Service for trading on the stock exchange Robinhood accused of selling data on user requests to high-frequency traders

The publication on finance and technology Seeking Alpha has published an investigation into the activities of the financial startup Robinhood. In particular, it claims that the service, which offers users the ability to trade on the stock exchange without commissions, sells data about the bids they submit to high-frequency traders.

What's the matter

Journalists have studied the statements that Robinhood submits to the US Securities Commission (SEC). From the documents, it became clear that Robinhood sells data about the requests (order flow) of its clients to HFT companies.

')

This practice is legalized in the US brokerage market, although there is no consensus regarding the ethics of such actions. Some large companies refuse to sell, albeit impersonal, but customer data, Robinhood, according to journalists, sells them at a price, on average, ten times higher than normal.

What's wrong here

According to the SEC, revenue from the sale of data on user trade orders constitutes a large part of the income of the Robinhood. Usually, for brokerage firms, this is not the main source of profit, since they earn the main money on commissions for performing operations and additional services.

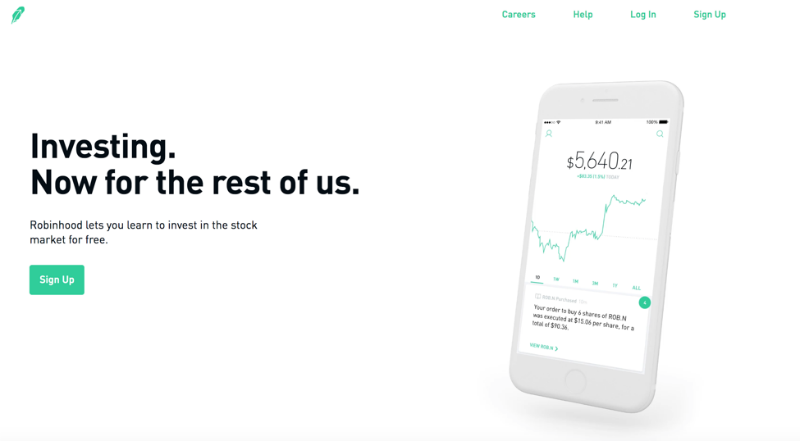

Robinhood works on a different model - the service provides access to the exchange without commissions. Thus, the creators hoped to attract millennials to the market, young people for whom the investments had seemed too complicated before. In the case of Robinhood, you can buy and sell promotions directly in the mobile application, making swipes and tapas or via the website.

Robinhood web version interface

Seeking Alpha experts have doubted that the practice of attracting users by offering “free” investments and selling data on their operations is completely legal and ethical. The author of the investigation is convinced that HFT merchants would not pay Robinhood ten times more than any other broker if they were not sure that they would be able to earn much more money from the data received.

If US regulators find violations of the law, the Robinhood is in serious trouble. Periodically brokers are fined with substantial amounts. In the example, the popular company Citadel was fined $ 22 million in 2017 for violating stock trading laws, and Wolverine Securities broker paid $ 1 million for violating insider trading rules.

Other materials on finance and stock market from ITI Capital :

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies from the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions

Source: https://habr.com/ru/post/424083/

All Articles