Lyft and Uber go IPO. Why invest in Lyft?

At United Traders, we follow all the technology companies that go to an IPO, and of course, the loudest. Probably, many people know that on March 29 Lyft will enter the stock exchange, and in April Uber promises to come out.

To tell about Lyft - Uber's competitor in the US and Canada markets, we translated the CCN article, supplemented it with figures and presented our forecast. For UT, the comparison of these companies, their financial performance and product advantages is a very interesting topic. We hope for Habr's readers too. In any case, write in the comments.

As soon as plans for IPO of the two largest ridesharing services became known, disputes do not subside about which company is better to invest. It may seem that companies offer the same services, but upon close inspection, everything becomes not so clear. In this article, we give five reasons why Lyft could be a serious threat to Uber and a more profitable investment.

')

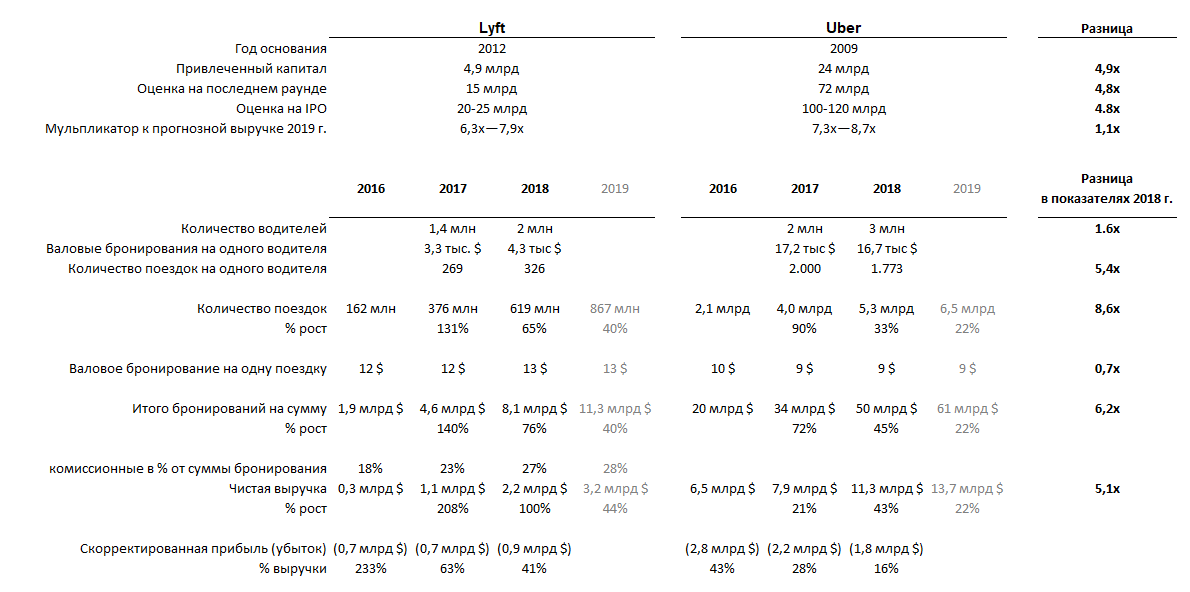

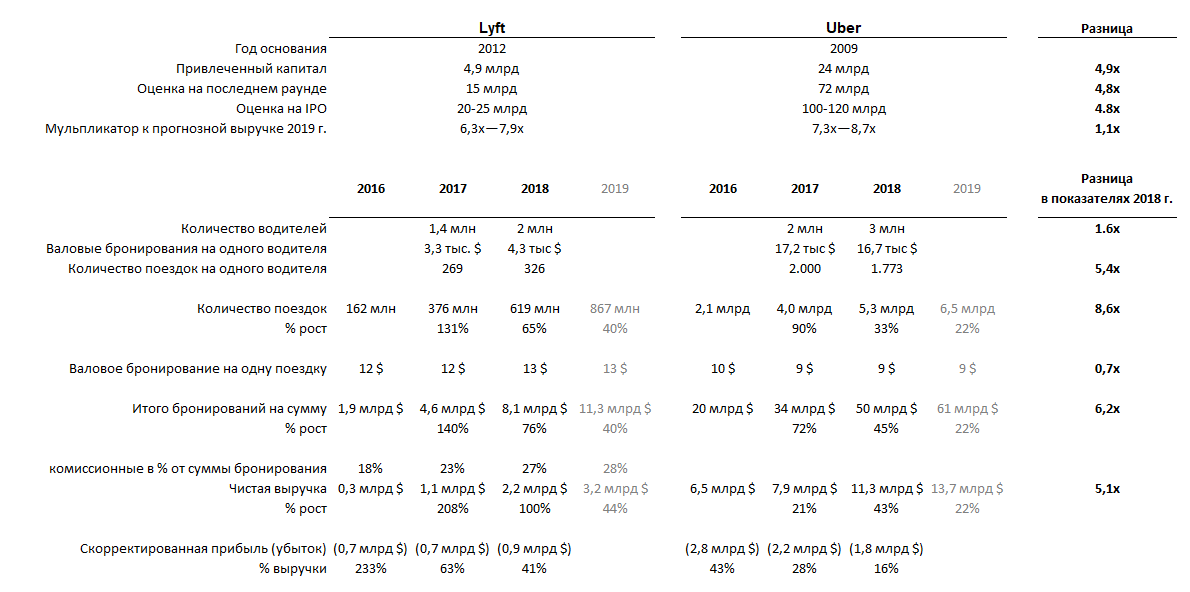

Technically, Lyft is like a classic unicorn worth over $ 1 billion. However, in its application for an IPO, the company disclosed a lot of interesting financial information. Taking this into account, as well as the metered published data from Uber, for the first time we had the opportunity to compare the business of two companies.

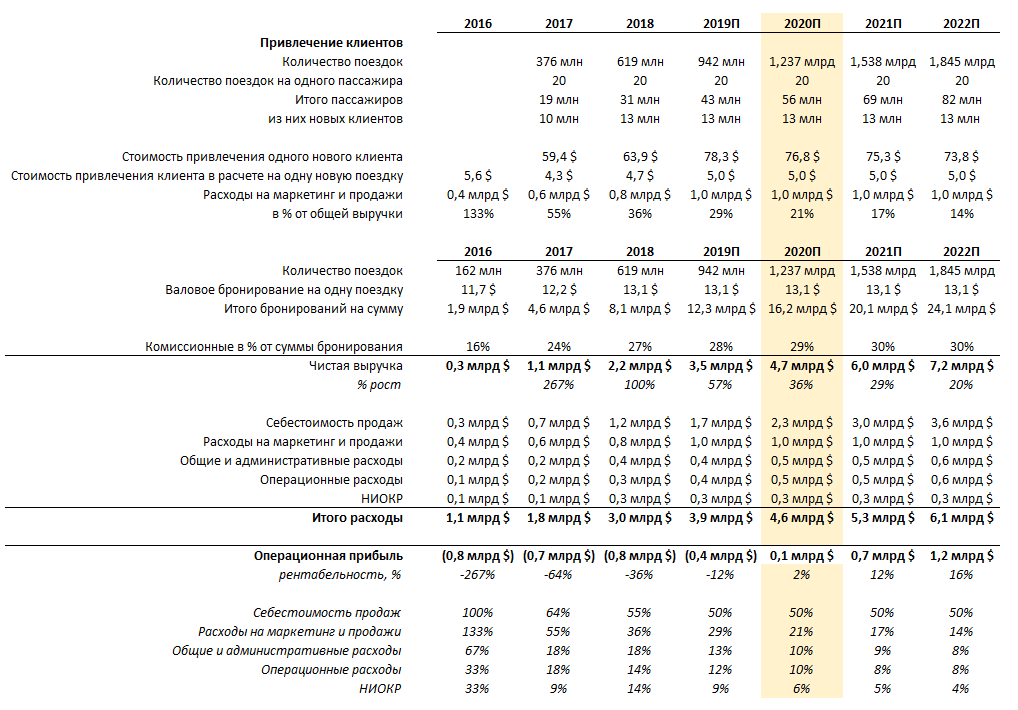

Data: Form S-1; figures for 2019 are predictions.

The principal difference between the two companies is their size. While Uber operates in almost 70 countries around the world, Lyft services are only available in 300 cities in the United States and Canada.

Some might think that buying Uber shares would be a more reasonable investment because of the size of the company, but this is not entirely true. The larger the size of the company, the higher the costs and operational risks it carries. While Uber continues to be under the gun of the regulators, Lyft is present only in the US and Canada, and most of these problems are not familiar to him.

As the younger brother watches the elder, so Lyft learns from the mistakes of Uber.

Both companies are still unprofitable, but let's look at the dynamics of their growth.

In 2018, Lyft's revenue grew by 100% to $ 2.2 billion, and Uber's revenue grew “only” by 45% to $ 11 billion. In part, such a strong increase in Lyft is associated with an increase in commission (from 23% to 27%), which may well be a temporary phenomenon. Therefore, it is better to look at the number of bookings: at Lyft, they grew by 76% compared to last year, and at Uber by 45%. As you can see, the difference in growth rates is not so serious, especially considering that Uber is five times larger than Lyft.

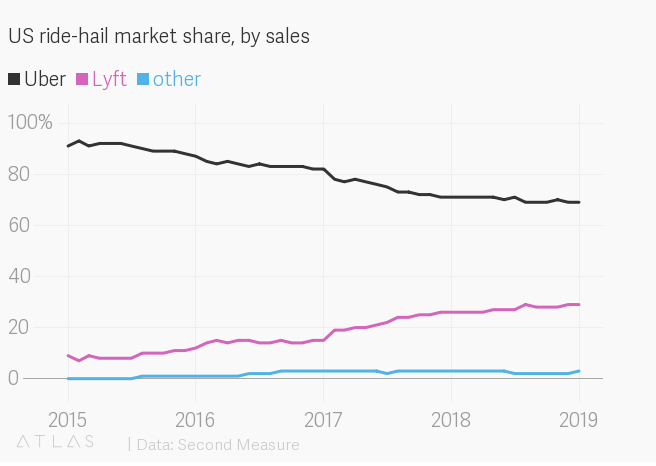

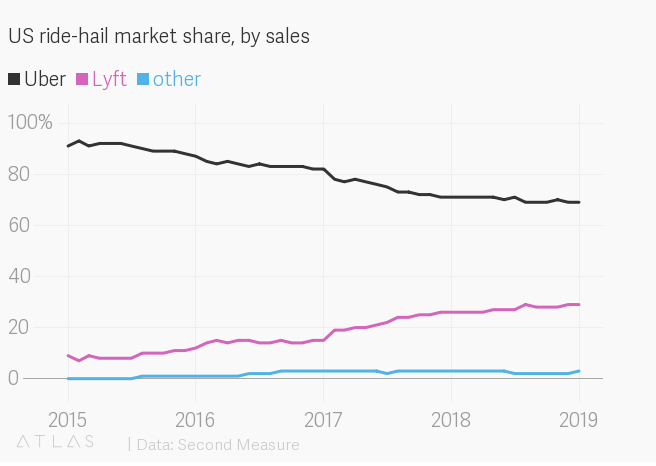

However, these numbers unequivocally indicate that Lyft is growing faster. At the same time, interestingly, Lyft is growing in the United States, taking Uber’s market share: the company itself speaks about 39%, while Second Measure, analyzing credit card payment data, estimates Lyft’s share at 29% (and Uber 69%). In the context of individual cities, this statistic looks even more interesting: in Seattle, for example, the share of Lyft is close to 50%.

Market share by sales

Judging by the numbers above, Lyft’s strategy of concentrating its efforts on the US market seems justified, which is largely promoted by the liberal position of the country's regulatory authorities, which so far differs from the position of the authorities in many countries where Uber operates.

If you think hypothetically, the main obstacle to the use of ridesharing is the safety of the trip. All the passenger needs is to get to his destination safely and efficiently. For both companies, this is number one priority. Of course, at the time when there were no alternatives to Uber on the market, the choice was obvious. But as we can see, Lyft is gradually taking market share from Uber, which confirms the trust of customers to the drivers of this company.

By applying for an IPO and having every chance of becoming the first public company that promotes an innovative approach to passenger transport, Lyft attracted the attention of the general public (and not least because now it is constantly compared to a direct competitor - Uber). In a niche where buyers trust the company rules, to declare oneself as a public company is worth a lot. In addition, both Lyft founders, after changing the status of the company, will retain both visionary and managerial roles in it, which contrasts very vividly with the story of the founder of Uber and can also add to the attractiveness of Lyft in the eyes of potential investors and its clients.

Lyft and Uber have different driver profiles - most Lyft drivers work in their spare time, while for Uber drivers this employment is their main source of income. This is confirmed by the available figures: the average Lyft driver earns 4.3 thousand dollars a year and this figure has been growing in recent years; and the average Uber driver earns 16.7 thousand dollars a year (and the figure decreases).

On average, there are 1 trips per day for Lyft drivers (or 326 trips per year), and for Uber drivers - 5 trips per day (1,773 trips per year). Uber has only 1.5 times more drivers than Lyft (3 million and 1.9 million drivers, respectively), although the size of the company's business is 5 times larger.

However, many drivers use the applications of both companies and they do not care from which service a new order will arrive. In this case, it is important that a small and less well-known Lyft company managed to achieve the availability of a sufficient number of available drivers who are satisfied with the work with the company, despite the fact that Lyft has significantly fewer customers than Uber.

Maintaining the availability of drivers in the cities where the service is located is a complex task and a critical factor determining the choice of customers. After all, few people, after waiting the car for 20 minutes in the rain, will want to use this service at least once more. And the more drivers, the more customers: Lyft will be able to increase the number of available cars on the roads as long as it is profitable for drivers.

One of the major advantages of Uber as an object of investment on the expected IPO is its positioning itself not only as a taxi, but also as a food delivery service and developer of a much more attractive unmanned vehicle technology. Lyft also invests in the development of unmanned cars, although there are few references to this in the public space.

In the development of progressive ideas for the development of urban transport companies go hand in hand. For example, in April 2018, Lyft signed a five-year strategic partnership agreement with Magna, a manufacturer of automotive parts and components for the companies to share technological developments in the field of unmanned vehicles with each other, and in October 2018, the company acquired view of blue vision labs.

In addition to its own developments, Lyft also plans to allow third-party manufacturers of unmanned vehicles to its platform (and client base), which should speed up the gradual transition to unmanned vehicles. Thus, together with the company Aptiv, in January 2018, commercial use of unmanned vehicles (with a driver in the cabin) on the Lyft platform was launched in Las Vegas: over the year, passengers made more than 35,000 trips.

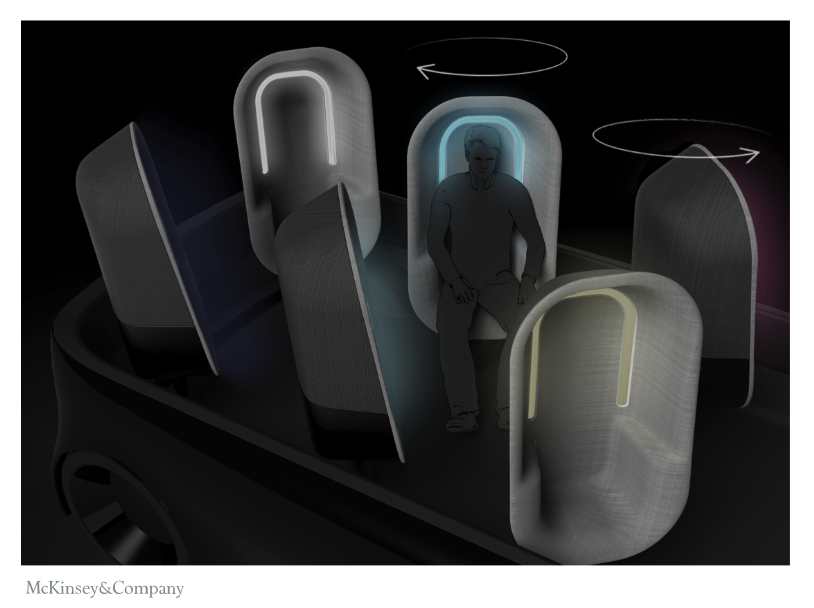

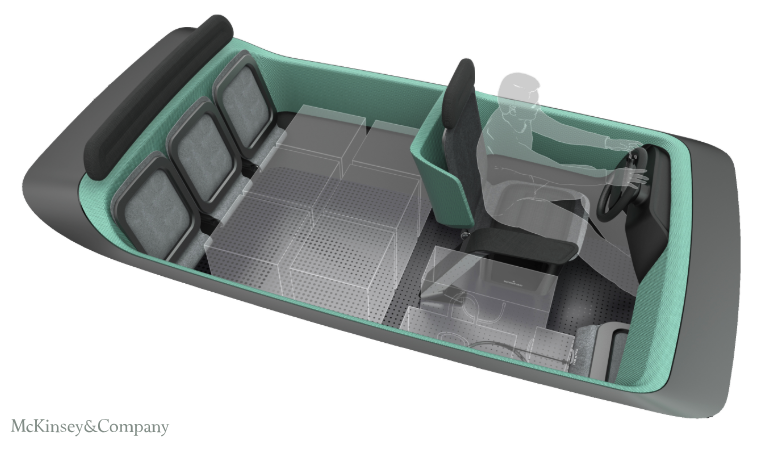

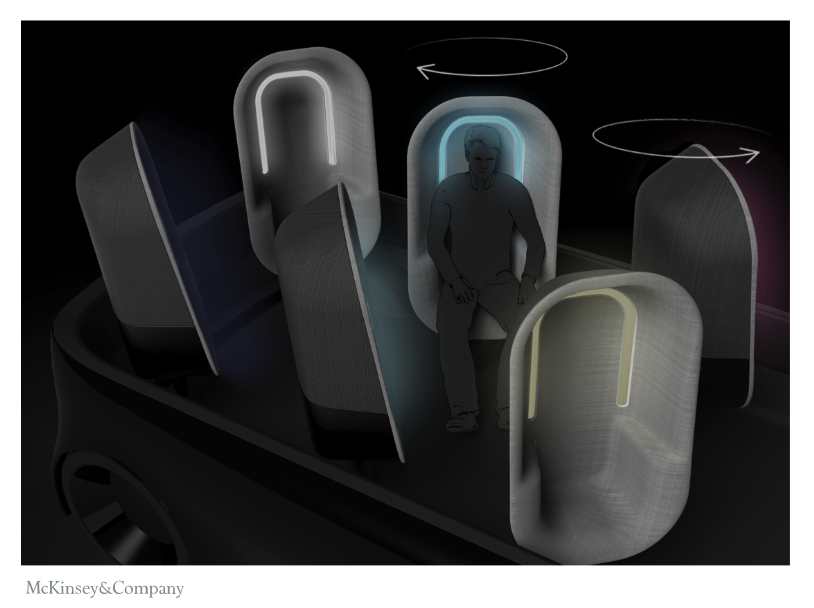

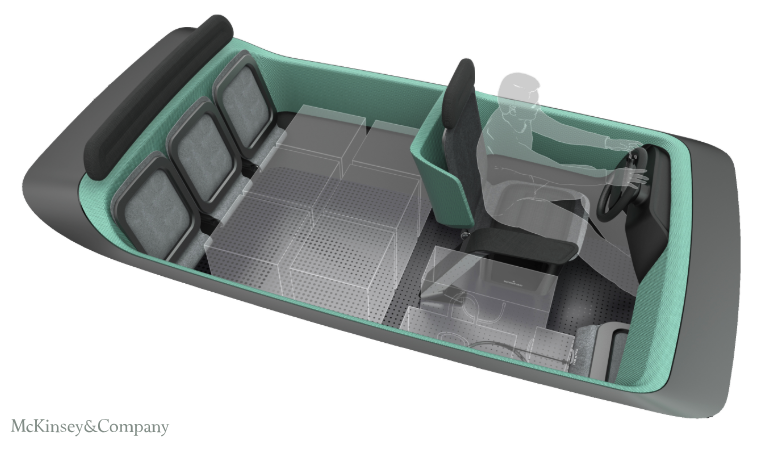

Unmanned vehicles will not only help rideshering companies to get rid of costs in the form of drivers' wages, but also to attract new categories of customers who are still reluctant to use their services: for example, those who return home after shopping, families with children (who use extreme ridesharing) - due to difficulties with the availability of suitable seats), as well as regular customers (for example, daily commuting to work this way) who are not always comfortable in the cabin with unfamiliar fellow travelers. For this, the interior of unmanned cars will have to be changed.

McKinsey , unmanned vehicle design for transporting several people

McKinsey , design of unmanned vehicle for shopping delivery

Bicycle rental is another direction of development: Uber entered this market in April 2018, bought Jump Bikes and invested in the rental of Lime electric scooters, and Lyft acquired Motivate in July of the same year and launched a pilot project to rent electric scooters in Denver. At the same time, the leaders of this market, the companies Bird and Lime, are already estimated at $ 2 billion each.

In financial markets, there is much talk about dynamics and impulses, and often this is extremely subjective. Just because something grew by X last month doesn’t mean continued growth. But often these trends should be taken into account, since they can shed some light on consumer behavior.

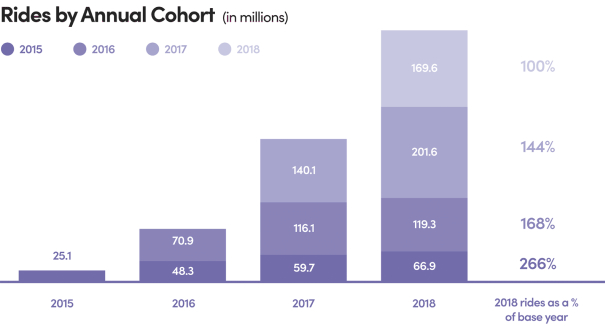

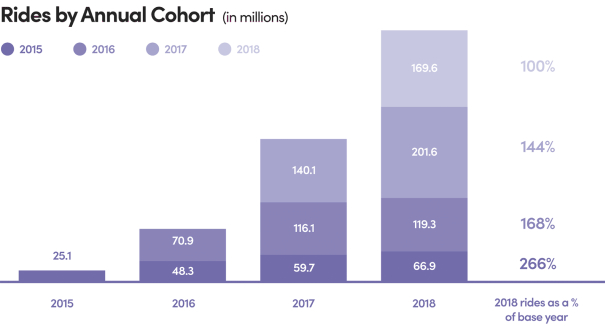

The statistics of trips made by existing Lyft customers looks impressive enough. On this chart, customers are divided into cohorts by the year of their involvement.

As we see, every year the number of trips of new clients grows, as does the number of trips of those clients whom the company attracted in previous years. Lyft attracted about 13 million new customers in 2018 (an increase from 19 million to 31 million per year). Knowing the company's marketing and sales expenses ($ 0.8 billion in 2018), we can estimate the cost of attracting one customer - about $ 70. At the same time, the revenue per customer per year is also approximately $ 70 (on average, one customer made 20 trips in 2018), but the company's margin is only half of this amount. Thus, investment in customer acquisition pays off only for two years, but in the light of the statistics above, such expenses look quite justified.

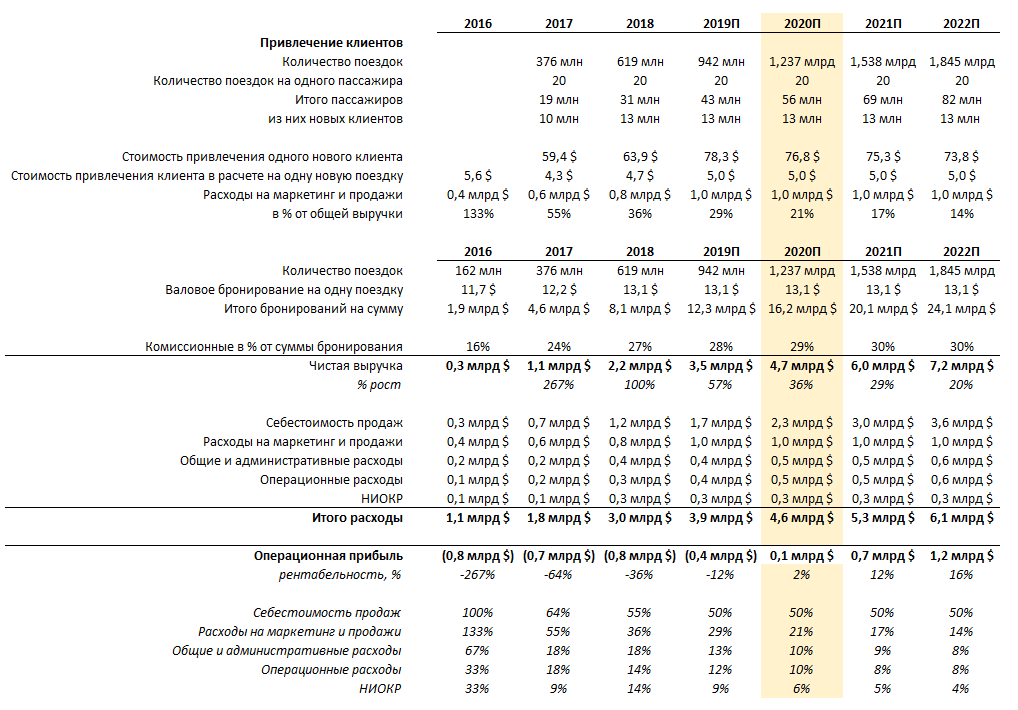

The most important question, which is equally relevant for Lyft and Uber, concerns their current profitability and the prospects for profit. Taking as a basis the current operating indicators of Lyft, their relative values and the dynamics of their changes over the past few years, we predict that the company will be able to enter the break-even zone as early as 2020 with continued business growth, but a slowdown in its pace.

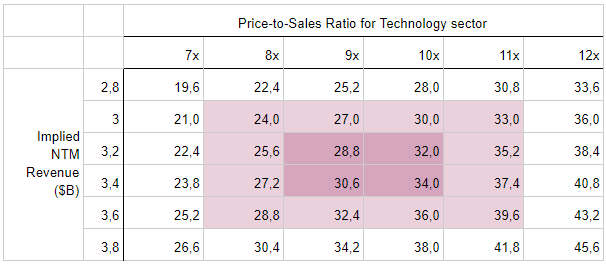

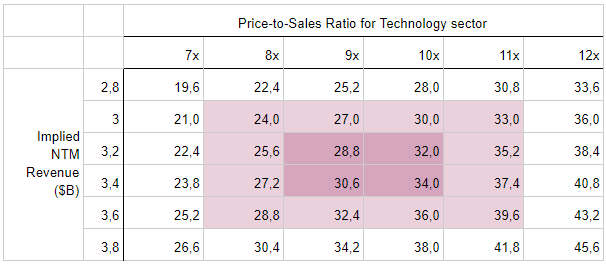

One of the most popular methods for evaluating a company’s IPO is a comparative analysis of Price-to-Sales, where Price is the cost of share capital and Sales is the company's projected revenue in the next 12 months after the IPO.

Lyft is the first to go to IPO from the economy sharing segment, and there are no similar companies for comparison yet, but if Lyft belongs to the technological sector of the USA, then the average P / S value is currently 10x.

In 2017 and 2018, the company's revenues amounted to $ 1.06 billion and $ 2.16 billion, respectively. Lyft showed significant revenue growth over this period (209% and 103%). Considering these indicators, in the baseline scenario, we forecast a revenue indicator of $ 3.2- $ 3.4 billion in 2019 (an expected growth of 50%).

Thus, the expected market value of Lyft in the baseline scenario will be $ 31.3 billion. At the moment, it is known that Lyft will be placed in the range of $ 62-68 per share, which will give an estimate of $ 19.3 billion at the upper limit of the price range. It can be concluded that the growth potential of shares on the market will be 62%.

When forecasting the profitability of an investment, we take into account the difference between pricing and the company's fundamental value (intrinsic valuation). The horizon for investing in an IPO is 1–3 months - in this case, heightened investor interest is the decisive driver for the stock price. In other words, investing in an IPO involves evaluating a company in terms of short-term demand, while evaluating a company for a buy-and-hold strategy involves predicting the company's fundamental or fair value. Therefore, the comparative analysis is the most suitable method for the first strategy, and the cash flow discounting method for the second one.

Even if everyone around would like to combine Uber and Lyft, from an investment point of view, this may be a mistake. Yes, companies offer the same service, but their ambitions vary greatly. Uber is an attempt to create a global monopoly, and Lyft wants to become the leader in the domestic ridesharing market and rethink the movement of people in urban space.

It is for this reason that, despite the smaller size of the company, Lyft may be a safer option in terms of IPO investment. We do not want to say that Lyft has no problems, but given the global scale of the business and the succession of scandals in the past, Uber no longer has only drivers and passengers, but also problems and risks.

To tell about Lyft - Uber's competitor in the US and Canada markets, we translated the CCN article, supplemented it with figures and presented our forecast. For UT, the comparison of these companies, their financial performance and product advantages is a very interesting topic. We hope for Habr's readers too. In any case, write in the comments.

As soon as plans for IPO of the two largest ridesharing services became known, disputes do not subside about which company is better to invest. It may seem that companies offer the same services, but upon close inspection, everything becomes not so clear. In this article, we give five reasons why Lyft could be a serious threat to Uber and a more profitable investment.

')

Technically, Lyft is like a classic unicorn worth over $ 1 billion. However, in its application for an IPO, the company disclosed a lot of interesting financial information. Taking this into account, as well as the metered published data from Uber, for the first time we had the opportunity to compare the business of two companies.

Data: Form S-1; figures for 2019 are predictions.

1. Lyft grows faster than Uber

The principal difference between the two companies is their size. While Uber operates in almost 70 countries around the world, Lyft services are only available in 300 cities in the United States and Canada.

Some might think that buying Uber shares would be a more reasonable investment because of the size of the company, but this is not entirely true. The larger the size of the company, the higher the costs and operational risks it carries. While Uber continues to be under the gun of the regulators, Lyft is present only in the US and Canada, and most of these problems are not familiar to him.

As the younger brother watches the elder, so Lyft learns from the mistakes of Uber.

Both companies are still unprofitable, but let's look at the dynamics of their growth.

In 2018, Lyft's revenue grew by 100% to $ 2.2 billion, and Uber's revenue grew “only” by 45% to $ 11 billion. In part, such a strong increase in Lyft is associated with an increase in commission (from 23% to 27%), which may well be a temporary phenomenon. Therefore, it is better to look at the number of bookings: at Lyft, they grew by 76% compared to last year, and at Uber by 45%. As you can see, the difference in growth rates is not so serious, especially considering that Uber is five times larger than Lyft.

However, these numbers unequivocally indicate that Lyft is growing faster. At the same time, interestingly, Lyft is growing in the United States, taking Uber’s market share: the company itself speaks about 39%, while Second Measure, analyzing credit card payment data, estimates Lyft’s share at 29% (and Uber 69%). In the context of individual cities, this statistic looks even more interesting: in Seattle, for example, the share of Lyft is close to 50%.

Market share by sales

Judging by the numbers above, Lyft’s strategy of concentrating its efforts on the US market seems justified, which is largely promoted by the liberal position of the country's regulatory authorities, which so far differs from the position of the authorities in many countries where Uber operates.

2. Lyft IPO boosts credibility

If you think hypothetically, the main obstacle to the use of ridesharing is the safety of the trip. All the passenger needs is to get to his destination safely and efficiently. For both companies, this is number one priority. Of course, at the time when there were no alternatives to Uber on the market, the choice was obvious. But as we can see, Lyft is gradually taking market share from Uber, which confirms the trust of customers to the drivers of this company.

By applying for an IPO and having every chance of becoming the first public company that promotes an innovative approach to passenger transport, Lyft attracted the attention of the general public (and not least because now it is constantly compared to a direct competitor - Uber). In a niche where buyers trust the company rules, to declare oneself as a public company is worth a lot. In addition, both Lyft founders, after changing the status of the company, will retain both visionary and managerial roles in it, which contrasts very vividly with the story of the founder of Uber and can also add to the attractiveness of Lyft in the eyes of potential investors and its clients.

3. “Drivers of Lyft work in their spare time, drivers of Uber make a living”

Lyft and Uber have different driver profiles - most Lyft drivers work in their spare time, while for Uber drivers this employment is their main source of income. This is confirmed by the available figures: the average Lyft driver earns 4.3 thousand dollars a year and this figure has been growing in recent years; and the average Uber driver earns 16.7 thousand dollars a year (and the figure decreases).

On average, there are 1 trips per day for Lyft drivers (or 326 trips per year), and for Uber drivers - 5 trips per day (1,773 trips per year). Uber has only 1.5 times more drivers than Lyft (3 million and 1.9 million drivers, respectively), although the size of the company's business is 5 times larger.

However, many drivers use the applications of both companies and they do not care from which service a new order will arrive. In this case, it is important that a small and less well-known Lyft company managed to achieve the availability of a sufficient number of available drivers who are satisfied with the work with the company, despite the fact that Lyft has significantly fewer customers than Uber.

Maintaining the availability of drivers in the cities where the service is located is a complex task and a critical factor determining the choice of customers. After all, few people, after waiting the car for 20 minutes in the rain, will want to use this service at least once more. And the more drivers, the more customers: Lyft will be able to increase the number of available cars on the roads as long as it is profitable for drivers.

4. Lyft is looking for new customers and is launching ridesharing for unmanned vehicles, bicycles and electric scooters.

One of the major advantages of Uber as an object of investment on the expected IPO is its positioning itself not only as a taxi, but also as a food delivery service and developer of a much more attractive unmanned vehicle technology. Lyft also invests in the development of unmanned cars, although there are few references to this in the public space.

In the development of progressive ideas for the development of urban transport companies go hand in hand. For example, in April 2018, Lyft signed a five-year strategic partnership agreement with Magna, a manufacturer of automotive parts and components for the companies to share technological developments in the field of unmanned vehicles with each other, and in October 2018, the company acquired view of blue vision labs.

In addition to its own developments, Lyft also plans to allow third-party manufacturers of unmanned vehicles to its platform (and client base), which should speed up the gradual transition to unmanned vehicles. Thus, together with the company Aptiv, in January 2018, commercial use of unmanned vehicles (with a driver in the cabin) on the Lyft platform was launched in Las Vegas: over the year, passengers made more than 35,000 trips.

Unmanned vehicles will not only help rideshering companies to get rid of costs in the form of drivers' wages, but also to attract new categories of customers who are still reluctant to use their services: for example, those who return home after shopping, families with children (who use extreme ridesharing) - due to difficulties with the availability of suitable seats), as well as regular customers (for example, daily commuting to work this way) who are not always comfortable in the cabin with unfamiliar fellow travelers. For this, the interior of unmanned cars will have to be changed.

McKinsey , unmanned vehicle design for transporting several people

McKinsey , design of unmanned vehicle for shopping delivery

Bicycle rental is another direction of development: Uber entered this market in April 2018, bought Jump Bikes and invested in the rental of Lime electric scooters, and Lyft acquired Motivate in July of the same year and launched a pilot project to rent electric scooters in Denver. At the same time, the leaders of this market, the companies Bird and Lime, are already estimated at $ 2 billion each.

5. Lyft goes to breakeven

In financial markets, there is much talk about dynamics and impulses, and often this is extremely subjective. Just because something grew by X last month doesn’t mean continued growth. But often these trends should be taken into account, since they can shed some light on consumer behavior.

The statistics of trips made by existing Lyft customers looks impressive enough. On this chart, customers are divided into cohorts by the year of their involvement.

As we see, every year the number of trips of new clients grows, as does the number of trips of those clients whom the company attracted in previous years. Lyft attracted about 13 million new customers in 2018 (an increase from 19 million to 31 million per year). Knowing the company's marketing and sales expenses ($ 0.8 billion in 2018), we can estimate the cost of attracting one customer - about $ 70. At the same time, the revenue per customer per year is also approximately $ 70 (on average, one customer made 20 trips in 2018), but the company's margin is only half of this amount. Thus, investment in customer acquisition pays off only for two years, but in the light of the statistics above, such expenses look quite justified.

The most important question, which is equally relevant for Lyft and Uber, concerns their current profitability and the prospects for profit. Taking as a basis the current operating indicators of Lyft, their relative values and the dynamics of their changes over the past few years, we predict that the company will be able to enter the break-even zone as early as 2020 with continued business growth, but a slowdown in its pace.

United Traders Lyft Score

One of the most popular methods for evaluating a company’s IPO is a comparative analysis of Price-to-Sales, where Price is the cost of share capital and Sales is the company's projected revenue in the next 12 months after the IPO.

Lyft is the first to go to IPO from the economy sharing segment, and there are no similar companies for comparison yet, but if Lyft belongs to the technological sector of the USA, then the average P / S value is currently 10x.

In 2017 and 2018, the company's revenues amounted to $ 1.06 billion and $ 2.16 billion, respectively. Lyft showed significant revenue growth over this period (209% and 103%). Considering these indicators, in the baseline scenario, we forecast a revenue indicator of $ 3.2- $ 3.4 billion in 2019 (an expected growth of 50%).

Thus, the expected market value of Lyft in the baseline scenario will be $ 31.3 billion. At the moment, it is known that Lyft will be placed in the range of $ 62-68 per share, which will give an estimate of $ 19.3 billion at the upper limit of the price range. It can be concluded that the growth potential of shares on the market will be 62%.

When forecasting the profitability of an investment, we take into account the difference between pricing and the company's fundamental value (intrinsic valuation). The horizon for investing in an IPO is 1–3 months - in this case, heightened investor interest is the decisive driver for the stock price. In other words, investing in an IPO involves evaluating a company in terms of short-term demand, while evaluating a company for a buy-and-hold strategy involves predicting the company's fundamental or fair value. Therefore, the comparative analysis is the most suitable method for the first strategy, and the cash flow discounting method for the second one.

So why Lyft?

Even if everyone around would like to combine Uber and Lyft, from an investment point of view, this may be a mistake. Yes, companies offer the same service, but their ambitions vary greatly. Uber is an attempt to create a global monopoly, and Lyft wants to become the leader in the domestic ridesharing market and rethink the movement of people in urban space.

It is for this reason that, despite the smaller size of the company, Lyft may be a safer option in terms of IPO investment. We do not want to say that Lyft has no problems, but given the global scale of the business and the succession of scandals in the past, Uber no longer has only drivers and passengers, but also problems and risks.

Source: https://habr.com/ru/post/444426/

All Articles