Tesla reported a record loss. Shares of the company still rose due to forecasts for the next quarter

Image: Unsplash

In early August, Tesla reported on the results of the previous quarter: from April to June, the company's losses amounted to more than $ 717 million. At the same time, Ilon Mask reported on the successful production and sale of new electric vehicles and planned profits in the next period. This caused a jump in the value of the company's stock by almost 14% over the week.

')

Conflicting results and optimistic forecasts

Tesla, an innovative company that did not reach profits during all 15 years of its existence, ended the quarter with a record loss of $ 717 million. During the quarter, Tesla spent more than $ 430 million of its remaining cash, reducing the balance to $ 2.2 billion. These costs are caused by the expansion of new production Tesla 3 models designed for the mass market.

At the end of June, Tesla reached the target for the production of new cars: 5,000 per week. The New York Times reports that having overcome this threshold, Tesla is looking to make a profit. “We expect the second half of 2018 to be profitable for the first time in our history and will end with a positive cash flow,” the Guardian quotes a letter from Tesla management to investors.

This and other optimistic forecasts made by Ilon Mask during a telephone conference after the publication of the report revived investor interest in Tesla shares. Since August 1, the value of shares has increased from $ 296 to $ 344 per unit at the time of the opening of the exchange. According to the Financial Times, one of the major buyers of Tesla shares was the Saudi Arabian State Fund, which invested $ 2 billion in the company.

Attention to the future of Tesla is attracted by both official company reports and media analytics, as well as loud statements that Ilon Mask publishes on his twitter. Since August 7, the billionaire said that he intends to make Tesla a private company and plans to buy out all the company's shares at a price of $ 420 each. In response to a request from the NASDAQ, Musk said that the decision had not been finally made and had not yet been agreed with the shareholders.

How Musk plans to go into profit

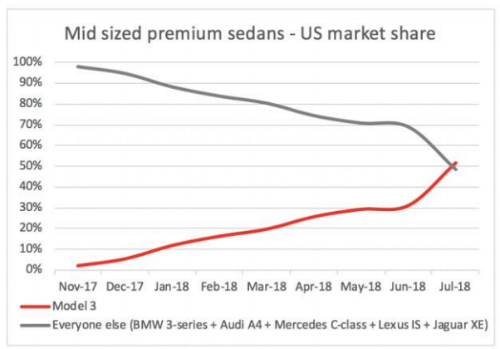

Relying on profits, the company specializing in innovative electric cars relied on the Tesla 3 sedan, inferior in performance to the luxury Tesla S and Tesla X that had been released earlier. According to a Tesla report , in July 2018, their new model did not become the best seller in its segment in The US, but ahead of other mid-size premium sedans, occupying 52% of the market.

Schedule: Tesla

According to CNN, for the third quarter, Tesla 3 buyers received 18,440 cars, more than 11,000 electric cars produced are still being delivered to their owners. In the current quarter, Tesla plan to release from 50 to 55 thousand Tesla 3.

We also forecast the demand for future periods: already 420,000 Tesla 3 are reserved by future buyers. Interest in cars is caused not only by Tesla's reputation, but also by objective technological advantages. Comparing energy intensity, charge rate, resource consumption of battery production, Forbes put Tesla 3 above competitors.

Some analysts remain skeptical about Tesla's plans. The plan to move to a profitable model through expanding the production of affordable electric cars seems feasible, but it can easily collapse due to production disruptions, delivery delays and lower-than-expected demand for Tesla 3, Barclays analyst Brian Johnson quotes the New York Times. Previously, Tesla has repeatedly failed to fulfill the announced plans for the production of new cars.

Other materials on finance and stock market from ITI Capital :

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies from the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions

Source: https://habr.com/ru/post/419795/

All Articles