Why invest in loss-making companies?

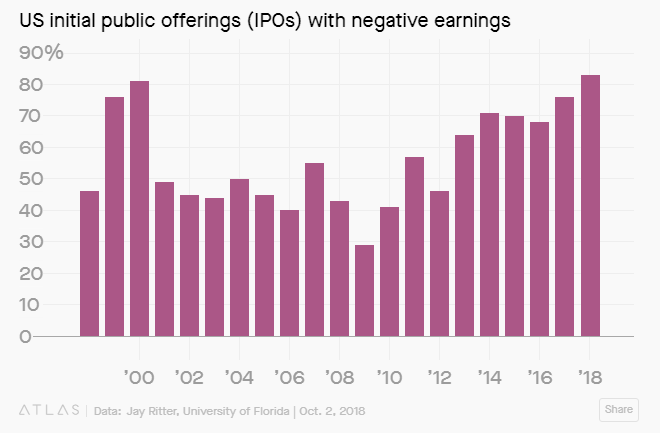

In 2018, more than 80% of companies that were listed on the exchange were unprofitable. But investors continue to invest money in them, and we at United Traders continue to offer them as investment ideas, on which you can earn. Why is that? We tell.

But first about what it is. IPO (Initial Public Offering) - initial public offering of shares. This is a process during which a company offers to buy its shares to an unlimited number of investors, that is, it becomes public. To earn an IPO, you need to buy shares before placing them on the stock exchange, choosing a company whose shares will grow in price, and selling them after three months after placement (three months Lock up lasts when the shares cannot be sold according to the rules of the stock exchange).

Investment strategies differ in the period when an investor plans to make a profit. For example, the buy-and-hold strategy is long-term: we expect to make a profit in a few years, so when evaluating, we look at the forecast of the company's fair value and use the cash flow discounting method (DCF approach).

')

The horizon of investing in an IPO is several months, so we estimate the company in terms of short-term demand. In this situation, increased investor interest is the decisive driver of the share price on the offering, and the most appropriate assessment method is comparative analysis (exit multiple approach).

According to our research, the most significant factors in evaluating a company by the comparative method are 2 indicators - the amount of revenue in the last 12 months before an IPO and quarterly revenue growth year-on-year (or annual revenue growth, if there are no quarterly data). It turns out that the greater the growth of the company's revenue, the better.

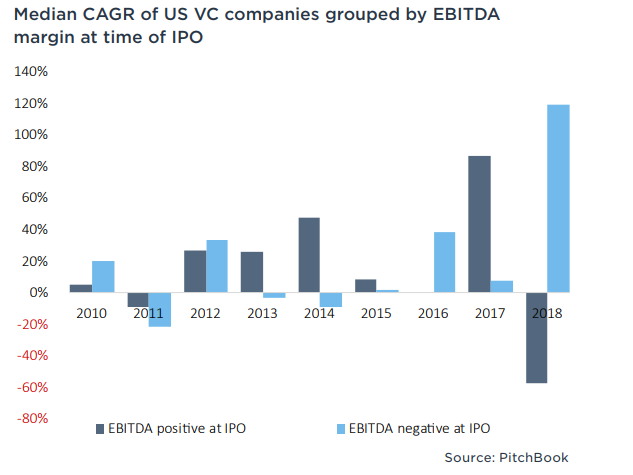

As for profit margins, recent statistics from Pitchbook * showed that in 2018 more than 80% of the companies that were listed were unprofitable. Moreover, the average price increase for shares of loss-making companies was 120% from the IPO date to March 2019. At the same time, shares of profitable companies fell by an average of 57% from the IPO date in 2018 to March 2019. However paradoxical it may sound, In 2018, investor demand for shares of loss-making companies far exceeded demand for profitable companies during an IPO (Fig. 1).

Picture 1

If we talk about a long horizon, over the past 9 years, the profit factor has not affected the stock returns. It turns out that the company's profitability is not statistically significant for determining the future profitability of an investment.

We looked at US IPO statistics for 2018 in more detail.

In total for 2018, 228 companies were placed on the NYSE and NASDAQ with an average return on the first trading day of 13.2%. Usually, the success of an IPO is determined by the dynamics of the price on the first trading day: if the share price on the first day closed above the offering price, the company's IPO can be considered successful, and vice versa. Therefore, to determine the statistical significance of profitability in IPO success, we tested the following model:

f (ipo_return) = b0 + b1 (profitability)

profitability is an independent variable that reflects the company's EBITDA — earnings before interest, taxes and amortization. In our case, this is a binary variable (source of information is Yahoo Finance).

ipo_return is a dependent variable that reflects the return on the first trading day, that is, the difference between the closing price and the placement price (source of information iposcoop).

Since EBITDA is not a required financial indicator of US GAAP, some companies do not reflect this data in their reports. So in our final sample there were 132 companies for which EBITDA was available.

Of these 132 companies, 38 were profitable at the time of the IPO, the other 94 companies showed negative EBITDA.

The median yield of 38 profitable companies on an IPO was 3%, while the median yield of loss-making companies on an IPO was 13.5%. On average, in 2018, the profitability of loss-making companies on IPO exceeded the profitability of profitable companies.

The results of the regression analysis are shown in the table below:

From these results, it can be concluded that there is a slight negative relationship between the company's profitability on an IPO and the yield on the first day of trading, but this is not a statistically significant effect. It turns out that the company's profitability factor cannot be used to predict the profitability of an IPO.

These statistics are explained by the fact that investors value the future growth of the company, that is, the growth of revenues and capital investments, rather than the current profitability of the business. Investors in the IPO analyze companies in terms of the potential of a startup - consider the size of the future market and evaluate the innovativeness of the product.

1. Many current unprofitable companies can quickly become profitable if they switch their attention from growth to profit.

Spotify , a music streaming service, said that the company could become profitable in a short time if it did not spend money on marketing, R & D and other investments in future growth. By the way, Spotify recently showed profitability for the first time, less than a year after entering the stock exchange.

Lyft could also show profitability last year if she hadn't spent money on attracting new customers and R & D. However, without investing this money in growth, the company will not be able to expand its client base, which is a key factor at this stage of development. By lowering investments, Lyft may also fail to realize the company's dream of developing and using unmanned vehicles, which will significantly reduce costs in the future.

2. Companies that are becoming public today have more mature products.

More recently, the average age of a company at the time of an IPO was 5 years, while today's average age at an IPO more than doubled to 11 years. Companies that are becoming public today have more established business models than, for example, at the time of the dot-com. So, last year, Lyft's revenue was $ 2.2 billion (an incredible figure for Internet companies of the late 90s).

№1. IPO YETI Holdings

The American company YETI, a manufacturer of products for outdoor activities, applied for an IPO on September 27, 2018. The company's revenue growth in the first half of 2018 was 35%, and its profit increased from $ 156 thousand to $ 15.6 million. However, upon further detailed study, it turned out that the company's revenue is not growing at a steady pace, subject to seasonal factors and consumer sentiment. We began to doubt about the company's share in the market of products for active recreation - YETI has many competitors in both the US and international markets, and after analyzing the other factors, we decided not to participate in this IPO. The company's shares were sold at $ 18 on placement, and 3 months after the IPO, on January 28, the price of the shares after the close of trading was $ 17.8, the yield with commissions would be -5%.

Despite the fact that the company was profitable over the past 3 years, showed revenue growth in the first half of 2018, the company's prospects did not impress investors and the yield in the IPO would have given a negative result.

№2. IPO Anaplan

To eliminate the factor of profitability of the common market, we will give an example of a company that was listed on the stock exchange at about the same time as YETI Holdings.

The American company Anaplan is developing a platform for financial and operational planning and modeling of business processes. Quarterly revenue of the company is growing rapidly, 50% yoy. The company also demonstrates stable growth of customers along with improved unit-economy indicators. The size of the potential market is $ 21 billion. Considering these and other factors, United Traders decided to participate in this IPO.

It is worth noting that this company is unprofitable: the company's profit fell from - $ 16 million to - $ 47 million in the first half of 2018. However, this figure did not frighten investors - the return on investment for 3 months after the IPO was + 63%.

According to the statistical study of Pitchbook, as well as our own analysis, we found that the factor of the company's profitability on the IPO does not affect the movement of the stock price after the offering. Growth in the company's revenue, product innovation, the size of the potential market, the price of share capital on the offering, as well as other factors are of greater importance for investors in an IPO.

It is important to note that the company's valuation on an IPO was carried out with the growing broad market for US stocks. Since investing in relatively young companies in an IPO is a risky strategy, possible reductions in the overall market will negatively affect the return on investment of this strategy.

Sources:

pitchbook.com ,

United Traders analysis.

IPO is

But first about what it is. IPO (Initial Public Offering) - initial public offering of shares. This is a process during which a company offers to buy its shares to an unlimited number of investors, that is, it becomes public. To earn an IPO, you need to buy shares before placing them on the stock exchange, choosing a company whose shares will grow in price, and selling them after three months after placement (three months Lock up lasts when the shares cannot be sold according to the rules of the stock exchange).

Investment horizon

Investment strategies differ in the period when an investor plans to make a profit. For example, the buy-and-hold strategy is long-term: we expect to make a profit in a few years, so when evaluating, we look at the forecast of the company's fair value and use the cash flow discounting method (DCF approach).

')

The horizon of investing in an IPO is several months, so we estimate the company in terms of short-term demand. In this situation, increased investor interest is the decisive driver of the share price on the offering, and the most appropriate assessment method is comparative analysis (exit multiple approach).

Comparative analysis: revenue is more important than profit

According to our research, the most significant factors in evaluating a company by the comparative method are 2 indicators - the amount of revenue in the last 12 months before an IPO and quarterly revenue growth year-on-year (or annual revenue growth, if there are no quarterly data). It turns out that the greater the growth of the company's revenue, the better.

As for profit margins, recent statistics from Pitchbook * showed that in 2018 more than 80% of the companies that were listed were unprofitable. Moreover, the average price increase for shares of loss-making companies was 120% from the IPO date to March 2019. At the same time, shares of profitable companies fell by an average of 57% from the IPO date in 2018 to March 2019. However paradoxical it may sound, In 2018, investor demand for shares of loss-making companies far exceeded demand for profitable companies during an IPO (Fig. 1).

Picture 1

If we talk about a long horizon, over the past 9 years, the profit factor has not affected the stock returns. It turns out that the company's profitability is not statistically significant for determining the future profitability of an investment.

Comparative analysis: we considered

We looked at US IPO statistics for 2018 in more detail.

In total for 2018, 228 companies were placed on the NYSE and NASDAQ with an average return on the first trading day of 13.2%. Usually, the success of an IPO is determined by the dynamics of the price on the first trading day: if the share price on the first day closed above the offering price, the company's IPO can be considered successful, and vice versa. Therefore, to determine the statistical significance of profitability in IPO success, we tested the following model:

f (ipo_return) = b0 + b1 (profitability)

profitability is an independent variable that reflects the company's EBITDA — earnings before interest, taxes and amortization. In our case, this is a binary variable (source of information is Yahoo Finance).

ipo_return is a dependent variable that reflects the return on the first trading day, that is, the difference between the closing price and the placement price (source of information iposcoop).

Since EBITDA is not a required financial indicator of US GAAP, some companies do not reflect this data in their reports. So in our final sample there were 132 companies for which EBITDA was available.

Comparative analysis: results

Of these 132 companies, 38 were profitable at the time of the IPO, the other 94 companies showed negative EBITDA.

The median yield of 38 profitable companies on an IPO was 3%, while the median yield of loss-making companies on an IPO was 13.5%. On average, in 2018, the profitability of loss-making companies on IPO exceeded the profitability of profitable companies.

The results of the regression analysis are shown in the table below:

From these results, it can be concluded that there is a slight negative relationship between the company's profitability on an IPO and the yield on the first day of trading, but this is not a statistically significant effect. It turns out that the company's profitability factor cannot be used to predict the profitability of an IPO.

So why are investors investing in unprofitable companies?

These statistics are explained by the fact that investors value the future growth of the company, that is, the growth of revenues and capital investments, rather than the current profitability of the business. Investors in the IPO analyze companies in terms of the potential of a startup - consider the size of the future market and evaluate the innovativeness of the product.

1. Many current unprofitable companies can quickly become profitable if they switch their attention from growth to profit.

Spotify , a music streaming service, said that the company could become profitable in a short time if it did not spend money on marketing, R & D and other investments in future growth. By the way, Spotify recently showed profitability for the first time, less than a year after entering the stock exchange.

Lyft could also show profitability last year if she hadn't spent money on attracting new customers and R & D. However, without investing this money in growth, the company will not be able to expand its client base, which is a key factor at this stage of development. By lowering investments, Lyft may also fail to realize the company's dream of developing and using unmanned vehicles, which will significantly reduce costs in the future.

2. Companies that are becoming public today have more mature products.

More recently, the average age of a company at the time of an IPO was 5 years, while today's average age at an IPO more than doubled to 11 years. Companies that are becoming public today have more established business models than, for example, at the time of the dot-com. So, last year, Lyft's revenue was $ 2.2 billion (an incredible figure for Internet companies of the late 90s).

Case: Investing in a profitable and unprofitable company

№1. IPO YETI Holdings

The American company YETI, a manufacturer of products for outdoor activities, applied for an IPO on September 27, 2018. The company's revenue growth in the first half of 2018 was 35%, and its profit increased from $ 156 thousand to $ 15.6 million. However, upon further detailed study, it turned out that the company's revenue is not growing at a steady pace, subject to seasonal factors and consumer sentiment. We began to doubt about the company's share in the market of products for active recreation - YETI has many competitors in both the US and international markets, and after analyzing the other factors, we decided not to participate in this IPO. The company's shares were sold at $ 18 on placement, and 3 months after the IPO, on January 28, the price of the shares after the close of trading was $ 17.8, the yield with commissions would be -5%.

Despite the fact that the company was profitable over the past 3 years, showed revenue growth in the first half of 2018, the company's prospects did not impress investors and the yield in the IPO would have given a negative result.

№2. IPO Anaplan

To eliminate the factor of profitability of the common market, we will give an example of a company that was listed on the stock exchange at about the same time as YETI Holdings.

The American company Anaplan is developing a platform for financial and operational planning and modeling of business processes. Quarterly revenue of the company is growing rapidly, 50% yoy. The company also demonstrates stable growth of customers along with improved unit-economy indicators. The size of the potential market is $ 21 billion. Considering these and other factors, United Traders decided to participate in this IPO.

It is worth noting that this company is unprofitable: the company's profit fell from - $ 16 million to - $ 47 million in the first half of 2018. However, this figure did not frighten investors - the return on investment for 3 months after the IPO was + 63%.

Conclusion

According to the statistical study of Pitchbook, as well as our own analysis, we found that the factor of the company's profitability on the IPO does not affect the movement of the stock price after the offering. Growth in the company's revenue, product innovation, the size of the potential market, the price of share capital on the offering, as well as other factors are of greater importance for investors in an IPO.

It is important to note that the company's valuation on an IPO was carried out with the growing broad market for US stocks. Since investing in relatively young companies in an IPO is a risky strategy, possible reductions in the overall market will negatively affect the return on investment of this strategy.

Sources:

pitchbook.com ,

United Traders analysis.

Source: https://habr.com/ru/post/446944/

All Articles