How to reduce the risk of stock investment: 3 useful tools

Image: Unsplash

Many people want to increase financial literacy and try some new ways to invest free money, in addition to bank deposits. The logical continuation of such a desire to become thoughts to explore stock trading.

')

At the same time, few people want to pay for any mistake losing their own money. This will scare off potential investors, but there are a number of ways that can significantly reduce the risk of such investments and in some cases bring it closer to investments in bank deposits. Today we will talk about useful tools for beginning investors.

First step: test access

To minimize the risk of losses at the start of trading on the stock exchange, it is worthwhile to deal as deeply as possible with the arrangement of specific markets from stock to currency, to explore the possibilities of a trading terminal, etc. Even a banal study of the functionality of a trading terminal takes time. To do it when very little people like to pay for every mistake with real money.

To reduce the likelihood of loss, there is a test access to the stock exchange, which allows the beginner to begin acquaintance with the stock exchange with virtual money. ITI Capital also provides this service. Its users can perform trading operations using the SMARTx terminal. 300,000 virtual rubles are available for trade to a trader, as well as brokerage leverage for performing margin operations. Securities and derivatives traded on the Moscow Exchange are available for transactions.

With the help of test access, you can not only understand the operation of the terminal, but also get an idea of the productivity of the chosen investment strategy.

What next: choosing a low-risk investment strategy

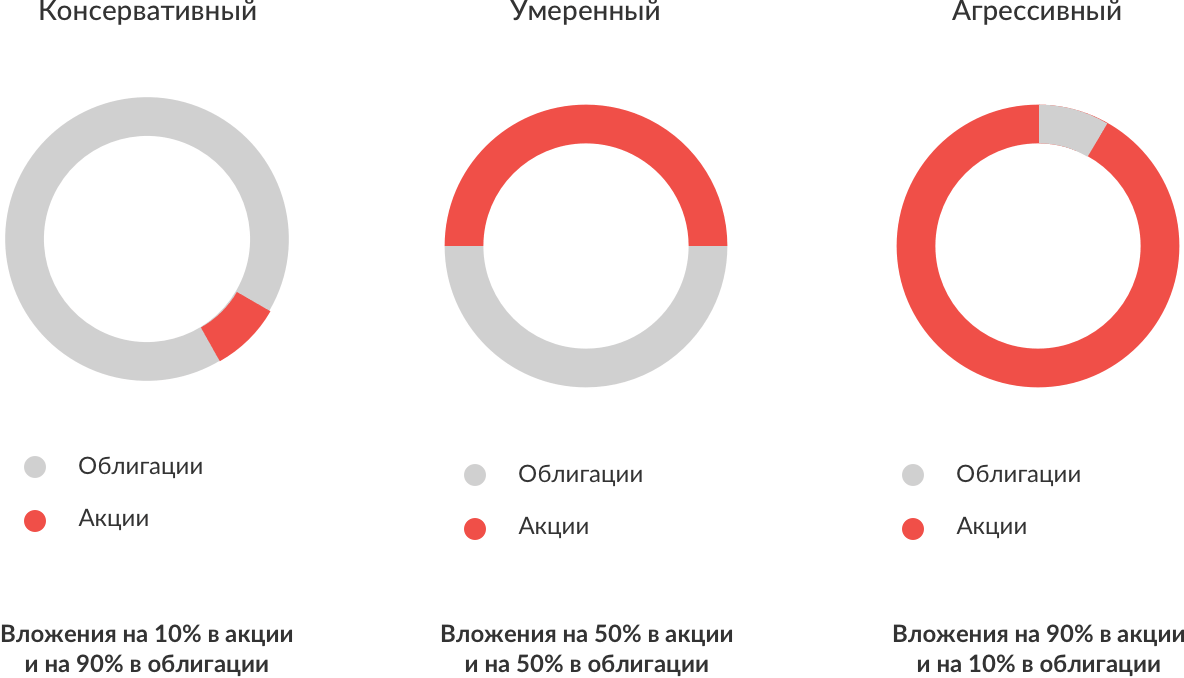

It is difficult for a beginner to even understand what level of investment risk he is really ready to accept. And this is a very important point - after all, it is one of the important factors when choosing a trading strategy. To solve this problem, you can use a specialized software - a robot manager .

Such programs automate the work of financial advisors. It works this way - at the beginning, the user needs to answer several questions from the robot about the acceptable level of risk, the expected investment period, etc. Based on the responses received, the system will select an investment algorithm and a risk portfolio.

Various classes of assets are available to ITI Capital clients for such automated investments, such as stocks and federal loan bonds (OFZs). Initial investments can be from 10 thousand rubles.

If you adjust the minimum level of risk, the trading strategy proposed by the robot advisor will be close to a bank deposit in terms of its reliability.

Another option for low-risk investments is to work with model portfolios . These are already ready investment portfolios consisting of several securities selected by ITI Capital analysts for certain characteristics (for example, bonds or shares of one sector of the economy).

Getting additional income using IIS

An Individual Investment Account (IIS) is an investment tool that gives an owner the right to different types of tax benefits. In essence, this is a brokerage account whose owners receive bonuses of various types.

The first type of exemption is a tax deduction in the amount of 13% of the amount deposited on the IIA. The second is the exemption from income tax on investments made through an individual account.

The conditions are simple: the account holder can deposit up to 1 million rubles (and then 400 thousand more each year), the money must lie on it for at least 3 years. When using benefits of the first type, the maximum amount of deduction is 52 thousand rubles (13% of the initial limit of 400 thousand).

Also IIS can be used to make investments on the stock exchange: purchases of shares, futures, and currency. If the account holder will use it for investment, having managed to earn more than 100% of the amount originally deposited in the account over three years, he will be exempt from income tax. In the case of ordinary brokerage accounts, income tax must be paid.

ITI Capital analysts have developed strategies with different levels of risk and potential returns that are great for IIS. With them, account holders can receive almost a quarter of the amount paid in a year (up to 22%), a third (up to 34%) or even more than half (53%).

For example, the “ Bond ” model portfolio for IIS accounts can bring up to 22% of annual profits at the lowest risk level. Working with model portfolios is convenient, because everything is already selected in them by analysts who are engaged in their support and updating. The amount of the initial investment is only 50 thousand rubles, and you can withdraw money before the completion of the established period of investment.

Conclusion

Investment on the stock exchange is risky, and it is impossible to get rid of it completely. However, there are a number of tools for newbies that allow you to start working more prepared (test access), at first invest with minimal risks (model portfolios and robot-editing), as well as receive additional income (IIA accounts).

Other materials on finance and stock market from ITI Capital :

- Western securities analysis tool

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of information security companies

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions

Source: https://habr.com/ru/post/431748/

All Articles