How to save money when starting a business in the USA: company registration, office, accounting and promotion

I have been living and developing my project in the USA for almost two years now. They are considered to be a rather expensive country for work. Today, relying on personal experience of mistakes and more or less successful solutions, I would like to talk about how you can save money on startup and at the first stage of the company's work in America. Go.

Disclaimer: everything described below is only my experience, which, I hope, will be useful to someone, but not the fact that the described steps will be ideal for you.

')

Company registration

The very first thing that those who are going to open a business in the US will need to do is, in fact, create a legal entity. We did not go the best way, as it turned out later, and lost a lot of money on this. The fact is that I started the company shortly before I started collecting a package of documents for obtaining an O1 visa for work in the States (I wrote a separate material about getting it). Accordingly, lawyers involved in the visa, and recommended colleagues who can help with the registration of the company.

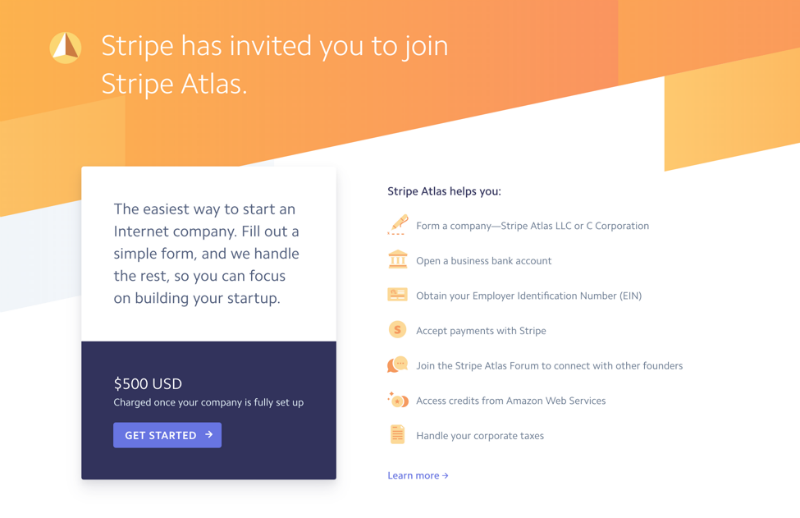

Those have worked well, and there are no complaints about them, however, like all lawyers in the USA, they charge a lot of money for not very hard work. As a result, the creation of C-Corp in Delaware cost me almost $ 3000. Of course, for this money we received several foundation documents customized for the business needs (for example, we refused to issue a pool of shares for issuing options to future employees), but not templates with a changed name, but the overpayment turned out to be very high. After all, for example, using the Stripe Atlas service, you can register a company (LLC or corporation) for $ 500:

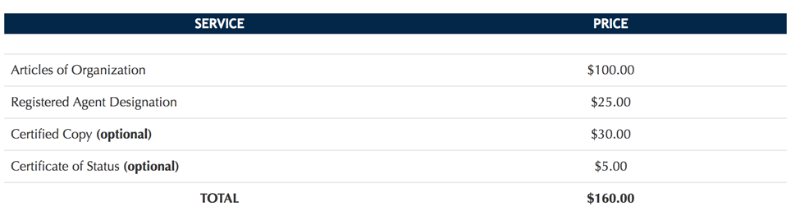

And if you do everything yourself, for example, in Florida, where I live, the creation of LLC will cost only $ 160:

Thus, even at the very first stage of business withdrawal in the USA, there is an opportunity to seriously save money.

Office

The next thing you need to work in the US and what you can save on is the physical office and mailing address. Here the easiest way to save is to rent places in coworkings, of which there are many in the USA. For example, in Miami, where I live, there is both WeWork and Regus. For example, places in one of the WeWork buildings in Miami cost from $ 220 per month. For about $ 50 per month, you can get the mailing address service.

WeWork staff will check email on request and tell if there is anything worthwhile.

On the Internet, you can find tips instead of renting a postal box for about $ 100 a year - an option to save even more. However, this method is much more inconvenient. Coworking employees can always write and ask if there is a mail for your company, and go only if something important has arrived (because of all kinds of spam, just mountains come). This is convenient if you do not plan to always be in your office, as I do.

An interesting point: despite the fact that the same WeWork is a network, the prices of the same services in different cities of the company's presence are not the same. So, for example, the prices for renting one place in coworking in the San Francisco Bay Area start at $ 400 a month, in San Diego start at $ 350 , while other cities have options for $ 220-250. So if a specific location address is not important to you due to the nature of the business, then there is another opportunity for savings.

Accounting

A very important point is the choice of an accountant. In general, it is worth preparing that in any communications with people on business issues in the USA you can be deceived or try to tear many times more money than the cost of the service. Therefore, you need to remain vigilant and check all that is possible.

With regard to accounting, it is best to cooperate with a licensed accountant (CPA, Certified Public Accountant). In addition to the knowledge of what reports when and where to submit, such accountants have the right to send all documents online. If you keep track of your own accounting and at the same time be a non-resident, you will have to send a lot by physical mail and understand it yourself.

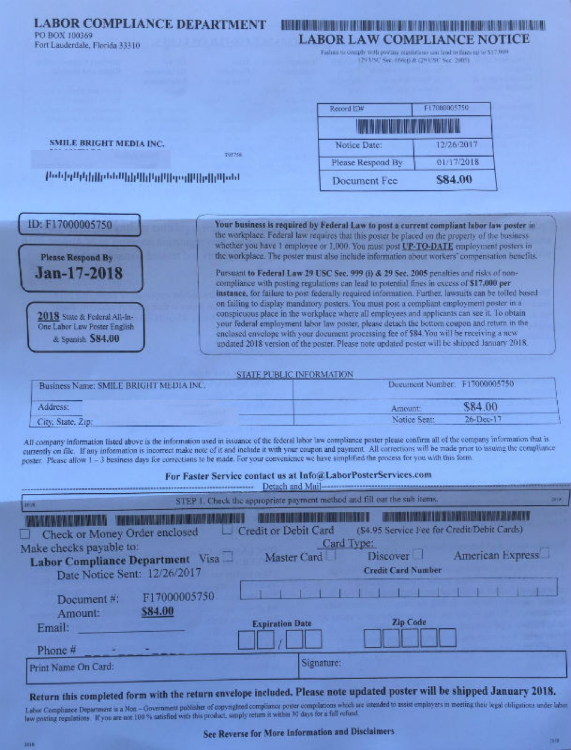

Already at the stage of work with mail, CPA saves money. If in Russia direct mail marketing has long become ineffective (everyone is used to raking and throwing out multi-colored advertising booklets), in America, instead, marketers of local firms play on the ignorance and fears of potential buyers. For this, for example, they disguise their advertisements under the official reports of the authorities: they use official language, similar to official forms, various phrases like “Urgent! The notice requires an immediate response! ”Threatened with fines.

For example, here is a letter stating that we need to order certain stickers / posters that should be placed next to the workplace of each employee. Each such label costs $ 84, and immediately there is kindly indicated that its absence is punishable by a fine of $ 17,000. It looks like an awesome letter from the authorities, but in fact this intermediary company is trying to get a new customer to issue these stickers to him.

I myself would never have distinguished such a fake from an official letter, if not for the help of our accountant. This experienced lady has seen such tricks a million times and helps to figure out what you really should pay attention to in the mail.

In addition to such indirectly related to the accounting of things, CPA helps to save on software for accounting. In the USA, the most popular accounting software is Quickbooks . There is also its online version. The program is really very convenient, but paid, and it’s not so easy to figure out the rates yourself. It will be necessary to buy some version of the plan that is suitable for the needs of the business, and then buy more packages - for example, if you need to process the salary right there.

Plus, an accountant here is that usually Quickbooks developers give such specialists the opportunity to provide software licenses for their clients for free. Thus, if you sign an agreement with the CPA, then you will not have to pay separately for the basic version of the program.

But where to find such a good specialist? If you do not have any familiar US businessmen who would recommend an accountant, one option remains - a freelance exchange like Upwork. I found our accountant there, and I think I pulled out a lucky ticket. Looking back, you can give the following advice on finding an accountant on the freelance market.

It’s better to start with a simple small project: we had to fill out one report (Annual report) and pay one tax (Delaware franchise tax). So you can understand the general adequacy of a specialist without signing any long-term contracts with him (as will become clear below, problems can be adequate).

Compare offers of several candidates and do not agree to paid consultations. By the time of reporting, the company did not yet conduct business, so from an accounting point of view, everything was simple.

However, some of the specialists who responded to my task (mostly Russian-speaking, by the way) offered to do it for "about $ 1,200," and, learning about the simplicity of the task, offered to "throw off to $ 800." Others (already mainly Americans) either wanted to “discuss everything by phone” first — that is, to conduct a paid consultation, which usually costs about $ 200, or give some wild price spreads: one candidate suggested doing everything for $ 50, and the accountant , which we eventually chose - a couple of hundred.

At the same time, the one who offered for $ 50 even sent the result - and it turned out that he simply took the tax filling pattern and entered the name of our company there. He did not take into account that franchise tax in Delaware may be calculated according to different schemes - depending on, for example, the number of shares issued by a corporation, and chose the wrong one, as a result of which an incorrect figure was payable. When I pointed this out to him, he was not embarrassed and demanded payment: the work, they say, was done anyway.

Promotion through the media

Another area that is very different from the situation in the home market. In RuNet there are - if not so much - online media that can be used to promote a company, but there are quite adequate ones among them - you can correspond with them, offer materials, get feedback. Columns are regularly published, and if you wish, you can order an advertising article and a special project for not quite unreal money. As a result, often startups can get the first users and customers with the help of such placements - that's exactly what I did with my projects in Russia, and it always worked.

In the US, this is all bad: contextual advertising on the Internet is very expensive, and the media is not so loyal. Earlier, I talked about my experience of interacting with the editor of a major media project: the answer to one letter took him about a month. In the end, the publication was refused without explanation. The paid publication at the time of my appeal cost more than 10 thousand dollars.

As a result, to use the usual channel in the United States had to try. The analysis showed that now in the States Medium has become one of the leading media platforms. Very popular collective blogs work on the basis of this site, some of which have already evolved into full-fledged media with their own domain, design, editorial staff and millions of readers.

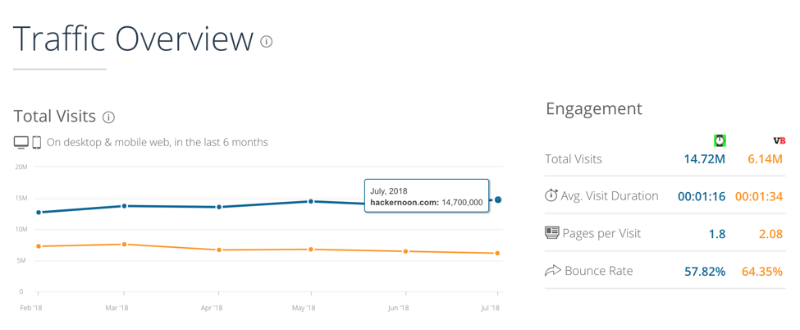

It turned out that publishing in such resources is much easier. For example, we managed to get with our materials into a number of large blogs (in terms of Medium, they are called publications), including Hackernoon, which in terms of audience size overtakes the popular IT edition VentureBeat.

In such blogs, you can publish for free, and their editors are much more loyal to those coming to the review. And most importantly - they respond to letters within a couple of days, not months. So working with Medium is another way to save a young company.

Conclusion

In conclusion, we will give a few basic tips, the use of which will help not only to “cut the bones” on the listed things, but in general, to pay less often for business services in the States.

- Never take the time to choose : the biggest overpayments occur when you agree to the first proposed option for anything. If I had spent time studying the issue of registering a firm, I would have saved a couple thousand dollars; and when I spent it on a thoughtful choice of choice of an accountant, I was able to avoid unreasonable costs.

- Feel free to ask about savings options . Discounts are common in the US - it does not matter whether you are negotiating an annual accounting contract or are renting a car for a company. You should always ask either about the possibility of obtaining a discount, or about the inclusion of any additional. services in cost - it works very often.

- You do not need to do everything yourself, but control is very important . The option to understand everything on your own can be very costly - both in time and in money (penalties for incorrectly filled out reports can be large), so it is better to trust sensitive moments to professionals. But the “paid and forgotten” approach does not work either: even if you take your money, no one will run after you, you will have to control the work of the accountant and other employed specialists. This is the only way to reduce the likelihood of problems.

Source: https://habr.com/ru/post/422485/

All Articles