Fintech Digest: Central Bank will keep records of victims of hackers, Russians will get a credit rating, Yahoo Finance and crypt trading

Hi, Habr! Today we will tell about this:

- The Central Bank plans to maintain a hacker victim base;

- Russians will get a credit rating;

- Mastercard tests tokenization;

- Yahoo Finance will open the possibility of trading cryptocurrencies.

Central Bank will create a register of companies and people whose accounts were used by hackers to withdraw money

The announcement stated that the Central Bank plans to create a base of “victims” of hackers, that is, companies and people whose accounts were used to withdraw funds. In principle, accounts can be used with the consent of the owners, so that it is not only about the victims.

')

The plans of the Central Bank - to keep "in the light" of the account, which were seen in unauthorized transfers. The regulator will share this information with the banks so that they can better counteract the fraudsters. If the bank reports an unauthorized transfer, the Central Bank can send a request to the beneficiary's bank. He will be required to provide information about the card number or account of the recipient. In addition, data such as the amount, date, and time of the operation will be disclosed.

Moreover, banks will be required to transfer to the Central Bank in an impersonal form (hashing) the recipient's passport number and SNILS, for companies - TIN, hash passport details of the management and the SNILS of the person who is authorized to manage the money in the account.

Experts believe that the Central Bank is going to keep records of the so-called droperov, through which the stolen money is withdrawn (cashed). Most often it is individuals, but it happens that they are involved in the process and the company. Let's face it, some companies are created just for this.

Russians will be assigned credit ratings in 2019

Nikolay Myasnikov, acting director general of the Joint Credit Bureau, said that starting in 2019, Russians will begin to assign a personal credit rating. According to him, we are talking about "a certain score, which is calculated automatically on the basis of different parameters from the credit history."

The calculation takes into account the presence of delinquency, the level of debt load, the number of requests for checking credit history, its “age” and other parameters.

Higher score - lower risk. In essence, this is the same as scoring, which is actively used by lenders when making a decision on issuing a loan to a borrower,- said the Butchers.

Innovation was made possible by the entry into force of amendments to the law "On credit histories." These amendments make it easier for banks to make credit decisions. Citizens will have the opportunity to see themselves and their credit history through the eyes of lenders.

Mastercard will send money using tokenization

The international payment system Mastercard is testing a money transfer service using tokenization technology. It allows not to disclose payment card data during the transfer.

Now the technology is being tested on the basis of the Samsung Pay application. About 5 thousand Mastercard cardholders will take part in the testing. The acquirer in this case is VTB. It is assumed that the introduction of technology will improve the security of remittances. The fact is that when transferring funds, these cards will be replaced with a unique generated code (token), which can be used only once for a specific purchase.

In case of tokenization, the card number is not stored either on the mobile device, or on the servers of the smartphone manufacturer, or at a commercial enterprise. Instead, when you connect the Mastercard to the mobile payment service, a unique token is created - a 16-digit combination of numbers that is tied to the payment service on a specific device,- explained in the press service.

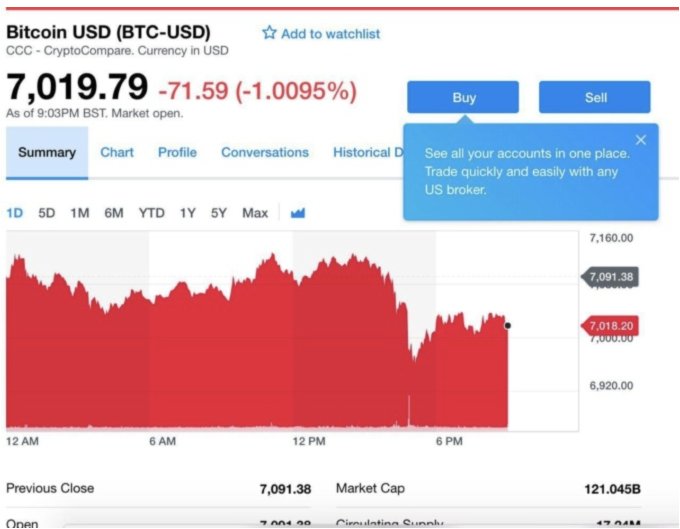

Yahoo Finance has added the ability to trade cryptocurrencies

Recently it became known that the financial information service Yahoo Finance has added the ability to trade a number of cryptocurrencies , including Bitcoin, broadcast and lightcoin. At the moment they occupy the first, second and seventh place in capitalization, respectively.

Quotes for these and other cryptocurrencies appeared on Yahoo Finance at the end of last year, but until now it was impossible to perform any operations on them.

Unfortunately, the service is available only for residents of the United States. To bid, participants must have an open brokerage account at Coinbase or Robinhood.

Have a good week.

Source: https://habr.com/ru/post/422113/

All Articles