Q3 MoneyTreeReport - US Venture Report

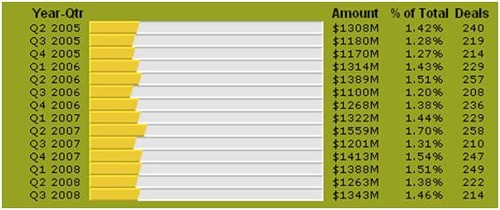

We often talk about startups in the .com zone, but rarely where they talk about the volume of the American venture capital market. How many startups are they funding? What amounts? What is the share of Silicon Valley in the total flow of projects. And also an important question, what stages of projects are most often financed. I will give a table from a study that allows you to trace the dynamics of investment by quarters since 2005, it also shows the number of transactions, the share in all venture capital investments (in all sectors) and the amount in dollars.

1. Investments by quarters from 2005 to 2008

2. Investments by location from 2005 to 2008

')

The volume of transactions over the past 12 months is interesting - 932 companies were invested, the total investment is 5.49 billion dollars. This innovative conveyor. How many deals per year do we have?

During the third quarter of 2008, $ 1.3 billion was invested. The average transaction is $ 6.2 million.

Link: www.pwcmoneytree.com/MTPublic/ns/index.jsp

Source: https://habr.com/ru/post/45065/

All Articles