How to get the most out of your investment portfolio?

The fool said: “Don't put all your eggs in one basket!” - in other words: spray your interests and money! And the sage said: "Put all your eggs in one basket, but ... take care of the basket!". This phrase belongs to Mark Twain, but you must have heard its "wise" part from Warren Buffett. Yes, the legendary investor is not a supporter of asset allocation and is invested exclusively in US stocks.

Is this approach justified and is portfolio diversification useful as it is said? Let's check. To do this, take the most popular ETF funds for investment and see how effective they are when combined into a portfolio. At the same time, we will find out whether the number of funds in a portfolio affects its performance.

')

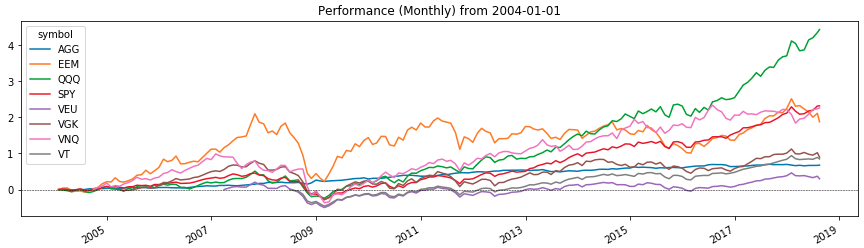

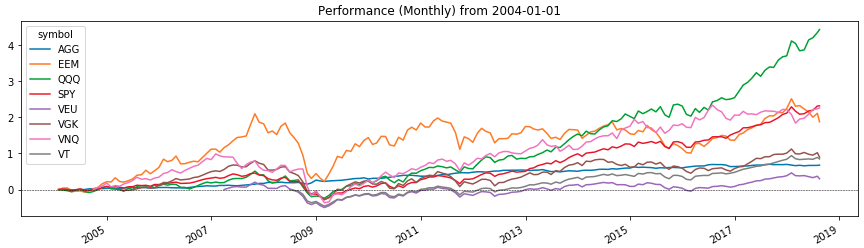

The graph above shows the profitability of ETF-funds with which we will work, in the period from January 2004 to August 2018. During this period we will test portfolios. And below is a description of what they consist of. (Pay attention to the date of the appearance of funds (ETF launch column) - we will need it later.)

Now, from the above listed funds, we will form portfolios of an aggressive model (we want to get the most from portfolio investment). Such a model assumes the predominance of shares in the portfolio, in our case it will consist of 80% of the shares and 20% of the US bonds (as the most risk-free asset). The structure of the portfolios will differ in the number of assets and the depth of diversification. In total there will be six:

In parentheses are the shares of assets in accordance with their order in the title. So, SPY, AGG (80/20) portfolio consists of 80% of S & P 500 shares and 20% of US bonds of investment rating. Now that our portfolios are ready, let's test them with Python. Test, as already mentioned, we will for the period from January 2004 to August 2018. However, you probably noticed that not all of the ETFs we considered were on the market in 2004. Therefore, in the tests we will do so. Those funds that have not been traded at the time of testing start will be added to the portfolio as they appear on the market.

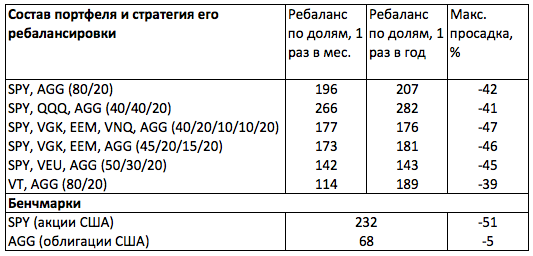

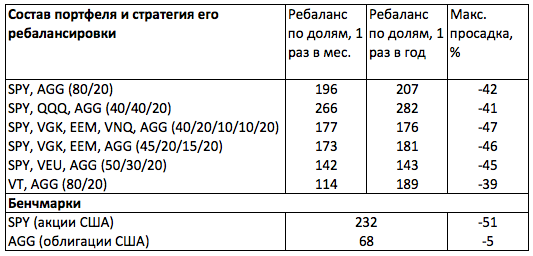

The table below shows the test results. The Benchmarks section shows the yield and the maximum drawdown for the period for stocks (SPY) and bonds (AGG). By their values, we can easily understand what to expect from stocks and bonds as aggressive and defensive asset classes. (However, we should always (!) Remember that past results do not guarantee future ones).

As can be seen, over the period of the wide market share (SPY), they gave an aggregate return of 232% with a maximum drawdown of 51%. That is, if we had been holding a portfolio consisting only of S & P 500 shares since 2004, we would have increased our investments by 3.3 times, but at some point half of the invested funds could have been missing (these are the risks of the stock market). But if we added 20% of bonds to it, we would soften the blow a bit and reduce the drawdown by 20% (42% vs 51%), but paying 15.5% of the return (196% vs 232%).

At the same time, if we, along with bonds, added fund shares to the Nasdaq 100 in the portfolio, we would get the same 41% of the drawdown, but with a higher yield (266% or 282% - depending on the rebalancing frequency). And this means that with this portfolio we would have overtaken the wide market (SPY) and sank less into crisis. But if we diversified our portfolio across different countries, we would significantly worsen its return (173% or 181% - depending on the rebalancing frequency - and lower) and ensure a drawdown of 46% on average. Adding a US real estate fund (VNQ) to the portfolio would slightly improve its profitability, but increased the drawdown.

The test results lead us to the following conclusions.

It turns out that Buffett is right in putting all his eggs in one basket. And if we want to get the most out of our portfolio, we must bet on the American market. Is it worth worrying that a portfolio of 80% consisting of US stocks is not diversified? I do not think it is worth. At least by the fact that the S & P 500 includes securities of companies operating around the world. That is, this index is diversified by default. And whether we need additional diversification across countries is a big question. On this issue, I suggest you think (and write what you decide in the comments below). And we are moving from the most profitable portfolio model to the most efficient way to manage it.

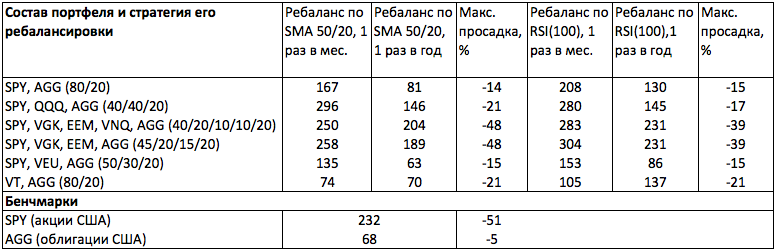

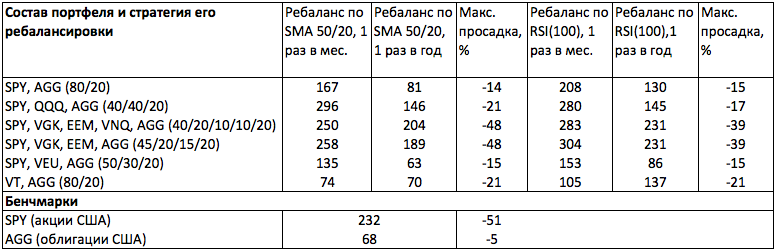

When analyzing the effectiveness of the portfolio structure, we relied on the results of the classical management. That is, those that we would receive by rebalancing the portfolio once a year for shares. Let's now look at the results of alternative rebalancing on indicators. The essence of this rebalancing is to check the daily graphs of the portfolio assets for the fulfillment of one of the following conditions (depending on the chosen strategy): 1) RSI (100) value is above 50. 2) SMA (50) moving average is above SMA (200).

In the first case, we buy and hold an asset in the portfolio only when its RSI (100) value is above 50. In the second case, when the SMA (50) is on the SMA (200). If these conditions are not met, the asset is not taken to the portfolio. If the asset is already in the portfolio, then it is sold, and the money received is distributed among other assets.

What does this approach give us? As can be seen from the results of the table, reducing the drawdown of the portfolio and the increase in profitability. At the same time, we would get the maximum effect from the monthly portfolio rebalancing (annual balancing is not suitable here) by RSI (100). So, for the simplest portfolio of SPY, AGG (80/20), we would have a yield of 9% lower than the SPY (208% vs. 232%), and the drawdown is less than 3.4 (!) Times (51% vs. 15%). Moreover, due to the rebalancing of RSI (100), we would be able to get to the diversified by country portfolio (SPY, VGK, EEM, AGG) increase in EEM in 2007-2009, and thereby overtake SPY by 30% (304% against 232%).

The test results lead us to the idea that portfolio management is more important than its model. And they also make you think about the use of elements of technical analysis in portfolio investment in order to maximize profit and reduce risk. Whether to combine passive investment with active management is up to you. But it is obvious that just such a synthesis allows getting more from standard portfolios.

Is this approach justified and is portfolio diversification useful as it is said? Let's check. To do this, take the most popular ETF funds for investment and see how effective they are when combined into a portfolio. At the same time, we will find out whether the number of funds in a portfolio affects its performance.

')

The graph above shows the profitability of ETF-funds with which we will work, in the period from January 2004 to August 2018. During this period we will test portfolios. And below is a description of what they consist of. (Pay attention to the date of the appearance of funds (ETF launch column) - we will need it later.)

Make up portfolios

Now, from the above listed funds, we will form portfolios of an aggressive model (we want to get the most from portfolio investment). Such a model assumes the predominance of shares in the portfolio, in our case it will consist of 80% of the shares and 20% of the US bonds (as the most risk-free asset). The structure of the portfolios will differ in the number of assets and the depth of diversification. In total there will be six:

- SPY, AGG (80/20).

- SPY, QQQ, AGG (40/40/20).

- SPY, VGK, EEM, VNQ, AGG (40/20/10/10/20).

- SPY, VGK, EEM, AGG (45/20/15/20).

- SPY, VEU, AGG (50/30/20).

- VT, AGG (80/20).

In parentheses are the shares of assets in accordance with their order in the title. So, SPY, AGG (80/20) portfolio consists of 80% of S & P 500 shares and 20% of US bonds of investment rating. Now that our portfolios are ready, let's test them with Python. Test, as already mentioned, we will for the period from January 2004 to August 2018. However, you probably noticed that not all of the ETFs we considered were on the market in 2004. Therefore, in the tests we will do so. Those funds that have not been traded at the time of testing start will be added to the portfolio as they appear on the market.

Testing portfolios

The table below shows the test results. The Benchmarks section shows the yield and the maximum drawdown for the period for stocks (SPY) and bonds (AGG). By their values, we can easily understand what to expect from stocks and bonds as aggressive and defensive asset classes. (However, we should always (!) Remember that past results do not guarantee future ones).

As can be seen, over the period of the wide market share (SPY), they gave an aggregate return of 232% with a maximum drawdown of 51%. That is, if we had been holding a portfolio consisting only of S & P 500 shares since 2004, we would have increased our investments by 3.3 times, but at some point half of the invested funds could have been missing (these are the risks of the stock market). But if we added 20% of bonds to it, we would soften the blow a bit and reduce the drawdown by 20% (42% vs 51%), but paying 15.5% of the return (196% vs 232%).

At the same time, if we, along with bonds, added fund shares to the Nasdaq 100 in the portfolio, we would get the same 41% of the drawdown, but with a higher yield (266% or 282% - depending on the rebalancing frequency). And this means that with this portfolio we would have overtaken the wide market (SPY) and sank less into crisis. But if we diversified our portfolio across different countries, we would significantly worsen its return (173% or 181% - depending on the rebalancing frequency - and lower) and ensure a drawdown of 46% on average. Adding a US real estate fund (VNQ) to the portfolio would slightly improve its profitability, but increased the drawdown.

Buffett was right?

The test results lead us to the following conclusions.

- Portfolio diversification across countries would not increase our portfolio returns.

- Adding an additional asset class to the portfolio (US Real Estate Fund, VNQ) would also not give us an advantage.

- The largest return and the smallest drawdown would be brought to us by a portfolio focused on US stocks, especially innovative companies (QQQ).

It turns out that Buffett is right in putting all his eggs in one basket. And if we want to get the most out of our portfolio, we must bet on the American market. Is it worth worrying that a portfolio of 80% consisting of US stocks is not diversified? I do not think it is worth. At least by the fact that the S & P 500 includes securities of companies operating around the world. That is, this index is diversified by default. And whether we need additional diversification across countries is a big question. On this issue, I suggest you think (and write what you decide in the comments below). And we are moving from the most profitable portfolio model to the most efficient way to manage it.

Choosing a portfolio management model

When analyzing the effectiveness of the portfolio structure, we relied on the results of the classical management. That is, those that we would receive by rebalancing the portfolio once a year for shares. Let's now look at the results of alternative rebalancing on indicators. The essence of this rebalancing is to check the daily graphs of the portfolio assets for the fulfillment of one of the following conditions (depending on the chosen strategy): 1) RSI (100) value is above 50. 2) SMA (50) moving average is above SMA (200).

In the first case, we buy and hold an asset in the portfolio only when its RSI (100) value is above 50. In the second case, when the SMA (50) is on the SMA (200). If these conditions are not met, the asset is not taken to the portfolio. If the asset is already in the portfolio, then it is sold, and the money received is distributed among other assets.

What does this approach give us? As can be seen from the results of the table, reducing the drawdown of the portfolio and the increase in profitability. At the same time, we would get the maximum effect from the monthly portfolio rebalancing (annual balancing is not suitable here) by RSI (100). So, for the simplest portfolio of SPY, AGG (80/20), we would have a yield of 9% lower than the SPY (208% vs. 232%), and the drawdown is less than 3.4 (!) Times (51% vs. 15%). Moreover, due to the rebalancing of RSI (100), we would be able to get to the diversified by country portfolio (SPY, VGK, EEM, AGG) increase in EEM in 2007-2009, and thereby overtake SPY by 30% (304% against 232%).

Is portfolio management more important than its model?

The test results lead us to the idea that portfolio management is more important than its model. And they also make you think about the use of elements of technical analysis in portfolio investment in order to maximize profit and reduce risk. Whether to combine passive investment with active management is up to you. But it is obvious that just such a synthesis allows getting more from standard portfolios.

Source: https://habr.com/ru/post/444104/

All Articles