Consensus is a lie

Many people know that in the blockchain and systems based on it, one of the most important things is consensus, the agreement of machines and people about something according to the established rules. But ... is this really true? And is this not ... self-deception? In the article below we will look into this.

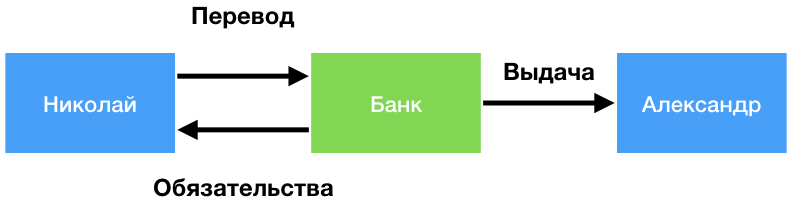

To begin with, we will understand why consensus is needed at all and what it is. Let us have one bank and one depositor Nikolay, on whose account 1000 rubles are listed. He sends a letter to the bank with a request to transfer all the money to the account of his friend Alexander. And everything is fine - the money was written off from one account and signed up for another. In this case, there are no problems, and the new owner of the money decided to withdraw them at that very moment and everything is fine.

But what if the bank has two branches at once?

All the same 1000 rubles are on Nikolay's account, but now there are already two friends, Alexander and Konstantin, who are in both branches and are waiting for the money to go to the account in order to take it and leave. And two letters come to both departments, but in one of them 1000 rubles are transferred to Alexander, and in the other to Konstantin. And out of 1000 rubles, 2000 arises. And so that this could not happen - each branch of the bank must notify the others that the money has been written off and transferred to someone, then the second attempt to write them off will not work - then there is no money in the account anymore. And who will get 1000 rubles? In an ideal world, the one in whose name the letter came first is a possible option and with the fact that the sender would be asked to clarify who the translation was assigned to. And everything is good, there are no problems.

But this is still not the consensus that is used in modern cryptocurrencies.

And what if the branches of banks are not really branches, they are just small private banks connected to a single payment system without a central server? Why not, quite a practice for different areas. Only a system without a leader, just agreed on partnership agreements and send each other changes in the accounts of common customers, all is well ... or not. If an event occurs as in the example above - who decides who was right and who will get the money? But the time of arrival of this letter even in the modern super-fast Internet may be the same - there are a lot of delays, there is a server processing time - you can't just decide who was first, because it is not clear which of the letters was sent first in reality, up to a certain size time scales. And so it turned out that the letter on it came at the same time, completely identical, but with different recipients of funds. Which of these two banks will be right when it begins to distribute to all other banks that now this amount of funds on the account of the specified client? How to understand who is right? And if one of the banks is a fraud?

Actually, systems of consensus appeared. The most popular Bitcoin cryptocurrency is PoW - proof of the power of the miner, calculating hashes that are useless to the world, but useful to the consensus. There is also a PoS where the “bank” is right and it has more money in its account, but there is also dPoS where delegates are elected who decide who is right, and the voting power is equal to the amount of money in the account, but delegates decide just by majority or otherwise to the rules. There are many other consensus of varying degrees of equality and speed of work. And everything seems to be fine.

But there is a nuance ...

When you come to the store you buy a product, and if the product is bad, you can usually come in and change it for a new one, or for money back. But maybe so you bought something from your hands or traveling, you can never again meet the seller who sold you the goods, so the quality of the claims especially apply will not work. Well, money - money in fact in the modern world is increasingly not in your pocket, but in a bank, and you only have a key in the form of a card or an Apple Pay entry on your phone. One touch and “letter” flies through a chain of different providers and banks, writing off funds in one bank and writing them down in another, possibly in another country. And everyone trusts everyone. But what went wrong that there was a need for cryptocurrencies and consensus? This micro-game will explain this (just come back then, the most interesting things will begin):

The fact is that there are spheres where the interaction case is that there are only one interaction rounds, and anonymity makes it possible and true to make it one. As a result, the most effective way to work will be deception - to deceive your partner and get more, because you will never meet again. Game theory is harsh, but fair. As a result, in this vein, a system is needed that will allow to get around this problem, technically make you follow these rules.

And everything is good, everything is wonderful, but ...

Those people who interact with the cryptocurrency now often use different tools besides the usual wallets, because ordinary wallets assume complete synchronization, and so it’s a pleasure to download and store a terabyte of data. As a result, people choose light wallets ... or even web wallets, where you just need to enter your key or use a browser plugin and voila - everything works, from anywhere in the world, no worse than a regular wallet. True, no technical guarantees ... because the guarantees are in a different plane. Nevertheless, this is a classic case of using cryptocurrency and other products.

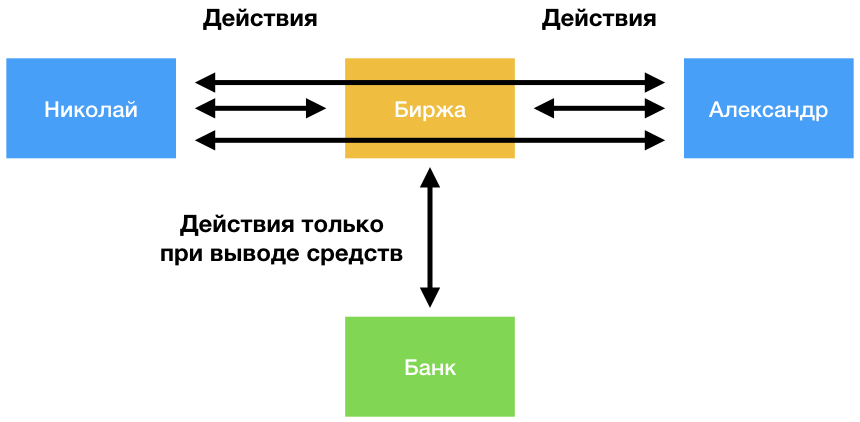

There are people who have never kept cryptocurrencies on their accounts, but they are completely participants in the ecosystem. For example traders and some investors. You can relate to their activities differently, but somehow, routine is when people get cryptocurrency right into the account of the exchange, send funds to other exchanges, but, ultimately, they also withdraw money through exchanges, immediately to Fiat or through exchangers to Fiat - rubles, dollars or yuan - is no longer important, but participating in this ecosystem does not touch the consensus.

Exchangers, which are many - there is no consensus that guarantees you that when you transfer to the account of bitcoins - you will receive rubles on the card. And here you are a crypto-programmer or freelancer, withdraw your hard-earned bitcoins or some other coins or tokens - and you will most likely receive your earned money, but for a completely different reason, without consensus. Real estate for crypt, on smart contracts. Or something else from the real world that is recorded in the virtual. No one ever guarantees you the fulfillment of obligations in a smart contract, and even across the globe, no matter what is recorded. However, oddly enough, it can work - only for completely different reasons and nothing to do with consensus. And of course, the shares of the companies - no guarantors did not save those who invested in Scam-ICO in 2017, because they sold cars and apartments and businesses for tokens. And the tokens really remained on the account of investors, the consensus helped. But it did not in any way save them from losses, from, in fact, stolen funds, it did not bring the expected profits. Tokens are still in their accounts, but value is no longer.

And what about the big crypto companies? An interesting example of the Ethereum project, which made a big smart contract called DAO, which collected a lot of money ... and which was robbed by a hacker, because the contract did not provide for some nuances, which allowed to divert funds, and all - according to the rules of the system. And ... the blockchain was simply forked, rolled back the changes ... in the immutable decentralized blockchain ... the centralized decision of the company. When you really need to - any rules are suddenly canceled, and who will go against the decision of the central company developing the project, right? Of course, some people went, the Classic was formed, which is even still alive, but a couple of orders of magnitude weaker and almost nobody needs, there is no influence, values are also, the price of tokens is orders of magnitude lower.

And of course, even if the rules do not change - there are always nuances. In the dPoS consensus, everything seeks for oligopoly, flowing into a monopoly or close to such a power, delegates come up from the air, who are completely controlled by the need and the project is ruling as needed. In PoS, it’s enough to buy the right amount of coins for different accounts, no one knows that the owner is one, and with PoW it’s certainly difficult to mine everything yourself, but if you own the pool and your customers mine pieces for you, you can safely do the things you need from their name and rule the system as you need it.

Of course, there is a weighty argument against this, the last line of defense in case any of the cryptocurrencies or crypto projects begins to be controlled by someone in one or in the cartel. The fact is that if you own a blockchain ... it is not profitable for you to cheat. After all, you spent so much effort on the way to the top of what to take and simply demolish the system, which usually brings you tokens through mining / staking / delegate ... no, it is more profitable for you to continue to keep it working, undermining the file for yourself, but do not interfere on the line. But ... how does this differ from an ordinary corporation?

And it all comes down to the Theory of Games - when it is not profitable for you to cheat if you play a long game, and cooperation brings you benefits.

The industry has grown. But not because the consensus protected money and that's it. Not. The reason for the growth in the expansion of financial instruments for ordinary people. For example, crowdfunding - there used to be projects that allowed you to raise money for anything. But there have never been so many convenient international instruments, and even without the requirements for verification, explanations from where the money, cross-border exchange controls and that’s all. Borders have been erased. Similarly with payments abroad. No, due to volatility and commissions, this is still not always the best option, but in some cases it is very much the case. So much so that some states thus bypass the embargo from other countries, the history of Venezuela is particularly noteworthy.

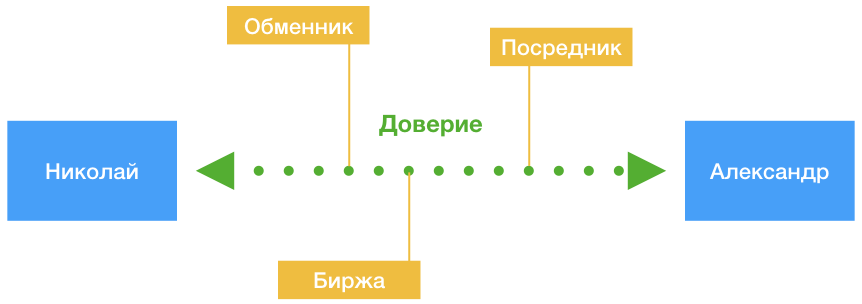

But everywhere, by and large - the principle of credibility works. When you send money to someone via cryptocurrency - you trust the owners of the cryptocurrency system, whether there are still many hosts or one already. When you exchange a cryptocurrency on a card in the exchanger, you trust the exchanger and its authority, but not to anything else and no matter how the cryptocurrency is arranged - the main fulfillment of obligations by the exchanger. When you use cryptographic services you trust her because she has some kind of authority, but authority for you and you use her services according to her rules. When you suddenly buy or sell something for cryptocurrency - you trust the person on the other side and no matter how the payment process takes place, the main thing is that everything is within the framework of the conditions here and now. Whatever happens, no matter how it works, everything is built on trust and authority. The US dollar is very authoritative. The store in front of your house may not be so much, but if suddenly there is an inappropriate product there is some probability that the goods can be returned, besides, there are laws that are enforced, depending on the country, to varying degrees, but if they are observed, then this overflow of authority from the state where it is a guarantor. But here in the Bitcoin exchanger for rubles on the card there are no guarantors, except one - the Theory of Games, according to which it is not profitable to cheat you, especially if the exchanger exists for a long time and the commission completely pays for all expenses and satisfies the desires of the owner. Only in this whole consensus is completely unnecessary and in fact everything is built on trust.

Cryptocurrencies themselves gave another bonus - the ability to make your token / asset / point / coin / share in a number of not complicated actions. But is it possible to provide the ability to create your asses of something without having to drag a consensus with you, not to be part of a decentralized (or not) system? About 10 years ago it would have looked ridiculous, not confidential ... if it were a small company. In fact, rubles, dollars, or the same stocks are the same tokens in essence, IOUs, futures or something else, and the bank or other organization acts as a debtor, starting with the appearance of the first coins in exchange for physical pieces of gold. But the world has changed, cryptocurrency gave the moral right to print their coins, even anonymous ones. And the role of the blockchain here is only in the first step, in narrow cases, but it has benefited. Everything else is built on top of the Games Theory itself with a strategy of no gain in deception, the benefits of cooperation because it just brings more benefits, this is the reality at this point in time.

To be continued…

(same article in pdf )

')

Source: https://habr.com/ru/post/452486/

All Articles