Six more myths about the blockchain, where will it still be used

The author of the article is Alexey Malanov, an expert in the development of anti-virus technologies at Kaspersky Lab.

Recently we wrote an article “ Six myths about the blockchain and Bitcoin, or Why this is not such an effective technology ”, which looked at how the unpleasant features of any solution built on the blockchain derive from the essence of the blockchain. In order to inspire fans of fashionable technology, we wrote a flip-flop article “ Why blockchain is not such a bad technology, ” which looked at the same properties and limitations of the blockchain, but from a different point of view, how other technologies try to circumvent them.

Today we will focus on the areas of application of the blockchain. In our opinion, in many areas the potential is greatly exaggerated.

')

They say that banks are so afraid that they will not be needed, that some “Rothschilds” in every way sabotage the blockchain's triumphant march around the planet.

There is an idea that banks are mainly involved in money transfers, charge a large commission for this, and they also transfer slowly. Here cryptocurrencies, perhaps, really help. Although commissions in cryptocurrencies are not at all small, but hidden commissions at the expense of issuing are generally mocking.

But what else the banks are doing is issuing loans, taking deposits, evaluating borrowers, considering risks, knocking out debts. None of this blockchain and cryptocurrency help.

I know only one use of the blockchain here - you can issue a loan in digital currency on the security of another digital asset. There are few risks, there is no interaction with the real world, it will work. But this scenario does not cover even one percent of banking.

Add a funny story about this myth. There is such a banking blockchain consortium R3 . It includes hundreds of the largest banks in the world: UBS, Bank of America, Barklays, UniCredit - everything is there. They really wanted to do something with the blockchain, spent $ 59 million on research , and then said authoritatively : “ We don’t need blockchain! “Some blockchain fans began to mock the consortium, others still call the resulting solution Corda a blockchain solution and rejoice in its success.

In fact, this story only shows: do not use the blockchain where it does not belong.

They say that you can track money transfers in the blockchain: who translated what to whom. Then we take the bribe hand and catch it!

But not so simple. Usually, people do not transfer a bribe from their card to a bribe card.

In fact, the supervisory authorities and the Central Bank, and so they see all the travel money from account to account, but not very much it helps. For example, a billion rubles was allocated for the construction of a hospital, the money came to the general contractor, from his subcontractor, 50 million for a brick, some for pipes. And how to understand who is whose brother, who is the matchmaker, who won in the tender, and who in the fake tender? How to find out why the price of pipes from the supplier is higher than in the neighboring city? Need to understand, it's not the blockchain.

You can argue that the supervisory authorities do not cope, but if the entire accounting department was published for all comers, then we would all piled on and find out where the prices are inflated. May be. But it is also impossible to open all the finances of private companies - counterparties, prices for services, marketing costs, research costs, etc. - this is a commercial secret, transparency can adversely affect the market.

In any case, we can open financial flows without any blockchain, there would be a desire.

Like, documents can be stored in the blockchain, then no copies need to be certified. Who will sell diplomas in the metro if there is no graduation record in the blockchain register of diplomas? Why should a notary verify the authenticity of my passport if I can sign a will with my secret key?

First, if we want to make a single database of diplomas or the Unified State Register of Real Estate (USRN), then we absolutely do not need to use the blockchain. Just take and make the registry. Decentralization here brings nothing. What is important is not the form in which the database is stored, but what opportunities for changing the data we want to leave in the system. If we fear that someone, having received direct access to the database, will start to edit the records retroactively, then we need to make backups and monitor integrity. The ability of the owner to rewrite the apartment to another person and this way and that will remain.

Secondly, the notary usually looks at the passport and makes sure that you are you. In principle, it is possible to replace the passport with an electronic secret key. Only you need to try so that the citizen does not compromise this key. It means that it would be good for him to issue the “second factor” and the storage of this key. You’ll get an Estonian ID card, which has been actively used since 2002 and has nothing to do with the blockchain. But we are for.

Thirdly, the notary verifies that the client is sober, that his wife does not pressure him, that he understands what he is doing. Surely the notary is still trying to figure out what exactly the client is trying to write in the will / power of attorney, because there are different fantasies. This activity is not only blockchain, but also a strong artificial intelligence is unlikely to ever be able to carry out.

Separately, we mention one of the functions of the notary: witnessing the existence of something. This can be done with the help of the blockchain (now), and with the help of the traditional Trusted Timestamping. But we are talking only about digital objects (music, documents, etc.).

If you still do not know what a smart contract is, we advise you to quickly figure it out . Despite the name, a smart contract is not a contract at all (in the definition of Wikipedia). A contract is a set of promises that are enforced legally (“If you’ve signed a contract, you’ll be able to enforce it”). In the case of a smart contract, no one promises anything to anyone, no one is forced to anything, especially legally.

A smart contract is simply a digital asset management program . The program says what can be done with an asset, what will happen if it is done, etc. The only difference from the most usual conventional programs is that a smart contract is executed not by one specific computer, but by all-all miner computers synchronously. If the result is the same for everyone, then everything is fair.

So, we can write programs for hundreds of years. We can automate what can be automated. Machine learning helps automate even what is difficult to formalize. And the fact that the blockchain has allowed us to write homeless programs is unlikely to allow us to program what we have not yet succeeded.

Yes, smart contracts turned out to be very useful where we do not trust the programmer: for the lottery, the pyramid, for collecting money and taking participants' contributions ( ICO ). But in most tasks in life, programmers and services do not deceive us. Do not think that pervasive deception is the engine of progress, and we urgently need smart contracts.

For example, if you are traveling in a taxi, the taximeter counts kilometers and minutes and gives the final cost of the trip. How often do you ask yourself: “Does the program really work as described in the public offer? Give the code a look. And let's transfer it to the blockchain, and then you never know ... ”

You have placed money on a deposit in a bank, the bank considers and charges compound interest . Do you have to see the code of the calculation function to trust the bank? Of course, sometimes the code is written crookedly, does not take into account a leap year or some other parameter, or the programmer just did some bugs. But even here, conventional programs are better than smart contracts - at least they can be corrected. And in a smart contract, if it’s a mistake, then forever . And if a smart contract permits updating the logic at the whim of the author, then this is no longer a canonical smart contract, carved in stone.

The blockchain-enthusiasts desire to translate into smart contracts something that is already automated and works perfectly is completely incomprehensible.

Of course, when two or more people want to make a bet or some other monetary relationship to issue, it is inconvenient to conclude a traditional contract, it is more convenient for them to write a program for interaction. Yes, only this situation does not arise so often, and besides, it is hard to formalize - after all, real-life events themselves do not fall into the blockchain.

Like, yes, the blockchain is slow, heavy, incomparable with traditional centralized solutions, but so far. YouTube and the Internet were once too slow, and now everything flies.

The problem is that the Internet was slow, because there were few resources (narrow channels, poor equipment), but it was scalable, but the blockchain was slow by design.

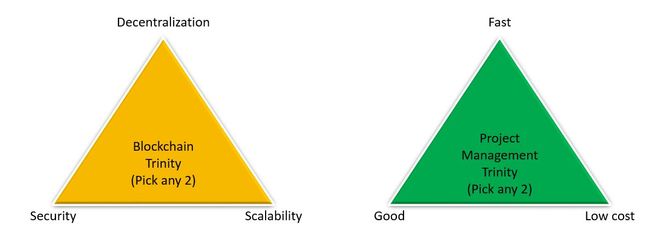

There is such a “ blockchain trilemma ”: “Decentralization, scalability and security cannot be achieved simultaneously.”

A source

The old blockchains (Bitcoin, Ethereum) chose security and decentralization at the expense of scalability. When the speed of 7-15 transactions per second ceased to satisfy even the most devoted fans of the blockchain, they began to try to fasten scalability to what is at the expense of security. So there are ideas sharding, Lightning Network, Plasma .

The new generation of blockchains (EOS) slightly deviate from decentralization. They do not have all the nodes in the network coordinate their actions with each other, but, for example, only 21 are very good and powerful nodes. Since these 21 lucky ones can be changed by voting, we still have decentralization. Of course, 21 computers are not 10,000 , as in Bitcoin, but the average speed has reached 3,000 transactions per second. Better than 10, agree. But still, since there is a blockchain, you can’t just add equipment and get more speed.

Some solutions ( BigChainDB , IOTA , Corda ) simply refused to use the blockchain and gained scalability.

We lead to the fact that this is not the blockchain will be fast sometime, but the resulting solution will no longer be a blockchain if it becomes scalable. Also, how long can you wait?

They say that ordinary money (national currencies) are subject to inflation, because the states are constantly printing them, but at Bitcoin (but not all cryptocurrencies), the issue is programmed. Only you manage your money with cryptocurrency, and not someone else, nothing can be frozen and taken away.

Let's reject the technical component: even if the blockchain is unsuitable for creating world and even state money, suddenly something else would be technically suitable. Let us focus on the question why there is not and will not be a national cryptocurrency.

First, the state wants to pursue a monetary policy . Printing (or drawing on accounts) money is necessary as the economy develops. Banks must issue loans more than they accumulated deposits. If the Central Bank does not control the emission of this national cryptocurrency, the economy will be bad.

Secondly, the state wants to be able to take money away. If someone stole a billion dollars in the form of cryptocurrency, and we caught him, then it would be good to return the money, right? And in cryptocurrencies, if you do not know the key, then nothing can be taken away and frozen.

Thirdly, giving away free money to the miners for servicing the blockchain for the state is somehow wasteful. Although you can, of course, cancel the award, and "mine" in banks.

Fourth, the state loves when it knows who owns the money and where it came from . If cash were invented now, they would be immediately banned. Although, of course, you can make a cryptocurrency on passports.

All this suggests that the principles of public money and cryptocurrency are opposite. Cryptananarchists believe that cryptocurrency is better, but this does not increase the chances for the replacement of ordinary money.

If the state does not need all of the above, then you can pay at least with a cryptocurrency, even with bottle caps. For example, the Venezuelan government recently released the token Petro . Let's see if he can keep the course in the required range.

Blockchain enthusiasts often claim that cryptocurrency and blockchain are not the same thing .

Well, formally, of course, yes. For example, Telegram Messenger LLP is not the same as Telegram Messenger. But if you look essentially, the blockchain is currently used almost exclusively in cryptocurrencies (and there it is needed and justified).

The point is this. Blockchains are divided into two types: public and private. An unlimited number of people can write to a public blockchain; access control is not performed. All public blockchains are cryptocurrency , because to achieve decentralization, it is necessary to financially motivate the participants to support the work of the blockchain. This is mining, and a reward is paid for it.

Of course, on the basis of an already existing public blockchain, you can build something else just by using it as a diary, but you will have to pay for the use of such a storage cryptocurrency. It turns out much more expensive than in centralized systems, although for someone the independence of the solution is more important than efficiency and price.

And in the public sector and corporations, the possibility of using a private blockchain is being actively investigated. It is accessed by a regulated circle of persons (as a rule, members of the consortium), they also provide the power to support the work, no reward for this is necessary. So, the private blockchain does not have any unique properties . Stability, redundancy, integrity control, self-consistency, etc. - we were able to achieve all this even earlier in centralized systems (and much more efficiently). Moreover, since the proof of the work done (Proof-of-Work) is not used in the private blockchain, participants (and few of them) can agree and rewrite the blockchain at will.

In most tasks, the private blockchain is screwed only for the ease of implementation of the interaction of participants (although this simplicity is controversial in the end). More often for creating infopovod / excitement.

That is why we constantly hear the news "Someone is piloting the blockchain for something", "Someone made the first transaction / operation in such a sphere using the blockchain." But what systems are really put into operation? Moreover, what systems really compete with centralized services? Alone talk and promise.

I do not know if there will ever be any other use for the blockchain besides cryptocurrency, but for now my advice to you is: if you don’t believe in cryptocurrency, don’t believe in the blockchain.

If you are ready to protect something from the other 50 applications of the blockchain , let's discuss it in the comments.

Recently we wrote an article “ Six myths about the blockchain and Bitcoin, or Why this is not such an effective technology ”, which looked at how the unpleasant features of any solution built on the blockchain derive from the essence of the blockchain. In order to inspire fans of fashionable technology, we wrote a flip-flop article “ Why blockchain is not such a bad technology, ” which looked at the same properties and limitations of the blockchain, but from a different point of view, how other technologies try to circumvent them.

Today we will focus on the areas of application of the blockchain. In our opinion, in many areas the potential is greatly exaggerated.

Myth # 1. Blockchain will kill banks, banks are afraid

Source 1 . Source 2 . Source 3.')

They say that banks are so afraid that they will not be needed, that some “Rothschilds” in every way sabotage the blockchain's triumphant march around the planet.

There is an idea that banks are mainly involved in money transfers, charge a large commission for this, and they also transfer slowly. Here cryptocurrencies, perhaps, really help. Although commissions in cryptocurrencies are not at all small, but hidden commissions at the expense of issuing are generally mocking.

But what else the banks are doing is issuing loans, taking deposits, evaluating borrowers, considering risks, knocking out debts. None of this blockchain and cryptocurrency help.

I know only one use of the blockchain here - you can issue a loan in digital currency on the security of another digital asset. There are few risks, there is no interaction with the real world, it will work. But this scenario does not cover even one percent of banking.

Add a funny story about this myth. There is such a banking blockchain consortium R3 . It includes hundreds of the largest banks in the world: UBS, Bank of America, Barklays, UniCredit - everything is there. They really wanted to do something with the blockchain, spent $ 59 million on research , and then said authoritatively : “ We don’t need blockchain! “Some blockchain fans began to mock the consortium, others still call the resulting solution Corda a blockchain solution and rejoice in its success.

In fact, this story only shows: do not use the blockchain where it does not belong.

Myth # 2. Blokchain wins corruption

Source 1 . Source 2 . Source 3 . Source 4 .They say that you can track money transfers in the blockchain: who translated what to whom. Then we take the bribe hand and catch it!

But not so simple. Usually, people do not transfer a bribe from their card to a bribe card.

In fact, the supervisory authorities and the Central Bank, and so they see all the travel money from account to account, but not very much it helps. For example, a billion rubles was allocated for the construction of a hospital, the money came to the general contractor, from his subcontractor, 50 million for a brick, some for pipes. And how to understand who is whose brother, who is the matchmaker, who won in the tender, and who in the fake tender? How to find out why the price of pipes from the supplier is higher than in the neighboring city? Need to understand, it's not the blockchain.

You can argue that the supervisory authorities do not cope, but if the entire accounting department was published for all comers, then we would all piled on and find out where the prices are inflated. May be. But it is also impossible to open all the finances of private companies - counterparties, prices for services, marketing costs, research costs, etc. - this is a commercial secret, transparency can adversely affect the market.

In any case, we can open financial flows without any blockchain, there would be a desire.

Myth # 3. Blockchain will leave notaries without work

Source 1 . Source 2. Source 3 .Like, documents can be stored in the blockchain, then no copies need to be certified. Who will sell diplomas in the metro if there is no graduation record in the blockchain register of diplomas? Why should a notary verify the authenticity of my passport if I can sign a will with my secret key?

First, if we want to make a single database of diplomas or the Unified State Register of Real Estate (USRN), then we absolutely do not need to use the blockchain. Just take and make the registry. Decentralization here brings nothing. What is important is not the form in which the database is stored, but what opportunities for changing the data we want to leave in the system. If we fear that someone, having received direct access to the database, will start to edit the records retroactively, then we need to make backups and monitor integrity. The ability of the owner to rewrite the apartment to another person and this way and that will remain.

Secondly, the notary usually looks at the passport and makes sure that you are you. In principle, it is possible to replace the passport with an electronic secret key. Only you need to try so that the citizen does not compromise this key. It means that it would be good for him to issue the “second factor” and the storage of this key. You’ll get an Estonian ID card, which has been actively used since 2002 and has nothing to do with the blockchain. But we are for.

Thirdly, the notary verifies that the client is sober, that his wife does not pressure him, that he understands what he is doing. Surely the notary is still trying to figure out what exactly the client is trying to write in the will / power of attorney, because there are different fantasies. This activity is not only blockchain, but also a strong artificial intelligence is unlikely to ever be able to carry out.

Separately, we mention one of the functions of the notary: witnessing the existence of something. This can be done with the help of the blockchain (now), and with the help of the traditional Trusted Timestamping. But we are talking only about digital objects (music, documents, etc.).

Myth # 4. Smart contracts are a breakthrough, they automate life

Source 1 . Source 2 .“First, artificial intelligence must analyze all Russian laws ...”

From the article Legislation will be transferred to the blockchain

If you still do not know what a smart contract is, we advise you to quickly figure it out . Despite the name, a smart contract is not a contract at all (in the definition of Wikipedia). A contract is a set of promises that are enforced legally (“If you’ve signed a contract, you’ll be able to enforce it”). In the case of a smart contract, no one promises anything to anyone, no one is forced to anything, especially legally.

A smart contract is simply a digital asset management program . The program says what can be done with an asset, what will happen if it is done, etc. The only difference from the most usual conventional programs is that a smart contract is executed not by one specific computer, but by all-all miner computers synchronously. If the result is the same for everyone, then everything is fair.

So, we can write programs for hundreds of years. We can automate what can be automated. Machine learning helps automate even what is difficult to formalize. And the fact that the blockchain has allowed us to write homeless programs is unlikely to allow us to program what we have not yet succeeded.

Yes, smart contracts turned out to be very useful where we do not trust the programmer: for the lottery, the pyramid, for collecting money and taking participants' contributions ( ICO ). But in most tasks in life, programmers and services do not deceive us. Do not think that pervasive deception is the engine of progress, and we urgently need smart contracts.

For example, if you are traveling in a taxi, the taximeter counts kilometers and minutes and gives the final cost of the trip. How often do you ask yourself: “Does the program really work as described in the public offer? Give the code a look. And let's transfer it to the blockchain, and then you never know ... ”

You have placed money on a deposit in a bank, the bank considers and charges compound interest . Do you have to see the code of the calculation function to trust the bank? Of course, sometimes the code is written crookedly, does not take into account a leap year or some other parameter, or the programmer just did some bugs. But even here, conventional programs are better than smart contracts - at least they can be corrected. And in a smart contract, if it’s a mistake, then forever . And if a smart contract permits updating the logic at the whim of the author, then this is no longer a canonical smart contract, carved in stone.

The blockchain-enthusiasts desire to translate into smart contracts something that is already automated and works perfectly is completely incomprehensible.

Of course, when two or more people want to make a bet or some other monetary relationship to issue, it is inconvenient to conclude a traditional contract, it is more convenient for them to write a program for interaction. Yes, only this situation does not arise so often, and besides, it is hard to formalize - after all, real-life events themselves do not fall into the blockchain.

Myth # 5. The blockchain will speed up, the Internet has also once been slow

Like, yes, the blockchain is slow, heavy, incomparable with traditional centralized solutions, but so far. YouTube and the Internet were once too slow, and now everything flies.

The problem is that the Internet was slow, because there were few resources (narrow channels, poor equipment), but it was scalable, but the blockchain was slow by design.

There is such a “ blockchain trilemma ”: “Decentralization, scalability and security cannot be achieved simultaneously.”

A source

The old blockchains (Bitcoin, Ethereum) chose security and decentralization at the expense of scalability. When the speed of 7-15 transactions per second ceased to satisfy even the most devoted fans of the blockchain, they began to try to fasten scalability to what is at the expense of security. So there are ideas sharding, Lightning Network, Plasma .

The new generation of blockchains (EOS) slightly deviate from decentralization. They do not have all the nodes in the network coordinate their actions with each other, but, for example, only 21 are very good and powerful nodes. Since these 21 lucky ones can be changed by voting, we still have decentralization. Of course, 21 computers are not 10,000 , as in Bitcoin, but the average speed has reached 3,000 transactions per second. Better than 10, agree. But still, since there is a blockchain, you can’t just add equipment and get more speed.

Some solutions ( BigChainDB , IOTA , Corda ) simply refused to use the blockchain and gained scalability.

We lead to the fact that this is not the blockchain will be fast sometime, but the resulting solution will no longer be a blockchain if it becomes scalable. Also, how long can you wait?

Myth # 6. Blockchain money supplant national currencies

Source 1 . Source 2 . Source 3 .They say that ordinary money (national currencies) are subject to inflation, because the states are constantly printing them, but at Bitcoin (but not all cryptocurrencies), the issue is programmed. Only you manage your money with cryptocurrency, and not someone else, nothing can be frozen and taken away.

Let's reject the technical component: even if the blockchain is unsuitable for creating world and even state money, suddenly something else would be technically suitable. Let us focus on the question why there is not and will not be a national cryptocurrency.

First, the state wants to pursue a monetary policy . Printing (or drawing on accounts) money is necessary as the economy develops. Banks must issue loans more than they accumulated deposits. If the Central Bank does not control the emission of this national cryptocurrency, the economy will be bad.

Secondly, the state wants to be able to take money away. If someone stole a billion dollars in the form of cryptocurrency, and we caught him, then it would be good to return the money, right? And in cryptocurrencies, if you do not know the key, then nothing can be taken away and frozen.

Thirdly, giving away free money to the miners for servicing the blockchain for the state is somehow wasteful. Although you can, of course, cancel the award, and "mine" in banks.

Fourth, the state loves when it knows who owns the money and where it came from . If cash were invented now, they would be immediately banned. Although, of course, you can make a cryptocurrency on passports.

All this suggests that the principles of public money and cryptocurrency are opposite. Cryptananarchists believe that cryptocurrency is better, but this does not increase the chances for the replacement of ordinary money.

If the state does not need all of the above, then you can pay at least with a cryptocurrency, even with bottle caps. For example, the Venezuelan government recently released the token Petro . Let's see if he can keep the course in the required range.

Conclusion

Blockchain enthusiasts often claim that cryptocurrency and blockchain are not the same thing .

Well, formally, of course, yes. For example, Telegram Messenger LLP is not the same as Telegram Messenger. But if you look essentially, the blockchain is currently used almost exclusively in cryptocurrencies (and there it is needed and justified).

The point is this. Blockchains are divided into two types: public and private. An unlimited number of people can write to a public blockchain; access control is not performed. All public blockchains are cryptocurrency , because to achieve decentralization, it is necessary to financially motivate the participants to support the work of the blockchain. This is mining, and a reward is paid for it.

Of course, on the basis of an already existing public blockchain, you can build something else just by using it as a diary, but you will have to pay for the use of such a storage cryptocurrency. It turns out much more expensive than in centralized systems, although for someone the independence of the solution is more important than efficiency and price.

And in the public sector and corporations, the possibility of using a private blockchain is being actively investigated. It is accessed by a regulated circle of persons (as a rule, members of the consortium), they also provide the power to support the work, no reward for this is necessary. So, the private blockchain does not have any unique properties . Stability, redundancy, integrity control, self-consistency, etc. - we were able to achieve all this even earlier in centralized systems (and much more efficiently). Moreover, since the proof of the work done (Proof-of-Work) is not used in the private blockchain, participants (and few of them) can agree and rewrite the blockchain at will.

In most tasks, the private blockchain is screwed only for the ease of implementation of the interaction of participants (although this simplicity is controversial in the end). More often for creating infopovod / excitement.

That is why we constantly hear the news "Someone is piloting the blockchain for something", "Someone made the first transaction / operation in such a sphere using the blockchain." But what systems are really put into operation? Moreover, what systems really compete with centralized services? Alone talk and promise.

I do not know if there will ever be any other use for the blockchain besides cryptocurrency, but for now my advice to you is: if you don’t believe in cryptocurrency, don’t believe in the blockchain.

If you are ready to protect something from the other 50 applications of the blockchain , let's discuss it in the comments.

Source: https://habr.com/ru/post/419867/

All Articles