News of cryptomir: Russia and China are preparing to fight, Germany and Australia have already relaxed and enjoy

The countries of the world, which have at least somehow expressed their attitude towards cryptocurrencies, are divided generally into two categories: those that think that they still do not have enough influence on the crypt, and those that are able to adequately perceive the changing world. Unfortunately, the first is quite a lot. In this publication, we have collected various nonsense, news and events of cryptomera over the past two weeks, provoked by both "fighters" with cryptocurrencies, and supporters of progress.

A shot from the film, whose name says that the world is sometimes inclined to send very conflicting signals

More and more governments loudly declare the need to introduce tough measures to control the cryptocurrency and those associated with it. In particular, the Chinese authorities announced their intention to tighten policies on platforms that allow citizens of the country to sell cryptocurrency on foreign sites.

The verification methods are simple and effective at the same time - monitoring transactions on the accounts of customers of Chinese banks and payment systems. It is clear that especially the Chinese Big Brother will monitor the accounts belonging to individuals and legal entities that are suspected of organizing trading at foreign cryptocurrency sites. If, after verification, officials conclude that the account holder is guilty of this terrible crime, his assets may be blocked and the bank will simply refuse to service the client.

')

Does not lag behind China in the desire to regulate the cryptocurrency sphere and Russia. In late February, the First Deputy Head of the Government Office, Maxim Akimov, announced the danger of a cryptocurrency exchange for Fiat. In his opinion , if the exchange process is not controlled, then this can cause dire economic and social consequences for Russia. It seems that the cryptocurrency has become almost the No. 1 threat to the country's economy.

But officials believe in the blockchain. March 1 this year, Deputy Minister of Communications and Mass Communications Alexei Kozyrev announced the need to create his own state blockchain platform. At the same time, the mining process should be excluded from its functions (although, as we know, not every blockchain is associated with cryptocurrency, and even more so, mining is just the name of the technology). Whatever it was, Kozyrev believes that the creation of such a platform would solve the problem of long-term storage of documents and identification.

“The government did the right thing by not allowing the Russian economy to make a global sandbox for laundering criminal funds. Everyone understands that if we allow the conversion of cryptocurrencies into fiat money, this will have dire consequences for the entire socio-economic system, ”Akimov said.

And, of course, the United States. In early March, the Securities and Exchange Commission of this country sent out dozens of subpoenas to technology companies, individual experts and legal advisers who participate in the ICO. All this bureaucratic work was carried out in the framework of a formal trial, which, as far as can be understood, was prepared a long time ago. The agency states that it needs information about the structure of tokensails and presales, which are not governed by the initial public offer (IPO) rules. According to the Commission , the tokens obtained during the ICO are securities with all the ensuing consequences.

But in Australia, everything is turned upside down (actually, why be surprised). Citizens without problems and worries (and checks of regulators, yes) can buy Bitcoins and broadcast for Fiat even at newsstands. This was made possible by the new project of the Australian cryptocurrency exchange Bitcoin.com.au. Since March 1, the service has become available in more than 1,200 newsstands.

But the most important step at the end of last month was Germany. The government of the country officially declared Bitcoin legal tender. Moreover, purchases made for cryptocurrency are not taxed, which, one must think, is a weighty argument for their holders. The ruling was signed at the end of February. Discussion of the role of Bitcoin in the financial infrastructure of the state has been going on for several years. It all started with the decision of the European Court of 2015, according to which Bitcoin is a currency in terms of taxation.

Let us turn from news of politics to news of cryptomere. A regular hardfork took place in the Bitcoin network (it is already possible to lose what account) Bitcoin Private. Its merit is the ability to work with the protocol based on the evidence of the zk-SNARK zero disclosure. Feature - the ability to hide data about transactions, which means anonymity, which is so lacking in the modern world (especially financial). Money loves silence, and cryptocurrency is no exception, although it is not money in the full sense of the term.

The fork is based on two blockchains at once - Bitcoin and Zcash.

Another hardfork in Ethereum Classic brought the entire amount of Callisto Network (CLO) coins to all ETC coin holders. Ethereum Classic is a decentralized, open-source peer-to-peer cryptocurrency, hardfork Ethereum. The ETC Blockchain adapts all Ethereum functions, including the smart contract and the Ethereum Virtual Machine (EVM). Well, Callisto is a technology that makes it possible to reward members of the system with tokens. The reward itself is interest without performing transactions, transactions are performed using the Proof-of-Work algorithm.

True, the main network Callisto Network will be launched only on March 23. Technical details of this event and the project itself are posted in the Ethereum Commonwealth repository on GitHub.

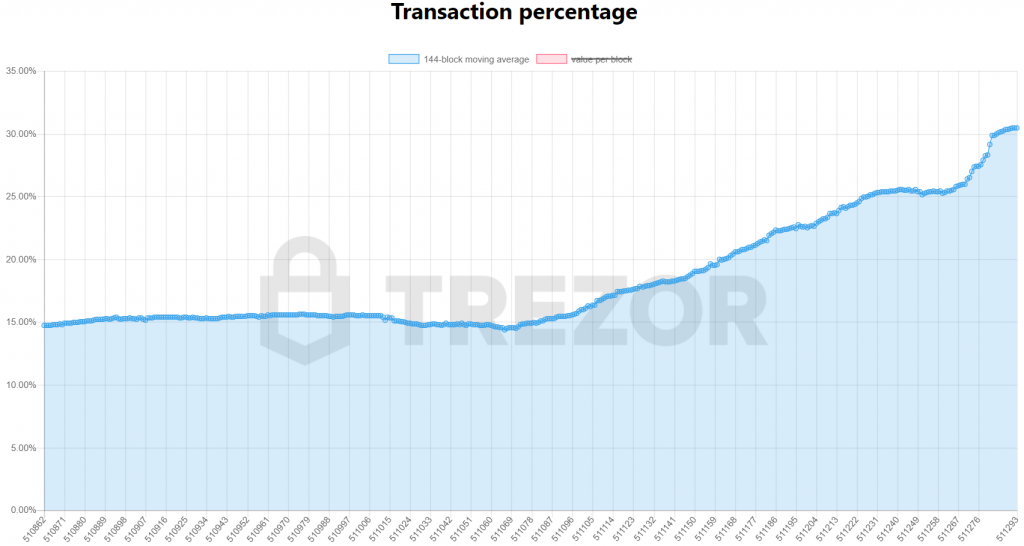

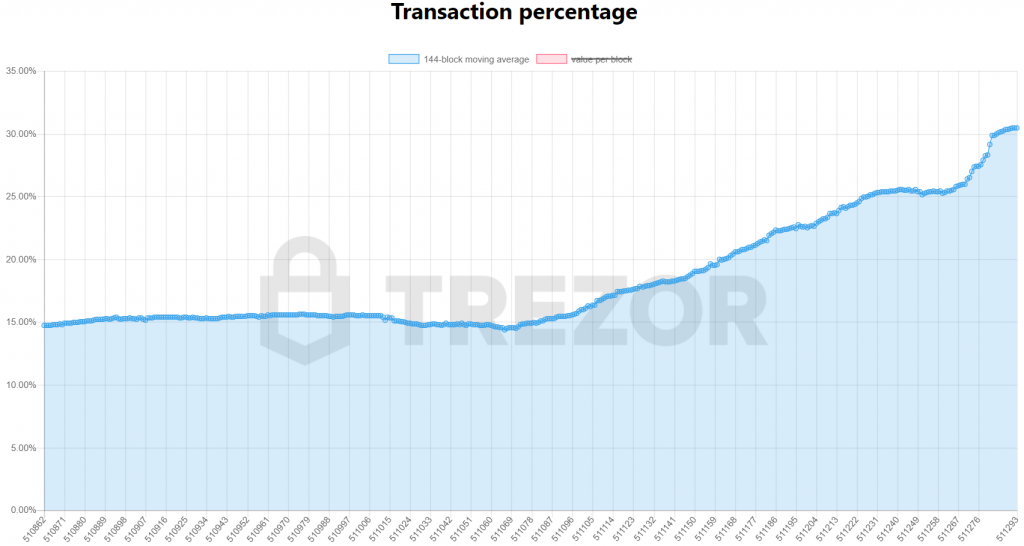

As for Bitcoin, almost a third of all transactions in the network are made with the support of the SegWit protocol. The main growth factor is the beginning of protocol support by two leading industry players: the Bitfinex exchange and the Coinbase platform.

And finally, some more interesting news.

First: PayPal is currently developing its own cryptocurrency payment system, which should increase the speed of transactions. Filed and a patent for technology. Information about the patent application is available on the website of the United States Patent and Trademark Office. The main goal pursued by PayPal when developing its cryptocurrency payment system is to reduce the transaction confirmation time and the appearance of a new unit in the network.

Second, not only PayPal, but QIWI is also involved in the creation of a blockchain platform. However, in the case of the domestic payment system, we are talking about creating a platform for unmanned cargo transportation. After completion of the development, the platform will provide the possibility of implementing logistic schemes and financial calculations of any complexity. The basis is SKYFT tokens. The platform itself is called SKYFchain.

Third, the Chinese giant Alibaba Group is transferring cross-border supply chains to the blockchain. We are talking about the transfer of data on imported and exported goods to the blockchain. Thanks to this system, you can track the country of origin, ports of departure and arrival, as well as all the necessary customs information.

Judging by the news, there are a lot of things happening in the world of blockchain and cryptocurrency. Moreover, the number of events is growing, which indicates an active development of the segment. More and more large players are entering the sphere, which in turn can mean further acceleration of the development of technologies, as well as their adaptation by public and private organizations around the world.

A shot from the film, whose name says that the world is sometimes inclined to send very conflicting signals

The bureaucracy’s regulation is only increasing

More and more governments loudly declare the need to introduce tough measures to control the cryptocurrency and those associated with it. In particular, the Chinese authorities announced their intention to tighten policies on platforms that allow citizens of the country to sell cryptocurrency on foreign sites.

The verification methods are simple and effective at the same time - monitoring transactions on the accounts of customers of Chinese banks and payment systems. It is clear that especially the Chinese Big Brother will monitor the accounts belonging to individuals and legal entities that are suspected of organizing trading at foreign cryptocurrency sites. If, after verification, officials conclude that the account holder is guilty of this terrible crime, his assets may be blocked and the bank will simply refuse to service the client.

')

Does not lag behind China in the desire to regulate the cryptocurrency sphere and Russia. In late February, the First Deputy Head of the Government Office, Maxim Akimov, announced the danger of a cryptocurrency exchange for Fiat. In his opinion , if the exchange process is not controlled, then this can cause dire economic and social consequences for Russia. It seems that the cryptocurrency has become almost the No. 1 threat to the country's economy.

But officials believe in the blockchain. March 1 this year, Deputy Minister of Communications and Mass Communications Alexei Kozyrev announced the need to create his own state blockchain platform. At the same time, the mining process should be excluded from its functions (although, as we know, not every blockchain is associated with cryptocurrency, and even more so, mining is just the name of the technology). Whatever it was, Kozyrev believes that the creation of such a platform would solve the problem of long-term storage of documents and identification.

“The government did the right thing by not allowing the Russian economy to make a global sandbox for laundering criminal funds. Everyone understands that if we allow the conversion of cryptocurrencies into fiat money, this will have dire consequences for the entire socio-economic system, ”Akimov said.

And, of course, the United States. In early March, the Securities and Exchange Commission of this country sent out dozens of subpoenas to technology companies, individual experts and legal advisers who participate in the ICO. All this bureaucratic work was carried out in the framework of a formal trial, which, as far as can be understood, was prepared a long time ago. The agency states that it needs information about the structure of tokensails and presales, which are not governed by the initial public offer (IPO) rules. According to the Commission , the tokens obtained during the ICO are securities with all the ensuing consequences.

But in Australia, everything is turned upside down (actually, why be surprised). Citizens without problems and worries (and checks of regulators, yes) can buy Bitcoins and broadcast for Fiat even at newsstands. This was made possible by the new project of the Australian cryptocurrency exchange Bitcoin.com.au. Since March 1, the service has become available in more than 1,200 newsstands.

But the most important step at the end of last month was Germany. The government of the country officially declared Bitcoin legal tender. Moreover, purchases made for cryptocurrency are not taxed, which, one must think, is a weighty argument for their holders. The ruling was signed at the end of February. Discussion of the role of Bitcoin in the financial infrastructure of the state has been going on for several years. It all started with the decision of the European Court of 2015, according to which Bitcoin is a currency in terms of taxation.

Fork, hardfork, fork, hardfork

Let us turn from news of politics to news of cryptomere. A regular hardfork took place in the Bitcoin network (it is already possible to lose what account) Bitcoin Private. Its merit is the ability to work with the protocol based on the evidence of the zk-SNARK zero disclosure. Feature - the ability to hide data about transactions, which means anonymity, which is so lacking in the modern world (especially financial). Money loves silence, and cryptocurrency is no exception, although it is not money in the full sense of the term.

The fork is based on two blockchains at once - Bitcoin and Zcash.

Another hardfork in Ethereum Classic brought the entire amount of Callisto Network (CLO) coins to all ETC coin holders. Ethereum Classic is a decentralized, open-source peer-to-peer cryptocurrency, hardfork Ethereum. The ETC Blockchain adapts all Ethereum functions, including the smart contract and the Ethereum Virtual Machine (EVM). Well, Callisto is a technology that makes it possible to reward members of the system with tokens. The reward itself is interest without performing transactions, transactions are performed using the Proof-of-Work algorithm.

True, the main network Callisto Network will be launched only on March 23. Technical details of this event and the project itself are posted in the Ethereum Commonwealth repository on GitHub.

As for Bitcoin, almost a third of all transactions in the network are made with the support of the SegWit protocol. The main growth factor is the beginning of protocol support by two leading industry players: the Bitfinex exchange and the Coinbase platform.

Blockchain Platforms - Trend of Modernity

And finally, some more interesting news.

First: PayPal is currently developing its own cryptocurrency payment system, which should increase the speed of transactions. Filed and a patent for technology. Information about the patent application is available on the website of the United States Patent and Trademark Office. The main goal pursued by PayPal when developing its cryptocurrency payment system is to reduce the transaction confirmation time and the appearance of a new unit in the network.

Second, not only PayPal, but QIWI is also involved in the creation of a blockchain platform. However, in the case of the domestic payment system, we are talking about creating a platform for unmanned cargo transportation. After completion of the development, the platform will provide the possibility of implementing logistic schemes and financial calculations of any complexity. The basis is SKYFT tokens. The platform itself is called SKYFchain.

Third, the Chinese giant Alibaba Group is transferring cross-border supply chains to the blockchain. We are talking about the transfer of data on imported and exported goods to the blockchain. Thanks to this system, you can track the country of origin, ports of departure and arrival, as well as all the necessary customs information.

Judging by the news, there are a lot of things happening in the world of blockchain and cryptocurrency. Moreover, the number of events is growing, which indicates an active development of the segment. More and more large players are entering the sphere, which in turn can mean further acceleration of the development of technologies, as well as their adaptation by public and private organizations around the world.

Source: https://habr.com/ru/post/410845/

All Articles