The rise and fall of IEO, all you need to know about the new wave of fundraising

In this article you will find the necessary information for successful investment in IEO:

To date, more than 5,000 ICOs have been conducted. The IEO market compared to the ICO market is relatively young and is one of the forms to attract funds. CryptoRank currently tracks 40 IEOs for analysis.

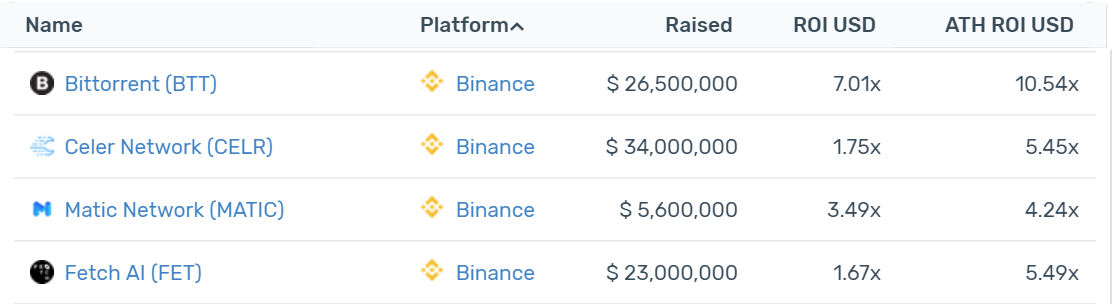

The first IEO Bittorent successfully passed on the Binance exchange on January 28, 2019 and marked the beginning of the IEO trend. Also, do not forget that the first IEO were held back in 2017. Bread and Gifto , which also went through the Binance exchange.

')

The purpose of the ICO in most cases was to collect funds. The purpose of conducting IEO can be both fundraising and the only opportunity for a project to go to the exchange and acquire liquidity for its tokens. As a rule, many projects at the time of IEO have already conducted several rounds of fundraising, including through ICO, but they did not go to the exchange. Also, the purpose of IEO is marketing and PR project. And the collected funds are often sent to market-making.

Most projects have the following dynamics after listing on the stock exchange.

After the auction, we everywhere see the same dynamics with very few exceptions. Fall in the first month / week after IEO, protroog and then possible start of growth.

The highest price usually happens on the day of sale and your ATH tokens are rarely overcome. This is due to both the price dynamics after the IEO, and the price movements of the altcoins as a whole at the time of analysis.

What metrics are important in selecting projects for investment? CryptoRank aggregates trading data by providing real-time ROI analysis for exchanges with at least 2 IEO. According to analytics , currently 15 out of 40 (37.5%) projects are traded below the price of IEO.

In addition to the analysis of the project itself, the choice of the exchange itself is equally important.

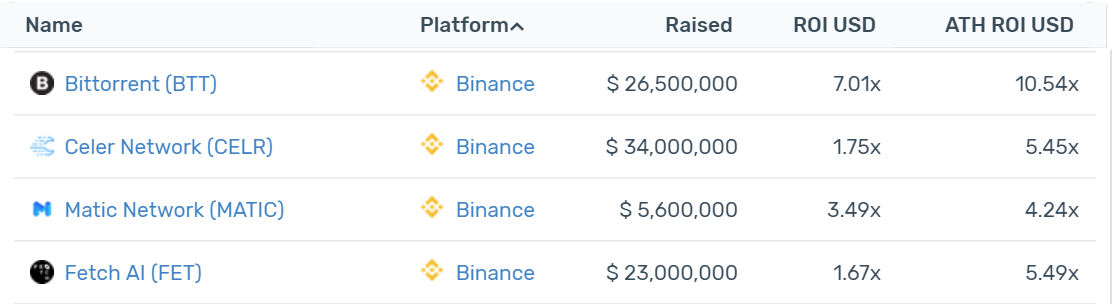

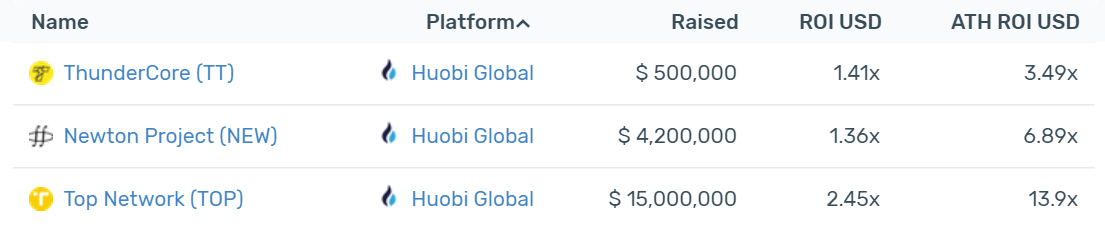

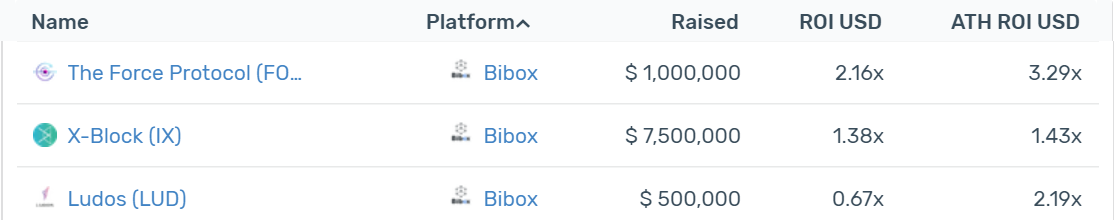

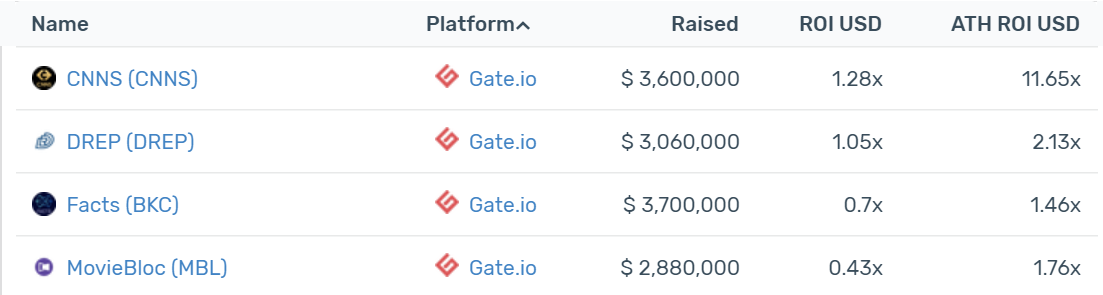

Let's take a closer look at how the projects on the exchanges were published.

Binance: Current AVG ROI: 248%

Kucoin: Current AVG ROI: 165%

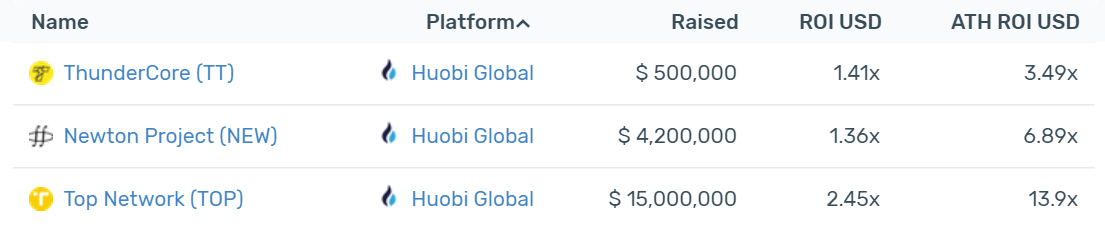

Huobi: Current AVG ROI: 74%

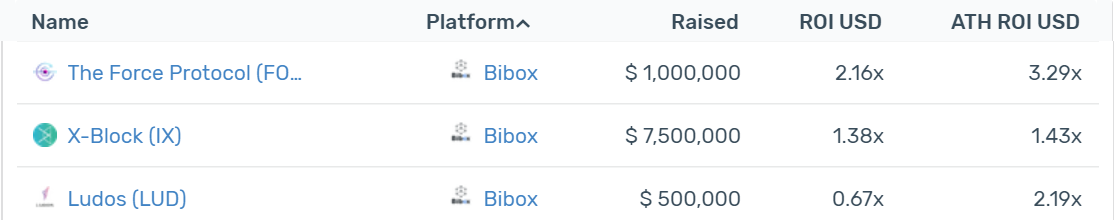

Bibox: Current AVG ROI: 40%

Bgogo: Current AVG ROI: 40%

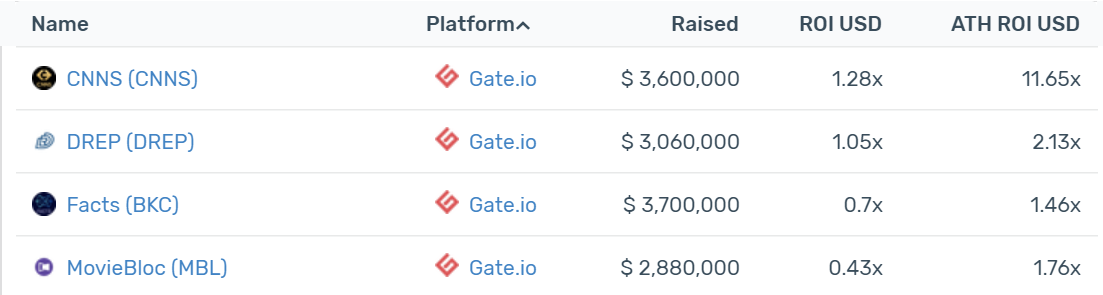

Gate: Current AVG ROI: -13.5%

Bittrex: Current AVG ROI: -69%

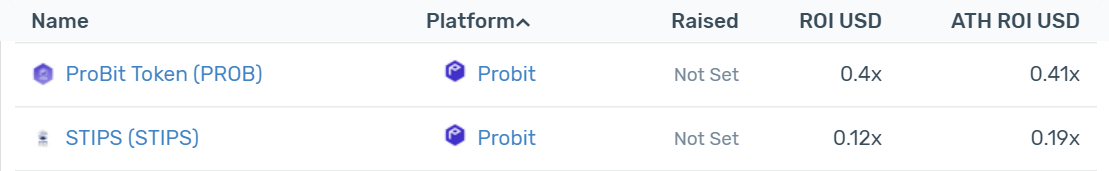

Probit: Current AVG ROI: -74%

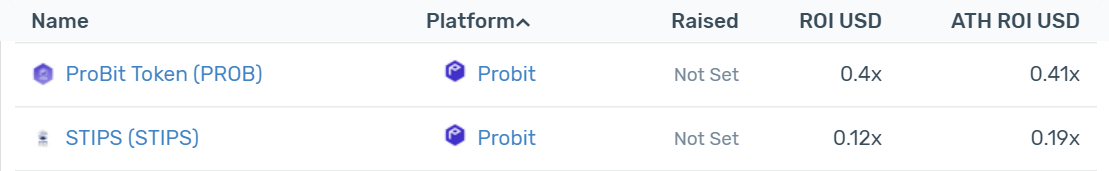

More detailed ROI analysis for all IEO platforms can be found here .

Of the 11 exchanges analyzed - 3 exchanges have a negative current average ROI. These are the Probit , Bittrex and Gate exchanges.

At the same time, Bittrex and Probit also have negative ATH ROI. This may indicate that these exchanges are poorly suited to the selection of projects and the selection of metrics for conducting IEO, and are also not interested in market-making to release IEO above the offer price. Or in the case of, for example, with the Probit exchange, perhaps there are not large media and financial resources. Also, the Probit exchange in our opinion seemed to be not transparent in terms of conducting IEO and providing information.

Of the 11 exchanges analyzed - 3 exchanges have a negative current average ROI. These are the Probit, Bittrex and Gate exchanges.

At the same time, Bittrex and Probit also have negative ATH ROI. This may indicate that these exchanges are poorly suited to the selection of projects and the selection of metrics for conducting IEO, and are also not interested in market-making to release IEO above the offer price. Or in the case of, for example, with the Probit exchange, perhaps there are not large media and financial resources. Also, the Probit exchange in our opinion seemed to be not transparent in terms of conducting IEO and providing information.

From the point of view of investment, in order to minimize risks, it is advisable at this stage of development of IEO to choose exchanges with high ATH ROI and current ROI.

See real-time analytics

There is a hypothesis that the less funds a project collects, the higher will be ROI due to an imbalance of supply and demand. But at the moment it’s too early to talk about it, because The selection of projects is small and there are no obvious trends in this.

The project may collect a small amount of funds for various reasons. For some famous project, this is just marketing. For example, IEO Thunder Core on Huobi in the amount of $ 500,000. And for another project, this amount may be large and very heavy to attract.

Also consider unlocked tokens and general circulation at the time of listing at the end of IEO. For example, the ECOMI project raised $ 600,000 through IEO. And investors who invested in this project at the pre-sale stage already had a large number of tokens available for sale.

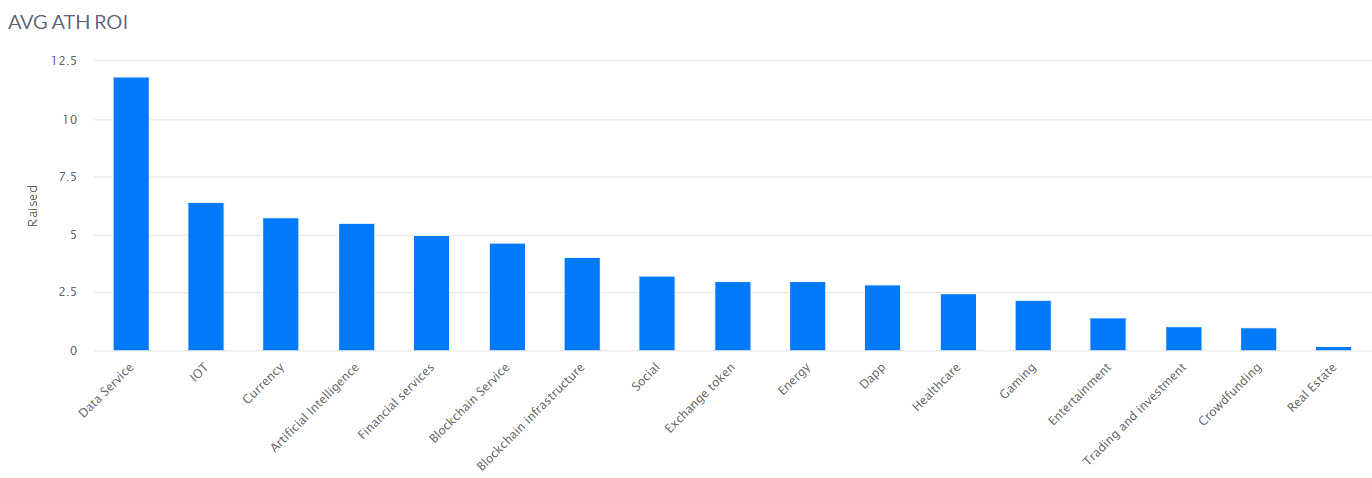

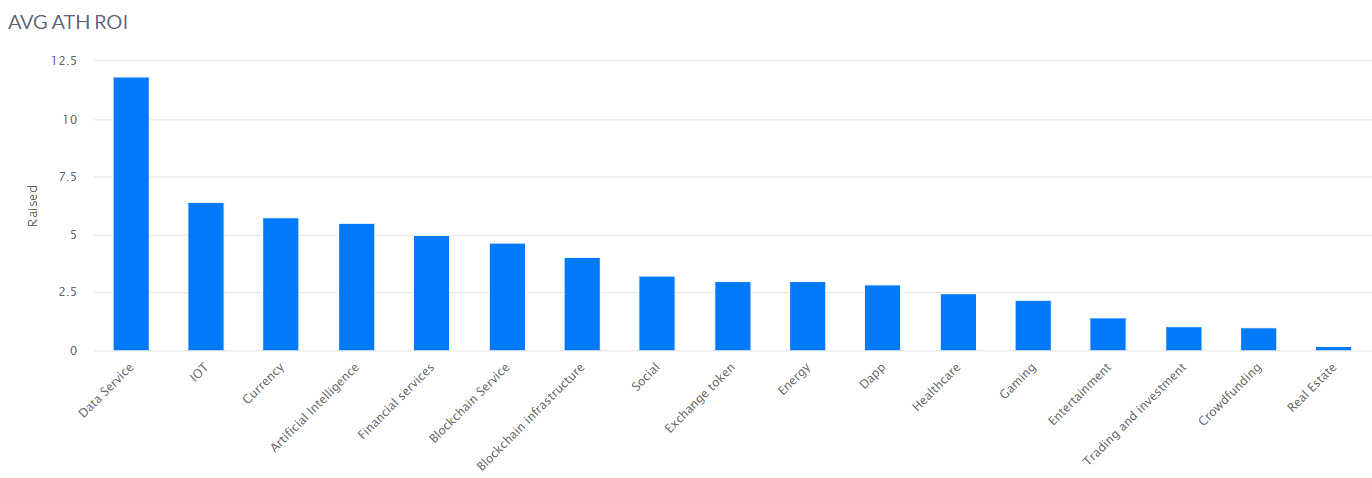

According to CryptoRank since the beginning of 2019. urrent AVG ROI is higher for Data Service projects, and the lowest ROI for projects in the Real Estate category.

During the popularity of ICO, projects in the Real Estate category, as well as areas more related to real business, had a low ROI.

See real-time analytics

AVG ATH ROI is also higher in the DATA Service project category, as well as in the more blokchain-related project categories of the industry.

The scope of IEO is growing rapidly. Changing approaches to conducting IEO. If initially it was IEO on the “First Come First Serve” system, now many exchanges are trying to create more comfortable conditions for the majority of participants.

Exchanges are trying to reduce volatility at the opening of trading. Pricing corridors and price restrictions are established, various systems of the type “matched orders” are introduced before the start of trading, during which trading is closed.

Exchanges are trying to create the conditions for long-term investment from the IEO stage and to protect inexperienced investors from large losses. Reputation suffers for exchanges, and projects can suffer major losses when, after IEO, project tokens are sold immediately and the project is forgotten.

Systems of lotteries, stock exchange tokens, oversubscription models and additional requirements are introduced, under which an investor to participate in IEO must also be an active user and trader of the exchange. Various marketing and marketing activities are also held at the end of the IEO.

The possible amount of investment in IEO projects is reduced due to rising popularity.

If this area is gaining momentum, then less attractive conditions will be created for participation in the IEO stage and it is possible that conditions for participation in private rounds will again be more profitable.

Why, despite such a high ROI, IEO is not yet so popular?

As mentioned earlier, participation in IEO often requires holding an exchange token, which can be very volatile. The project may come out with a good ROI, but the investor will lose funds from the drawdown of the exchange token. To successfully invest in IEO, it is necessary to buy / sell a stock token in time and conduct its fundamental analysis. To minimize the risk of drawdown of the exchange token on many exchanges, it is possible to hedge their position by opening short as well.

The greatest bursts of volatility of stock tokens occur with IEO announcements, changes in participation conditions and listing of the project after IEO ends.

You should also not keep most of your portfolio only in exchange tokens to diversify risks. Because situations are possible in which all exchange tokens will simultaneously fall in price. For example, when prohibiting the holding of IEO, if IEO becomes not profitable or if they are replaced by something new.

Based on the analysis performed, it can be concluded that exchanges should be selected where projects come out with high ROI, projects from categories with high ROI, pay attention to the section where it is described why tokens give X.

Also, when choosing a project, be sure to pay attention if the project is currently being traded on other exchanges and at what price.

- IEO Features

- Price dynamics of projects after IEO

- Analysis of the amount of collection

- Category Analysis

- What causes high ROI when conducting IEO

- IEO Trends

- Minimize risks when investing in IEO and conclusions

To date, more than 5,000 ICOs have been conducted. The IEO market compared to the ICO market is relatively young and is one of the forms to attract funds. CryptoRank currently tracks 40 IEOs for analysis.

The first IEO Bittorent successfully passed on the Binance exchange on January 28, 2019 and marked the beginning of the IEO trend. Also, do not forget that the first IEO were held back in 2017. Bread and Gifto , which also went through the Binance exchange.

')

The purpose of the ICO in most cases was to collect funds. The purpose of conducting IEO can be both fundraising and the only opportunity for a project to go to the exchange and acquire liquidity for its tokens. As a rule, many projects at the time of IEO have already conducted several rounds of fundraising, including through ICO, but they did not go to the exchange. Also, the purpose of IEO is marketing and PR project. And the collected funds are often sent to market-making.

IEO Features

- The collection of money takes place on the exchange itself and the exchange acts as an intermediary between the project and the investor.

- Many exchanges themselves have a responsible approach to the procedure for selecting projects and partially relieve this burden on the investor.

- Bidding starts immediately after collecting funds, the project does not need to worry about the fact that they will not be able to get on the stock exchange and there will be no liquidity to bid on their tokens.

- Unlike the ICO, the exchange rarely asks for a full KYC procedure. This procedure is usually easier without the need to provide a large number of documents.

- The exchange often helps to unleash even the most unpopular projects with a weak own community, while the ICO projects needed to invest significant funds in the development of their community before conducting fundraising.

Price dynamics of projects after IEO

Most projects have the following dynamics after listing on the stock exchange.

- Bidding at a high price in the first minute of listing (followed by a fall) and the ability to sell tokens with ROI 100% +.

- The accumulation zone, which can go for several months or days depending on different conditions.

- If the project has a long-term perspective, then the growth stage begins.

After the auction, we everywhere see the same dynamics with very few exceptions. Fall in the first month / week after IEO, protroog and then possible start of growth.

The highest price usually happens on the day of sale and your ATH tokens are rarely overcome. This is due to both the price dynamics after the IEO, and the price movements of the altcoins as a whole at the time of analysis.

Exchange analysis

What metrics are important in selecting projects for investment? CryptoRank aggregates trading data by providing real-time ROI analysis for exchanges with at least 2 IEO. According to analytics , currently 15 out of 40 (37.5%) projects are traded below the price of IEO.

In addition to the analysis of the project itself, the choice of the exchange itself is equally important.

Let's take a closer look at how the projects on the exchanges were published.

Binance: Current AVG ROI: 248%

Kucoin: Current AVG ROI: 165%

Huobi: Current AVG ROI: 74%

Bibox: Current AVG ROI: 40%

Bgogo: Current AVG ROI: 40%

Gate: Current AVG ROI: -13.5%

Bittrex: Current AVG ROI: -69%

Probit: Current AVG ROI: -74%

More detailed ROI analysis for all IEO platforms can be found here .

Of the 11 exchanges analyzed - 3 exchanges have a negative current average ROI. These are the Probit , Bittrex and Gate exchanges.

At the same time, Bittrex and Probit also have negative ATH ROI. This may indicate that these exchanges are poorly suited to the selection of projects and the selection of metrics for conducting IEO, and are also not interested in market-making to release IEO above the offer price. Or in the case of, for example, with the Probit exchange, perhaps there are not large media and financial resources. Also, the Probit exchange in our opinion seemed to be not transparent in terms of conducting IEO and providing information.

Of the 11 exchanges analyzed - 3 exchanges have a negative current average ROI. These are the Probit, Bittrex and Gate exchanges.

At the same time, Bittrex and Probit also have negative ATH ROI. This may indicate that these exchanges are poorly suited to the selection of projects and the selection of metrics for conducting IEO, and are also not interested in market-making to release IEO above the offer price. Or in the case of, for example, with the Probit exchange, perhaps there are not large media and financial resources. Also, the Probit exchange in our opinion seemed to be not transparent in terms of conducting IEO and providing information.

From the point of view of investment, in order to minimize risks, it is advisable at this stage of development of IEO to choose exchanges with high ATH ROI and current ROI.

See real-time analytics

Analysis of the amount of collection

There is a hypothesis that the less funds a project collects, the higher will be ROI due to an imbalance of supply and demand. But at the moment it’s too early to talk about it, because The selection of projects is small and there are no obvious trends in this.

The project may collect a small amount of funds for various reasons. For some famous project, this is just marketing. For example, IEO Thunder Core on Huobi in the amount of $ 500,000. And for another project, this amount may be large and very heavy to attract.

Also consider unlocked tokens and general circulation at the time of listing at the end of IEO. For example, the ECOMI project raised $ 600,000 through IEO. And investors who invested in this project at the pre-sale stage already had a large number of tokens available for sale.

Category Analysis

According to CryptoRank since the beginning of 2019. urrent AVG ROI is higher for Data Service projects, and the lowest ROI for projects in the Real Estate category.

During the popularity of ICO, projects in the Real Estate category, as well as areas more related to real business, had a low ROI.

See real-time analytics

AVG ATH ROI is also higher in the DATA Service project category, as well as in the more blokchain-related project categories of the industry.

What causes high ROI when conducting IEO

- The price advantage for the token on IEO compared to previous rounds of fundraising.

- Conducting IEO on the stock exchange with high liquidity and good market-making.

- Fundamentally high-quality projects with good metrics.

- Lack of unlocked tokens in circulation (ayrdrop and bounty, team tokens, tokens from presale round).

- Transparent IEO conditions.

IEO Trends

The scope of IEO is growing rapidly. Changing approaches to conducting IEO. If initially it was IEO on the “First Come First Serve” system, now many exchanges are trying to create more comfortable conditions for the majority of participants.

Exchanges are trying to reduce volatility at the opening of trading. Pricing corridors and price restrictions are established, various systems of the type “matched orders” are introduced before the start of trading, during which trading is closed.

Exchanges are trying to create the conditions for long-term investment from the IEO stage and to protect inexperienced investors from large losses. Reputation suffers for exchanges, and projects can suffer major losses when, after IEO, project tokens are sold immediately and the project is forgotten.

Systems of lotteries, stock exchange tokens, oversubscription models and additional requirements are introduced, under which an investor to participate in IEO must also be an active user and trader of the exchange. Various marketing and marketing activities are also held at the end of the IEO.

The possible amount of investment in IEO projects is reduced due to rising popularity.

If this area is gaining momentum, then less attractive conditions will be created for participation in the IEO stage and it is possible that conditions for participation in private rounds will again be more profitable.

Minimizing the risks of investing in IEO and conclusions

Why, despite such a high ROI, IEO is not yet so popular?

As mentioned earlier, participation in IEO often requires holding an exchange token, which can be very volatile. The project may come out with a good ROI, but the investor will lose funds from the drawdown of the exchange token. To successfully invest in IEO, it is necessary to buy / sell a stock token in time and conduct its fundamental analysis. To minimize the risk of drawdown of the exchange token on many exchanges, it is possible to hedge their position by opening short as well.

The greatest bursts of volatility of stock tokens occur with IEO announcements, changes in participation conditions and listing of the project after IEO ends.

You should also not keep most of your portfolio only in exchange tokens to diversify risks. Because situations are possible in which all exchange tokens will simultaneously fall in price. For example, when prohibiting the holding of IEO, if IEO becomes not profitable or if they are replaced by something new.

Based on the analysis performed, it can be concluded that exchanges should be selected where projects come out with high ROI, projects from categories with high ROI, pay attention to the section where it is described why tokens give X.

Also, when choosing a project, be sure to pay attention if the project is currently being traded on other exchanges and at what price.

Source: https://habr.com/ru/post/453414/

All Articles