Cryptocurrency: lives or dies?

Part 1. Bubbles as a scarecrow for beginners.

The “cryptomania” of 2017 was colossal. Although cryptocurrencies have existed since 2009, many people found out about them exactly in 2017 - against the backdrop of a staggering growth in rates and a clear sense of revolution. Many newcomers thought that courses would grow forever. They were ready to buy digital currencies at any price, considering any downturns to be local, and growth to be global.

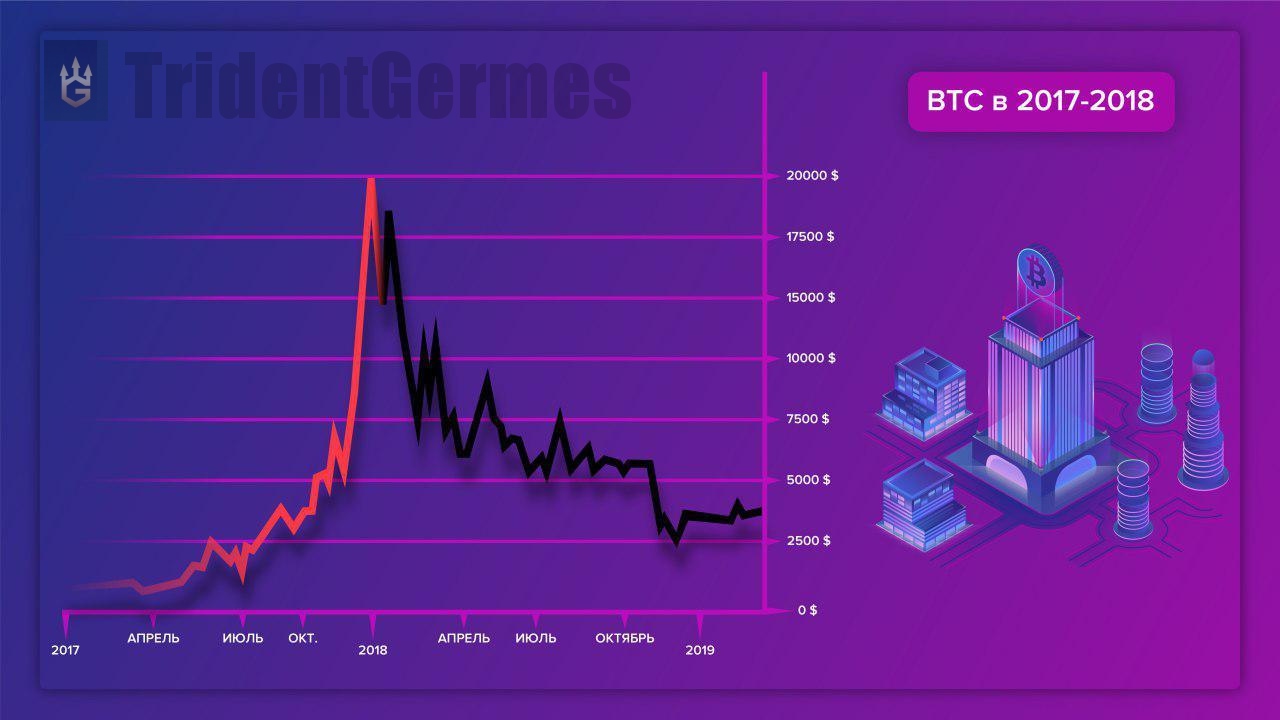

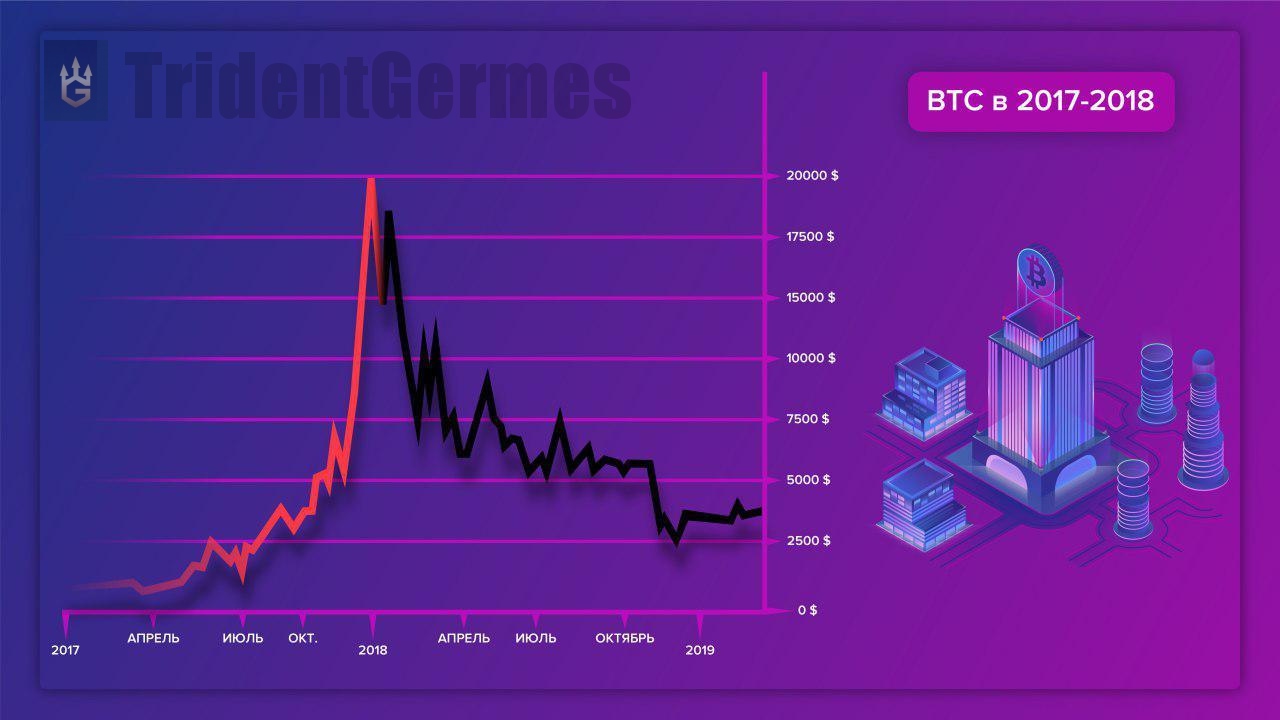

But the end of the year gave an unpleasant surprise: the market suddenly began to crumble. In the first quarter, many hoped that this was only a “correction,” but the collapse continued. If at the beginning of 2018, Bitcoin (BTC) was worth a record $ 20,000, then by September it had fallen in price to $ 6,300, that is, tripled. And the “heroic” broadcast (ETH), which almost surpassed BTC in terms of capitalization in the summer of 2017, dropped fivefold: from $ 1,300 to $ 250.

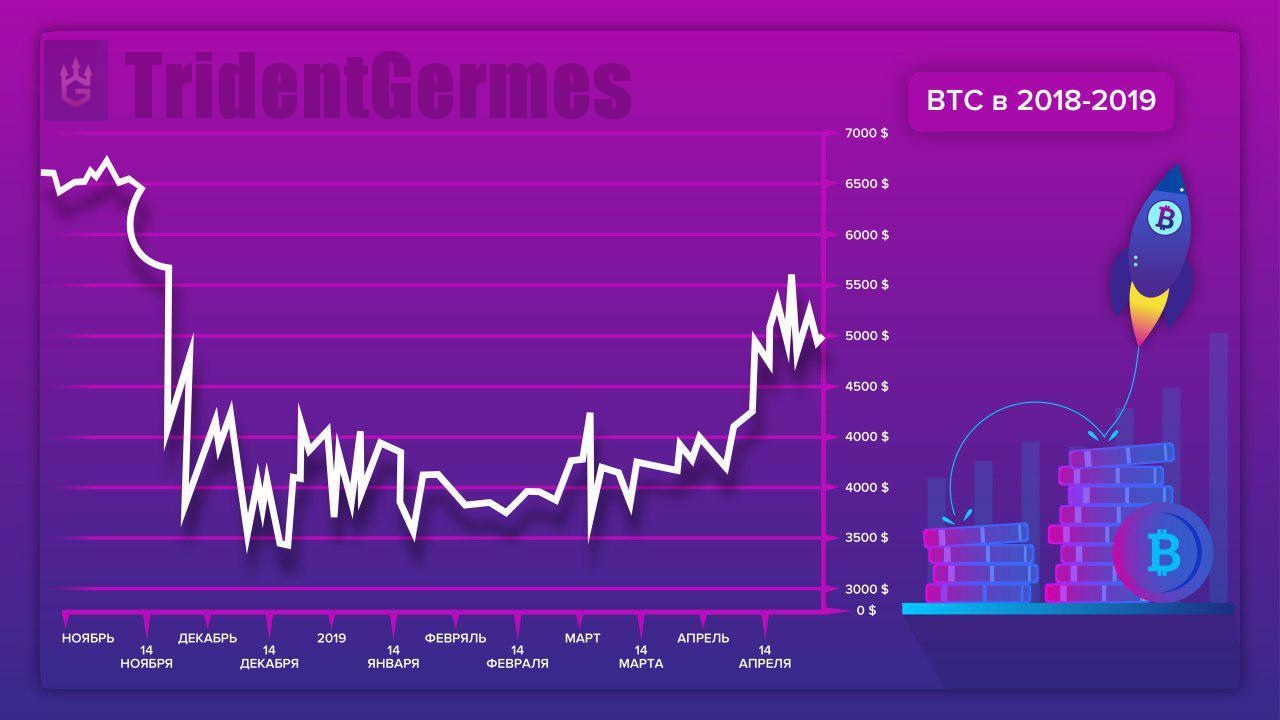

In the autumn, the market froze. It seemed that the bottom was reached and the restoration would begin soon. But November brought another surprise: the courses collapsed again. For example, BTC fell from $ 6,000 to $ 4,000. This happened so abruptly that it looked like a clear conspiracy of the largest players - the so-called "whales". Autumn investors, following the earlier ones, suffered losses. Many were completely disappointed in the crypto market, having decided that he was completely at the mercy of manipulators: such a “market” rather resembles MMM, where quotations are arbitrarily set by puppeteers.

')

In winter, the market froze again, and in spring the long-awaited growth began. In March - carefully, and in April - unexpectedly sharply and symmetrically to the November fall. In both cases, the BTC exchange rate literally changed by $ 800 in an hour, only in November it was a fall, and in April - a rise. In both cases, there was no rebound: on the contrary, the movement continued further. Optimists rushed to buy cryptocurrencies, but a significant mass of the population was left with a sense of trick. If not only falls, but also rises occur “at the click of a finger”, then is this not the best proof of puppelling?

So believe in genuine market recovery now? Perhaps this is another trick? Is it worth investing in cryptocurrencies, or is it better to forget them like a bad dream? Is the market entirely in the hands of puppeteers, or does it have objective laws? We will try to understand this in more detail.

How it all began: Bitcoin and its bubble 2013

The first in the world of cryptocurrency was Bitcoin (BTC). It appeared in 2009 and at first was known only to specialists in cryptography, as well as to particularly advanced free market activists. But soon he attracted the close attention of investors, demonstrating in 2010-2013 a tremendous growth of 4 orders: from $ 0.1 to $ 1000. In other words, the average exchange rate grew 10 times a year (!!!).

In 2013, this success BTC gained worldwide fame. But, as is often the case, the shock popularization did not benefit the asset rate: reaching a record $ 1,200 in December 2013, BTC began to fall in price. By the end of 2014, its rate rolled back to $ 250, after which it remained relatively stable in 2015. A significant part of the growth in 2013 turned out to be a bubble.

However, after blowing off the bubble, the BTC course still remained significantly higher than it was at the beginning of 2013 (and, especially, in all previous years).

How it went: altcoins and the general market bubble 2017

The new growth of the BTC rate began in 2016 and became particularly turbulent in 2017. At the same time, the Altcoins, the new cryptocurrencies, the “alternative” BTC - ether (ETH), lightcoin (LTC), emercoin (EMC) and many others, made a massive appearance. If until 2016 they remained in the deep shadow of the flagship of the market, then in 2017 their total capitalization for some time exceeded the capitalization of BTC. In the summer of 2017, there was even a moment when ETH alone almost beat BTC ahead.

By the end of 2017, BTC went up to $ 20,000, and the total capitalization of the cryptographic market reached a whopping $ 800 billion (higher than the capitalization of any global corporation). But it turned out to be another bubble: the whole of 2018, like 2014, the rate of BTC and other currencies fell). By the end of the year, market capitalization fell to $ 130 billion.

What shows the comparison of two bubbles

Financial bubbles - the phenomenon unpleasant, but natural. Studying their dynamics, you can discover a lot of interesting things about the nature of the new asset. If you look at the numbers, you can see: the bubbles of 2013-2014 and 2017-2018 have a lot in common.

- In both cases, the rate of Bitcoin fell about 5 times. The market capitalization of the second case fell about 6 times.

- In both cases, the main decline lasted about a year, followed by a lull.

- In both cases, “after the bubbles” courses were fixed at levels significantly exceeding the levels “before bubbles”. For example, at the end of 2014, BTC was much more expensive than at the end of 2012, and at the end of 2018 - much more expensive than at the end of 2016.

Already this simple comparison shows: the scale of the cryptocurrency catastrophe of 2018 is exaggerated. The bubble developed in the same scenario as last time, and seriously frightened mostly newcomers.

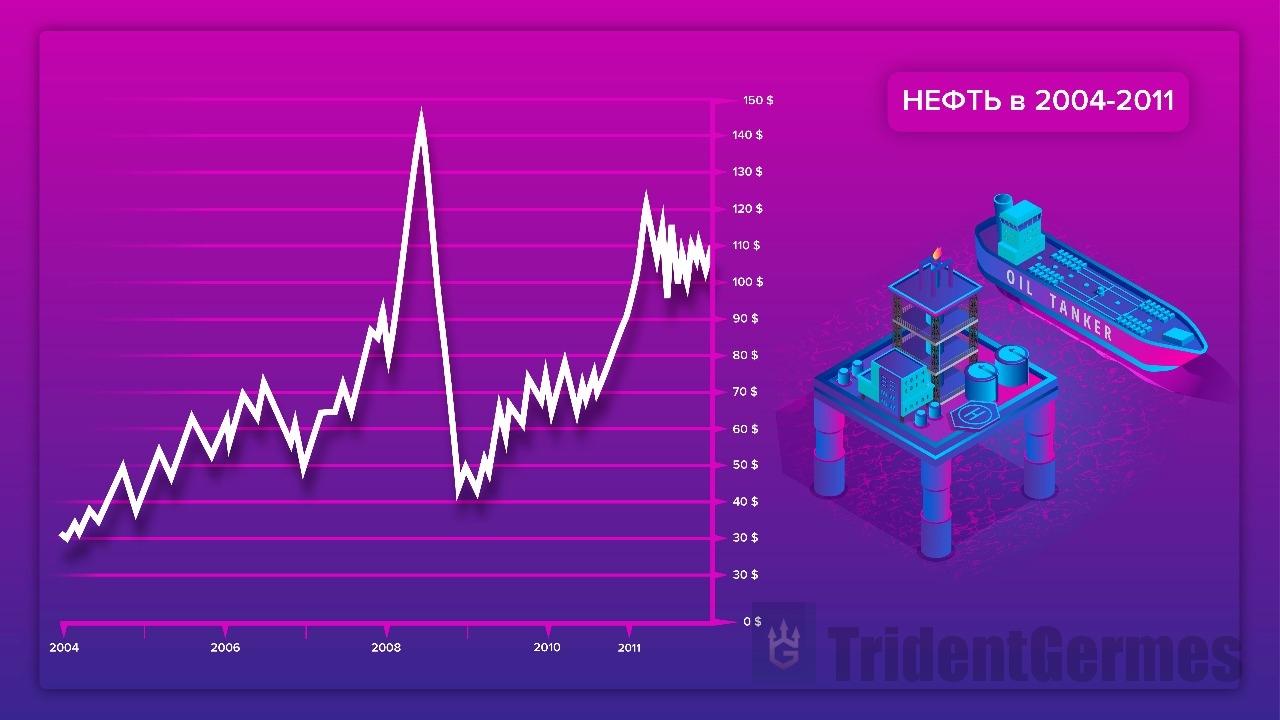

If you believe the charts, then kryptranok alive rather than dead. Moreover, it follows well the standard laws of development of financial bubbles, and the long-term trend is clearly positive. To be convincing, we can recall, for example, the graph of oil prices in the 2000s. As we can see, there was a bubble and a decline here too, but then - a recovery to values much higher than before the bubble. This is what happens when an asset is really valuable (it is not a momentary HYIP), and this is what we see in the case of a crypto market.

With high probability, right now cryptocurrency investments are of particular interest. The rise looks logical, and why it happened so abruptly, is there a trick, and what are the fundamental reasons for the rise - we will talk next time

Analytical department of the company "Trident".

Source: https://habr.com/ru/post/448942/

All Articles