How easy it is to legally organize your startup in the form of a simple partnership

Having more than twelve years of legal practice, including in different jurisdictions, including in the IT field, I want to share tips, supported by real experience.

So, this is an article for enterprising people who want to make possible their first independent commercial project together with partners.

Correctly fix the rights, duties, responsibilities, and even then, if you suddenly have the opportunity to legally present it - this is very important for the future project.

')

Creating a legal entity, say, a limited liability company is one of the most trodden paths and certainly has its advantages.

However, what if it doesn't fit? Say, you do not want to incur considerable primary costs for registration, legal and accounting support of our company? And what if the project fails, you will fold the work on it, and the elimination of legal entity is a much more dreary problem than the creation, and therefore you must either continue to maintain it, or roll out a round sum for liquidation.

I bring to your attention a guide on such a form of business as a “simple partnership”, and my experience of applying for an IT business project.

For the organization of internal relations of investment from the project partners, it is proposed to use the form of a simple partnership ( general partnership is not a literal translation, but a conceptual analogue in the common English law system), which is created on the basis of a joint activity agreement ( partnership agreement is similar) registration of a legal entity.

Recommended background information for beginners:

Benefits of simply partnership:

Creating a legal entity as compared with a simple partnership has drawbacks because, regardless of whether a business project will take place, you have to incur considerable costs right from the start, and moreover, regularly.

Disadvantages of registration of a legal entity:

Registration of a legal entity in a decent jurisdiction with paid costs for the first year of operation can cost on average about $ 1,000 - 5.000.

Therefore, when choosing a form of management, it is necessary to relate the costs of registering an enterprise with the costs of the project itself. Say, with a project cost of $ 15,000, registration at $ 5,000 can be considered a round sum, ¼ of costs!

Also in the case of non-success of the project, the legal entity remains and it is necessary to bear regular expenses on it. At the same time, the liquidation of a legal entity may cost even more than registration and usually much longer.

It should be mentioned that an additional advantage of simple society is that if the project succeeds, when its prospects become clear, it can always be turned into a legal entity by making registration in the usual way.

Different countries have their own peculiarities of the legal status of a simple partnership.

So, for example, under Russian law, only individual entrepreneurs and commercial organizations (Article 1041 of the Civil Code of the Russian Federation) can be comrades; in Ukrainian, natural persons can also be. In some countries of Europe, PT is not recognized as a legal entity, while in others it acts as an independent entity, but without state registration.

In my project, I chose English common law ( Partnership Act 1890 ). To get started, you need to make a contract - partnership agreement.

Although a simple partnership is not a legal entity and is not subject to registration, it may nevertheless be necessary to register with the tax authority of England only if the partnership includes a British resident.

I requested a legal opinion from two solicitors (lawyers in England). Further, I provide the text in the original with the indication of authorship and translation.

1. Simon Fagan LLB (Hons) Solicitor Advocate <Simon.Fagan {sobachka} aticuslaw.co.uk>

“If the Partnership (or any legal entity) trades in the UK, then it must be registered with HMRC for tax purposes as soon as it reaches the minimum threshold for VAT — which I am currently 50,000 pounds Sterling. If the partnership opens a bank account in the UK or intends to make payments in the UK from this bank account, it will need a tax reference. If a partnership agreement should be governed only by UK law, and not by trade within the UK, then there is no need to register HMRC. ”

2. Christian. The Law Firm. <info {sobachka} christianlawfirm.co.uk>

“[...] You do not need to register such a partnership with the UK tax authority.”

Great Britain right, I think, is the most convenient solution for a startup without creating a legal entity, considering if your partners are scattered around the world.

It is also possible to consider other jurisdictions, but I would adhere to this principle: English-speaking countries (it is easier to solve problems later, because other jurisdiction is another language), and common law, for example, Hong Kong.

However, other solutions can also take place.

It is necessary to determine the composition of participants, contributions and shares.

We conclude an agreement on joint activities (Partnership agreement on the common law of England). Can be bilingual.

In the contract we indicate the contributions, shares, and the procedure for making a profit. We describe the project, goals and objectives. As an annex to the contract is a business plan, presentation and TK.

Here it is also necessary to decide in principle whether the partners can act on behalf of the partnership or they will choose one (two, three ... representatives). By analogy with the director. A representative may even be a legal entity. If you do not specify anything in the contract, then by default, all partners can act on behalf of the partnership independently of each other, and everyone, acting on behalf of the partnership, can acquire rights and obligations for the partnership. You can also define some specific rules, for example, a transaction for some amount requires a collective decision, etc.

As mentioned above, a simple partnership can act as a business unit. But in the world this form is not understood by many people and there may be difficulties in external transactions.

Therefore, I propose to choose a legal entity for external representation. At first, it may even be some familiar legal entity, appointing him as the attorney of the partnership with the right to enter into transactions with third parties in the interests of the partnership.

This type of relationship is executed by the contract of agreement between the partnership (the principal ) and the company ( attorney ).

In my case, my partners and I decided the following. According to the contract, I was appointed managing partner, and was authorized to conduct business relations with market participants.

Transactions from 30.000 USD require the consent of the partners by general remote voting by a simple majority. For communication, we created a chat in the Telegram and agreed that all the issues specified in it acquire legally binding force for us.

For transactions requiring our side to be a legal entity, one of the partners will act (there are individuals and legal entities as part of the partners).

But for external relations, we have drawn up a contract of assignment with the legal entity and a power of attorney in case you need to confirm the authority. An attorney acting in the interests of a simple partnership [principal], all that he acquires is the property of the partnership [principal], including money, intellectual rights, property. Thus, we solved the issue with the bank, because the legal entity has an account and can pay or accept money.

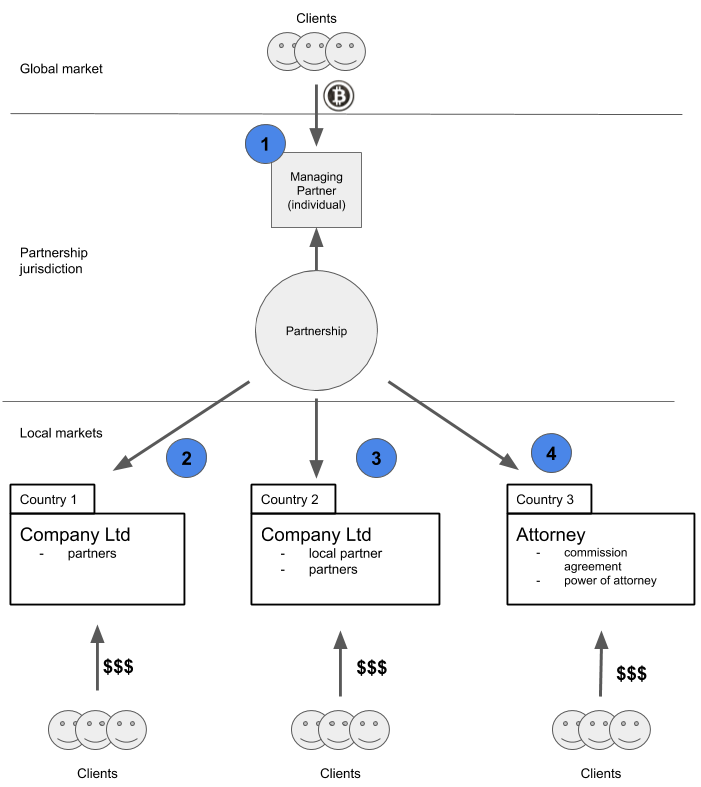

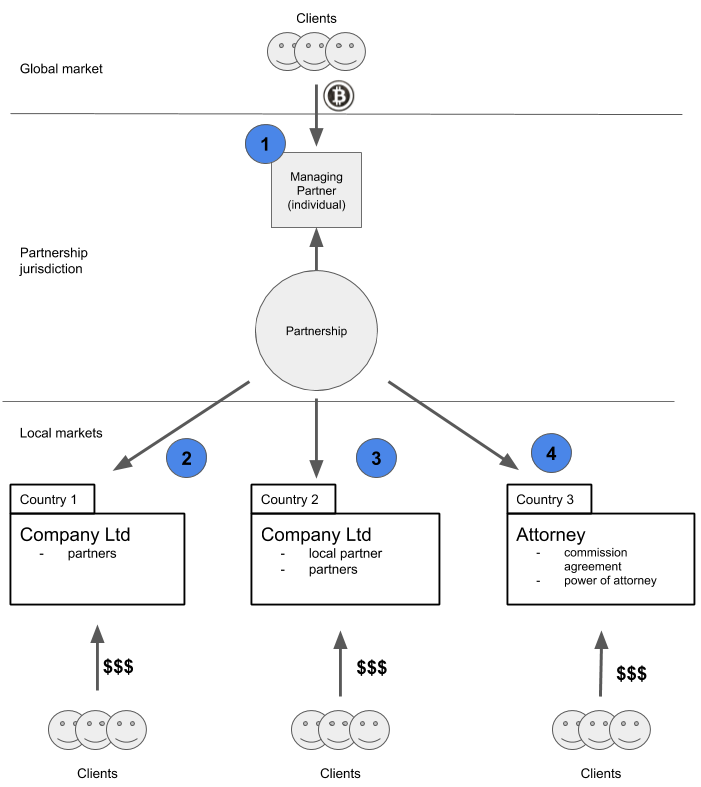

However, this is not the only work model. The diagram below presents other options for organizing relationships.

In reality, all relationships have to be built from the movement of money and property rights.

Scheme 1

The managing partner is an individual. He will be able to manage the project, but an individual can hardly legally succeed in opening an account for entrepreneurial activity anywhere. Therefore, in terms of revenue management, such a partner will be able to work only with cryptocurrency. As the only scheme, it is suitable in the event that revenues are only in cryptocurrency. Otherwise, it must be combined with other schemes. The managing partner distributes the cryptocurrency profit among other partners, and they, in turn, being law-abiding citizens of their states, declare and pay taxes.

Scheme 2

A legal entity (for example, an LLC) is created in some jurisdiction and becomes an attorney of a simple partnership. In principle, the scheme with a simple partnership is no longer needed if the same partners are included in the composition on the same conditions. However, it can be an additional element, if there are cryptocurrency in the calculations, and you do not want to shine it and carry it along this legal entity. Moreover, most likely in many jurisdictions you will encounter real problems when working with crypts and tokens, many banks simply refuse to service. Therefore, it is very likely that the combination with Scheme 1 is just what you need.

Scheme 3

A legal entity is created, which includes partners from a simple partnership and a local partner. Call it a regional representation scheme. This legal entity also works under a contract of assignment from a simple partnership. Especially it makes sense if your business requires local presence. Then the local partner is entrusted with the task of leading the company and developing the business locally. The issue of finance is also being resolved - the company will quietly open an account in a bank, and will distribute the proceeds between partners.

Scheme 4

A legal entity or an individual entrepreneur under an order agreement from a simple partnership. The scheme is also good, as a legal entity and an entrepreneur can open a bank account and accept payments from customers. The attorney will transfer the received profit to the partners of the simple partnership (after all, all the proceeds belong under the contract to the principal!), And leave a commission for the work done.

This part is optional, since there are a lot of ways to conclude.

In our case, all partners were in different countries and it was difficult to meet.

We decided to use modern technology. In particular, we have drawn up an agreement in electronic form. The blockchain address of each of us was included in the contract and indicated that we consider this contract concluded when each partner publishes a hash of the contract file from the specified addresses in the blockchain. Emercoin was chosen as the blockchain, and the signing scheme was “carousel”. What does it mean. The first signatory creates an NVS record with the contract hash, and then sends this record to the address of the next signatory (essentially, as a token), and so each partner is in a circle, and when the record returns to the first one, the circle closes - the contract is signed. Partners (and all who fell into the hands of this file) can verify the addresses participating in the carousel, and if they coincide with those announced, the contract is considered to be signed by the appropriate parties. And by the way, we send cryptographic certificates to the same addresses too. Operational and strategic issues are resolved in a separate telegram chat, all decisions agreed upon there are recognized as legally binding partners.

In the end, I think, it will be important to note that in each country there can be different peculiarities with taxes and allowance. So, for citizens and residents of the Russian Federation there is a requirement to notify the tax authority of their participation in such organizations, including abroad. But a simple notification is still better than the full registration and maintenance of a legal entity, for just starting a project. And yes, you need to pay taxes. What can you do?

The organization of a simple partnership has its pros and cons. Perhaps some will think that it is all sewn with white thread and this form will not protect you legally. My many years of experience have shown that the most ferro-concrete legal schemes can not help at all. Everything can turn out for partners with protracted and exhausting litigation, and often the winner still does not get anything, because there is nothing to recover from the debtor (he sold everything for a long time, copied it to grandmother and disappeared altogether). Common sense suggests that the matter is not in the best legal scheme, but in the integrity of the partners. In the dashing 90s (and even now quite often), no one signed any written contracts at all. They shook hands and let's work. And if you decide to throw, then they can shoot through the head. Fortunately, for many, these times are over and one thing remains. Reputation.

Now, when information about a person spreads with the power of thought, it can very quickly turn out that everyone will simply refuse to have any further business with a scam. And here is exactly what the contract is for. Not for the court (albeit for him), but for public censure. When a serious business and serious partners are at stake, credibility is capital that is earned long and hard, and you can lose in a second.

For those who naively believe that “the file is not a contract”, “e-mails will not be rented in court,” I dare dispel doubts. Initially, competently organized legal work in accordance with the jurisdiction where it is conducted, in most cases will help fix a scoundrel to the wall in court, and especially when the matter is very bad and the proceedings are no longer on an economic plane, but in a criminal one. But let it not come to this.

I wish you success in your endeavors!

So, this is an article for enterprising people who want to make possible their first independent commercial project together with partners.

Correctly fix the rights, duties, responsibilities, and even then, if you suddenly have the opportunity to legally present it - this is very important for the future project.

')

Creating a legal entity, say, a limited liability company is one of the most trodden paths and certainly has its advantages.

However, what if it doesn't fit? Say, you do not want to incur considerable primary costs for registration, legal and accounting support of our company? And what if the project fails, you will fold the work on it, and the elimination of legal entity is a much more dreary problem than the creation, and therefore you must either continue to maintain it, or roll out a round sum for liquidation.

I bring to your attention a guide on such a form of business as a “simple partnership”, and my experience of applying for an IT business project.

Investment scheme

For the organization of internal relations of investment from the project partners, it is proposed to use the form of a simple partnership ( general partnership is not a literal translation, but a conceptual analogue in the common English law system), which is created on the basis of a joint activity agreement ( partnership agreement is similar) registration of a legal entity.

Recommended background information for beginners:

- General Partnership video in English law (Eng.)

- wiki article

- Chapter 55 “Simple partnership” Civil Code of the Russian Federation

- General Partnership in English common law and civil law of different countries (English)

Benefits of simply partnership:

- no need to register a legal entity

- it is enough to conclude an agreement on joint activities, determining the contributions, the procedure for the distribution of profits, intellectual rights and other conditions

- simple society can act as a business education and make deals

- On behalf of the company, all partners or a selected partner or even a third party may speak on behalf of (an equivalent of a hired director)

- no administrative costs (legal address, accountant, etc.)

- There are no taxes, because each partner has personal obligations regarding income taxes, which they receive from the partnership in the jurisdiction where

- convenient for partners who are in different countries

Creating a legal entity as compared with a simple partnership has drawbacks because, regardless of whether a business project will take place, you have to incur considerable costs right from the start, and moreover, regularly.

Disadvantages of registration of a legal entity:

- costs for registration of a legal entity (official payments)

- costs of legal registration service

- pay share capital

- in some jurisdictions a non-resident founder must have an agent (representative)

- purchase of legal address (regular costs)

- hire a director (regular expenses)

- hire an accountant (regular expenses)

- time spent starting a business (1 month at best)

Registration of a legal entity in a decent jurisdiction with paid costs for the first year of operation can cost on average about $ 1,000 - 5.000.

Therefore, when choosing a form of management, it is necessary to relate the costs of registering an enterprise with the costs of the project itself. Say, with a project cost of $ 15,000, registration at $ 5,000 can be considered a round sum, ¼ of costs!

Also in the case of non-success of the project, the legal entity remains and it is necessary to bear regular expenses on it. At the same time, the liquidation of a legal entity may cost even more than registration and usually much longer.

It should be mentioned that an additional advantage of simple society is that if the project succeeds, when its prospects become clear, it can always be turned into a legal entity by making registration in the usual way.

Choice of jurisdiction

Different countries have their own peculiarities of the legal status of a simple partnership.

So, for example, under Russian law, only individual entrepreneurs and commercial organizations (Article 1041 of the Civil Code of the Russian Federation) can be comrades; in Ukrainian, natural persons can also be. In some countries of Europe, PT is not recognized as a legal entity, while in others it acts as an independent entity, but without state registration.

In my project, I chose English common law ( Partnership Act 1890 ). To get started, you need to make a contract - partnership agreement.

Although a simple partnership is not a legal entity and is not subject to registration, it may nevertheless be necessary to register with the tax authority of England only if the partnership includes a British resident.

I requested a legal opinion from two solicitors (lawyers in England). Further, I provide the text in the original with the indication of authorship and translation.

Legal opinions

1. Simon Fagan LLB (Hons) Solicitor Advocate <Simon.Fagan {sobachka} aticuslaw.co.uk>

If you don’t have a tax agreement, it’s worth it. If you are in the UK, then you will need a tax reference. It is a trademark of the United Kingdom.Transfer:

“If the Partnership (or any legal entity) trades in the UK, then it must be registered with HMRC for tax purposes as soon as it reaches the minimum threshold for VAT — which I am currently 50,000 pounds Sterling. If the partnership opens a bank account in the UK or intends to make payments in the UK from this bank account, it will need a tax reference. If a partnership agreement should be governed only by UK law, and not by trade within the UK, then there is no need to register HMRC. ”

2. Christian. The Law Firm. <info {sobachka} christianlawfirm.co.uk>

[...] HM Revenue & Customs in the UK.Transfer:

“[...] You do not need to register such a partnership with the UK tax authority.”

Great Britain right, I think, is the most convenient solution for a startup without creating a legal entity, considering if your partners are scattered around the world.

It is also possible to consider other jurisdictions, but I would adhere to this principle: English-speaking countries (it is easier to solve problems later, because other jurisdiction is another language), and common law, for example, Hong Kong.

However, other solutions can also take place.

Relationship Chart

It is necessary to determine the composition of participants, contributions and shares.

We conclude an agreement on joint activities (Partnership agreement on the common law of England). Can be bilingual.

In the contract we indicate the contributions, shares, and the procedure for making a profit. We describe the project, goals and objectives. As an annex to the contract is a business plan, presentation and TK.

Here it is also necessary to decide in principle whether the partners can act on behalf of the partnership or they will choose one (two, three ... representatives). By analogy with the director. A representative may even be a legal entity. If you do not specify anything in the contract, then by default, all partners can act on behalf of the partnership independently of each other, and everyone, acting on behalf of the partnership, can acquire rights and obligations for the partnership. You can also define some specific rules, for example, a transaction for some amount requires a collective decision, etc.

As mentioned above, a simple partnership can act as a business unit. But in the world this form is not understood by many people and there may be difficulties in external transactions.

Therefore, I propose to choose a legal entity for external representation. At first, it may even be some familiar legal entity, appointing him as the attorney of the partnership with the right to enter into transactions with third parties in the interests of the partnership.

This type of relationship is executed by the contract of agreement between the partnership (the principal ) and the company ( attorney ).

In my case, my partners and I decided the following. According to the contract, I was appointed managing partner, and was authorized to conduct business relations with market participants.

Transactions from 30.000 USD require the consent of the partners by general remote voting by a simple majority. For communication, we created a chat in the Telegram and agreed that all the issues specified in it acquire legally binding force for us.

For transactions requiring our side to be a legal entity, one of the partners will act (there are individuals and legal entities as part of the partners).

But for external relations, we have drawn up a contract of assignment with the legal entity and a power of attorney in case you need to confirm the authority. An attorney acting in the interests of a simple partnership [principal], all that he acquires is the property of the partnership [principal], including money, intellectual rights, property. Thus, we solved the issue with the bank, because the legal entity has an account and can pay or accept money.

However, this is not the only work model. The diagram below presents other options for organizing relationships.

In reality, all relationships have to be built from the movement of money and property rights.

Scheme 1

The managing partner is an individual. He will be able to manage the project, but an individual can hardly legally succeed in opening an account for entrepreneurial activity anywhere. Therefore, in terms of revenue management, such a partner will be able to work only with cryptocurrency. As the only scheme, it is suitable in the event that revenues are only in cryptocurrency. Otherwise, it must be combined with other schemes. The managing partner distributes the cryptocurrency profit among other partners, and they, in turn, being law-abiding citizens of their states, declare and pay taxes.

Scheme 2

A legal entity (for example, an LLC) is created in some jurisdiction and becomes an attorney of a simple partnership. In principle, the scheme with a simple partnership is no longer needed if the same partners are included in the composition on the same conditions. However, it can be an additional element, if there are cryptocurrency in the calculations, and you do not want to shine it and carry it along this legal entity. Moreover, most likely in many jurisdictions you will encounter real problems when working with crypts and tokens, many banks simply refuse to service. Therefore, it is very likely that the combination with Scheme 1 is just what you need.

Scheme 3

A legal entity is created, which includes partners from a simple partnership and a local partner. Call it a regional representation scheme. This legal entity also works under a contract of assignment from a simple partnership. Especially it makes sense if your business requires local presence. Then the local partner is entrusted with the task of leading the company and developing the business locally. The issue of finance is also being resolved - the company will quietly open an account in a bank, and will distribute the proceeds between partners.

Scheme 4

A legal entity or an individual entrepreneur under an order agreement from a simple partnership. The scheme is also good, as a legal entity and an entrepreneur can open a bank account and accept payments from customers. The attorney will transfer the received profit to the partners of the simple partnership (after all, all the proceeds belong under the contract to the principal!), And leave a commission for the work done.

How we made a contract

This part is optional, since there are a lot of ways to conclude.

In our case, all partners were in different countries and it was difficult to meet.

We decided to use modern technology. In particular, we have drawn up an agreement in electronic form. The blockchain address of each of us was included in the contract and indicated that we consider this contract concluded when each partner publishes a hash of the contract file from the specified addresses in the blockchain. Emercoin was chosen as the blockchain, and the signing scheme was “carousel”. What does it mean. The first signatory creates an NVS record with the contract hash, and then sends this record to the address of the next signatory (essentially, as a token), and so each partner is in a circle, and when the record returns to the first one, the circle closes - the contract is signed. Partners (and all who fell into the hands of this file) can verify the addresses participating in the carousel, and if they coincide with those announced, the contract is considered to be signed by the appropriate parties. And by the way, we send cryptographic certificates to the same addresses too. Operational and strategic issues are resolved in a separate telegram chat, all decisions agreed upon there are recognized as legally binding partners.

In the end, I think, it will be important to note that in each country there can be different peculiarities with taxes and allowance. So, for citizens and residents of the Russian Federation there is a requirement to notify the tax authority of their participation in such organizations, including abroad. But a simple notification is still better than the full registration and maintenance of a legal entity, for just starting a project. And yes, you need to pay taxes. What can you do?

Summary

- the relationship of partners and operating director (managing partner) is determined by a cooperation agreement (simple partnership) with the choice of jurisdiction

- English law is appropriate as a jurisdiction especially when partners are located in different countries

- the director can also be hired, then you need to decide who signs the contract with the manager, all partners or who they will assign to this task

- the managing partner and / or the hired director are given the right to make decisions on managing the project within a certain amount, the remaining decisions are collegially partners; also collegial solutions: on the entry / exit of partners, increasing and decreasing the amount of investment, share and goals and objectives of the project

- relations with attorneys are determined by the contract with the partnership [principal]. The attorney is a legal entity or an entity authorized to manage finances.

- A simple partnership scheme is necessary if you need to work with cryptocurrency, and banks refuse to service

- decisions are made online in the chat, and all the partners in the contract initially recognized their validity

- at any time, for example, when it becomes clear that the project has taken place and the matter has gone, it can always be turned into a legal entity by making registration in the usual way

PS

The organization of a simple partnership has its pros and cons. Perhaps some will think that it is all sewn with white thread and this form will not protect you legally. My many years of experience have shown that the most ferro-concrete legal schemes can not help at all. Everything can turn out for partners with protracted and exhausting litigation, and often the winner still does not get anything, because there is nothing to recover from the debtor (he sold everything for a long time, copied it to grandmother and disappeared altogether). Common sense suggests that the matter is not in the best legal scheme, but in the integrity of the partners. In the dashing 90s (and even now quite often), no one signed any written contracts at all. They shook hands and let's work. And if you decide to throw, then they can shoot through the head. Fortunately, for many, these times are over and one thing remains. Reputation.

Now, when information about a person spreads with the power of thought, it can very quickly turn out that everyone will simply refuse to have any further business with a scam. And here is exactly what the contract is for. Not for the court (albeit for him), but for public censure. When a serious business and serious partners are at stake, credibility is capital that is earned long and hard, and you can lose in a second.

For those who naively believe that “the file is not a contract”, “e-mails will not be rented in court,” I dare dispel doubts. Initially, competently organized legal work in accordance with the jurisdiction where it is conducted, in most cases will help fix a scoundrel to the wall in court, and especially when the matter is very bad and the proceedings are no longer on an economic plane, but in a criminal one. But let it not come to this.

I wish you success in your endeavors!

Source: https://habr.com/ru/post/446138/

All Articles