’ll have to continue to understand why.

These CCPs have been accredited by the state as CCPs that comply with legal requirements.

Our lawmakers did not take long to wait and decided that the current FFD (format of fiscal documents) should be corrected.

CCP, I recall, were acquired in February 2017. And approximately in September 2017, the following changes were made in FFD:

- Changed the numbering of payment types

- Changed the numbering of VAT rates

Just imagine, there is a CCP, the table is used to program the type of payment

Field 1 - Payment Type - Cash

Field 2 - Type of payment - Electronic payments.

They took them, roughly speaking, changed places, or changed the field number, and now your CCP does not meet the requirements of the law, in order to fix it you need to flash all CCP with a new firmware.

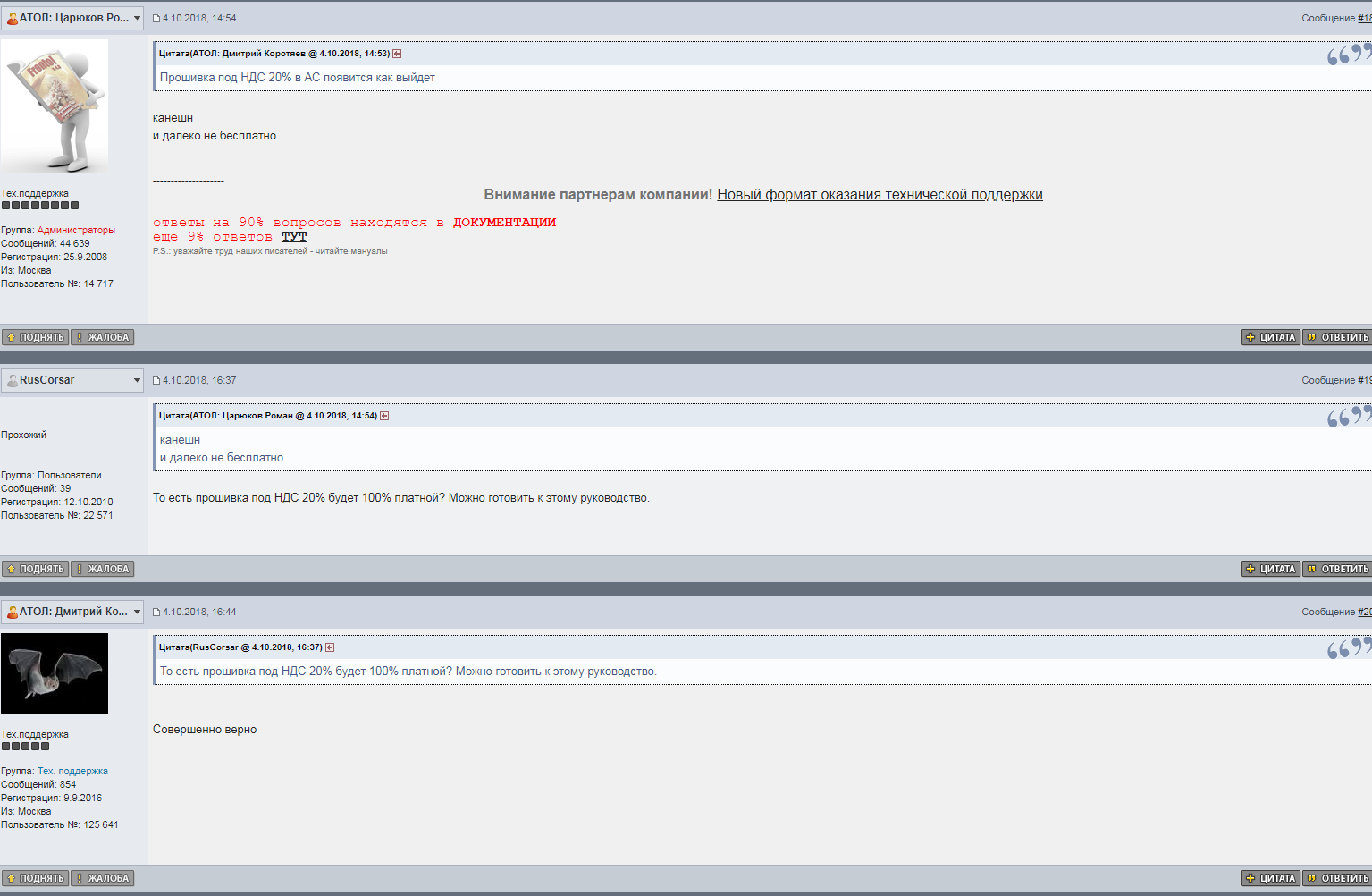

September 4, 2017, a message appears on the ATOL company forum about the release of a new firmware.

“List of changes v.4555

Spoiler header

- Changed the numbering of payment types in accordance with the requirement of FFD.

- Changed the numbering of VAT rates in accordance with the requirement of FFD.

- Universal firmware under FFD 1.0 and 1.0.5. Switching through setting T2P1P123 =: 1 - FFD 1.0, 0 - FFD 1.05 (With unfiscated FN)

- Added the ability to print QR and text on one line

- Added error handling for FN 210

- Added the ability to enable the display of "Received" and "Delivery" in the check

- Implemented the ability to reload CCP at the command "CE 41"

- Added FN error handling when opening / closing a shift

- The number of unsent documents has been added to the diagnosis of the connection with the CRF

- Implemented re-printing the receipt after errors (opening the lid, out of paper, etc.)

- Added printing of all non-zero payment types in X, Z reports

- Implemented dopekat all types of PD after the error FN 03h, 04h (213, 214) if the document in the FN closed

- Added the ability to change and transfer the tag 1187

- Added complex date / time setting command

- Implemented the ability to reset CCP settings without opening the case - Command 0x71- "Initialization of tables"

- Added the ability to transfer whole and weight goods

- Bugs fixed:

print long details (more than 180 characters) for ATOL 25F

Display wi-fi in the service menu for ATOL 25F

DYa work on setting T2P1P20

generation of numbers in the X and Z caps of reports and shifts in the FN

reset props 1117 after reloading

diagnostics of OPD on 6 squeaks

print details of 256 characters on the check tape

other errors ”

- Changed the numbering of VAT rates in accordance with the requirement of FFD.

- Universal firmware under FFD 1.0 and 1.0.5. Switching through setting T2P1P123 =: 1 - FFD 1.0, 0 - FFD 1.05 (With unfiscated FN)

- Added the ability to print QR and text on one line

- Added error handling for FN 210

- Added the ability to enable the display of "Received" and "Delivery" in the check

- Implemented the ability to reload CCP at the command "CE 41"

- Added FN error handling when opening / closing a shift

- The number of unsent documents has been added to the diagnosis of the connection with the CRF

- Implemented re-printing the receipt after errors (opening the lid, out of paper, etc.)

- Added printing of all non-zero payment types in X, Z reports

- Implemented dopekat all types of PD after the error FN 03h, 04h (213, 214) if the document in the FN closed

- Added the ability to change and transfer the tag 1187

- Added complex date / time setting command

- Implemented the ability to reset CCP settings without opening the case - Command 0x71- "Initialization of tables"

- Added the ability to transfer whole and weight goods

- Bugs fixed:

print long details (more than 180 characters) for ATOL 25F

Display wi-fi in the service menu for ATOL 25F

DYa work on setting T2P1P20

generation of numbers in the X and Z caps of reports and shifts in the FN

reset props 1117 after reloading

diagnostics of OPD on 6 squeaks

print details of 256 characters on the check tape

other errors ”

, .

, - .

- - .

– , , DIP- , , .

– !

– .

, “” . , , .

, , , - , .

, ? , .

, , , .

– , .

, , .

“ …”

, , .

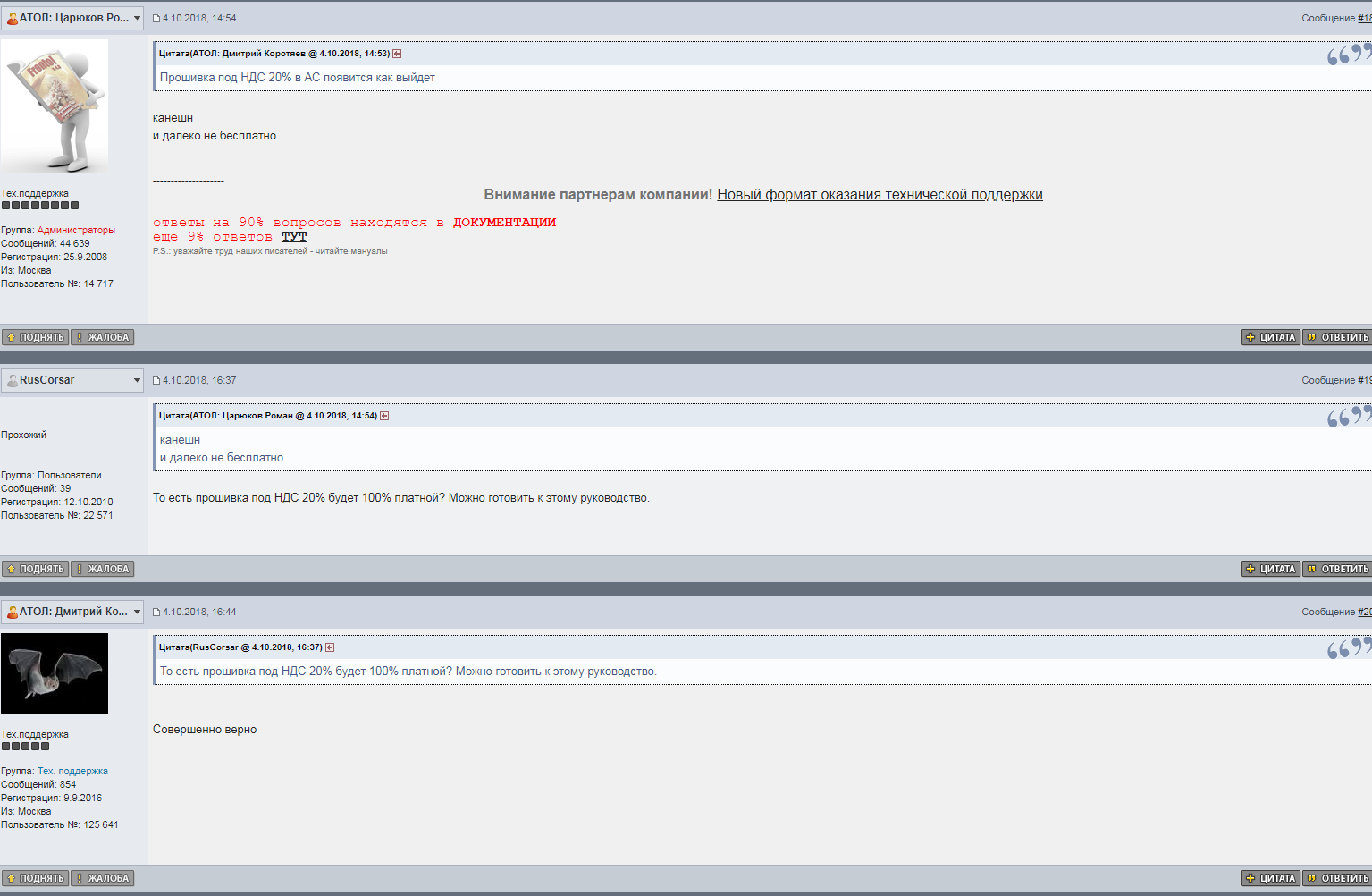

20%.

,

?

– .

1 2019 .

:

.

“” “”.

, .

, .

, . . . , , – . . — , .

:

“/10 as.atol.ru

= = — 8

10 ”

– , , .

1 2019 , “ ”

.

. -. , , . , - . . , - .

, , . « », . 49% , . -, …

, .

, , - .

.

.

:

20% , .

7.06

, .

.

Source: https://habr.com/ru/post/453822/

All Articles