What do you know about electricity wholesale and retail?

Once upon a time there was Petya, he had his own bakery “Fresh Bun”. The bakery worked three powerful electric furnaces. The bakery was connected to a 110 kV power line. This line is considered high-voltage. Ordinary houses are connected to lines 220, 380 V, that is, almost a thousand times smaller. Petya is a so-called industrial consumer; he buys electricity for his bakery from MoyEnergoSbyt. In fact, all electricity consumers can be divided into two large groups: industrial consumers and the public. In Russia in 2017 the share of industrial consumers accounted for about 85% of all electricity consumed. The price of electricity for Petina “Fresh Bun” in the same 2017 was 4 rubles / kWh, that is, for every 250 kWh, Peter paid a bag of money - 1,000 rubles.

1. Wholesale and retail electricity markets

At first the bag should be divided into two large parts: retail and wholesale . I tell those who are in the tank that the wholesale electricity market has been operating in Russia since 2006, in which large stations (with an installed capacity of more than 25 megawatts) sell electricity, and large consumers (the power of power receiving equipment more than 20 megawolt-amperes) buy it. Yes, yes, you heard right, it is the electricity market! The majority of consumers in the wholesale market buy electricity not for themselves, but only for the purpose of subsequent resale in the retail market. Such consumers are called sales companies . They work like a Pyaterochka store: bought wholesale, cheaper, sold at retail, more expensive. That and live. Since Peter bought electricity for “Fresh Bun” from the office of MoyEnergoSbyt, this means that he was a member of the retail market. There are, however, the so-called end users, that is, in fact, very large industrial consumers who buy electricity on the wholesale market for themselves. These are, for example, huge factories and factories that need a lot of electricity for work. There are few of them.

The retail electricity market was not born yesterday either, but began to work in Russia since 2011. And what happened before 2006-2011? Before that there were tariffs: the payment of all the electricity produced and consumed was carried out at the rates set by local legislators.

')

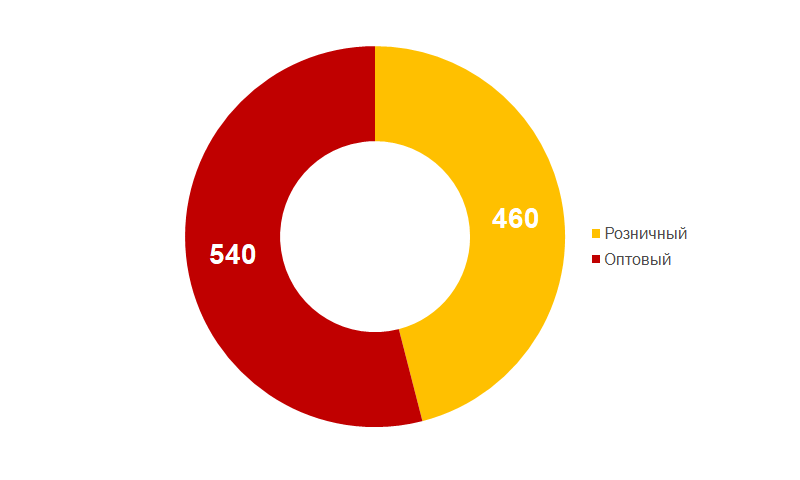

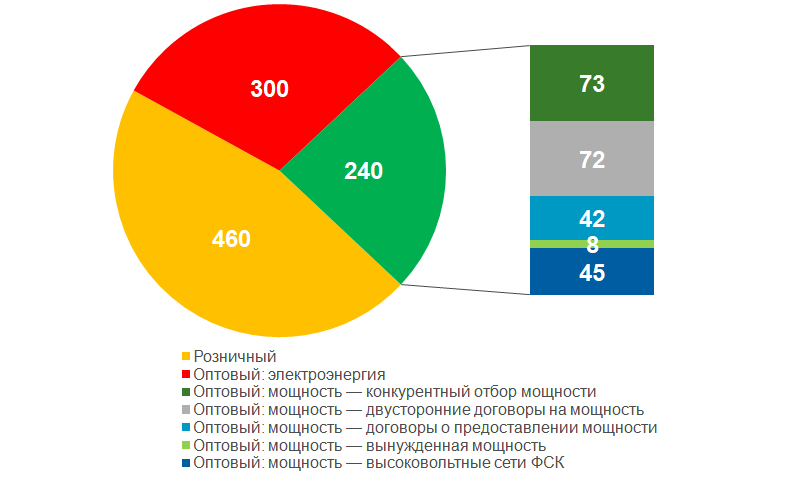

Fig. 1. Wholesale and retail part in the cost of electricity

At the first stage, we will divide Petina 1000 rubles into two parts: 540 escaped to the wholesale market, and the remaining 460 into the retail market. And this ratio is true not only for Petit, but also for all retail industrial consumers connected to the 110 kV network.

2. Payment for electricity and power in the wholesale market

Electricity is one of the types of energy obtained by converting the initial energy (for example, solar or wind energy) or energy carrier (for example, coal and fuel oil) into a combination of current and voltage in an electrical network. The functioning of modern civilization is 100% dependent on electricity. Anecdote on the subject. Google said: “I’ll find everything,” Facebook said: “I’ll make friends with everyone,” youtube said: “I’ll show you everything,” and commented on the electricity: “Hehe” ...

Electricity as a commodity has two key features, which in English were called demand side flaws (cracks). In the Russian official translation, these are “organic deficiencies on the demand side”. Hello to the translators!

First, by consuming electricity, we do not know its cost price . Secondly, the logistics of electricity , i.e. its transmission over the network, is not subject to the laws of economics, but to the laws of electrical engineering . I will dwell a little more on these two cracks.

Why we do not know the cost of electricity? Because the process of generating and transmitting electricity from power plants to consumers is a complex technological process. Every time when a consumer switches the equipment on or off from the network, the load of the power plants changes, their efficiency changes and, as a result, the cost of electricity changes. Since the load is switched on and off permanently, the cost of electricity varies constantly. However, it should be noted that most of these changes remain in a known range.

What is inconvenient logistics, subject to the laws of electrical engineering? Such logistics is inconvenient for concluding bilateral agreements. Not far from Petina bakery lives Vasya, who has a power station. This power plant generates electricity at a price of, say, 1 rub / kWh. However, Petya cannot go to Vasya and conclude an agreement on the purchase of electricity at a price of, say, 1.5 rubles / kWh. Why? Because when a power station produces electricity and gives it to the network, it will flow to the network where the laws of electrical engineering tell it, and not the agreement between Petya and Vasya. Hello to everyone who has studied the theoretical foundations of electrical engineering!

And one more important aspect: power balance . The constancy of the frequency of the AC network 50 Hz is very important! This constancy provides an instant balance of production and consumption of electricity (it’s instant, it means power): as much as we consume, we must produce as much. In case of excess of consumption over production, the so-called unbalance occurs, which leads to a decrease in frequency and voltage in the power system. If suddenly the unbalance becomes large, then apply special regulatory methods, for example, forcibly cut off consumers. Power supply reliability for power engineers is more important than “Our Father”.

In connection with the foregoing, the electricity market is organized as follows: there is an office called the exchange (in Russia it is called the Administrator of the trading system), which buys all the electricity from power plants and sells it to consumers.

Power generation costs can be divided into variable and fixed. The variable costs usually include fuel costs. For thermal stations that burn gas, coal, fuel oil to generate electricity, such costs can be from 0.3 ... 20 rubles / kW · h. For hydropower plants or nuclear power plants, such costs can be considered zero. The fixed costs include the wage fund, the cost of equipment repair and, most importantly, the construction of new stations.

If it is customary to share costs in the market, then two goods are traded: electricity and capacity. The revenue from the sale of electricity covers the variable costs of power plants, the revenue from the sale of power is fixed. Two products in the wholesale electricity market exist in Russia, UK, USA. In other electricity markets, for example, in Europe, Scandinavia, there is only one commodity and the price of electricity on the market includes the total costs of the stations.

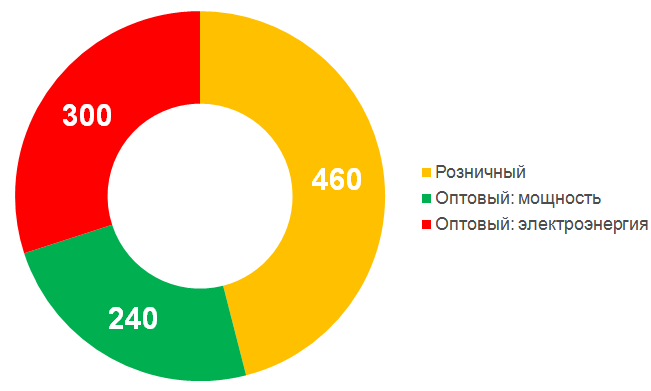

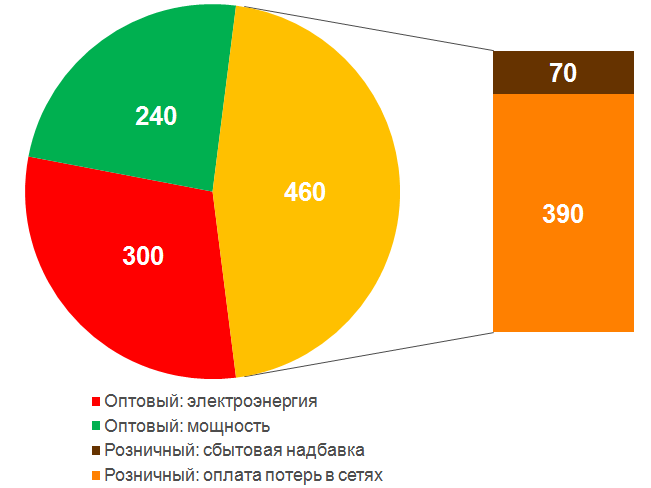

Fig. 2. Refined structure of the cost of electricity in the part of the wholesale market

From Petin 540 rubles, which went to the wholesale market, 300 rubles went to pay for variable costs of power plants and 240 rubles to pay for fixed costs.

2.1. Payment of electricity in the wholesale market

For what did Peter pay 300 rubles?

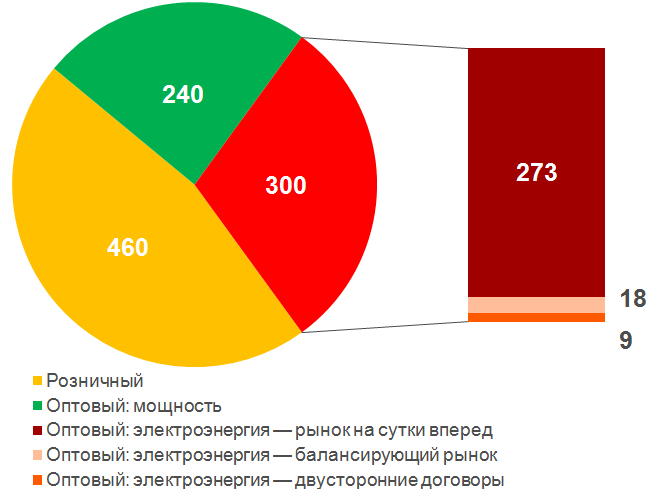

Fig. 3. Components of the cost of electricity in the wholesale market

The day ahead market . The largest part of the payment for electricity in the wholesale market falls on the day-ahead market: out of 300 rubles, this sector accounts for 273 rubles. In the day-ahead market, power plants and consumers trade their generation and consumption plans. Be careful: trade plans for production and consumption. What does this look like? Today, until 13:30 Moscow time, all power plants that are participants in the wholesale market submit their generation plans and electricity prices for tomorrow to the exchange. Moreover, the price of electricity includes only fuel costs. Simultaneously with the stations, electricity consumers submit to the stock exchange their plans (essentially forecasts) of consumption. Based on this information, the exchange calculates the load of each station to ensure the planned consumption and exchange prices for electricity. Petin "MoyenergoSbyt" submits a total consumption plan for all its consumers, including Petina bakery. We will understand, for what Peter pays in this case? In fact, 273 rubles out of 1000 went to pay for the costs of power plants for fuel.

Balancing market . When tomorrow comes, consumers, be they wrong, deviate from their plan-forecast. In this connection, it is necessary to deviate from the plan and power plants. For example, they planned to consume 100 kWh, and consumed 102 kWh. The station’s plan was to produce 100 kWh, and this output had to be increased to 102 kWh. These are deviations from the plan called the system balancing activity. The cumulative value of all balancing actions (decrease and increase in the output of power plants) is paid in the so-called balancing market. And the more the consumer deviates from the plan, the more expensive is the electricity for him. The reverse logic works for the power plant: the more the power plant takes part in balancing the system, the more it earns. What does Petya pay for? 18 rubles out of 1000 had to be paid to the stations that balance the system in real time.

Free bilateral treaties . This is a type of bilateral agreements, the volumes and prices of which are taken into account in the day-ahead market. The conclusion of bilateral contracts for electricity is always a dance with a tambourine. Why? We discussed above that electricity doesn't care about the economy. It’s still all right when it comes to trading in “virtual volumes of electricity”: an uncle is sitting, he has a small power station with a capacity of 25 megawatts, and he also buys a gigawatt · clock (very much) electricity at a lower price, then sells the same gigawatt · clock more expensive and earns. Such an uncle is called a trader. In countries where trading in virtual electricity is permitted, there are no special problems with bilateral agreements, since virtual electricity is subject to the laws of economics. In Russia, trading is prohibited: you cannot buy or sell what you are not ready to consume or produce. Why? Because the activity of traders leads to the volatility (variability) of electricity prices. And our regulators at the word volatility begin to convulse: anything, but not this! But Russia really wants to have exactly the electricity market and keep up with developed countries. So they invented a stupid type of contract, which seems to be there, but it does not allow either to earn money or reduce risks. So no one really uses such contracts.

For what did Peter pay 9 rubles out of 1000? In fact, he paid a tiny bilateral contractor, who apparently, for a change, concluded “MoyEnergoSbyt”.

2.2. Payment capacity in the wholesale market

Payment for capacity, i.e., covering fixed costs of power plants, on the wholesale market is achieved through several types of contracts. Let's see, for what did Peter pay 240 rubles?

Fig. 4. Power Cost Components in the Wholesale Market

Competitive power selection . This is the exchange mechanism for paying fixed costs of operating power plants. Power plants are applying for readiness to generate electricity for several years to come. The exchange forms a consumption plan and carries out the so-called competitive power take-off. What is the competition? The competition between power plants is that those who have these costs lower will receive payment for their fixed costs. Based on the results of the selection, we know which stations are planning to be in operation in the long term and how much they will pay for maintaining the equipment in working condition. Now, for example, the results of competitive selection for 2021 are known. What did Petya pay for? In fact, 73 rubles out of 1000 were spent on the repair of operating power plants.

Free capacity contracts . Similar to bilateral electricity contracts, bilateral power contracts have been developed. The purpose of concluding such contracts is to reduce the risk of the price of competitive power selection. 72 rubles out of 1000 were spent on the repair of operating power plants, with which MoyEnergoSbyt entered into a bilateral agreement without the knowledge and permission of Petit.

Power contracts This is a special type of contract under which payment is made for the construction of new power plants in Russia. Moreover, the return of investments with high yield on such construction is guaranteed by the state. That is, if the actual yield is lower than the guaranteed one, then the state will pay extra from the budget. According to these types of contracts, all types of stations are being built: thermal, hydro and nuclear stations, as well as solar and wind stations. I would like to note that by 2024, in Russia, using solar and wind power plants, they plan to produce 4.5% of the total electricity. What did Petya pay for? 42 rubles out of 1000 went to pay for the construction of new power plants, including solar panels and windmills.

Contracts with power plants that produce electricity in a forced mode . There are special stations in the power system. For example, a power plant simultaneously produces electricity and heat for the city of N. Such power plants are called combined heat and power plants (CHP). At the same time, the costs of this power plant for generating electricity and repair are enormous. Then, for economic reasons, it should be turned off altogether. However, turning it off will lead to the fact that the whole city will remain without heating and hot water. Then we are forced to maintain this power plant in working condition due to additional fees. What did Petya pay for? 8 rubles out of 1000 were spent on repairing power plants that work in forced mode.

High-voltage networks FGC . High-voltage networks are called a set of power lines with a voltage of 110 kV and above. All high-voltage networks belong to one state office - Federal Grid Company (FGC). Maintenance and development of high-voltage power lines consumers pay at the rate. I could not find an exact assessment of the share of FGC in the total volume of the open access market. However, according to my estimates for Petin "MoyEnergoSbyt" such a fee is about 45 rubles out of 1000. So, for what did Peter pay? 45 rubles out of 1000 went into the pocket of FGC to cover the fixed costs of maintenance and development of high-voltage power lines. It should be noted that such lines are very important for the electricity market. Due to two consumption cracks (see above), competition in the wholesale electricity market is possible only among power plants. And this competition is the higher, the better developed high-voltage networks.

3. Payment for electricity in the retail market

3.1. Payment services sales company

What happens in the retail market? MoyEnergoSbyt bought electricity on the wholesale market, and all expenses for this purchase were safely transferred to Petina's bakery. Additionally, the sales have only to get money for the work. The payment for MoyEnergoSbyt’s activities is made at the expense of a sales markup. Petya paid 70 rubles out of 1000 for the honest work of his sales. For comparison: Petins, the cost of building new stations was only 42 rubles.

Fig. 5. Components of the cost of electricity in the retail market

It would seem that this is all? No, it remains to pay the losses in the networks.

3.2. Payment of electricity transmission services

In Russia, there is a special type of contracts for electricity - regulated contracts . This type of contract is designed to provide the population with cheap electricity. In 2017, the population accounted for about 15% of all electricity consumed. The population, as you may have noticed on their electricity bills, pays this very electricity at a tariff. Let us distract for a minute from the industrial consumer, and look at our hero as a citizen and owner of an apartment. Our acquaintance, Peter, pays for the light in his apartment at the rate set by the local executive authorities for the population, say, 3.5 rubles per kWh. In order to provide the necessary volumes of electricity at a given price, distribution companies enter into special agreements with power plants that impose such a tariff. This, in essence, is the legacy of the previous system of functioning of the power industry, when all payments were made at a tariff. The population is a member of the retail electricity market and, like industrial consumers, buys electricity from a distribution company.

The problem arises when the costs for the production and transmission of electricity for the population exceed the tariff: the value of the tariff is 3.5 rubles per kWh, and the costs, say, 8.3 rubles per kWh. Who will pay the difference: who will pay 4.8 rubles per kWh? Shifting costs from place to place, namely from the population to industrial consumers, is called cross-subsidization.

Now back to the industrial consumer - Petina bakery "Fresh Bun." The price of electricity for Petit, the owner of Fresh Bun, is 4 rubles / kW · h, and the price for the population is 3.5 rubles / kW · h. Look at your receipts from last year and make sure that your fare was close to the specified value. At the same time, the bakery is connected to high-voltage networks, in which losses amount to about 3%, and the population is connected to low-voltage networks, in which the total losses reach 30%. In order to maintain low tariffs for the population, industrial consumer Petya, the owner of Fresh Bun, pays astronomical grid companies 390 rubles out of 1000. In fact, Petya pays a lot of bills at once:

- own losses (even if they are 3%, but they must be paid);

- the difference between the tariff for the population and the real costs of the station (per population);

- losses in low voltage networks (per population);

- maintenance of medium and low voltage network facilities (per population).

Tariffs of regional grid companies are set by local executive authorities. Moreover, the calculation of the tariff is made in such a way that it will break the leg and find out how much money was spent on each article, it is almost impossible.

In 1985, the tariff for the population was 2.5 times higher than the tariff for industrial consumers. In 2017 in Russia, after all the sighs about the dangers of cross-subsidization, these are comparable values.

4. Conclusion

We examined the structure of the cost of electricity for an industrial consumer in the retail market. I recall that the share of industrial consumers in 2017 accounted for about 85% of all electricity consumed. The vast majority of industrial consumers buy it on the retail market.

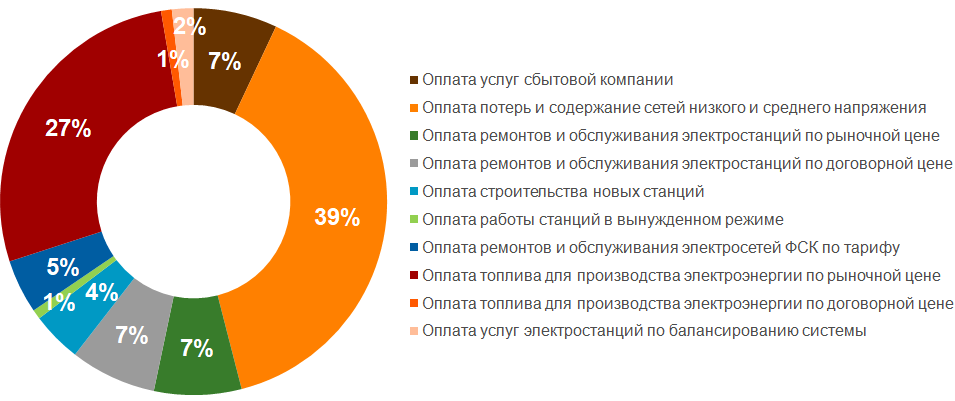

Fig. 6. The structure of the cost of electricity

What will such industrial consumers pay for? From the figure above it is easy to distinguish three main articles:

- payment of losses and maintenance of low and medium voltage network facilities 39%;

- payment of fuel required for electricity generation, 27% + 1% = 28%;

- payment for repairs and maintenance of power plants in operation, 7% + 7% = 14%.

On the one hand, there are costs for maintenance and repair of power plants , as well as costs for the purchase of about 200 million tons of fuel in 2017. In total, these costs make up 42% of the total cost of electricity for industrial consumers, such as Petina “Fresh Bun”. On the other hand, there is a payment of losses in networks and services of network organizations at turbid tariffs set by legislators in the amount of 39% of the total cost of the same electricity.

An obvious question arises : can the maintenance of low and medium voltage networks and the payment of losses in them be comparable in size to the costs of maintaining and operating power plants, including the cost of heating stations for fuel? I have no answer to this question. Maybe you have? ..

Links

The baseline data for the post is taken from the annual report on the activities of the NP Council of Market Association for 2017 , as well as Thomson Reuters analytical report “Review of retail electricity prices for industrial consumers in 2017”.

You can read more about electricity trading on the wholesale market and analyzing wholesale electricity prices in my new popular science article: I. Chuchueva. A dragon about three heads: electricity, trade, analytics. Energy Info. October 2018. №6. Pp. 32 - 47.

A dragon about three heads: electricity, trade, analytics. Head One - Electricity

How is electricity fundamentally different from other products? Why is there a power market besides the electricity market? How can I trade electricity? Who is a member of the Russian wholesale electricity market? Who and how regulates this market?

A dragon about three heads: electricity, trade, analytics. Head Two - Trade

What are the stages of electricity trading in the wholesale market? What is the process of trading for market participants? How are wholesale electricity prices formed? What is the difference between wholesale electricity prices in different regions of the country?

A dragon about three heads: electricity, trade, analytics. Head Three - Analytics

How to set the task of analyzing the wholesale price of electricity? How to solve this problem? What influences the prices of the day ahead market? How to monitor wholesale electricity prices?

Source: https://habr.com/ru/post/432880/

All Articles