The gaming market, trends and forecasts - a great analytics from App Annie

The company App Annie once again conducted a study of the mobile application market and posted a report on 160 pages with graphs and reports.

To translate them all is not a trivial task, so I chose the topic closest to me. Inside about what was happening with the mobile gaming market in 2018, and what awaits in 2019. Spoiler: everything is very good.

')

But first, look at the main points from the report .

- 194 billion downloads. Compared to 2016, the figure increased by 35%.

- $ 101 billion dollars was spent by users in app stores. Compared with 2016, an increase of 75%.

- The user spends an average of 3 hours in a mobile device. Growth from 2016 - 50%.

- The market value of companies targeting the mobile market in 2018 has grown by an average of 360%.

- Users from the USA, Korea, Japan and Australia have an average of 100 installed applications on a smartphone.

- In 2018, China provided half of the downloads of mobile applications and 40% of spending in the world.

- More than 80% of the 48 companies that went public in the USA in 2018 are involved in the mobile market.

- The cost of non-gaming applications increased by 120% compared with 2016.

Mobile games are the fastest-growing segment of the gaming market, surpassing sales of titles on consoles, PC / Mac and laptops. In 2018, they accounted for 74% of all expenses of users of stores.

China, the USA and Japan remain the three most visible markets in terms of consumer spending. Together, they accounted for 75% of all revenue from mobile games in 2018. Stable two-year cost increases are noticeable in any market.

Games are still confidently ranked first in terms of revenue and downloads on the App Store and Google Play.

In 2018, the border between mobile and console games became less noticeable. The success of PUBG Mobile and Fortnite shows that mobile devices are already powerful enough to run games from consoles or PCs.

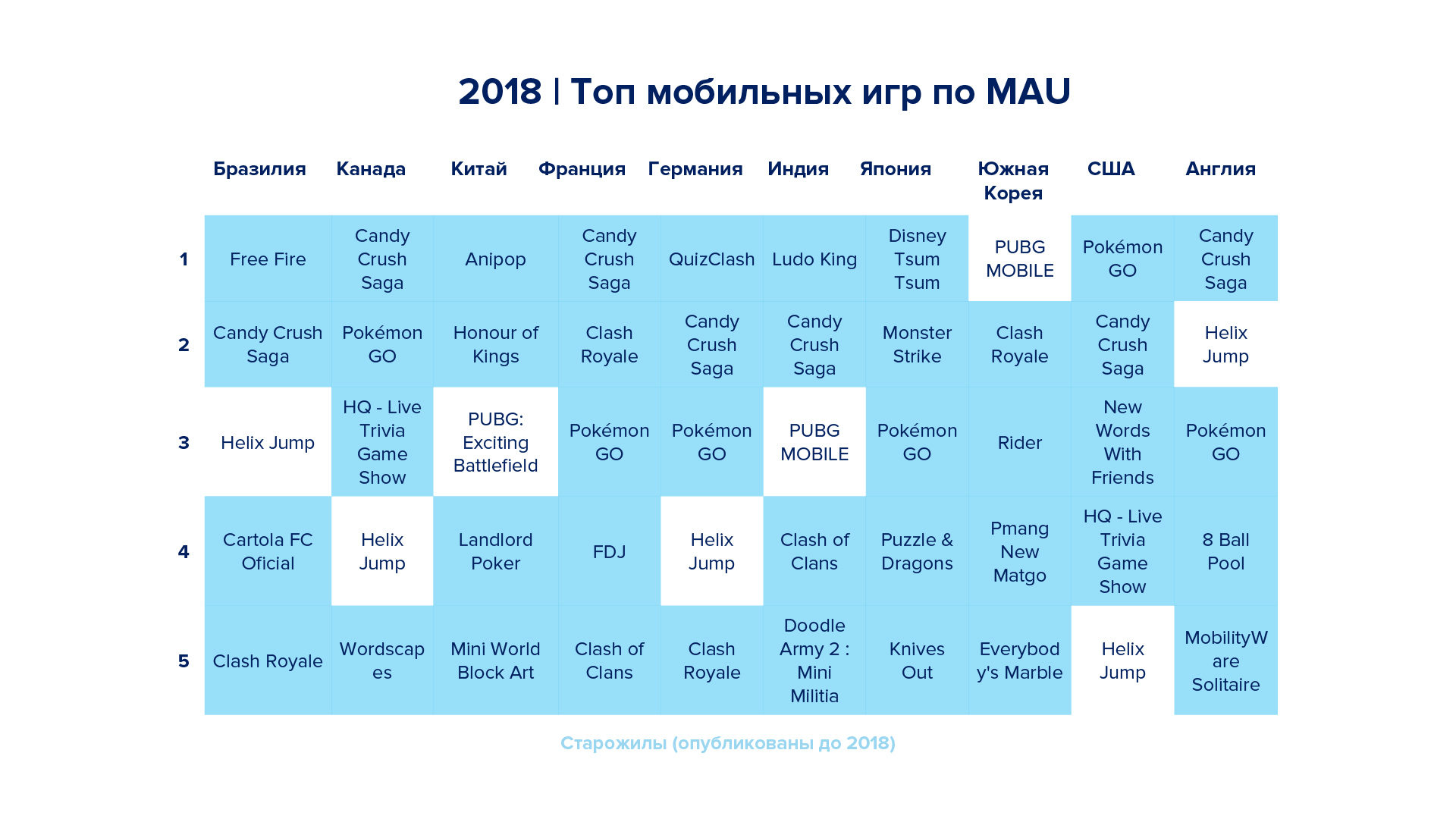

The tastes of mobile gamers in China, Japan and South Korea show the prevailing online gaming culture in these markets. The popularity of the Battle Royale genre in 2018 helped them to make significant progress.

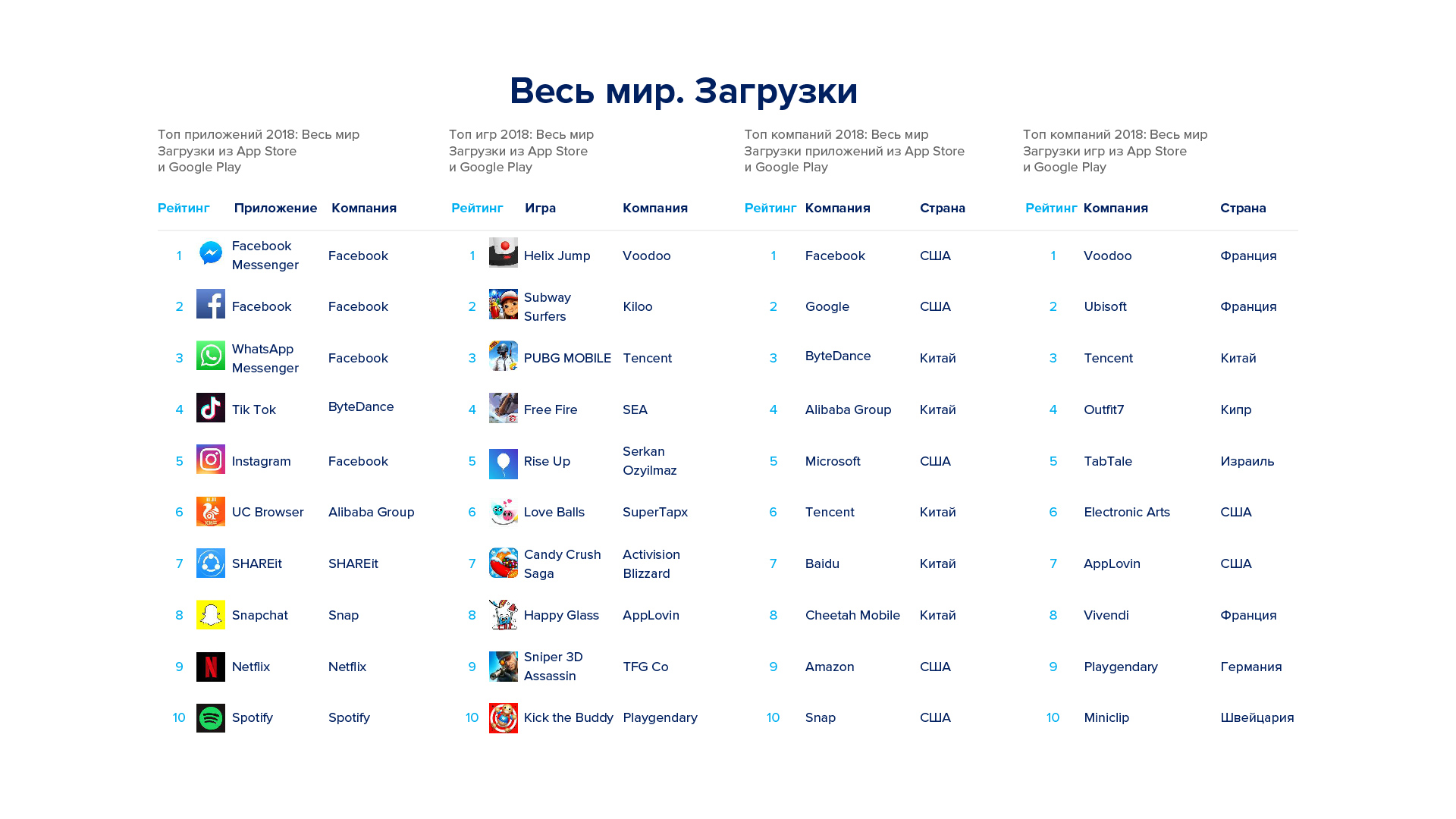

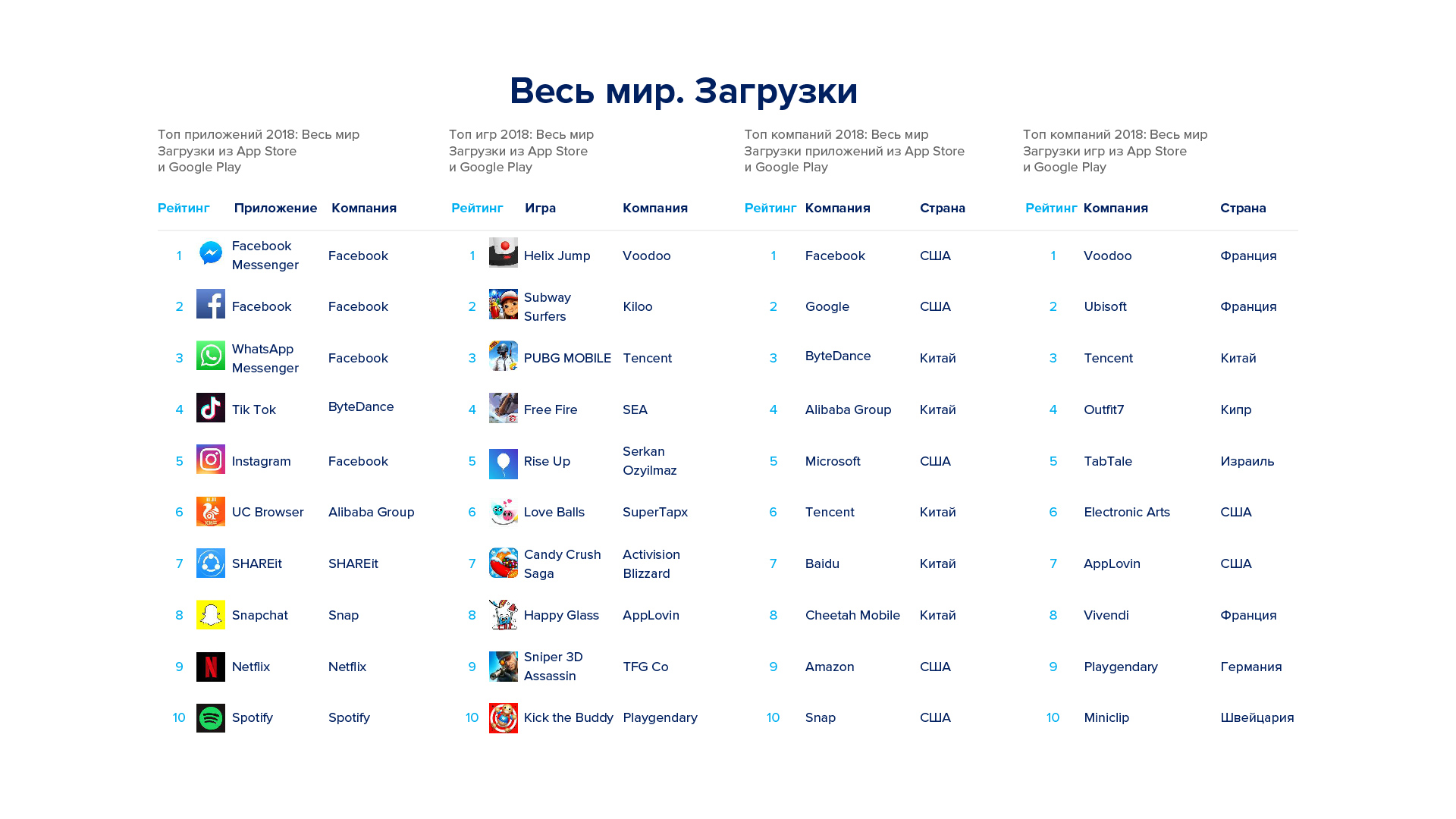

Hyper-casual games also dominate most of the tops. Voodoo spent a good year, releasing the hits Helix Jump and Hole io.

Candy Crush Saga has maintained its position in Western markets. In 2016, Pokémon GO popularized local AR-games, and two years later it was still one of the most popular games in the world. Partly due to the social aspect, PvP battles and events.

New PUBG Mobile and hyper-casual Helix Jump broke into the tops around the world in less than a year.

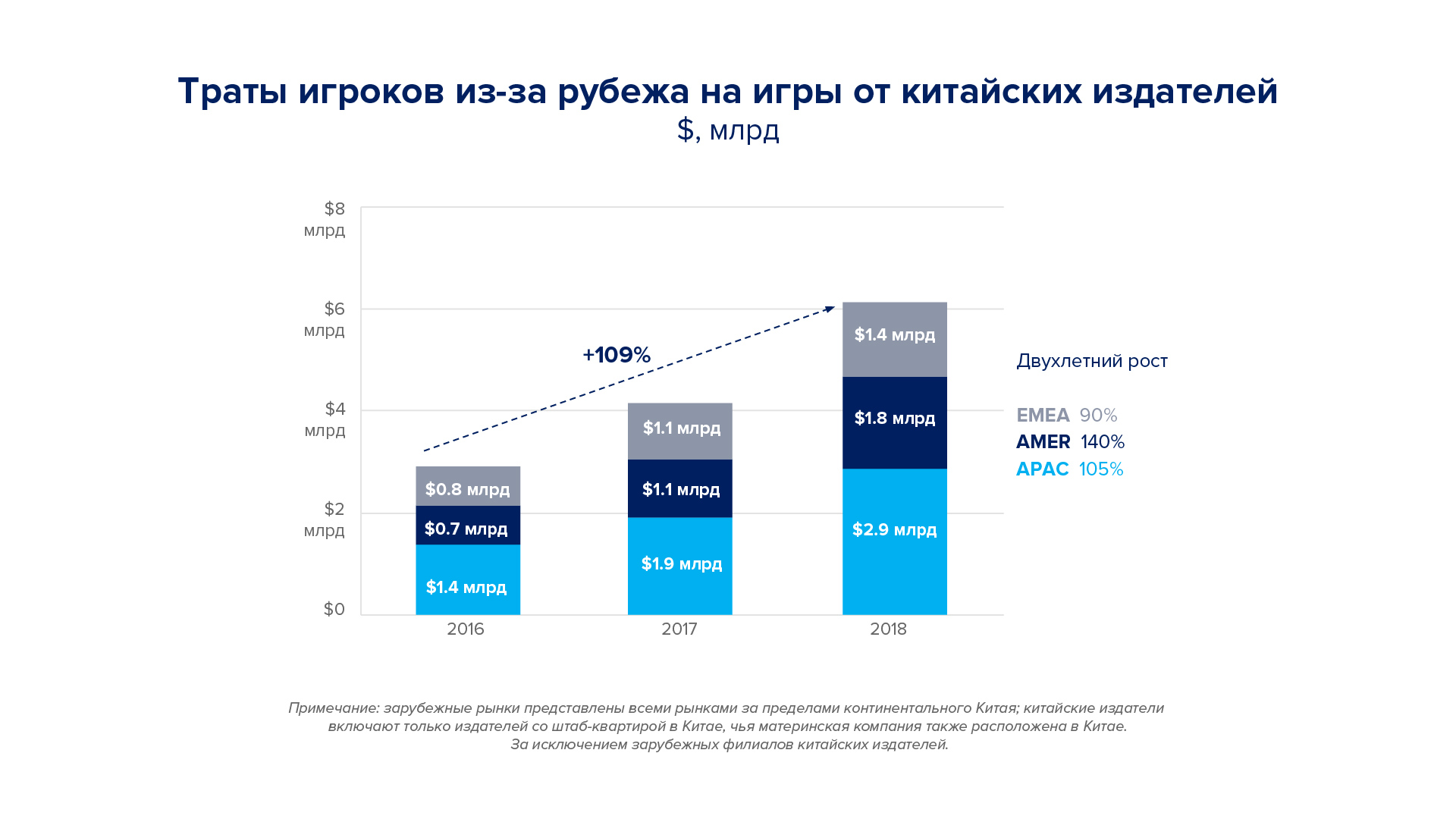

In recent years, Chinese publishers have been hard at work looking for ways to get potentially high returns in foreign markets, especially in the US. And their strategies are paying off. The average foreign gamer in North America spends 140% more on Chinese games than in 2016.

China in 2018 suspended the issuance of licenses, but the global consumer spending on games from Chinese publishers still increased. Though less than a year earlier. In early 2019, licenses for new games are gradually renewed, Chinese companies will continue to press for international expansion, and mergers and acquisitions may occur more often.

In 2018, we saw the growth of mobile gaming. Fortnite and PUBG - along with improved smartphone performance - provided a multiplayer experience that put them on par with RTS and shooters on PC / Mac or consoles. Many publishers see great potential in the mobile market, which makes it particularly attractive.

Hyper-casual games with the simplest gameplay will quickly increase the number of downloads and the involvement of players in 2019. Mobile gaming user spending is expected to reach 60% of total revenue on all gaming platforms: PC / Mac, consoles, portables and mobile devices.

The coming Harry Potter: Niantic's Wizards Unite will enter the top charts in terms of downloads, usage, and consumer spending. But whether it will surpass Pokémon GO is an open question. Pokémon GO set a record for mobile games, earning $ 100 million in the first two weeks and earning $ 1 billion the fastest.

Some more interesting ratings.

The most downloaded applications in the world for 2018

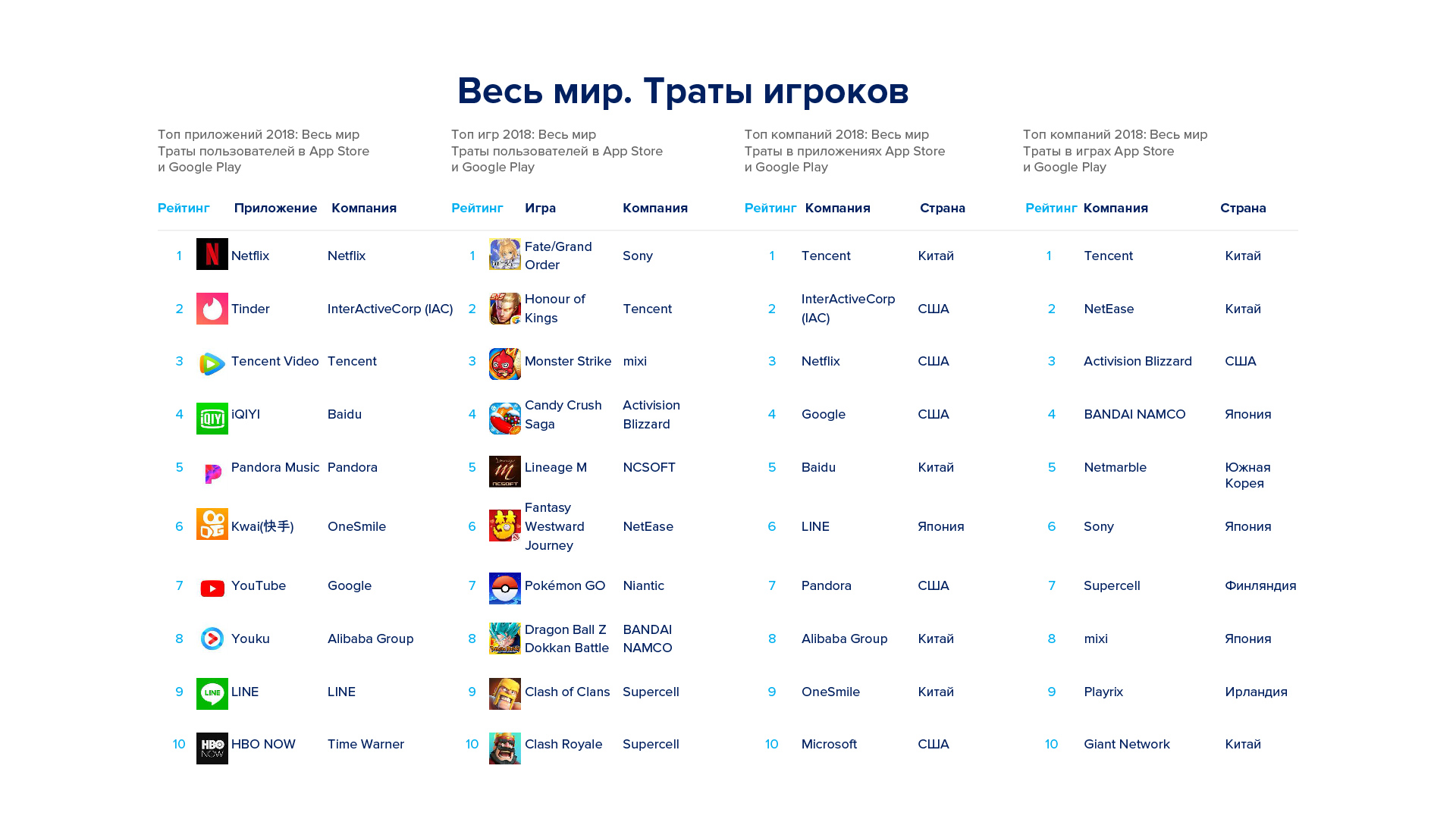

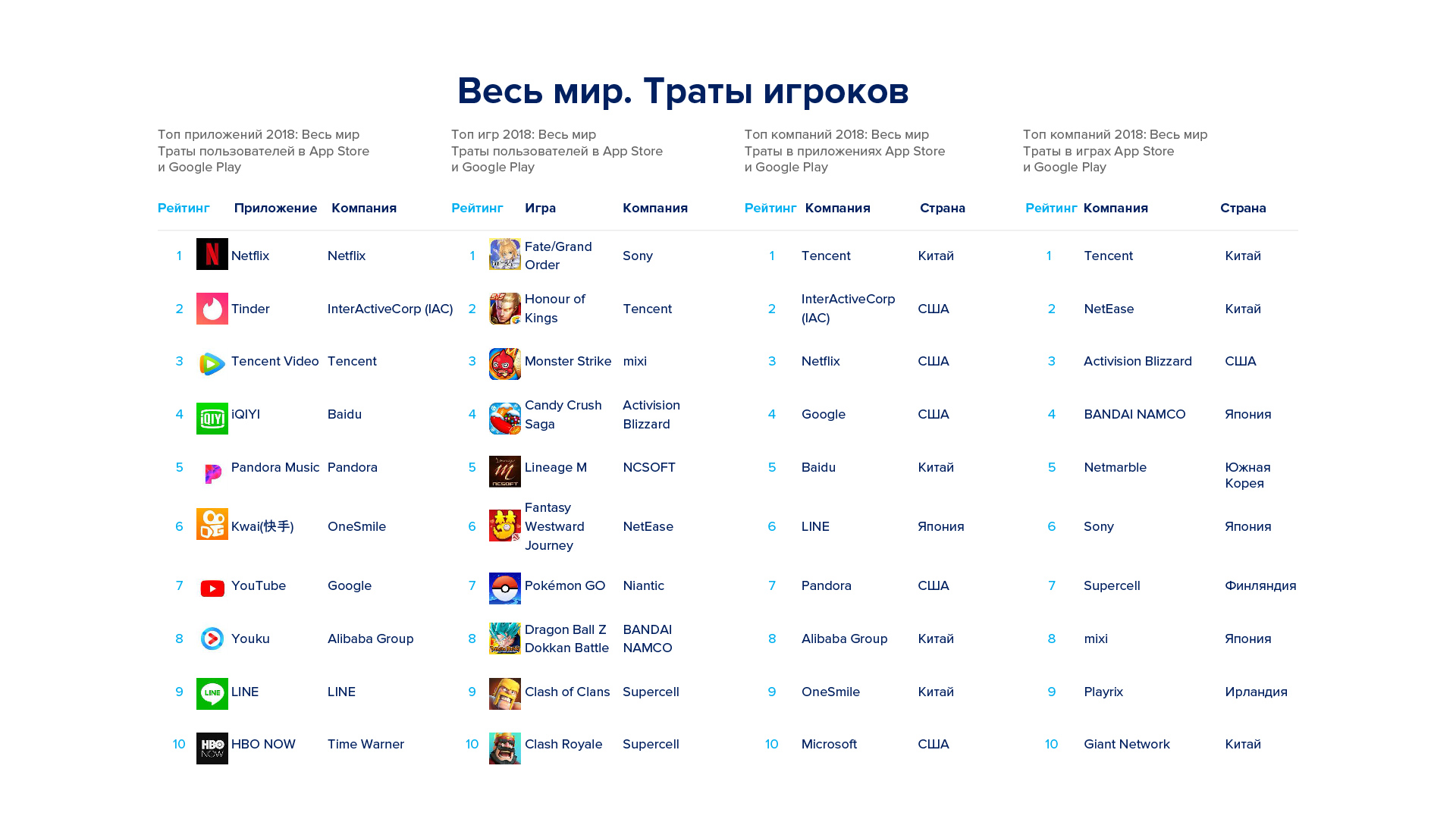

The most profitable applications in the world for 2018

Applications with the most unique users per month in the world

Most downloaded applications in Russia for 2018

The most profitable applications in Russia for 2018

Applications with the most unique users per month in Russia

Sources:

Source: https://habr.com/ru/post/443746/

All Articles