95% of the stated Bitcoin trading volume were fake

As part of the 226 slides submitted by the Securities and Exchange Commission, we ( @BitwiseInvest ) conducted the first-of-its-kind analysis of data from all of the 81 exchanges that report BTC> $ 1M on CoinMarketCap

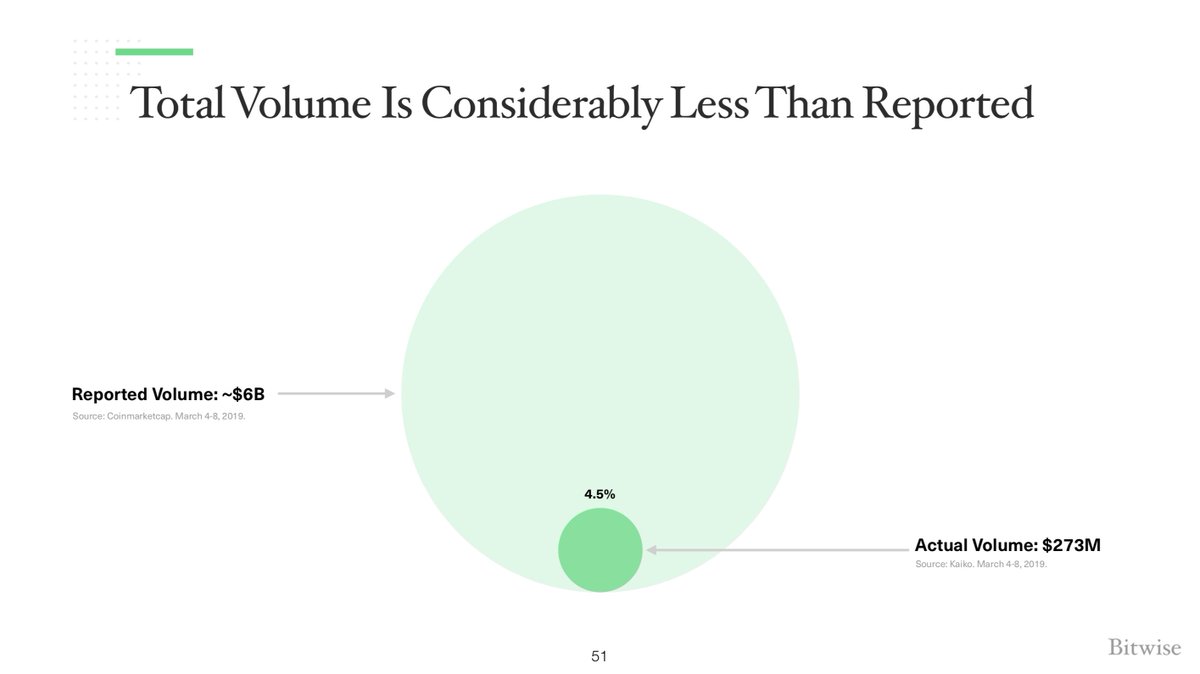

TLDR: 95% of the indicated volume is fake, but there is also good news!

')

Carefully, under the cut will be a pack of images from the presentation

Key points

- 95% of reported BTC volume is fake

- Likely motive - listing fees (maybe $ 1-3M)

- Real daily volume ~ $ 270M

- 10 of 81 exchanges provide real data

- Most of them (out of 10) are regulated

And three links

- 1. Full presentation on 226 slides: t.co/DNw36VboPl

- 2. Review @paulvigna in the Wall Street Journal: t.co/NI4XP3hYKK

- 3. Real Daily BTC Trading Volume: www.bitcointradevolume.com

The total daily volume of transactions is about $ 270M - 95% less than reported.

Only 10 exchanges have> $ 1M of real daily turnover of BTC trading:

@binance , @bitfinex , @krakenfx , @Bitstamp , @coinbase , @bitFlyerUSA , @Gemini , @itBit , @BittrexExchange and @Poloniex

The daily BTC trading volume on these exchanges is located at the following link .

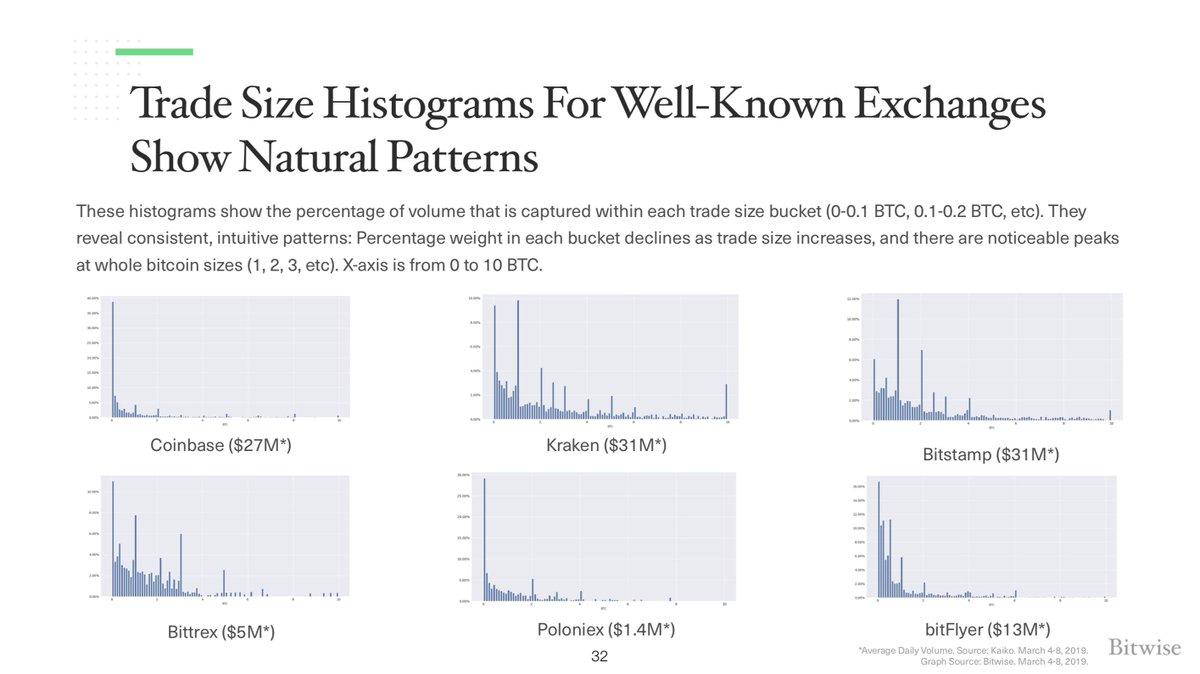

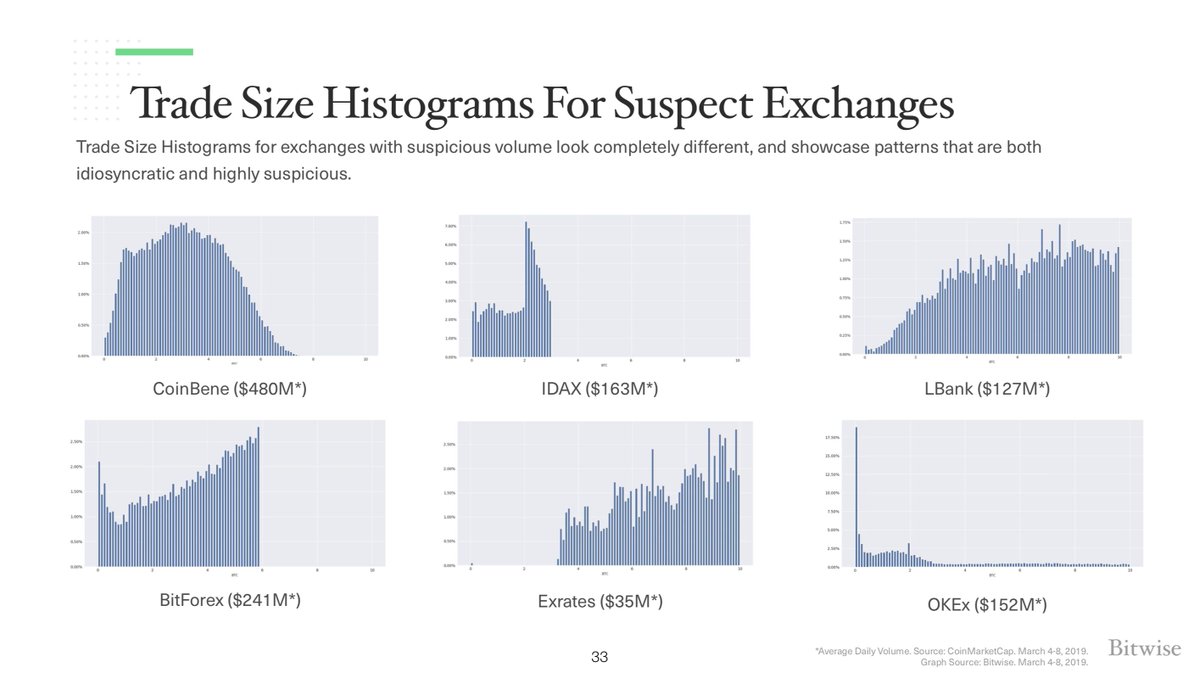

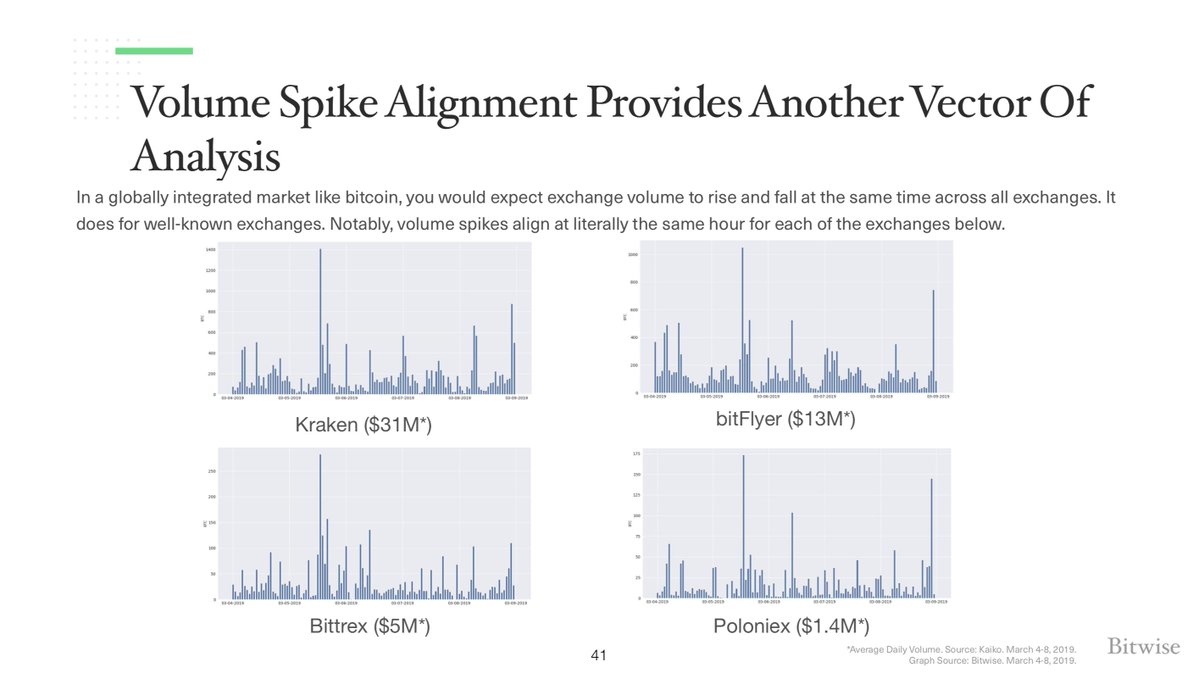

How can you tell what is real and what is fake?

There are two tests (described in more detail in the presentation):

First: real exchanges have more deals with small amounts than large ones (with spikes on round numbers, such as 1.0 BTC due to behavioral preferences).

Unfair exchanges have clearly artificial bar graphs of trading volume.

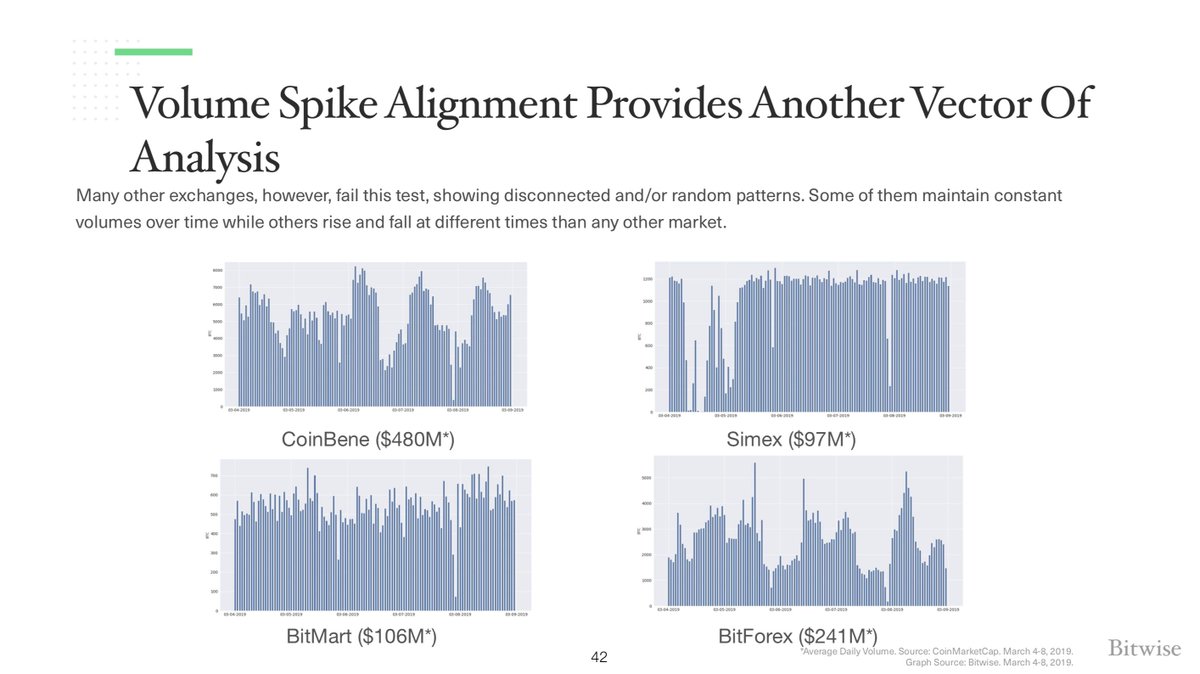

Second test: On real stock exchanges, trading volume surges are almost perfectly symmetrical to each other, since are part of the same market

On fake exchanges, trading volume charts do not have such an obvious similarity and do not correspond to a wider market. (More examples and detailed analysis on the site ).

Eliminating counterfeit data, the real volume of BTC is quite healthy, given its market capitalization.

The market capitalization of gold is ~ $ 7T with a volume of ~ $ 37B, which means a daily turnover of 0.53%.

Bitcoin's market capitalization of $ 70B means a daily turnover of 0.39%, which is quite similar to the numbers with gold.

Good news time!

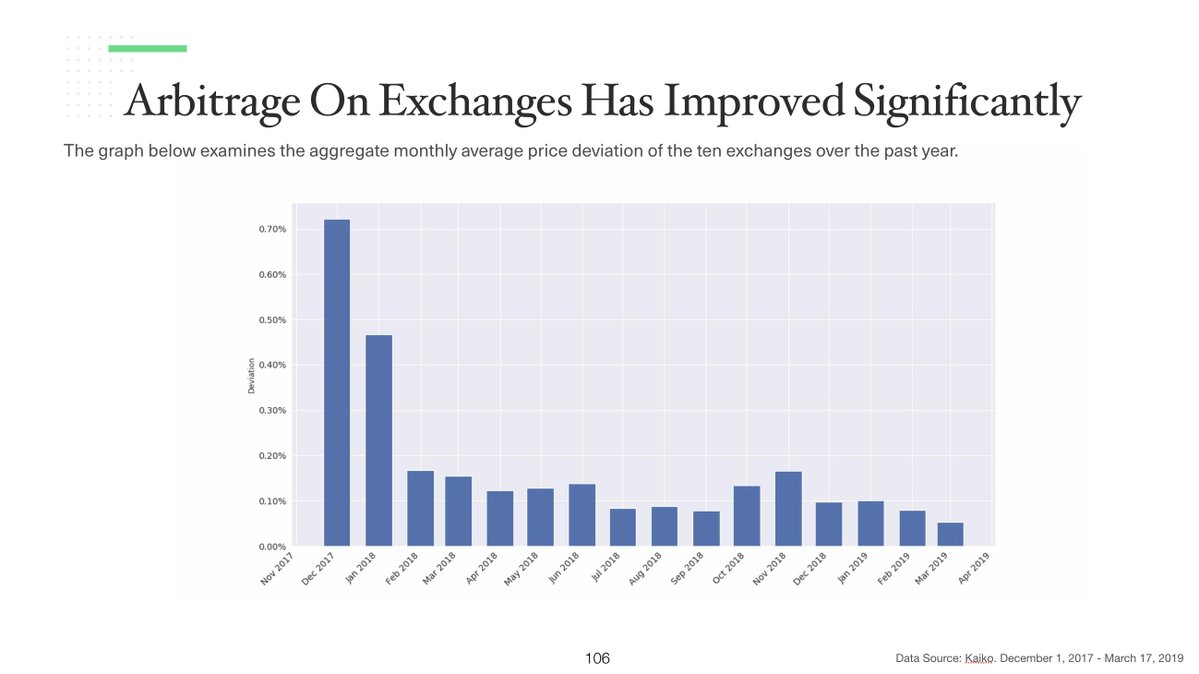

The arbitration between the 10 real exchanges has improved significantly. The deviation of the average price of any exchange from the total price is now less than 0.10%! Considerably lower than the arbitration range, taking into account exchange fees (0.10-0.30%) and hedging expenses

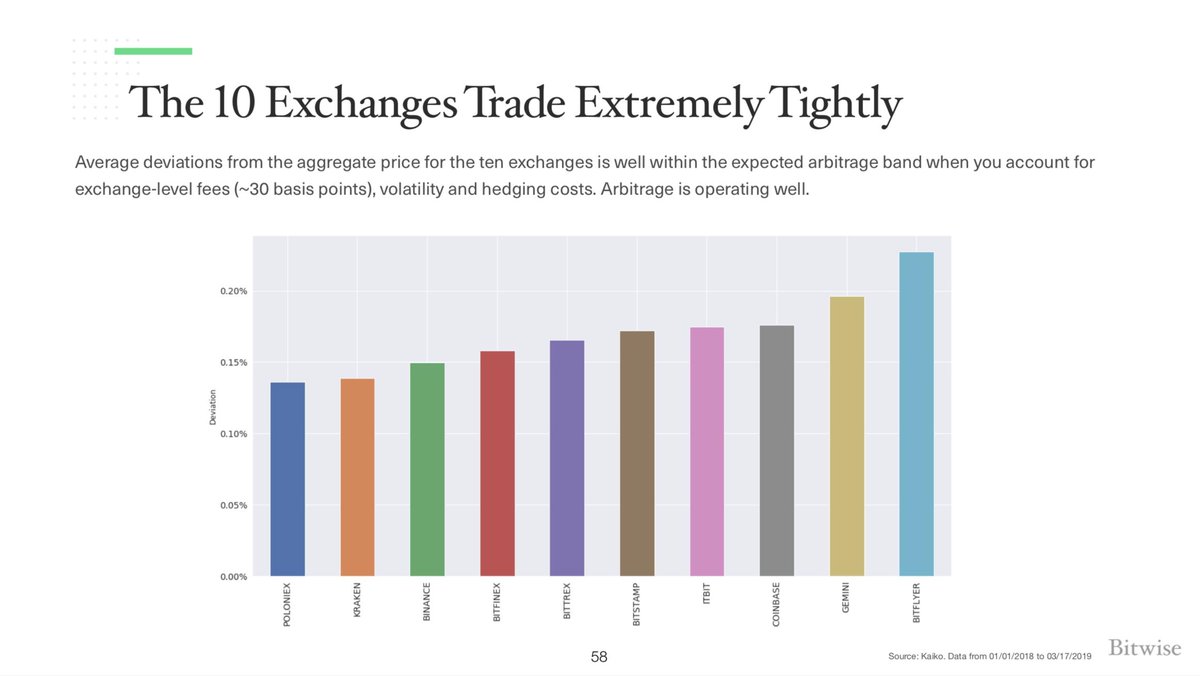

Here is the price deviation, broken for each of the 10 exchanges with real volume. Deviations are very small, which is good

Here is another chart showing the range of prices among these 10 exchanges. There is one global, single price.

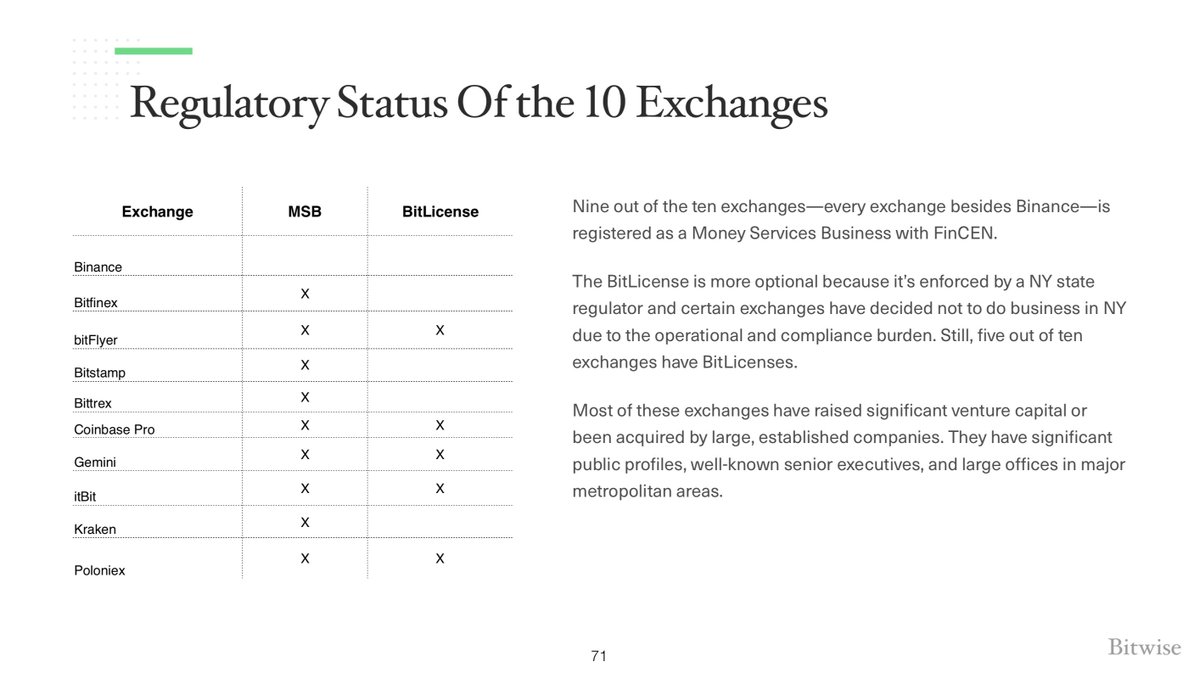

More good news - 9 out of 10 stock exchanges with real volume are regulated by FinCEN as cash services companies and 5 out of 10 by the Financial Services Department of the State of New York under BitLicense.

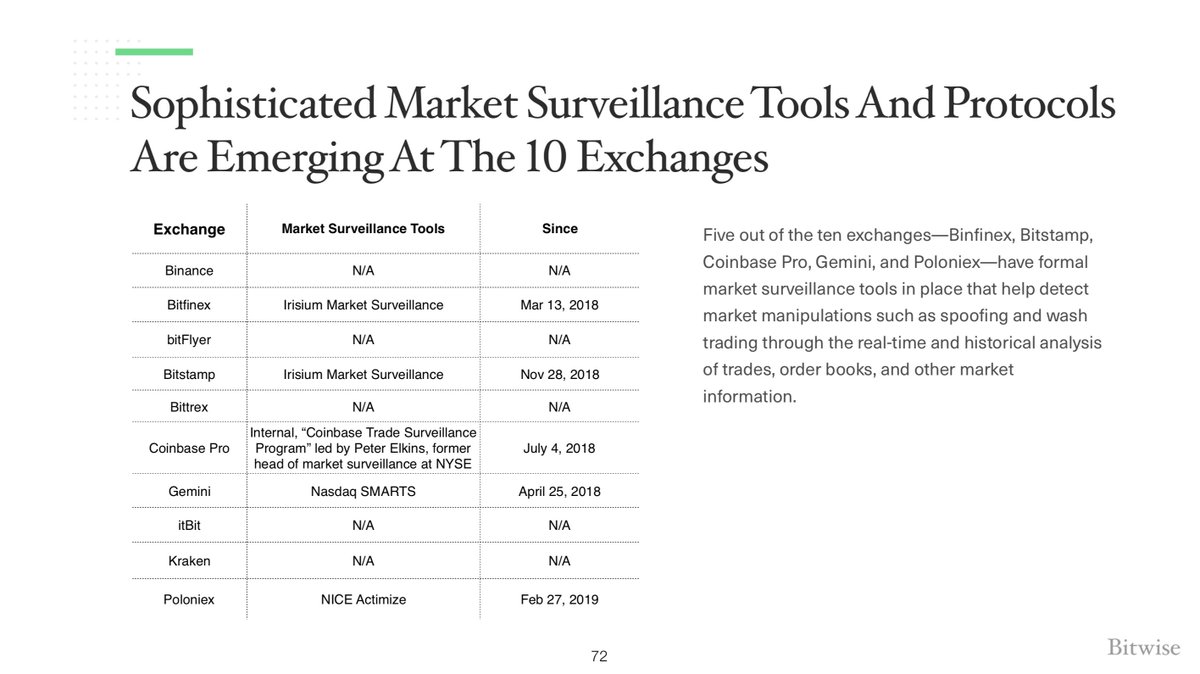

Also, 5 out of 10 exchanges have introduced oversight tools to prevent market manipulation.

And, not taking into account the fake data, the volume of CME and CBOE futures is significant ($ 91M), especially compared to the actual trading volume (35% of the monthly trading volume for February 2019).

This is good news, because it means that the CME is regulated, the observed market is of material size, which is important for foreign exchange-traded investment funds.

To summarize: The bitcoin market is smaller than what was reported, but more efficient and regulated, reducing the risk of problems around market manipulation.

You can learn more about our report at the links above.

Source: https://habr.com/ru/post/444928/

All Articles