Microsoft has overtaken Apple by market capitalization: how did this happen?

Since taking Satya Nadella into the position of executive director in 2014, Microsoft shares have almost tripled. Photo: CreditCreditTed S. Warren / Associated Press

Eight years later, Microsoft has regained the title of the most expensive American company by market capitalization. Apple’s five-year dominance in this indicator continued from August 1, 2013, except for two days in 2016, when it was slightly ahead of Google. Now Apple's leadership has come to an end. And it seems that for a long time.

At the close of trading on Friday, November 30, 2018, Microsoft shares were worth $ 110.89, which corresponds to a market capitalization of $ 851.22 billion, while Apple shares fell by 0.5%, closing at $ 178.58, which corresponds to a market capitalization of $ 847.43 billion . Last week, Microsoft briefly outpaced Apple during intraday trading, and now consolidated its leadership in the week.

You can add that at this moment (December 3, 13:41:35 MSK), Microsoft's advantage has become even stronger: $ 875.88 billion against $ 847.43 billion .

')

Market capitalization of Microsoft and Apple in 2009–2018

Apple for the first time overtook Microsoft in terms of market capitalization on May 28, 2010, when both companies were worth about 226 billion dollars. Graphs of changes in the capitalization of both companies are shown at the top. As we can see, over the course of eight years, the value of the shares of both of them has increased several times, so that the shareholders have earned good money. Last year alone, Microsoft shares rose by 29.6%, which is much higher than the interest paid on dollar deposits in the largest banks.

But even more fortunate for those who invested in Apple shares a few years ago: for example, if instead of a single iPhone in 2009, Apple bought the same amount of shares, now they would be worth more than $ 5000. On a longer period of time, the advantage of buying Apple stock instead of its gadgets is even more obvious .

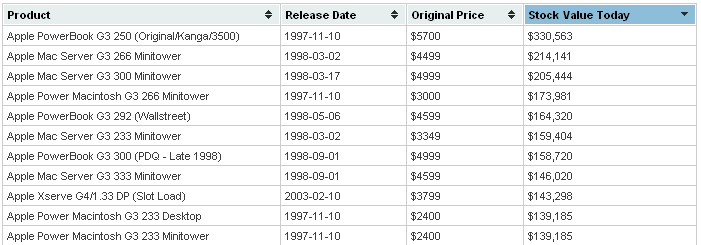

Table as of 2011 . By now, the value of Apple shares bought in the mid-90s instead of Apple’s laptop exceeds one million dollars

Apple is on the throne among US public companies almost continuously since August 1, 2013, and for the first time it reached the top in August 2011 , taking this title from the oil giant Exxon Mobil.

As for Microsoft, it owned the title of the most valuable American company until November 3, 2003, and it lasted as much as 3,796 trading days. After that, it seemed that the era of Microsoft is irretrievably gone, and it will never return to the first place, it will not become a world technological leader. How not surprising, it still happened.

Analysts attribute the miraculous return of Microsoft to the name of Satya Nadella, who took on the post of executive director of the company in 2014 instead of Steve Ballmer.

"There is a short-term explanation for the growth of the Microsoft market, and there is a longer-term one," writes the NY Times . - In the short term, the answer is that Microsoft better endured the latest drop in technology companies. Apple investors are concerned about the slowdown in iPhone sales. Facebook and Google face constant attacks for their role in spreading fake news and conspiracy theories, and investors fear that their privacy policy may scare users and advertisers. But the more important answer is that Microsoft has become an example of how the once dominant company can build on its strengths and not be a prisoner of the past. She fully mastered cloud computing, abandoned the confusing raids on the smartphone market, and returned to her roots as a technology provider for business customers. ”

In fact, this strategy was outlined by Satya Nadella shortly after he became the chief executive officer in 2014. As you can see, the strategy was successful. Since then, Microsoft's stock price has almost tripled. Microsoft recently overtook Amazon as the largest provider of cloud solutions, and now has overtaken Apple as the largest technology company in the world.

Source: https://habr.com/ru/post/431884/

All Articles