What does the S-shaped mobile wallets look like?

Three years after its launch, the product is either at the peak of an S-shaped curve, or it turns out to be a failure. This is the classic model of the product life cycle, which can be found in business school.

The author of the article organized a study in order to check how well the Apple product, and the competitors that followed it, passed the S-curve test in the US market.

')

This cycle is shown in the graph above, in the form in which it was first published in an article by the economist, marketing science expert and professor at Harvard Business School Theodore Levitt .

And now, three years and four months after the launch of the first publicly available mobile wallet on the market - Apple Pay - the authors of the study decided that it was time to test how good the Apple product, and the competitors that followed it, were tested by the S-shaped curve.

The author of the article used her research on the spread of mobile devices.

This consumer study of the level of activity of using mobile wallets is conducted by the authors of the study on a quarterly basis together with InfoScout since the launch of Apple Pay in October 2014. You may remember that during the course of the study, the authors of the survey interviewed consumers who met the following criteria:

- their smartphones support one of four monitored mobile wallets,

- they just purchased something from a store that accepts one of these four mobile wallets,

- they say why they used this or that mobile wallet to buy or vice versa, did not do it.

In other words, the authors of the study observed what people were doing, and then asked them why they did that. Quarterly, they survey about 2 thousand users of each wallet. As a result, the surveyed audience is about 8 thousand consumers.

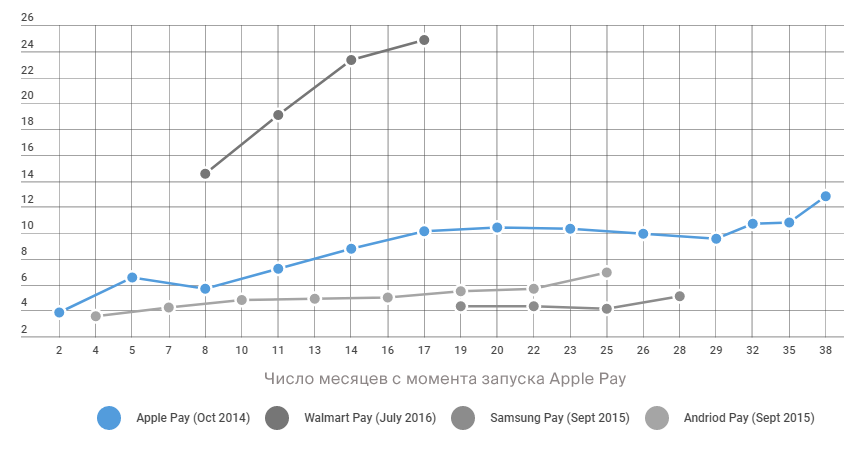

This project revealed that the distribution of Apple Pay from its launch in October 2014 looks more like a straight line than an S-shaped curve. As for the growth in the number of Apple Pay transactions, in general it is more likely to be associated with an increase in the number of merchants who installed NFC terminals, rather than with an increase in the interest of iPhone users in this payment method.

Meanwhile, Walmart Pay shows results more similar to the S-shaped curve, in any case, if we consider it from the point of view of its direct purpose - to pay for purchases at Walmart.

The growing distribution and use of mobile wallets in the fourth quarter of 2017

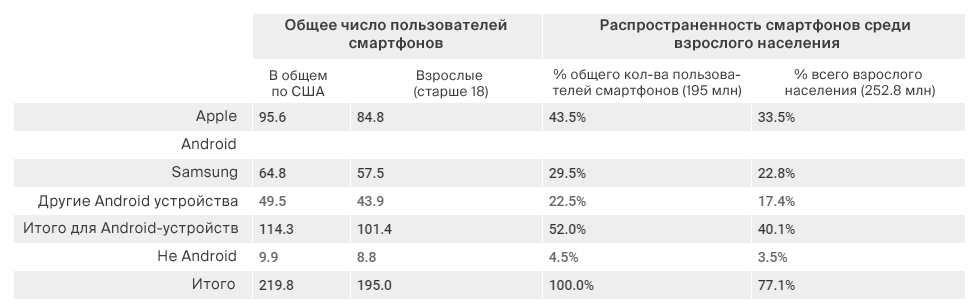

Today, most Americans have a smartphone that supports mobile wallets. Of the 195 million representatives of the adult (over 18) population of the United States, 77.1% have smartphones.

Apple and Samsung together account for 70% of the smartphone market, 43.5% and 29.5%, respectively. Android’s market share is 52%, iOS - 43.5%. If we consider these shares, taking into account the entire adult population, and not only adult owners of smartphones, the distribution is as follows: 33% from Apple, 22.8% from Samsung and 40% from Android.

These numbers are very important to keep in mind when comparing the popularity of the corresponding wallets on all smartphones and the entire US adult population.

It should also be noted that the ability to receive payments using NFC wallets has significantly increased as a result of the actions of card networks to transfer responsibility for fraud, which provoked merchants to install new terminals that support contactless payments.

In the latest Apple-based newsgroup, Apple CEO Tim Cook said that more than half of US retail outlets accept Apple Pay today. These include two-thirds of the companies from the list of the hundred largest retailers. These data were not verified by the authors of the study, but they are based on the fact that they are correct.

In practice, the fact of accepting Apple Pay at one point or another means that all other contactless mobile wallets are also used in this place, because the main factor in ensuring access in such cases is the presence of contactless terminals and the desire to connect such payment methods. The lack of reception of contactless wallets no longer represents such a serious barrier to their distribution, as before. For example, Samsung Pay technology supports old-style terminals that read magnetic tapes on cards, although they do not have data on how often they are used.

The results of the survey last quarter, conducted at the end of Christmas with InfoScout, can be called good. They can be attributed to the Christmas boom, statistical deviations, or called the beginning of the take-off, but anyway, the good news is always nice.

The percentage of users who have tried contactless payments has grown a bit.

The emphasis in this sentence should be made on the word a little, since in most cases the growth was so small that it is statistically indistinguishable from earlier results.

The time of the study in the last quarter was chosen in such a way as to study the behavior of consumers in the festive week that lasted from Christmas to New Year. The authors of the study wanted to observe the effect of the holidays on the first attempts to use wallets by new users. Smartphones are often placed under the Christmas trees and 2017 has proved very successful in terms of donating smartphones.

Therefore, the authors of the study were not surprised when it turned out that more people tried mobile wallets immediately after Christmas, especially considering their increased advertising during this period and a greater incentive to try new phones in action.

The inflow of new Apple Pay users was 29.4% (compared to 24.8% in the previous quarter), Samsung Pay - 17.2% (13.9% in the previous quarter). Android Pay was first tested by 13.3% of Android smartphone users (against 11% earlier). As for Walmart Pay , there was an increase of 24.8% of users of various smartphones (against 23.3% previously).

It should be remembered that the testing of these mobile wallets takes place in stores that accept them, that is, by making real purchases in them.

Unfortunately, the data show that the lion’s share of smartphone users never tried mobile wallets. More than 70% of iPhone users still have never used Apple Pay 40 months after its launch. Yet growth, albeit small, is better than nothing.

The percentage of users who installed mobile wallets and used them in stores, when it was possible, also increased slightly.

For each wallet, the authors of the study calculated the number of cases in which consumers with a wallet were installed, and used it to conduct the last transaction in the store that accepts this payment method.

In December, 23.1% (versus 22.9% previously) of iPhone owners used Apple Pay to conduct the last transaction at the store, where they had such an opportunity. Explanation: This statistic means that of 29.4% of users who activated and tried Apple Pay in the last quarter, 23.1% used it when making their last at the time of the survey, buying at a retail outlet, where Apple Pay is accepted for payment.

The similar indicators of other wallets: Samsung Pay - 26.8% of users (against 21.8 previously), Android Pay - 17.3% (against 15.6% previously), Walmart Pay - 23.7% (against 25.6% earlier).

Based on these data, it can be assumed that consumers who have worked to install at least one of the wallets, in general, showed no more interest in them than in December.

To compare mobile wallets and determine how well they are doing from the point of view of the S-shaped curve, it is necessary to compare identical concepts.

This means that it is necessary to analyze information on all users in general, without focusing on specific hardware platforms or operating systems.

Pass an S-curve exam (or at least not fill it up)

The growth trajectory of Walmart Pay seems to be close to S-shaped. In any case, this statement is true if we consider this wallet in the context of what it was intended for, that is, payment for purchases in Walmart stores.

As shown in chart 2 below, the percentage of all US smartphone users who installed Walmart Pay and used it for the last transaction increased from 3.3% in March 2017 to 5.9% in December 2017.

Almost double growth between March and September indicates just the S-shaped curve. If December was a deviation, then perhaps it is because Walmart users exhausted their balance sheets at the end of the month and began to use cash. In this case, growth will continue, and we will soon talk about a new success story, especially against the background of the fact that the product was not even two years old.

Chart 2. The percentage of smartphone users who have installed Walmart Pay and used it to conduct their latest purchase at the time of the survey.

Today, 25% of all adult smartphone users have set up and used Walmart Pay at least once. In December, 5.9% of users used it to make a purchase in a Walmart store.

A limited number of points throughout the country (the application can only be used in stores of the network) is compensated for by the availability of the application for an entire army of smartphone owners, regardless of the brand or operating system of these devices.

Of course, such a scenario is possible, in which further development of Walmart Pay will slow down. Nevertheless, the already achieved results of this payment solution stand out noticeably against the background of other players.

As for Samsung Pay, its growth, unlike Apple Pay, is not due to the effect of holiday sales of smartphones, but rather the wider popularity of the company's products and its Samsung Rewards loyalty program.

As for Apple Pay, he, alas, failed the exam on the S-shaped curve.

Today, after almost 40 months on the market, Apple Pay’s growth curve cannot be called a curve. Yes, she had periods of growth and recession, but in general it is a straight line.

The number of owners of smartphones that used Apple Pay to conduct their last purchase increased from 1.9% immediately after launch to 2.6% in March 2015, and 3.0% in December 2017, with some jumps up and down between these timestamps.

These studies show the absence of any signs that iPhone users have begun to show more or less interest to Apple Pay.

Of course, it is also possible that the small December jump actually marked the beginning of a long-awaited growth. But in fact, it is most likely due to the recent launch of the new iPhone and new activations of devices for Christmas. That is, it was the newbies who tried Apple Pay for the first time, and not the “oldies” began to show increased interest in the payment system.

But this is not all bad news for the company. The volume of Apple Pay transactions is growing, but this growth is due to the introduction of new NFC terminals by merchants, and not by increased user interest in the product. And this effect will fade away with time.

In order for Apple Pay to come to its S-shaped curve, iPhone users need to learn to love this payment method.

You will say that this is a feasible task, because Apple Pay is available not only at Walmart stores, as is the case with Walmart Pay, but at a much larger number of points throughout the country. Walmart provides only 7.3% of all US sales, and the growth potential of Apple Pay looks incomparably greater against its background.

However, it is easy to understand why Walmart is ahead of competitors in terms of active use of the application.

They probably visit Walmart every week (or even more often) to buy groceries and other home and family goods. It is well known that such a frequency leads to habit formation.

And besides Walmart wallet offers something more than just launching a payment. It automatically applies discounts and accumulated points during the checkout process and simplifies other aspects of online purchase, allowing you to manage your purchases both online and offline.

What's next?

A few weeks ago, Tim Cook told shareholders of the company that he was not impressed with the progress of Apple Pay, and if you would have given him similar figures three years ago, he probably would not have believed them. It was the first recognition from Apple and in particular from the mouth of Cook, indicating that not everything goes smoothly in the country of Apple Pay.

And the thing is that the guys from Cupertino look at the same data as the authors of the study and compare them with the S-curves of products released in the past and in the present.

Recall the growth of the iPhone, iPad and iPod in the first three years of their existence.

Following them, the Apple Music service appeared and was launched. Despite a tough start in 2015, Apple Music is on the rise, and the release of the HomePod smart speaker is likely to further boost its performance.

There is also information that a new generation of AirPods headphones is scheduled for release soon. They are also expected to stimulate an increase in Apple Music subscriptions.

As for Apple Pay, it cannot even boast the same results.

Percentage of respondents who tried a particular wallet:

The percentage of respondents who used the wallet more or less regularly:

Earlier, the author has already written about the need for Apple to get rid of the iPhone addiction and that the company cannot always rely on the success of this product alone. In that material, I also expressed the thesis that mobile wallets should follow the user wherever he went, which means that they can be used on a variety of devices, operating systems and channels.

IPhone owners use Walmart Pay. And besides, also Amazon Pay .

Everything goes to the fact that the number of alternative wallets available on the iPhone over time will only increase.

The author suggests that the recent renaming of Android Pay to Google Pay is associated with the desire to eliminate any consumer prejudices about where they can or cannot use this wallet to pay for purchases. This includes Chrome, available as a mobile app on the iPhone, as well as Google Shopping during a search in Safari. The author believes that in the future we will see how other payment solutions will also begin to move towards similar cross-platform solutions.

Unfortunately, Apple Pay does not work in the opposite direction.

You cannot use Apple Pay at Walmart, in conjunction with Amazon Pay, with Google, Alexa or similar voice assistants. The same applies to Samsung smartphones. And this opportunity is unlikely to ever come to you.

Thus, it appears that the Apple Pay S-shaped curve will have to be created mainly only on its own and in full dependence on the mobile device, which does not prevent consumers from using alternative solutions from competitors.

Source: https://habr.com/ru/post/410963/

All Articles