How 2019 will change Russian stores

What legislative changes will affect retail in 2019, how to prepare for them, and what will happen to customer activity in this article.

VAT 20% and FFD 1.05

The first and very serious change for Russian retail will come into force already on January 1, 2019 - from 00:00, shops will have to switch to 20% VAT and use the fiscal data format (FFD) 1.05.

')

In order to meet these requirements, you need to upgrade your cash registers (online cash registers) and update the cash register software.

What inconveniences will occur on the way of retailers:

- increases the cost of ownership of cash register and cash register software;

- in the cash software you need to add data that is required according to FFD 1.05;

- Thoroughly test a combination of "cash software - KKT".

Let's explain in advance why we will talk so much here about the bundle of “cash software - KKT”. 54-FZ changed the methodology for calculating and sending data to the FTS. Previously, taxes were calculated by the cash software and through the accounting system sent information about them to the tax. Now this process also duplicates the cash register: the cash software sends information on the prices of goods to the online cash desk, and it recounts them taking into account VAT.

We will sort by points:

Cost of ownership. Several expenses are added at once:

- Many manufacturers of online cash registers updated the KKT firmware into a separate paid service. Moreover, the firmware is sold separately for each CCP. If the network has 100 online cash registers, then the amount increases proportionally. Moreover, a number of manufacturers sell so-called "annual" and "one-time" firmware. The first takes into account in one amount all the changes that may still occur with the light hand of the legislators in the FFD. The second means that for each comma that developers will contribute to the online cash registers that meet the requirements of the law, you will have to pay extra. That is, in the case of a “one-off” every change in the regulatory framework, it is likely to entail a new paid firmware;

- some developers of cash register software did the same: for upgrading their cash programs so that they work correctly with the updated CCP drivers, they requested additional payment.

Updated data. According to the requirements of 54-FZ, FFD 1.05 must include the following mandatory details that will be contained in the check:

- FFD version;

- TIN cashier;

- place of payment;

- sign of the method of calculation;

- the amount of VAT for the calculation;

- prepaid check amounts (advance payment), postpay (credit), counter-presentation;

- email address of the sender of the check, the address of the site of the Federal Tax Service.

Cashier software must send information about all these details in the CCP. Accordingly, it is necessary to update the existing data in the software and add the missing ones.

Preliminary testing. Since the transition to FFD 1.05 and a 20% global VAT is not one kind of CCV, but all the retailer's online cash registers, then in order to avoid sudden problems with the advent of the new year, you need to coordinate actions, deadlines and complete pre-testing.

Testing is also needed because a number of online cash register manufacturers regularly change interaction protocols. Therefore, you should make sure in advance that the retailer's cash register software supports the new version of the KKT driver.

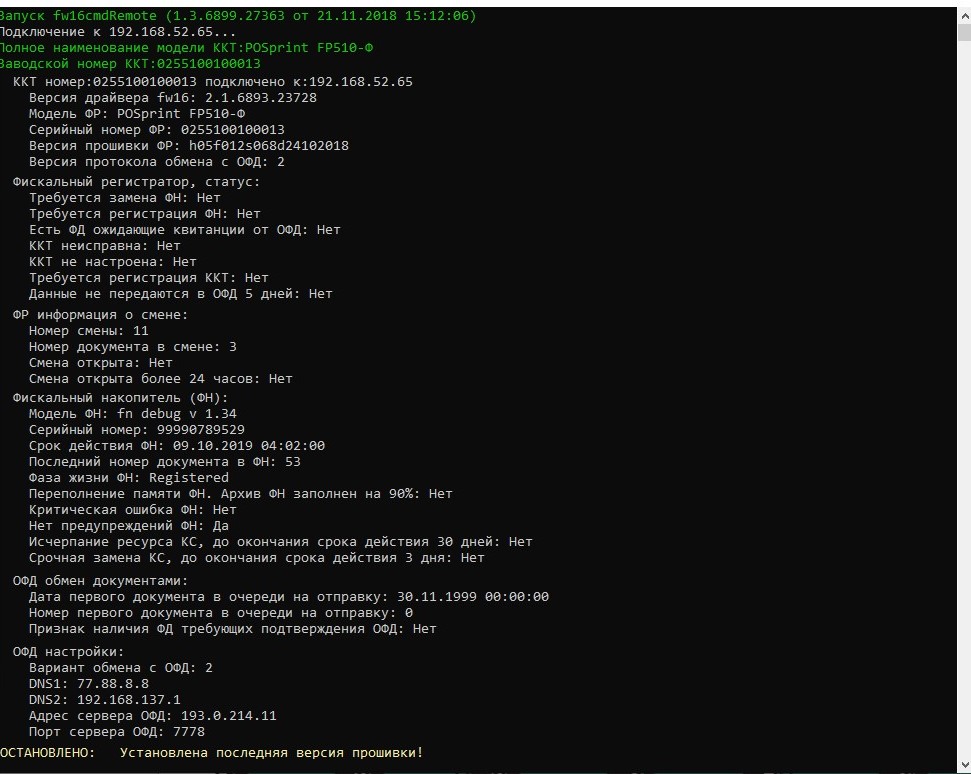

The main problem: time. All work on upgrading the CCP firmware must be done in the remaining days before the end of the year. And one of the main problems here is that not all manufacturers of online cash registers can remotely update their devices: that is, you need to go legs to each CCP. If you have 2-3 stores, then the problem is small, and if we are talking about a federal retailer with outlets in most large cities of our vast Motherland, then labor costs increase significantly. However, if you wish, you can solve this problem. For example, we can remotely update our CCV ( SKY-PRINT Mini-F , SKY-PRINT 54-F , POSprint FP510-F ) with a single utility (figure below).

Mandatory labeling of goods

Mandatory labeling of goods starts from 2019. It will affect the following products: tobacco (from March 1, 2019), shoes (from July 1, 2019), tires and tires (from December 1, 2019), perfume and eau de toilette (from December 1, 2019), cameras and lamps- flashes (from December 1, 2019), garments (from December 1, 2019 will be marked: knitted blouses, blouses and knitted or crocheted blouses — for women or for girls, men's, women's and children's coats, short coats, capes, cloaks, jackets, coats, jackets and similar outerwear, clothing made from leather or composite leather).

How will the labeling be done. Each seller, distributor of goods subject to labeling must take care that a special control mark (DataMatrix) is affixed to them. Scanned information stored in it will be sent to the “Marking” information system, which is operated by the Federal Tax Service of the Russian Federation. Thus, the state will be able to track the entire chain of product life from the moment of production to the purchase by the final consumer.

Despite the fact that the authorities do not oblige manufacturers to label goods (this obligation is imposed on sellers), it is most likely that this task will fall on their shoulders. This applies to both domestic and foreign manufacturers, since importing goods into our country without DataMatrix is prohibited. Moreover, the products must be marked in advance, prior to receipt of the customs service.

What retailers need. However, sellers are completely free from the need to self-label goods will not. They need to take care of the marking of stock balance in advance, as well as be able to place the DataMatrix on the product in case of its return. This means that retailers still have to spend money on additional commercial equipment that will help them read and apply check marks.

It:

- 2D barcode scanners that read DataMatrix codes;

- data collection terminals (TSD), able to work with DataMatrix;

- label printers that can print DataMatrix.

The main problem: the minimum information available. Of all the goods subject to mandatory labeling in 2019, more or less worked out the scheme of working with legislative innovations only for tobacco sellers. For all other categories, pilot projects are underway, and only on the basis of their results will regulatory documents be finalized. Therefore, the main advice to all retailers is to monitor sites of the “Honest Sign” type as regularly as possible and to participate in pilot experiments in order to assess the full extent of the tragedy and restructure business processes in advance. There is no way to avoid labeling: if it was first introduced in order for the state to fight counterfeit, now its main goal is to give the tax and other supervisory body the maximum amount of data and opportunities for business control and timely replenishment of the treasury. And do not forget that by 2024 marking will become mandatory for all goods sold in the country. Therefore, even if what you are selling now while it is not subject to it, you need to be aware of the matter - marking will affect you anyway.

USAIS 3.0

The transition to EGAIS 3.0 began in 2018, but it will fully affect retailers selling alcohol, and in the beginning of 2019. After all, they will have to adapt their business processes to their products, as well as modified excise stamps.

Alcohol accounting mark. Until October 1, 2018, producers, importers and sellers of alcohol were leading a serial system for the registration of excise stamps. That is, these special marks were not tied to specific bottles of alcohol. Excise stamps were issued for each specific batch of alcohol by the number of bottles produced. Therefore, duplication of information regularly arose: the seller could scan the same bottle several times - then Rosalkogolregulirovanie received duplicated information. Of course, this violation was punished with a fine, but not very severe.

Even at that time, some software manufacturers tried to combat the duplication of excise stamps. For example, in our "Profi-T" a ban on such actions has been implemented - the seller cannot re-scan the same bottle of alcohol.

From October 1, 2018, the movement of all alcoholic beverages is carried out on the basis of the metering (including acceptance of goods): a certain excise stamp must correspond to each bottle of alcohol.

Changes in excise stamps. Track each bottle of alcohol from the moment of its production to the sale of the authorities get due to the changed format of the excise stamp. The old format (from 2012) from January 1, 2019 will be forbidden to use. According to the decree of the Cabinet, until this time, the Federal Customs Service must conduct an inventory of old stamps and destroy their remnants.

On the old format of excise stamps were placed two codes: PDF417 and DataMatrix. At the same time at the checkout it was enough to scan only one: PDF417. Cash scanners even specifically set up so that they do not read DataMatrix and cashiers thus did not make mistakes.

In the new format of the excise stamp, only one code was left - DataMatrix. It consists of 150 characters, reflecting at the same time: brand type, brand series, brand number, EGAIS service information, checksum and electronic signature created using SKZI according to GOST, brand's date of manufacture.

By the way, for customers Rosalkogolregulirovanie developed a special application "AntiKontrafakt Alko" , which will allow you to independently determine the legality of alcoholic beverages.

What is the difficulty for retailers. They need until January 1, 2019:

- change business processes and work with staff (instruct cashiers);

- reconfigure the equipment so that it can scan the DataMatrix (both at the stage of acceptance and at the stage of sale);

- purchase the missing commercial equipment;

- check the relevance of the cash register version for working with modified excise stamps and mark control.

Even greater decline in consumer demand

The fact that retail is heavier than one year from year can be seen with the naked eye. The main reason is that, although there is no official crisis in Russia, the fall in consumer demand continues. Already, we can assume that 2019 will not be an exception, and it may turn out to be even harder than the previous ones. The Ministry of Economic Development has published a pessimistic forecast, which suggests GDP growth by 1.4% next year, real wages — below 1% and inflation above 4%. Experts call several laws at once that will affect the financial condition of Russians:

- an increase in the base rate of VAT from 18% to 20%;

- double increase in utility tariffs;

- tax for self employed.

In this regard, many analysts believe that in 2019, Russians will be less likely to afford large purchases, chipping them away for a more favorable moment.

That is, the task of attracting and retaining customers becomes even sharper in front of retailers. How to do it? Here are some of our tips:

- work more closely with customer loyalty - implement loyalty programs, conduct promotions;

- to expand the sphere of influence: the business should be presented not only offline, but on the Internet, so that buyers can choose which platform is more comfortable for them to interact with you;

- offer new services: implement Click & collect technology, make business hybrid, for example, open a cafe on the basis of a grocery store, deliver products;

- introduce innovative technologies that allow you to build up from competitors, create a WOW-effect and attract customers;

- give preference to reliable trading equipment and software so as not to increase the cost of ownership due to endless repairs.

So, 2019 for retail will turn out to be difficult: the scope will be affected both by changes in the legislative base and by the difficult economic situation in the country. But a sound approach to building business objectives and systematic preparation for new requirements will help keep the trading network afloat.

Source: https://habr.com/ru/post/433048/

All Articles