Paperwork and Currency control Upwork + USN6% / Patent + VAT

This note contains a brief description of the process of filling the papers in the Elbe (relevant for other similar services, but adjusted for their UI) when working with Upwork in the event that you decide to pay VAT and take everything that comes to your upwork account into income e (I note immediately that there are several opinions on this point, the final choice is always yours), as well as passing currency control.

Initially, all this was written as a memo for personal use , but it turned out that it was interesting to other users. Publish at their request. The choice of services is due solely to my personal experience (what I use about it and write), if you have experience with other / best / cheap services I will be glad to hear in the comments :)

Important:

- Actual on 08/27/2018

- Examples are given for Elba ( for other services, everything, in principle, will be the same, but adjusted for their UI )

- The bank is not particularly important, he used Alfa Bank, and the Module, in principle, all the same, but there are / there may be nuances that are best specified with your accountant, your bank’s currency control, and even the tax authority itself.

- Again, there are different opinions at what point in time income arises (see links) and whether it is necessary to pay VAT at all. In any case, it is highly advisable to consult with your accountant, currency control of your bank, tax (by the way, it’s strange that no one has yet asked them ). The possible consequences of a choice are also in the articles on the links.

- I am not even close to an accountant - you do everything at your own peril and risk.

useful links

- How to pay VAT on Uber services

- Upwork, IP and currency control - how to properly execute documents?

- Certificate of earnings

- User Agreement and Confirmation of Service ( ask upwork for current versions )

- Work with Upwork: questions on working with currency (a good discussion )

- Legal withdrawal of funds with upwork ( there are a lot of comments there + a lot of links to previous topics )

- VAT and freelancers working with Upwork (the most valuable there is a list of links to the laws explaining why everything is so, it can be useful when dealing with the tax )

- Google Taxes have been changed

General

- With the cost of upwork services, it is necessary to pay 18% VAT once a quarter ( up to 01/01/2019 [8], further, as far as I understand, we do not have to pay this VAT, but what will happen in reality is unknown to me yet )

- USN 6% must be paid from the total amount received on the account, date of income = date of availability of funds in the account upwork ( from gray became white ).

- On the Patent, it is still necessary to enter an accounting book, date of income = date of availability of funds ( and here you should be more careful with the names of the receipts - it came across somewhere that the tax might doubt the legality of including some formulations in the Patent instead of the USN ).

- You do not need to pay VAT for the withdraw fee (bank transaction)

- If the sale of currency exchange rate turns out more than the rate of the Central Bank ( at the date of sale ), then you need to pay a tax on the income generated ( elba can do it yourself, but for the fact that the currency is on the account and it does not grow, you do not need to pay for several years ).

Registration of income in the Elbe

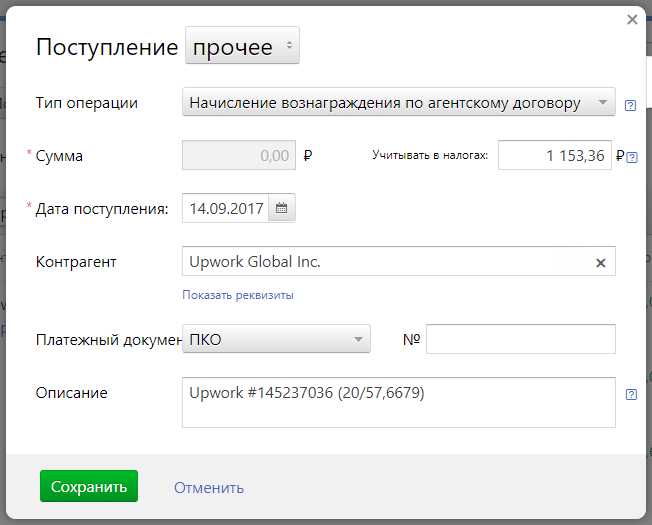

- In the "Money" section, create a receipt with the type "Other" on the availability date of the funds in the upwork account and take into account in income the full amount at the Central Bank rate on the availability date. The description for the USN is usually indicated simply in the form of Upwork # 190703319 (123.45 * 70.07) (# figures are the transaction number), but for the Patent I copy directly from Transaction History as "PHP Backend and API Development / Upwork # 190703319 ( 123.45 * 70.07) "(along with the transaction number, the numbers in brackets make it easier to check for yourself)

- Next, you need to create an invoice for the same date, type of operation "Payment for electronic services by Uber, Apvork and other foreign firms that are not registered in Russia", to drive in the amount of the commission (in rubles at the Central Bank rate on the availability date), more Elba will add VAT and then form a billing for the quarter ( why so, see [1] ). Description again in the form of "Upwork # 191740947: Provision of service - Ref # 191740944 (12.34 * 70.07)"

- Money that will come from upwork to the p / s is not necessary to take into account either in the simplified tax system or in the Patent, for this it is necessary to reset the amount in the column "to take into account in the income", and the type of operation "other" (the comment there is true after This will be something like “payment for services”, I don’t know if it has any value (?), but I usually change it to “transfer between accounts” ).

- As a result, all of our receipts and invoices, and therefore the declarations and the accounting book, almost literally repeat the Transaction History, which can be very useful when dealing with tax.

Currency control

Each bank has its own characteristics, so it’s best to specify all this in the bank itself, but on the whole it’s all quite simple, and it’s even easier than filling out a payment for paying a patent ... I’d like to say that large amounts (from about $ 1000) it makes sense to withdraw only in foreign currency, for rubles came from Kivi Bank in that year with a commission of 5%, which is very much.

He personally used the following banks:

On their website there is a fairly detailed article describing the process and all the necessary documents, there is really nothing special to add. Unless , it does not say that their correspondent bank bites off its 12 euros (~ $ 14) from each incoming payment - i.e. when withdrawing the final commission will be ~ 30 + $ 14 . Somewhat unpleasant.

I repeat - it is advisable to clarify with the bank , after all, a year has passed since I added the contract. I also note that the old version is used (therefore, when the same functionality appears in the new one, the information below is likely to become obsolete)

First time

- Please open an account in the currency

- We add it to the apvork: SWIFT Code ALFARUMM, your full transliteration (should be the same as the bank), the address and the account number (I have a currency p / c, you may need to specify a transit one, but that’s how it works ...)

- Next, you need to get a signed User Agreement [4] and sign the last page (you need to sign and scan / take back), download Certificate Of Earnings (located in the Reports menu, it is necessary for the bank to set the contract amount and know when it is time to put it on accounting, what to do if you created an account for more than 12 months, I do not know).

- After that, go to the "Notifications / Dossier" and create a "Contract / contract,

not requiring registration with the Bank, "without number, without amount, date" start "= registration date on upwork," end "- any time within reasonable limits, I like 15 years, attach documents from the previous paragraph (User Agreement, Last signed page and Certificate Of Earnings), we add a counterparty (here is the biggest ambush - details are needed, I indicated the details of upwork escrow, from which the payment came, which is of course a little wrong, it is best to clarify this point in the bank) - After the contract is registered, you can withdraw money

Withdrawal of money

- Funny, but a few ruble conclusions came without any currency control

- Withdraw money, sign with Confirmation of Service [4] for the amount excluding $ 30 (fill in, print, sign, scan / photograph, send for signature in upwork)

- We are waiting for the incoming payment notification

- We go to the "Notifications / Currency Control Documents" and create the "Order on withdrawal of funds from the transit currency account" and "Information on the Currency Transaction" (add the signed Confirmation of Service [4] to them, you can create it directly from the Order) all necessary fields - notification, contract, amount, currency, what to do with it (transfer to r / s or sell), indicate the currency operation code 21500 ( Payment in connection with the provision by the non-resident of services for selling goods, works, services, information to other persons) and results intellectually th activity, including exclusive rights to them, resident in accordance with the agreement of the commission (agency agreement, contract of assignment) ).

- Sign, send to the bank, everything.

I did not use it myself, but I would add it to be in one place:

Personal experience

Since last year, I take everything into account as it is written (2017 USN6%, from spring 2018 Patent), it takes about an hour and a half a month for youtube in time - unpleasant, but not very critical. Further, in the articles on Habré, many were afraid that in this case, what comes in at p / c does not coincide with the income book and tax questions arise. And so - really will arise :) After delivery of the declaration somewhere in the spring the inspector called, asked, "what for a garbage ?!", and then sent the requirement for providing explanations. As a result, everything was limited to the provision of a screen for transactions over the past year and the explanation that I work under an agency agreement, taking into account the income on the date of availability of funds in the account upwork (as initially assumed almost complete identity of documents and Transaction History was very good). And that's all. But no, not all — then they even called about VAT, but after explaining that I am obliged to pay it because the foreign organization is not registered in the Russian Federation, they also fell behind. Those. In general, there are no particular problems yet and in theory there should not be (ttt).

')

Source: https://habr.com/ru/post/421331/

All Articles