News of transport sharing: electric scooters do not live long; Lyft and Uber are going to go public

I studied data on scooter rides in Louisville, Kentucky, which are available online in the city data openness program. The latest data can be downloaded from the link . I used the older set and also included monthly travel data taken from August to December. I also included unique identifiers for each scooter in the set, since this detail was key to my analysis, and it was removed from subsequent data sets published by Louisville. The data do not distinguish between the Bird and Lime sharing companies, but since Bird began operating in August 2018 and Lime in November, the bias of the data towards Bird is understandable.

Given all this, here's what I found:

The life of a scooter is a key factor in the rental economy. The more trips and kilometers the average scooter can hit, the better for the sharing companies who need to beat off the cost of each scooter before they start earning. In October, The Information wrote that Bird spends $ 551 on a scooter, and intends to lower their cost to $ 360. At that time, I said that this means that Bird needs each scooter to make five trips per day of 5.25 months, only to beat off the costs of it.

')

The painting in Louisville turns out to be even darker. Transportation enthusiast Nathan Stevens also analyzed data on Louisville from August 9 to November 30, and I’ll give some of his figures for the scooter economy:

Using

Income

Total expenses based on information from The Information

Louisville wastes associated with sharing policy without docking stations.

Louisville Daily Scooter Economy

Are you tracking? Good. So, our company eventually makes $ 2.32 profit per day from the average scooter in Louisville. As we mentioned, data from the city say that the average scooter is working for 28-32 days. This means that a regular scooter makes a profit of $ 65 to $ 75 during its lifetime.

Catch? We make a generous assumption, saying that the company paid $ 360 for each scooter, as Bird would like. According to estimates, it turns out that the company returns only $ 65- $ 75 of the value of each scooter - that is, it loses $ 295- $ 285 from the scooter. And this does not even include an annual fee of $ 50 for a device without a docking station, $ 3000 for a license, and $ 100 for each group parking. If you take the price tag of $ 551, then the losses grow even stronger.

The numbers are not encouraging, but it should not surprise you. Electric scooters, taken by Bird for commercial sharing, are originally Xiaomi devices designed for use by one person with a weight limit of 91 kg. The average American weighs 89.7 kg , and the American - 77.4 kg. Also, these scooters were designed for use in good weather on flat surfaces. They were generally not designed to travel several times a day in any weather and on any roads, and for American riders, who on average almost fall short of the maximum weight limit, even without taking into account clothes and all sorts of things that they can carry with myself. No doubt, in the face of such an uncomfortable situation, in October, Bird revealed the details of a new electric scooter developed jointly with Okai specifically for sharing. In order for the scooters to pay off, they will have to make a giant leap in reliability and become much cheaper.

A Bird spokesperson contested a finding from Louisville data that the average life of a scooter is 28 days. “Our park is dynamic, the devices are moving back and forth. Just because it looks like he worked 28 days in Louisville doesn’t mean that he was there for the rest of his life. ” The representative didn’t answer to the question of where the scooters that were withdrawn from circulation in Louisville - or in some other cities near Bird - are moving to. It remains to assume that they just fly away.

More scooters!

And how do you like this statement:

Details about rental of electric scooters in Moscow

While Lyft and Uber are going to go public, Lyft is going to publish its S-1 form this week, discounts have become popular again. Both carrier companies are clicking on advertising, fighting for market share at the final spurt before an IPO. According to The Information, Lyft took the first step and increased its market share in the USA by 4%.

It's funny to watch how history repeats itself. Big discounts were observed when Uber and Lyft first competed for control of the US market, as the increase in the number of passengers resulted in a more beautiful growth story and in large investments. It does not matter that they practically burned money, but the schedule of their growth looked like a stick! Investors have promised them money!

At the moment, IPO complicates things a bit. As soon as Lyft releases the shares, she will not be able to control the outgoing information, and she will have to publish detailed quarterly and annual reports.

By the way, apparently, Lyft comes to the benefit of a “spoiled phone”, when the ambiguous fact voiced by Reuters several weeks ago - that “Lyft plans to inform investors about its market share approaching in the USA to 40%” - was repeated, supplemented and repeated again , as a result of which he became an unconditional truth, and today PitchBook writes in a research note that the growth of Lyft is “stable” and that the company “has recently reached a market share of 40% in the United States.”

Handouts for passengers in the process of discussing market share may look attractive, but freebies are expensive for the company, and all these expenses will necessarily affect the final Lyft figures. The company, apparently, will try to get ahead of this moment, going to the Nasdaq at the end of March, as reported by the Wall Street Journal, long before the publication of the results of the first quarter.

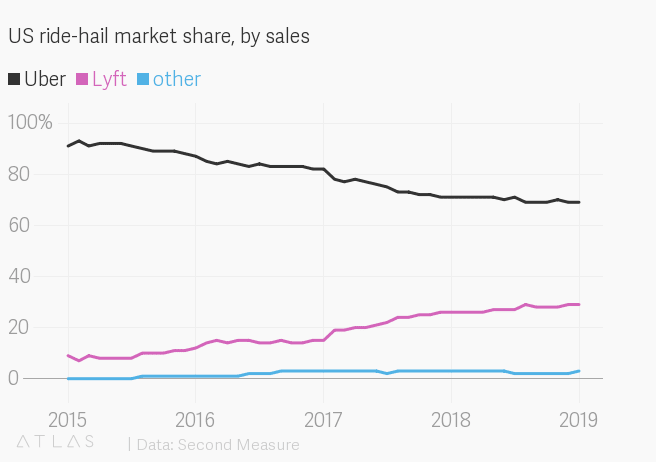

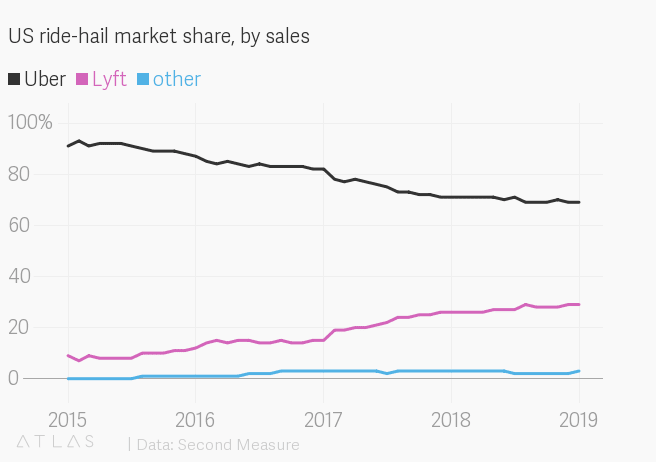

At the same time, in January, analysts from Second Measure, studying anonymous acquisitions, more conservatively approached the estimation of Lyft's share of the on-demand transportation market, and found it to be 29% in sales, compared to 69% of Uber. In the past few years, the trend is developing in favor of Lyft, whose market share is growing, and the share of Uber is falling.

If my incoming letters can be considered some kind of indicator, then Uber is not idle, watching how Lyft scatters handouts. Over the last week, Uber sent me two letters, with a 50% discount on the next 10 trips, and from 30% on 10 trips to UberX. Lyft offered me a 10% discount on 10 trips on weekdays this month; My editor, who lives in San Francisco, thought the company was “overly aggressive” and offered a 25% discount on 10 trips on a weekday.

Do not switch, and wait for Lyft to publish the S-1 form, which will start the exchange entrance party in 2019, where quite a lot of participants have already accumulated.

Given all this, here's what I found:

- The average lifetime of a scooter in Louisville from August to December was 28 days.

- Median - 23 days.

- If you remove the scooter IDs that first appear in December, so that the statistics concentrate on older scooters, then the average lifetime increases to 32 days, and the median to 28.

- Also in this case, the median scooter made 70 trips with a total length of more than 136 km.

The life of a scooter is a key factor in the rental economy. The more trips and kilometers the average scooter can hit, the better for the sharing companies who need to beat off the cost of each scooter before they start earning. In October, The Information wrote that Bird spends $ 551 on a scooter, and intends to lower their cost to $ 360. At that time, I said that this means that Bird needs each scooter to make five trips per day of 5.25 months, only to beat off the costs of it.

')

The painting in Louisville turns out to be even darker. Transportation enthusiast Nathan Stevens also analyzed data on Louisville from August 9 to November 30, and I’ll give some of his figures for the scooter economy:

Using

- 663 scooters in the city.

- The average trip length is 2.6 km.

- The average duration is 18 minutes.

- The average scooter makes 3.49 trips per day.

Income

- Bird and Lime charge $ 1 for opening the lock and $ 0.15 per minute.

- For 18 minutes, the average trip gives a profit of $ 3.7 (interestingly, this figure, taken from three months in Louisville, almost coincides with the average June figure of $ 3.65, which Bird told investors about ).

- For 3.49 trips per day, the average scooter will give $ 12.91 profit per day.

Total expenses based on information from The Information

- Bird spends $ 1.72 on each trip.

- $ 0.51 for each trip is spent on repairs.

- Payment by credit card - $ 0.41 per trip.

- User support - $ 0.06 per trip.

- Insurance - $ 0.05 per trip.

Louisville wastes associated with sharing policy without docking stations.

- $ 2,000 for a trial license (in the first six months of operation).

- $ 1000 for obtaining a full license.

- $ 50 annually for each scooter.

- $ 1 daily for each scooter.

- $ 100 for each group parking.

Louisville Daily Scooter Economy

- Scooter brings $ 3.7 per ride.

- Subtract the cost of payment, repair, credit cards, support and insurance, we get $ 0.95 per trip.

- Multiply by 3.49 trips per day, we get $ 3.32 net profit per scooter per day.

- We take a daily fee of $ 1, we get $ 2.32.

Are you tracking? Good. So, our company eventually makes $ 2.32 profit per day from the average scooter in Louisville. As we mentioned, data from the city say that the average scooter is working for 28-32 days. This means that a regular scooter makes a profit of $ 65 to $ 75 during its lifetime.

Catch? We make a generous assumption, saying that the company paid $ 360 for each scooter, as Bird would like. According to estimates, it turns out that the company returns only $ 65- $ 75 of the value of each scooter - that is, it loses $ 295- $ 285 from the scooter. And this does not even include an annual fee of $ 50 for a device without a docking station, $ 3000 for a license, and $ 100 for each group parking. If you take the price tag of $ 551, then the losses grow even stronger.

The numbers are not encouraging, but it should not surprise you. Electric scooters, taken by Bird for commercial sharing, are originally Xiaomi devices designed for use by one person with a weight limit of 91 kg. The average American weighs 89.7 kg , and the American - 77.4 kg. Also, these scooters were designed for use in good weather on flat surfaces. They were generally not designed to travel several times a day in any weather and on any roads, and for American riders, who on average almost fall short of the maximum weight limit, even without taking into account clothes and all sorts of things that they can carry with myself. No doubt, in the face of such an uncomfortable situation, in October, Bird revealed the details of a new electric scooter developed jointly with Okai specifically for sharing. In order for the scooters to pay off, they will have to make a giant leap in reliability and become much cheaper.

A Bird spokesperson contested a finding from Louisville data that the average life of a scooter is 28 days. “Our park is dynamic, the devices are moving back and forth. Just because it looks like he worked 28 days in Louisville doesn’t mean that he was there for the rest of his life. ” The representative didn’t answer to the question of where the scooters that were withdrawn from circulation in Louisville - or in some other cities near Bird - are moving to. It remains to assume that they just fly away.

More scooters!

And how do you like this statement:

Lime, one of the leading companies working with electric scooters, urges riders to be careful when using its devices, due to a technical "error" that can lead to "sudden sudden overlap" while driving - this announcement was made by the company over the weekend.Such a problem, of course, will never occur in a city like San Francisco , which is absolutely, completely and completely flat [ it was sarcasm, yes ]. Braking problems also occurred in Switzerland and New Zealand. Lime claims that the problem affected less than 0.0045% of trips, and said that “she can work to reduce, but not completely eliminate,” such risks. Indeed, no risk can be completely eliminated, but imagine that it would happen if a similar defect were found in a car. The automaker would withdraw the cars, encouraging people to bring them in for repair! In theory, Lime has even more responsibility, since the scooters belong to her, not to the users. Finding out the existence of a 0.0045% chance that your electric scooter can suddenly jam and reset you is the same as finding out that your smartphone has a small chance of self-ignition. The risk is small, but perhaps it will not suit you anyway.

The company reported that on tests it was found that sudden braking usually occurs when the scooter quickly goes downhill. The danger caused Lime to organize a remote firmware update, aimed at fixing the glitch, which led to a decrease in the number of cases of sudden braking.

Details about rental of electric scooters in Moscow

Access to the exchange

While Lyft and Uber are going to go public, Lyft is going to publish its S-1 form this week, discounts have become popular again. Both carrier companies are clicking on advertising, fighting for market share at the final spurt before an IPO. According to The Information, Lyft took the first step and increased its market share in the USA by 4%.

It's funny to watch how history repeats itself. Big discounts were observed when Uber and Lyft first competed for control of the US market, as the increase in the number of passengers resulted in a more beautiful growth story and in large investments. It does not matter that they practically burned money, but the schedule of their growth looked like a stick! Investors have promised them money!

At the moment, IPO complicates things a bit. As soon as Lyft releases the shares, she will not be able to control the outgoing information, and she will have to publish detailed quarterly and annual reports.

By the way, apparently, Lyft comes to the benefit of a “spoiled phone”, when the ambiguous fact voiced by Reuters several weeks ago - that “Lyft plans to inform investors about its market share approaching in the USA to 40%” - was repeated, supplemented and repeated again , as a result of which he became an unconditional truth, and today PitchBook writes in a research note that the growth of Lyft is “stable” and that the company “has recently reached a market share of 40% in the United States.”

Handouts for passengers in the process of discussing market share may look attractive, but freebies are expensive for the company, and all these expenses will necessarily affect the final Lyft figures. The company, apparently, will try to get ahead of this moment, going to the Nasdaq at the end of March, as reported by the Wall Street Journal, long before the publication of the results of the first quarter.

At the same time, in January, analysts from Second Measure, studying anonymous acquisitions, more conservatively approached the estimation of Lyft's share of the on-demand transportation market, and found it to be 29% in sales, compared to 69% of Uber. In the past few years, the trend is developing in favor of Lyft, whose market share is growing, and the share of Uber is falling.

If my incoming letters can be considered some kind of indicator, then Uber is not idle, watching how Lyft scatters handouts. Over the last week, Uber sent me two letters, with a 50% discount on the next 10 trips, and from 30% on 10 trips to UberX. Lyft offered me a 10% discount on 10 trips on weekdays this month; My editor, who lives in San Francisco, thought the company was “overly aggressive” and offered a 25% discount on 10 trips on a weekday.

Do not switch, and wait for Lyft to publish the S-1 form, which will start the exchange entrance party in 2019, where quite a lot of participants have already accumulated.

Source: https://habr.com/ru/post/443014/

All Articles