IT history lawyer. Life is business outsourcing. Part 2

The first part of this entertaining story is the link below:

IT history lawyer. Life is business outsourcing. PART 1

')

#DISCLAIMER

The characters are fictional, and the situations are modeled, but if you finish reading to the end, you will understand that the story is close to reality.

# EVALUATION

Sasha and Igor held a meeting, and made an unequivocal decision - to sell part of the company to a strategically important investor. Financial advisors suggested that the value of the company is estimated by various methods. In the opinion of the partners, the following was acceptable: take the company's net profit over the last year, multiply it by 5 (years) and thus obtain a valuation (valuation) of the company.

600,000 USD (net profit for the last year) * 5 (years) = 3,000,000 USD

Total controlling stake - 51% of the shares, was estimated at 1,530,000 USD

# LEGAL AUDIT

Negotiations began with SOFTWARE LLC.

As was established in the West, before buying a business, purchaser companies conduct an audit (financial, technical, legal).

The parties signed the NDA, SOFTWARE LLC sent a “questionnaire”, the completion of which required the disclosure of all legal and financial information of the company.

At first glance, the mechanics are simple: the lawyer of Sasha and Igor answered questions and provided the necessary documents. By the way, at this stage, lawyers from SOFTWARE LLC compared the data from the statement on the bank account of ALIG LTD and revealed that not all transactions had invoices and other primary documentation. Sasha and Igor had to get out and prepare these documents.

A couple of weeks came a number of additional questions and clarifications, the main of which were the following:

№1 “Why Sasha and Igor transfer 7% of the company's profits to personal accounts under the guise of services rendered. Is it really payment for the services actually rendered? If yes, prove it! ”

# 2 “Why does the company ALIG LTD have no employed employees, but only contractors who have signed the Independent Contractor Agreement?”

№3 “Why does LLC“ First ”have lower-than-market salaries for employed employees, or, to be more precise, the minimum salaries allowed by law? Prove that they really work for this money and do not receive any payments separately! ”

No. 4 “Why the profit center is ALIG LTD, and the office listed on the site is rented by LLC“ First “. What is the relationship between the companies? "

№5 "Why business ALIG LTD does not comply with the regulations of the GDPR"

The lawyer answered question 4, explained that it was difficult to arrange a lease for a foreign company, and for this purpose the local resident company was used in the group structure. She, in turn, works on the principle of B2B co-working, for a certain circle of people, and allows contractors of ALIG LTD (and actually employees) to be in the office, for which, in fact, makes a profit. Everything is fixed in the contract.

On question number 2, the lawyer said that such actions are legal. The attorney failed to give a clear answer to the first and third questions. Sasha and Igor just didn’t have time to implement GDPR ...

*** From the author: often in my legal practice I meet clients who, to the last, delay the introduction of a GDPR into their business. Let's discuss in the comments the reasons for this behavior. ***

#REALITY

The results of the legal audit were disappointing and SOFTWARE LLC put forward a number of conditions on which they are ready to continue negotiations on the purchase of the company. The main requirement is the transfer of full control over the movement of money within the company to the financial director (of course, after signing the Share Purchase Agreement)

If we talk about "non-legal" moments, then SOFTWARE LLC asked for an exact calculation of the company's main metrics, such as:

- Customer Acquisition Cost

- Lifetime Value

- Retention

- Month Over Month Growth

And the cherry on the cake was the last condition: the price of a transaction in the presence of substantial legal risks, radical tax planning methods, mess in financial documentation and analytics cannot be higher than 500,000 USD (and this is three times less than the offer of Sasha and Igor)

# TRAINING IN TRANSACTIONS

Sasha and Igor managed to reverse the course of negotiations, they “knocked out” the price of 750,000 USD for 51% of the company's shares, while Sasha is obliged to hold the position of CEO for another 3 years, Sasha is controlled by SOFTWARE LLC. The parties shook hands and agreed to close the deal after 2 months.

It was supposed to change the statutory documents of ALIG LTD (since the powers of the director had already become, and the majority shareholder represented by SOFTWARE LLC was broader) and the signing of the agreement - Share Purchase Agreement.

Under the terms of the contract, Sasha and Igor were supposed to accept money for selling shares to their personal bank account (after all, they are shareholders of the company). The guys did not see any problems, because they have personal accounts abroad.

#NEW LIFE?

SOFTWARE LLC became the full owner of ALIG LTD. Things of the company go up the hill. Every year, Sasha and Igor receive a decent amount of income from the company’s activities on their personal accounts, part of the profit remained undistributed among the shareholders, and was a kind of “reserve fund” of the company.

I will remind you!

Sasha is a tax resident and a citizen of Russia, and Igor is of Ukraine.

In Russia, the law “On controlled foreign companies” (CIC) has already been passed, under which Sasha falls (since he owns 42% of a foreign company) and is obliged to declare the ownership of the company, pay a tax on retained earnings.

*** Sasha decided not to comply with the requirements of the law. Argued by this reluctance to pay "extra" taxes. ***

The lawyer warned Sasha that this is a serious violation with real responsibility:

- additional accrual of personal income tax and interest,

- penalty for late submission of the 3-NDFL form (5% for each month of delay, but not more than 30% of the amount of tax payable)

- a penalty for failure to pay tax (20% of the amount of tax)

- criminal liability under Articles st.198,199 of the Criminal Code of the Russian Federation for tax evasion on a large scale

Sly OFFSHOR

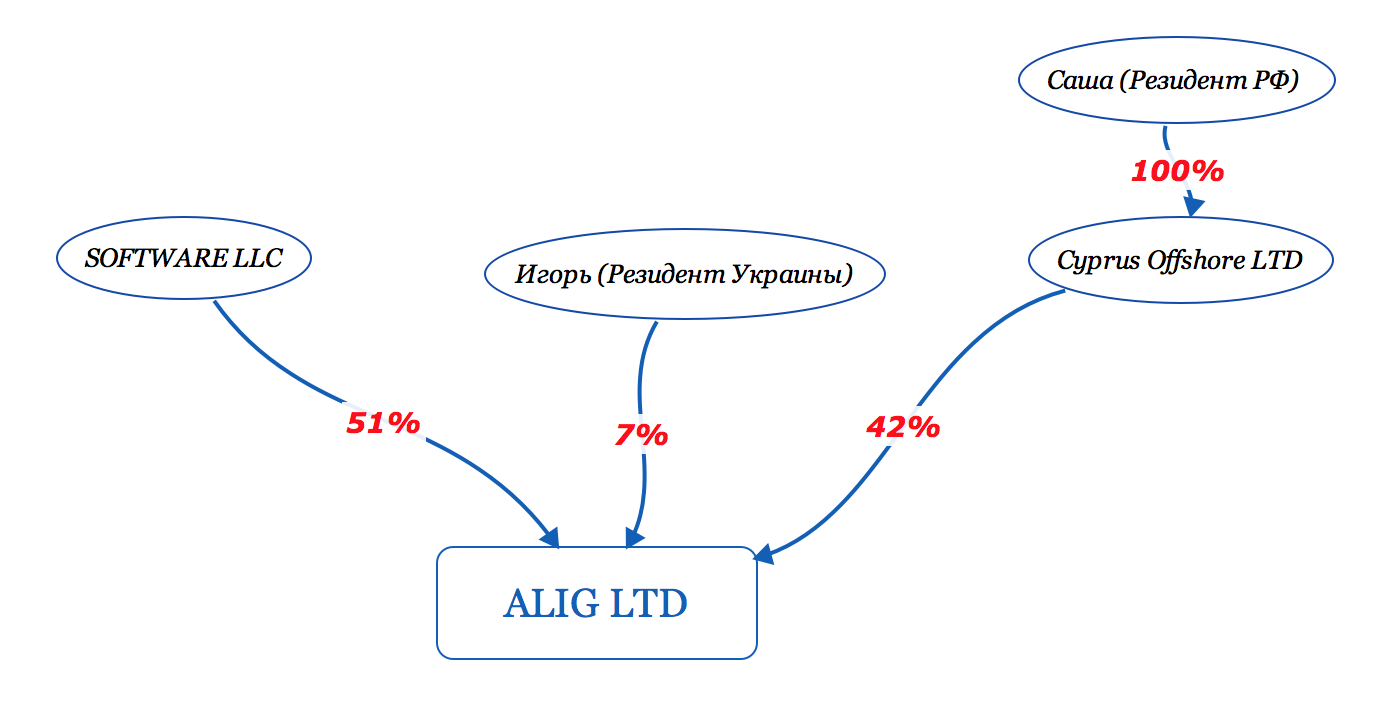

One of the consultants advised Sasha to register another additional foreign company and introduce it into the shareholders of ALIG LTD instead of himself. Thus, the name of Sasha will no longer appear in the register of companies, and dividends will fall not on Sasha’s personal account, but on the account of this company. Money can be stored there. Given the fact that in 2018 to open an account for a classic offshore is no longer possible Sasha decided to register a company in Cyprus. (By the way, a zero tax rate was applied to the incoming payments, namely dividends received from ALIG LTD, and Cyprian nominal shareholders appeared in the register of owners instead of Sasha). Sasha did so, he created the company Cyprus Offshore LTD

# EXCHANGE OF TAX INFORMATION

Russia has already begun to participate in the automatic exchange of tax information developed on the basis of the OECD Convention on Mutual Administrative Assistance in Tax Matters, which is provided for by the multilateral agreement CRS Multilateral Competent Authority Agreement (MCAA). Sasha heard about this agreement and realized that the tax authorities of Russia got a real chance to learn about his participation in foreign companies (remember, Sasha owned at that time 100% of Cyprus Offshore LTD shares which in turn owned 42% of ALIG LTD shares) and about personal account abroad, and he did not declare the company as a CIC, did not pay personal income tax. He urgently needed legal advice.

*** Meanwhile, Igor, unlike Sasha, was calm, because he is a tax resident and a citizen of Ukraine, who only recently began the procedure of integration into the tax information exchange system and has just signed the multilateral convention MLI. He still had time in store to get advice and restructure his legal model of owning a business. ***

#CONSULTATION

Sasha has been looking for a lawyer for a long time, because in the CIS there are few companies that professionally understand both the local legislation of Russia and the international CRS protocol, and also know the legislation of Cyprus.

OFFTOP CRS EXCHANGE OF TAX INFORMATION

*** For readers , as a representative of a law firm, I will try to reveal the essence of the exchange of tax information on the CRS standard. ***

If you have a company and an account abroad, and the country in which the bank account is opened, signed an agreement with Russia (73 such agreements), the bank is obliged to transfer data on the company's beneficiaries, the account balance, all financial receipts, and so on. either to Russia (if the company is passive, or does not have tax resident status and is tax transparent in the country of registration), or (if the company is active) to the “tax” one at the place of registration of the company.

The company is passive when the share of passive incomes (for example: dividends, interest, royalties, rent, income from transactions with currency or financial assets, etc.) is more than 50% during the reporting period. All other companies are active.

Example # 1: A Cyprus company with an account in a Cyprus bank

If the controller of the company is a resident of the Russian Federation and the company

a) passive , then the financial data will be transferred by the Cyprus Bank to the tax authorities of the Russian Federation

b) active , the financial data will be transferred by the Cyprus bank to the Cyprus tax, and then the Cyprus tax will not transfer them to the tax RF.

Case 2: Hong Kong company with an account in a Hungarian bank

If the company's controller is a resident of the Russian Federation and the company

a) passive , then the financial data will be transferred by the Hungarian bank to the tax RF

b) active , the financial data will not be transferred to the Hungarian bank anywhere, as in the Russian Federation there is no reason to transfer, and there is no exchange agreement between Hungary and Hong Kong.

Case 3: Scottish or English partnership (LP or LLP) with an account in Switzerland

If the company's controller is a resident of the Russian Federation, then whether the company is active or passive, the Swiss bank will transfer the information to the tax authorities of the Russian Federation, since the UK partnerships are tax transparent structures.

Immediately I will inform you that no nominal shareholders will help to “hide”, since the bank always knows the ultimate beneficiary (s) of the company.

What threatens the transfer of tax information on the CRS standard in the Russian Federation:

If you officially declared your company in the Russian Federation in accordance with the KIK Act, then there are no threats. Otherwise, fines and / or criminal liability for tax evasion are waiting for you.

# BAD EVENING

Sasha received a consultation with the following content:

According to ALIG LTD, there will be no information exchange with the tax authorities of Russia, since ALIG LTD is an active company, but there will be an exchange with Cyprus Offshore LTD, as the company’s activity is passive (recall that the company was created solely for the purpose of receiving dividends from ALIG LTD). That evening, Sasha made a couple of important conclusions.

To be continued...

Source: https://habr.com/ru/post/419365/

All Articles