How we integrated for SAP stores in Europe with cash registers in Russia through 1C

We recently published an article about why foreign retailers in Russia need the service “opening of turnkey stores”. Today we would like to talk again about the Russian branches of foreign brands and retail chains, and tell you about the Pilot solution, which helps them comply with the requirements of the legislation of our country.

Why do you need such a dock between programs

Representative offices of foreign companies that are discovering the Russian market for the first time are quite difficult to quickly adapt to the requirements of our legislation. And the information systems used by them do not allow us to keep accounting records and submit tax reports that comply with our laws. At the same time, the need to have consolidated information on all representative offices in their basic information system also does not disappear, since it is necessary for the analysis and making management decisions. Therefore, foreign retailers need software that can integrate multiple systems and synchronize data into them.

')

Let us consider an example. One of the Pilot's clients, a foreign network of women's clothing stores, approached us for just such a docking. He needed to integrate the following systems:

- accounting system of the head office located abroad (SAP);

- trading system front office for the work of cash desks and other commercial equipment ( "Profi-T" );

- system of visitors in stores (SM Counter);

- accounting system ("1C Accounting").

Therefore, the integration system should have the following basic functions:

- import of assortment and prices (from the main system of SAP company);

- import notifications of shipments of goods sent to Russia (from the main SAP system);

- import of data on actually received goods (from the customs declaration file provided by the customs broker);

- formation of documents on receipt of goods in stores (including on the basis of data from data collection terminals - TSD);

- the formation of documents moving between stores (including on the basis of data TSD);

- formation of inventory documents in stores (including on the basis of data TSD);

- import and consolidation of sales data from all stores of the network (from the trade-office system Profi-T);

- export of consolidated sales results (to SAP’s core system);

- reporting on product distribution and performance results in various cuts;

- export of performance data in order to provide tax reports to the accounting program (in “1C Accounting”).

To solve the task set before us , Pilot specialists developed the RBS system (Retail Backoffice System) on the 1C 8.3 platform . Today, it is already successfully used by famous fashion retailers in the Russian market. The RBS system is designed to collect, process and consolidate data about the customer’s activities in order to control activities, make management decisions, and submit financial statements to government bodies.

RBS exists in several modifications - for each customer has its own, since it is obvious that there can be no universal print solution in this case. After all, retailers come from different countries and almost all of them have their own basic information systems and accounting features. In addition, various cash programs can be used (for example, Profi-T, Retail Pro). Nevertheless, the composition of the basic modules of RBS varies slightly from version to version, but the program is rather seriously refined to the requirements and characteristics of each customer.

How RBS works

As part of our example, we want to show a description of the work of one of the latest modifications of RBS. The order of movement and data processing in electronic form is as follows:

1. From the SAP system of the head office to the data exchange catalog, a server in Russia receives an idoc file with a list of goods and retail prices.

2. The list of products and retail prices from the idoc file are loaded into the RBS database (automatic and manual mode is possible). Price values are periodic and in the presence of goods in the database are recorded only in case of change.

3. Upon the formation of shipments and shipment of goods in the direction of the Russian subdivision, the IT service of the head office generates files of shipment of goods - Goods delivery. This is done separately by each store. Shipment files are sent to a server in Russia in the exchange catalog, as well as a partner who is engaged in logistics and customs clearance of goods, and uses these files when distributing goods to stores and generating a Customs Declaration file.

4. RBS, on the basis of the data of the Goods delivery files, forms in its database documents “Notifications of Delivery”.

5. When goods arrive at a customs post in Russia, a partner company responsible for logistics and customs clearance generates a customs declaration file in the format approved by the Federal Customs Service of Russia. The customs declaration file is uploaded to the RBS server in the exchange directory. This file should contain the following necessary information:

- Unique product identifier

- TNVED code

- Invoice price

- Cost of delivery

- Cost of insurance

- Amount of duty

- Goods delivery identifiers for each consignment of goods intended for a specific store.

6. The stock manager at the head office downloads the customs declaration data using special processing, which creates the Customs Declaration document in the RBS database. When the “Customs Declaration” document is posted, “Receipt” documents are created in the RBS database.

7. The list of goods and retail prices from the RBS database are uploaded to the cash server of the Profi-T Center (automatic and manual modes are possible).

8. The list of goods and retail prices from the server database "Profi-T" are downloaded to the cash registers of stores, after which they are ready for the sale of goods.

9. Data on sales in stores, payments and returns from customers in real time come from the cash desks to the Profi-T server. In the event of a connection failure, they accumulate at the cash registers and are uploaded to the Profi-T server upon its restoration.

10. The Profi-T server automatically, at a specified frequency (by default, 1 time per day at 2 am) uploads data from cash registers to files in the exchange directory.

11. The RBS server automatically, at a specified frequency (by default, 1 time per day at 4 am) downloads data from cash registers from files uploaded by the Profi-T server to the exchange directory.

12. Data on sales results are downloaded by the 1C Accounting program via CSV files.

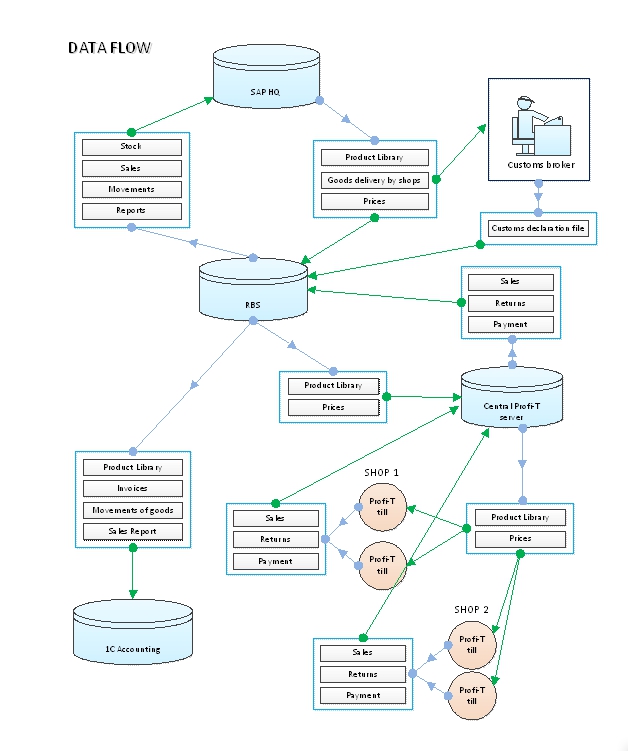

The following diagram shows the data flow pattern, blue arrows are outgoing data, green arrows are incoming data:

Thus, with RBS, the customer receives a solution that covers a wide range of tasks related to data storage and processing. In particular, it is:

- Add and store information about the goods;

- Add and store periodic retail pricing information;

- Adding and storing information on the movement of goods, including receipt, cancellation, posting, moving;

- Adding and storing information about sales in the context of shops, goods, their characteristics;

- Adding and storing information about payments by customers;

- Adding and storing information on import operations, including the processing of data from the customs declaration and deliveries;

- Adding and storing information about exchange rates;

- Downloading data from SAP idoc files with product information;

- Downloading data from SAP idoc files with information on the receipt of goods;

- Download data from the files "Profi-T" csv with information about sales;

- Uploading the results of the company’s activities for the period into csv files for uploading into the 1C Accounting software;

- Uploading data about products and prices to csv files for uploading to the Profi-T system;

- Upload sales data to idoc files for uploading to the SAP system;

- Uploading data on the movement of goods (moving, posting, decommissioning) in idoc files for uploading to the SAP system;

- Calculation of the cost of goods;

- Printing primary documents;

- Formation of reporting.

The RBS system allows companies starting their activities in Russia to reduce the time for starting a business, quickly adapt to Russian legislation, and also provide a convenient tool for monitoring and controlling activities.

Source: https://habr.com/ru/post/432144/

All Articles