Fintech-digest: robotization of the Central Bank, Ethereum 2.0, control of cryptocurrency by Rosfinmonitoring and trends in Fintech

This week, several interesting news and not only.

- The Central Bank of Russia is going to dismiss employees in connection with the robotization.

- Acne Buterin launches Ethereum 2.0 with a new name.

- Rosfinmonitoring will control this your crypt.

- 5 trends in fintech end of the year.

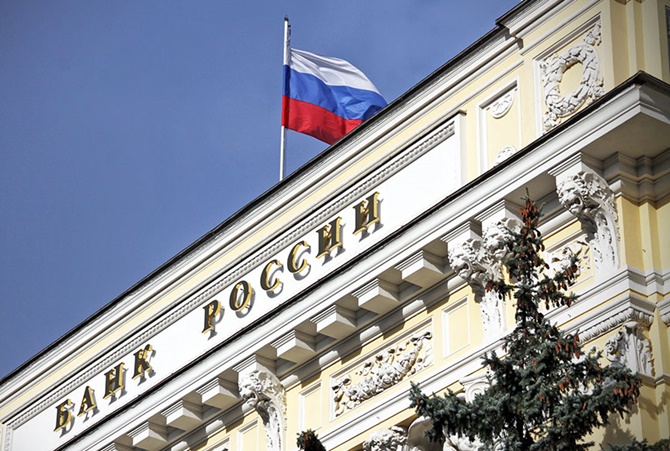

Robotization of the Central Bank

Recently it became known that the Central Bank of Russia plans to reduce the number of staff from 50 thousand to 43.5 thousand people by the end of 2019. This was told by Deputy Chairman of the Central Bank Ruslan Westerovsky.

In general, the bank is currently conducting a large reengineering. From the point of view of business processes, we look at what IT component is added there, what regulatory framework, we overestimate the number that we will have. At the “peak” of the Central Bank about 100 thousand employees had, this year we already have less than 50 thousand, broke through this bar. After we finish the process reengineering, we will have 43.5 thousand employees, this is at the end of 2019,- said the representative of the Central Bank.

')

By the way, the Central Bank considers robotization of one of the most promising financial technologies.

Vitaly Buterin announced the launch of Ethereum 2.0

Speaking at Ethereum’s annual developer conference, Vitaly Buterin, co-founder of Ethereum, announced that Ethereum 2.0 will be released soon. The new version allows you to increase the speed of processing transactions in the Ethereum network a thousand times. It should be noted that transaction processing speed is the stumbling block of the Bitcoin and Ethereum blockchain infrastructure. They handle online transactions thousands of times slower than Visa and MasterCard. For Ethereum, this is approximately 20 transactions per second; for traditional payment systems, 50 and 70 thousand.

New Ethereum gets its own name - Serenity. In addition to speed, the protocol promises increased security, lower power consumption and some other buns.

Another advantage of the new protocol is the transition from the proof-of-work to the proof-of-stake algorithm. In this case, users will receive bonuses.

Rosfinmonitoring is interested in cryptocurrency control

Cryptocurrencies are poorly controlled by the state authorities, and in general, control is not about the crypt. Therefore, the international team to develop measures to combat money laundering ( FATF ) recommended the introduction of control over the circulation of cryptocurrencies.

The deputy head of Rosfinmonitoring said that members of FATF (Russia is a member of FATF) are obliged to change the legislation by introducing licensing, registration, or accounting for the exchange services of cryptoactive assets, ICO, and administrators of cryptocurls. FATF believes that cryptocurrencies can "digitally apply or transfer, be used for payments and investments."

In addition, it is necessary to regulate the exchange of virtual assets for traditional currencies, for each other, their transfer, storage and placement. The threshold control will be set additionally. In the case of ordinary cash, the “threshold amount” is 600 thousand rubles.

Fintech trends of the end of 2018

And, finally, a little about trends. In total, they counted five:

- Development of conversational commerce. These are test and voice conversational interfaces that are becoming part of an increasing number of different services.

- Face identification. Actually, everything is more or less clear here - many organizations introduce customer identification by face. Often used for this smartphone;

- Behavioral biometrics for safety. Currently, behavioral patterns are used to protect users of various services less frequently, but this is quite an uptrend. Example - keyboard "handwriting", using the application interface, transaction analysis, digital portrait of the device, etc .;

- Roads. Computer advisors are becoming more "smart" and take on the work with a greater than before, the volume of functions.

- Personalization of products and services. Personalization in general is gradually becoming paramount, this is a long-playing trend that will remain ascending for a very long time.

Source: https://habr.com/ru/post/428904/

All Articles