How we made a system that gives customers discounts based on individual characteristics

There are textbook examples in marketing: the probability that a person will return to the store after the second purchase is much higher than after the first one. Therefore, MoneyMan (online lending service, included in ID Finance) has a 30% discount for the second loan, 10% for the third loan, and only 5% for the fourth loan. Usually at this point customer loyalty reaches its maximum, and he begins to use the service out of habit. We give the biggest discount (50%) to customers who have not used the service for 90 days. This is the point of no return for our business: without additional incentives, only 1% of all users return to the service after such a period.

Discounts, in general, do not work very well: many customers would have already bought a product or service, others would have attracted a smaller discount, and a third one needs more motivation. Someone needs a discount at the end of the week, someone - before the salary, and someone - before the release of a new model of iPhone. But the issuance of discounts, as a rule, is not regulated in any way and the money of companies is being wasted. At the same time, they can eat up to 30-40% of the marginality of the business.

Previously, when assigning a discount, we segmented clients by RFM analysis (time, frequency of operations and cash expenditures of clients) according to the socio-demographic principle (gender, age). These models are outdated and showed irrelevant results. About 40% of borrowers take a new loan in the first week after repayment. We gave such customers a discount less than the rest. Could they do without it? Maybe. But we couldn’t say for sure before. Therefore, we have built a new discount system.

')

We assessed the entire base of borrowers for a certain period: how they used discounts and how their value influenced payment discipline. Then we divided all new customers into six focus groups and tested several tests. Each group was given different discounts from 0 to 75% and looked at the conversion. The test took two months. The resulting analysis of the conversion of 50 parameters, we transformed into a mathematical model. The program based on the data array assigned a special score to the borrower, which evaluated his tendency to return to the service. In other words, the system itself assigned the optimum discount based on credit history data, information from social networks and the borrower's behavior. We connected the system with marketing tools, set up a direct, mailing list, push notifications and transferred data to the support service.

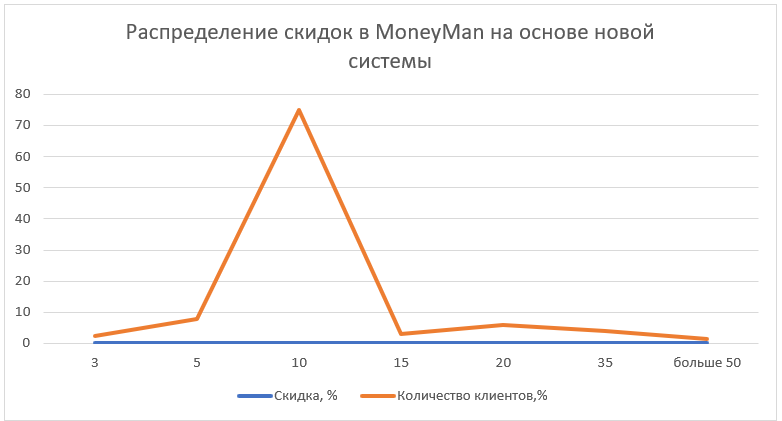

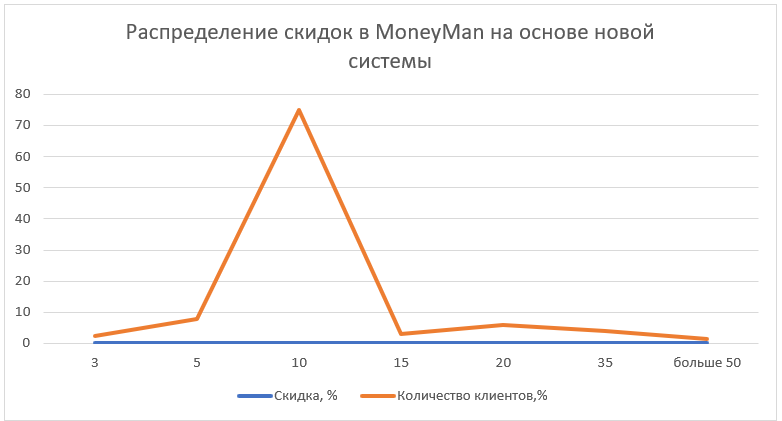

The pilot was introduced in the MoneyMan service in Russia and Kazakhstan in November 2017. Since 2018, the model has been implemented in other projects of the company (Solva, AmmoPay and Plazo) and in other countries (Georgia, Poland, Spain, Brazil, Mexico). Most often, the new system has set a 10% discount. It accounted for about 75% of all new issues. Discounts of more than 50% accounted for less than 1.5% of all returns. The average discount, which, for example, MoneyMan offered before the study - 24%.

As a result of the introduction of the new system, the share of returned funds to the loan amount increased by 3.2 percentage points. up to 24.7% per month. The number of repeat customers increased by 27%, while the quality of the client flow did not deteriorate. The economic effect is estimated at 110 million rubles. by the end of 2018 In the ID Finance group - about $ 4 million by the end of 2018

Tips for those who want to implement such a system

Discounts, in general, do not work very well: many customers would have already bought a product or service, others would have attracted a smaller discount, and a third one needs more motivation. Someone needs a discount at the end of the week, someone - before the salary, and someone - before the release of a new model of iPhone. But the issuance of discounts, as a rule, is not regulated in any way and the money of companies is being wasted. At the same time, they can eat up to 30-40% of the marginality of the business.

Previously, when assigning a discount, we segmented clients by RFM analysis (time, frequency of operations and cash expenditures of clients) according to the socio-demographic principle (gender, age). These models are outdated and showed irrelevant results. About 40% of borrowers take a new loan in the first week after repayment. We gave such customers a discount less than the rest. Could they do without it? Maybe. But we couldn’t say for sure before. Therefore, we have built a new discount system.

')

What we did

We assessed the entire base of borrowers for a certain period: how they used discounts and how their value influenced payment discipline. Then we divided all new customers into six focus groups and tested several tests. Each group was given different discounts from 0 to 75% and looked at the conversion. The test took two months. The resulting analysis of the conversion of 50 parameters, we transformed into a mathematical model. The program based on the data array assigned a special score to the borrower, which evaluated his tendency to return to the service. In other words, the system itself assigned the optimum discount based on credit history data, information from social networks and the borrower's behavior. We connected the system with marketing tools, set up a direct, mailing list, push notifications and transferred data to the support service.

How it works now

The pilot was introduced in the MoneyMan service in Russia and Kazakhstan in November 2017. Since 2018, the model has been implemented in other projects of the company (Solva, AmmoPay and Plazo) and in other countries (Georgia, Poland, Spain, Brazil, Mexico). Most often, the new system has set a 10% discount. It accounted for about 75% of all new issues. Discounts of more than 50% accounted for less than 1.5% of all returns. The average discount, which, for example, MoneyMan offered before the study - 24%.

As a result of the introduction of the new system, the share of returned funds to the loan amount increased by 3.2 percentage points. up to 24.7% per month. The number of repeat customers increased by 27%, while the quality of the client flow did not deteriorate. The economic effect is estimated at 110 million rubles. by the end of 2018 In the ID Finance group - about $ 4 million by the end of 2018

Tips for those who want to implement such a system

- You can make such a system based on open-source solutions.

- Attention should be paid to the freshness of the data. The behavior of borrowers is changing rapidly, information becomes irrelevant. The developed system prioritizes the latest data.

- Information about customer behavior within the service (financial discipline, loan amount, etc.) is more important than external data, including the history from the credit bureaus

- Monitor the sources of information delivery: it is important that there are several. The most effective are still SMS and push notifications.

- E-mail with new offers is better to send from 10:00 to 15:00, SMS customers respond better from 15:00 to 18:00

- With notifications about the discount is better not to part. One person should not receive more than two messages per week.

- If the discount is large, it should be indicated in the subject of the letter; if it is small, it should be in the text, and the subject of the letter should be clickable.

Source: https://habr.com/ru/post/417393/

All Articles