Proof-of-work effective

Hi, Habr! I present to you the translation of the article "PoW is Efficient" by Dan Held.

Most people think that the energy spent on Proof-Of-Work (hereinafter PoW) is wasted. In this article I will explain why everything is based on energy, including money. And also why the assessment of energy consumption is subjective, and how to compare the cost of energy spent on PoW with other systems. This article contains the thoughts of many people from the field of cryptocurrency, I just put it all together.

The idea that energy is needed to do the work arose from the French mathematician Gaspard-Gustav de Coriolis. In those days, work was completely carried out by people. The fuel for the work was food.

About a million years ago, man made fire. As a result, the amount of energy available to humans increased, now man could warm himself with the help of fire, and not just thanks to the food eaten. Thus, this extra energy has improved the life of humanity.

')

A few thousand years ago, human energy consumption increased even more, thanks to the domestication of animals. Animals did the work for man. Animals also required a lot of food, and this also contributed to further development.

Over the past few hundred years, man made cars. Machines performed work using first the energy of water and wind, and later using cheaper energy sources such as coal and gas. Currently used nuclear and thermonuclear energy. Both machines and nature do the work through the use of energy. The economy is not based on money, but on work and energy.

Everything in our life is closely related to the cost of energy. Water purification requires energy. The transportation of goods requires energy. Production of goods requires energy. Cooking requires energy. Refrigerators and freezers require energy. In the free market, the price of any commodity largely depends on the amount of energy spent on its production. As the market stimulates minimum prices for goods, the amount of energy used to produce energy is also minimized.

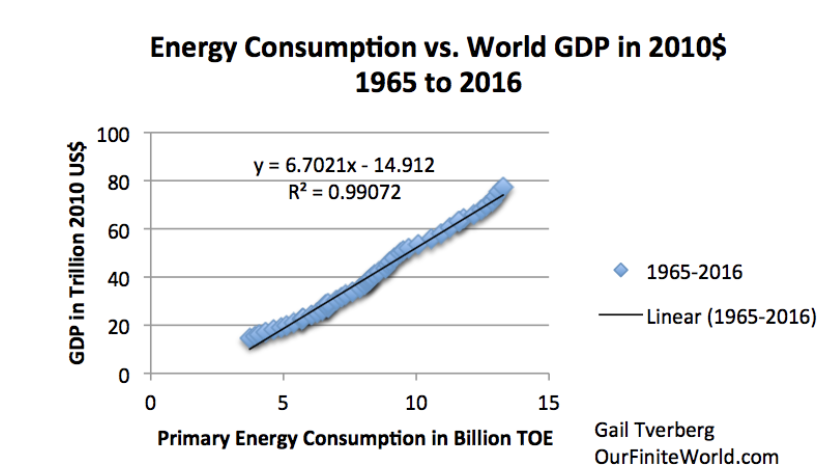

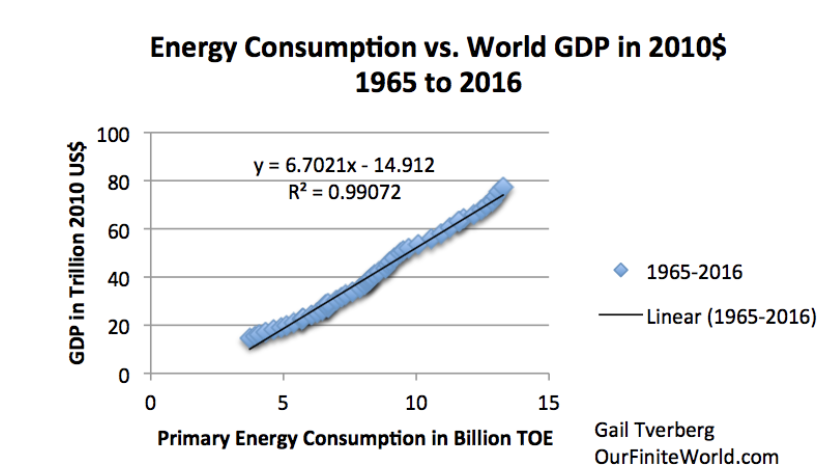

Global GDP (according to the United States Department of Agriculture) as compared to World Energy Consumption (based on BP data for 2014):

At the beginning of the 20th century, industry leaders Henry Ford and Thomas Addison considered the idea of replacing gold or a dollar with an “energy dollar” or “energy unit” (energy currency). The idea was popular, because such a currency had the characteristics of money: a well-defined measure of settlement, easily measurable, but difficult to counterfeit, divisibility into smaller parts and interchangeability (any unit is equivalent to any other unit). However, there were drawbacks - it was difficult to transfer and store energy-money.

Fast forward to October 31, 2008 - Satoshi published a work about Bitcoin. The PoW method was originally coined to combat spam. Then Satoshi adapted this technology for use in electronic money. Mining uses special machines (ASIC) to convert electricity into Bitcoins (as a reward for a mined block). Machines constantly perform hashing operations (assumptions / voices) until they find a solution to a cryptographic problem. For the solution found remuneration is paid in bitcoins. The solution found proves that the miner has spent energy in the form of an ASIC machine and electricity. Bitcoin is based on the capitalist principle of “risking money, you get a voice”, using energy and ASIC machines to calculate hashes (votes) - Hugo Nguyen.

When Satoshi designed the PoW method, he fundamentally changed the voting system from political votes to apolitical (hashes) using energy conversion. PoW serves as a test that energy has been spent. Why is it important? For the physical world, this is the simplest and fair method of checking anything in the digital world. PoW is about physics, not programs. Bitcoins are created from energy, the main product of the universe. PoW turns electricity into digital gold.

Bitcoin transaction history can be unchanged only if it is expensive to create. The need to use a large number of resources for PoW is not an error, so conceived. Until recently, the defense of something meant the construction of a thick physical wall around what was considered valuable. The new world of cryptocurrency is strange and unusual - there are no physical walls that protect our money, there are no doors that close the entrance to the vault. The Bitcoin public transaction history is protected by a total computing power: the sum of all the energy spent on “building the wall”. Due to the cost, a comparable amount of energy is required to break it (unjustified high cost).

Cryptopocalypse is approaching - Bitcoin PoW is so terrible that it will destroy the world by 2020! You may have noticed that most of the articles about the “end of the world” use the results of an investigation by Alex de Rice, “a financier and a blockchain specialist,” who works for PwC in the Netherlands. And also keeps the blog Digiconomist. His conclusions were rightly criticized for the lack of accuracy of energy consumption calculations. The metric “energy consumption per transaction” used by it is intentionally misleading for several reasons:

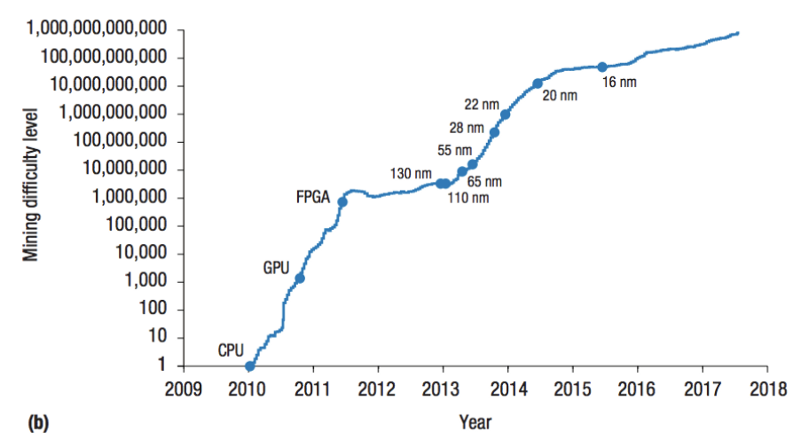

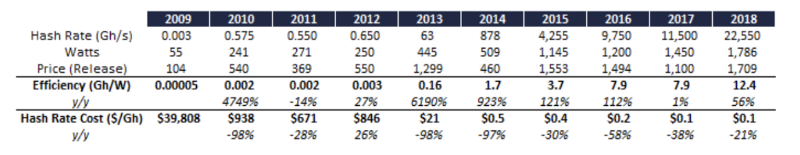

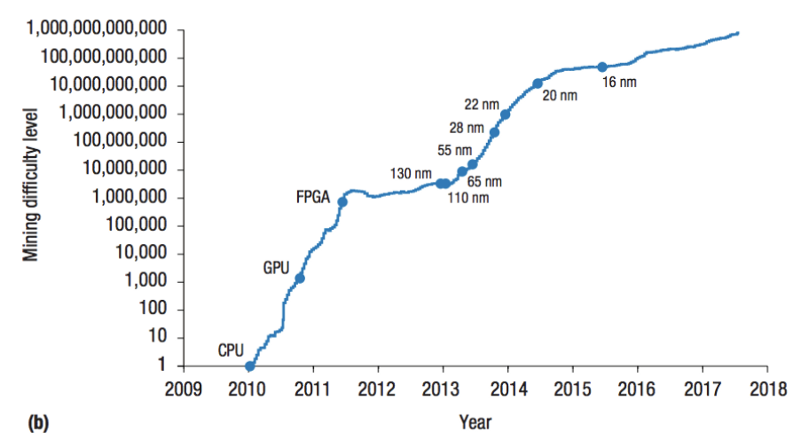

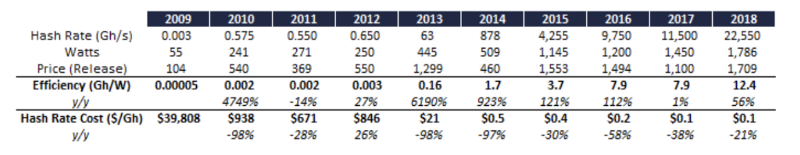

Now that we know that the correct efficiency metric is determined by the recoupment of energy costs, let's look at the change in the price of energy spent on PoW.

The increase in the efficiency of ASIC machines is reduced. Because decreases profits, we can expect an increase in competition among manufacturers of ASIC machines.

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

The total costs of mining will mainly consist of the cost of energy (operating costs), and not the cost of ASIC machines (capital costs). The physical location of mining centers is not important for the Bitcoin network, so miners tend to places with an excess of electricity, and, accordingly, its lower cost. In the long run, this may affect the efficiency of the electricity market. Bitcoin miners will act as arbitrage of electricity between global centers. For mining bitcoins will be used an excess of electricity. It can also help to solve the problem of renewable energy sources with excess capacity, which is not spent in any way, for example, hydroelectric power plants or burning of secondary gas during oil production. In the future, bitcoin mining may also use variable power sources of renewable energy. Electricity producers can connect mining machines, and save excess power in bitcoins.

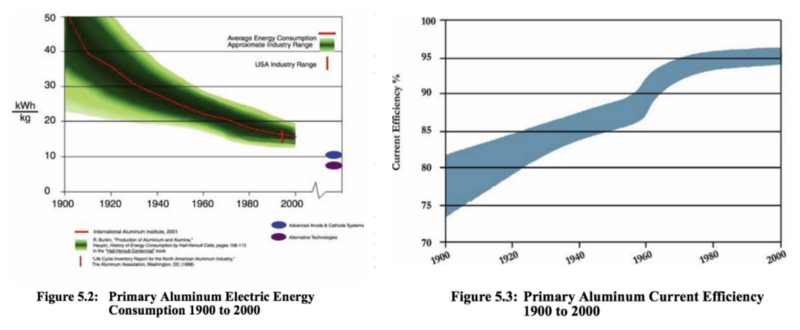

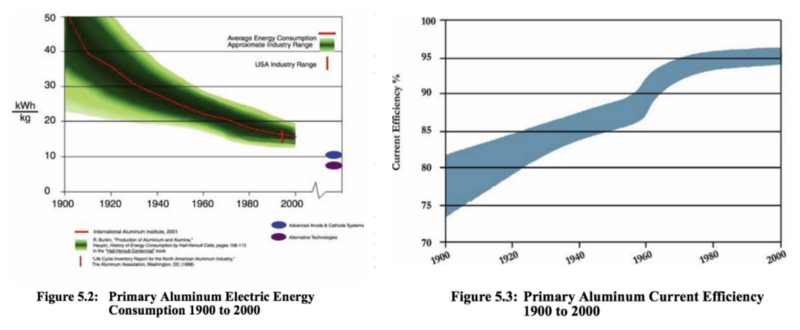

Aluminum has been widely used as a means of exporting electricity from countries in which there are many renewable sources of electricity, but there is no opportunity to realize them (for example, Iceland). The melting of bauxite (also aluminum ore) into aluminum requires a tremendous amount of energy, and this is a one-way process (as well as hashing). The same arguments about the inefficient use of energy were cited for aluminum 40 years ago - in 1979 (including the danger of centralization). Aluminum smelters are constantly looking for cheap sources of energy on the planet. With the development of aluminum production for decades, the specific energy consumption (kW per kilogram of aluminum produced) decreased.

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

Note: Bitcoin itself is extremely useful for society (otherwise mining would be unprofitable), so it’s irrational to ask miners to do side work without a special incentive.

Energy is used everywhere (the first law of thermodynamics). The opinion that the use of energy for some work is more wasteful than for another is completely subjective, since all users pay the market price for electricity.

In thermodynamics, the universe is a closed system. The use of excess electricity for mining bitcoins is an order of magnitude smaller than that used for existing fiat systems, which are based not only on the banking system that consumes electricity, but also on the existence of armed forces and a political system. Using this electricity to protect the backbone of the financial system is beneficial. The table below shows a comparison with the existing financial, military and political systems.

In the process of finding cheap sources of energy, we can use even more global opportunities. Thanks to the development of these energy sources, Bitcoin not only brings us closer to the Kardashev type I economy, but also to the Kardashev type I civilization (for the time being we are at about 0.72 on the Kardashev scale). It may take significantly less time to reach T1, thanks to the mining incentive of bitcoins. Several decades instead of 200 tons. After attaining type I, there will be less need to limit energy consumption, and this will improve living conditions for all.

The incentive to find cheap electricity will accelerate the creation of fusion reactors. Nature suggests how, providing thermonuclear energy to the whole universe (stars). Humanity is in the process of creating such a mechanism through the construction of thermonuclear reactors. It is estimated that it will take approximately $ 80 billion in research and development over several decades to learn how to use fusion energy. Fuels for thermonuclear reactors (mainly deuterium) abound on Earth in the oceans. It will be enough to provide humanity with energy for millions of years. Thermonuclear energy has the most advantages of renewable energy sources, such as obtaining energy for a long time, lack of greenhouse gas emissions or air pollution. The density of thermonuclear energy is very high, and production is continuous. Another aspect of thermonuclear energy is that its cost does not increase in proportion to volumes. For example, the cost of water and wind energy increases as the optimal locations for power plants are already used. The cost of thermonuclear energy will not increase significantly, even if many stations are built, because the initial raw materials (sea water) abound in different places of the planet.

Thermonuclear energy and other cheap sources of energy will solve many problems, for example, the availability of fresh drinking water. We are surrounded by sea water, but desalination stations consume large amounts of energy. The cost of desalination of sea water at the moment is higher than the cost of water from wells, water purification and storage.

The human desire to explore the highest mountain peaks, the deepest seas and oceans, the heart of the atom and the essence of spacetime, should not be limited to energy. We will reach for the stars.

Is it worth the annual volume of $ 1.34 trillion. mutual settlements, not based on trust, plus cheap energy for all, $ 4.5 billion spent on mining at the moment? I think the answer is sure yes.

Introduction

Most people think that the energy spent on Proof-Of-Work (hereinafter PoW) is wasted. In this article I will explain why everything is based on energy, including money. And also why the assessment of energy consumption is subjective, and how to compare the cost of energy spent on PoW with other systems. This article contains the thoughts of many people from the field of cryptocurrency, I just put it all together.

The work consists of energy

The idea that energy is needed to do the work arose from the French mathematician Gaspard-Gustav de Coriolis. In those days, work was completely carried out by people. The fuel for the work was food.

About a million years ago, man made fire. As a result, the amount of energy available to humans increased, now man could warm himself with the help of fire, and not just thanks to the food eaten. Thus, this extra energy has improved the life of humanity.

')

A few thousand years ago, human energy consumption increased even more, thanks to the domestication of animals. Animals did the work for man. Animals also required a lot of food, and this also contributed to further development.

Over the past few hundred years, man made cars. Machines performed work using first the energy of water and wind, and later using cheaper energy sources such as coal and gas. Currently used nuclear and thermonuclear energy. Both machines and nature do the work through the use of energy. The economy is not based on money, but on work and energy.

Everything in our life is closely related to the cost of energy. Water purification requires energy. The transportation of goods requires energy. Production of goods requires energy. Cooking requires energy. Refrigerators and freezers require energy. In the free market, the price of any commodity largely depends on the amount of energy spent on its production. As the market stimulates minimum prices for goods, the amount of energy used to produce energy is also minimized.

Global GDP (according to the United States Department of Agriculture) as compared to World Energy Consumption (based on BP data for 2014):

At the beginning of the 20th century, industry leaders Henry Ford and Thomas Addison considered the idea of replacing gold or a dollar with an “energy dollar” or “energy unit” (energy currency). The idea was popular, because such a currency had the characteristics of money: a well-defined measure of settlement, easily measurable, but difficult to counterfeit, divisibility into smaller parts and interchangeability (any unit is equivalent to any other unit). However, there were drawbacks - it was difficult to transfer and store energy-money.

Most want what's hard to get - Mark Twain

Fast forward to October 31, 2008 - Satoshi published a work about Bitcoin. The PoW method was originally coined to combat spam. Then Satoshi adapted this technology for use in electronic money. Mining uses special machines (ASIC) to convert electricity into Bitcoins (as a reward for a mined block). Machines constantly perform hashing operations (assumptions / voices) until they find a solution to a cryptographic problem. For the solution found remuneration is paid in bitcoins. The solution found proves that the miner has spent energy in the form of an ASIC machine and electricity. Bitcoin is based on the capitalist principle of “risking money, you get a voice”, using energy and ASIC machines to calculate hashes (votes) - Hugo Nguyen.

When Satoshi designed the PoW method, he fundamentally changed the voting system from political votes to apolitical (hashes) using energy conversion. PoW serves as a test that energy has been spent. Why is it important? For the physical world, this is the simplest and fair method of checking anything in the digital world. PoW is about physics, not programs. Bitcoins are created from energy, the main product of the universe. PoW turns electricity into digital gold.

Bitcoin transaction history can be unchanged only if it is expensive to create. The need to use a large number of resources for PoW is not an error, so conceived. Until recently, the defense of something meant the construction of a thick physical wall around what was considered valuable. The new world of cryptocurrency is strange and unusual - there are no physical walls that protect our money, there are no doors that close the entrance to the vault. The Bitcoin public transaction history is protected by a total computing power: the sum of all the energy spent on “building the wall”. Due to the cost, a comparable amount of energy is required to break it (unjustified high cost).

Power consumption

Cryptopocalypse is approaching - Bitcoin PoW is so terrible that it will destroy the world by 2020! You may have noticed that most of the articles about the “end of the world” use the results of an investigation by Alex de Rice, “a financier and a blockchain specialist,” who works for PwC in the Netherlands. And also keeps the blog Digiconomist. His conclusions were rightly criticized for the lack of accuracy of energy consumption calculations. The metric “energy consumption per transaction” used by it is intentionally misleading for several reasons:

- Energy is consumed in blocks that may contain a different number of transactions. More transactions don't mean more energy.

- The economic value of bitcoin transactions is constantly increasing (with the use of batch processing, Segwit, Lightning, etc.). As Bitcoin increasingly plays the role of a network of mutual settlements, more economic value falls on a unit of energy.

- The average transaction cost is not an adequate metric when evaluating the effectiveness of Bitcoin PoW. The metric should consider keeping transaction history. Energy is spent on preserving the stock of bitcoins, the relative number of which decreases with inflation. Bitcoin sums up the energy spent on the extraction of all blocks since the launch of the network. Researcher LaurentMT empirically determined that Bitcoin PoW actually becomes more effective over time. Increasing cost is compensated by the increasing value of coins stored in the system.

Now that we know that the correct efficiency metric is determined by the recoupment of energy costs, let's look at the change in the price of energy spent on PoW.

The increase in the efficiency of ASIC machines is reduced. Because decreases profits, we can expect an increase in competition among manufacturers of ASIC machines.

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

The total costs of mining will mainly consist of the cost of energy (operating costs), and not the cost of ASIC machines (capital costs). The physical location of mining centers is not important for the Bitcoin network, so miners tend to places with an excess of electricity, and, accordingly, its lower cost. In the long run, this may affect the efficiency of the electricity market. Bitcoin miners will act as arbitrage of electricity between global centers. For mining bitcoins will be used an excess of electricity. It can also help to solve the problem of renewable energy sources with excess capacity, which is not spent in any way, for example, hydroelectric power plants or burning of secondary gas during oil production. In the future, bitcoin mining may also use variable power sources of renewable energy. Electricity producers can connect mining machines, and save excess power in bitcoins.

Aluminum has been widely used as a means of exporting electricity from countries in which there are many renewable sources of electricity, but there is no opportunity to realize them (for example, Iceland). The melting of bauxite (also aluminum ore) into aluminum requires a tremendous amount of energy, and this is a one-way process (as well as hashing). The same arguments about the inefficient use of energy were cited for aluminum 40 years ago - in 1979 (including the danger of centralization). Aluminum smelters are constantly looking for cheap sources of energy on the planet. With the development of aluminum production for decades, the specific energy consumption (kW per kilogram of aluminum produced) decreased.

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

The global energy network releases unused assets and creates new ones. Imagine a three-dimensional topographic map of the world where low-energy sources are lowlands, and more expensive ones are hills. I imagine Bitcoin mining looks like a glass of water poured on this surface, filling any cavities and leveling the surface - Nick CarterBitcoin miners are reliable buyers of electricity. They stimulate the construction of new power plants for the use of additional energy sources that would otherwise not be used.

When will the increase in the amount of energy used for PoW stop? Exactly when there is enough electricity producers to include equipment for PoW, and the profit from the operation of this equipment will be equal to the profit from the sale of electricity to consumers. Thus, the "additional profit" from the work of mining equipment will be reduced to zero. I call this balance the Nakamoto point. I assume that PoW will spend from 1 to 10% of global energy when equilibrium is reached. - Druv BanzalThere is an idea that mining Bitcoins does not do useful work, in contrast to the search for prime numbers , for example. The idea of using PoW to perform some other tasks may seem good, but in fact it negatively affects the network security. The separation of the reward may lead to a situation where it is more profitable to perform secondary work than the main one. Even if the background work is harmless (heater, for example), instead of income $ 100 for X hashes, it turns out to be $ 100 + $ 5 (as heat) for X hashes. A heater with a mining function is just an example of an increase in equipment efficiency, leading to an increase in complexity and, consequently, energy consumption for the extraction of a block. Such a problem will never be in Bitcoin, because PoW is used only to protect the network.

Note: Bitcoin itself is extremely useful for society (otherwise mining would be unprofitable), so it’s irrational to ask miners to do side work without a special incentive.

Cost comparison

Energy is used everywhere (the first law of thermodynamics). The opinion that the use of energy for some work is more wasteful than for another is completely subjective, since all users pay the market price for electricity.

If people decide that it is profitable, electricity will be spent. Those who spend electricity will be rewarded by bitcoins. - Saifedin Ammos

In thermodynamics, the universe is a closed system. The use of excess electricity for mining bitcoins is an order of magnitude smaller than that used for existing fiat systems, which are based not only on the banking system that consumes electricity, but also on the existence of armed forces and a political system. Using this electricity to protect the backbone of the financial system is beneficial. The table below shows a comparison with the existing financial, military and political systems.

Type I civilization

In the process of finding cheap sources of energy, we can use even more global opportunities. Thanks to the development of these energy sources, Bitcoin not only brings us closer to the Kardashev type I economy, but also to the Kardashev type I civilization (for the time being we are at about 0.72 on the Kardashev scale). It may take significantly less time to reach T1, thanks to the mining incentive of bitcoins. Several decades instead of 200 tons. After attaining type I, there will be less need to limit energy consumption, and this will improve living conditions for all.

The incentive to find cheap electricity will accelerate the creation of fusion reactors. Nature suggests how, providing thermonuclear energy to the whole universe (stars). Humanity is in the process of creating such a mechanism through the construction of thermonuclear reactors. It is estimated that it will take approximately $ 80 billion in research and development over several decades to learn how to use fusion energy. Fuels for thermonuclear reactors (mainly deuterium) abound on Earth in the oceans. It will be enough to provide humanity with energy for millions of years. Thermonuclear energy has the most advantages of renewable energy sources, such as obtaining energy for a long time, lack of greenhouse gas emissions or air pollution. The density of thermonuclear energy is very high, and production is continuous. Another aspect of thermonuclear energy is that its cost does not increase in proportion to volumes. For example, the cost of water and wind energy increases as the optimal locations for power plants are already used. The cost of thermonuclear energy will not increase significantly, even if many stations are built, because the initial raw materials (sea water) abound in different places of the planet.

Water, water everywhere. But not a drop to drink. - Samuel Taylor Coleridge

Thermonuclear energy and other cheap sources of energy will solve many problems, for example, the availability of fresh drinking water. We are surrounded by sea water, but desalination stations consume large amounts of energy. The cost of desalination of sea water at the moment is higher than the cost of water from wells, water purification and storage.

The human desire to explore the highest mountain peaks, the deepest seas and oceans, the heart of the atom and the essence of spacetime, should not be limited to energy. We will reach for the stars.

Is it worth the annual volume of $ 1.34 trillion. mutual settlements, not based on trust, plus cheap energy for all, $ 4.5 billion spent on mining at the moment? I think the answer is sure yes.

Source: https://habr.com/ru/post/446776/

All Articles