Global War of Cash

Trends in recent years indicate the struggle of the authorities of different countries with cash. A recent example is the withdrawal from circulation of banknotes of 500 and 1000 rupees in India. In more detail this trend is illustrated by the infographics below.

Legislators around the world are seeking to eliminate the use of cash notes and coins in their countries. This movement is often called the “War of Cash”. Mostly 3 parties participate in it:

')

1. Initiators

Who!

National governments and central banks.

What for?

Waiver of cash will simplify tracking of all types of operations, including those committed by criminals.

2. Opponents

Who!

Criminals and terrorists

Why against?

Large denomination banknotes simplify the execution of illegal transactions and allow you to maintain anonymity.

3. Civilian population

Who!

Ordinary citizens

What does they have to do with it?

The forced abolition of physical forms of cash will have undesirable consequences for the economy and social freedoms.

Cash always ruled the ball, but closer to the end of the 90s, new technologies appeared that made non-cash operations more practical. These are technologies such as:

By 2015, the number of cashless transactions made worldwide reached a figure of 426 billion transactions, which is 50% more than in 2010.

Today there are many ways of digital payment. Including:

The success of these new technologies formed the basis of a lawmakers initiative to digitize all monetary transactions.

Here are their arguments in favor of a cashless society:

The withdrawal of large denomination banknotes complicates the activities of terrorists and drug traffickers, as well as money laundering or tax evasion.

Regulators get more control over the economy.

Cashless transactions are faster and more efficient /

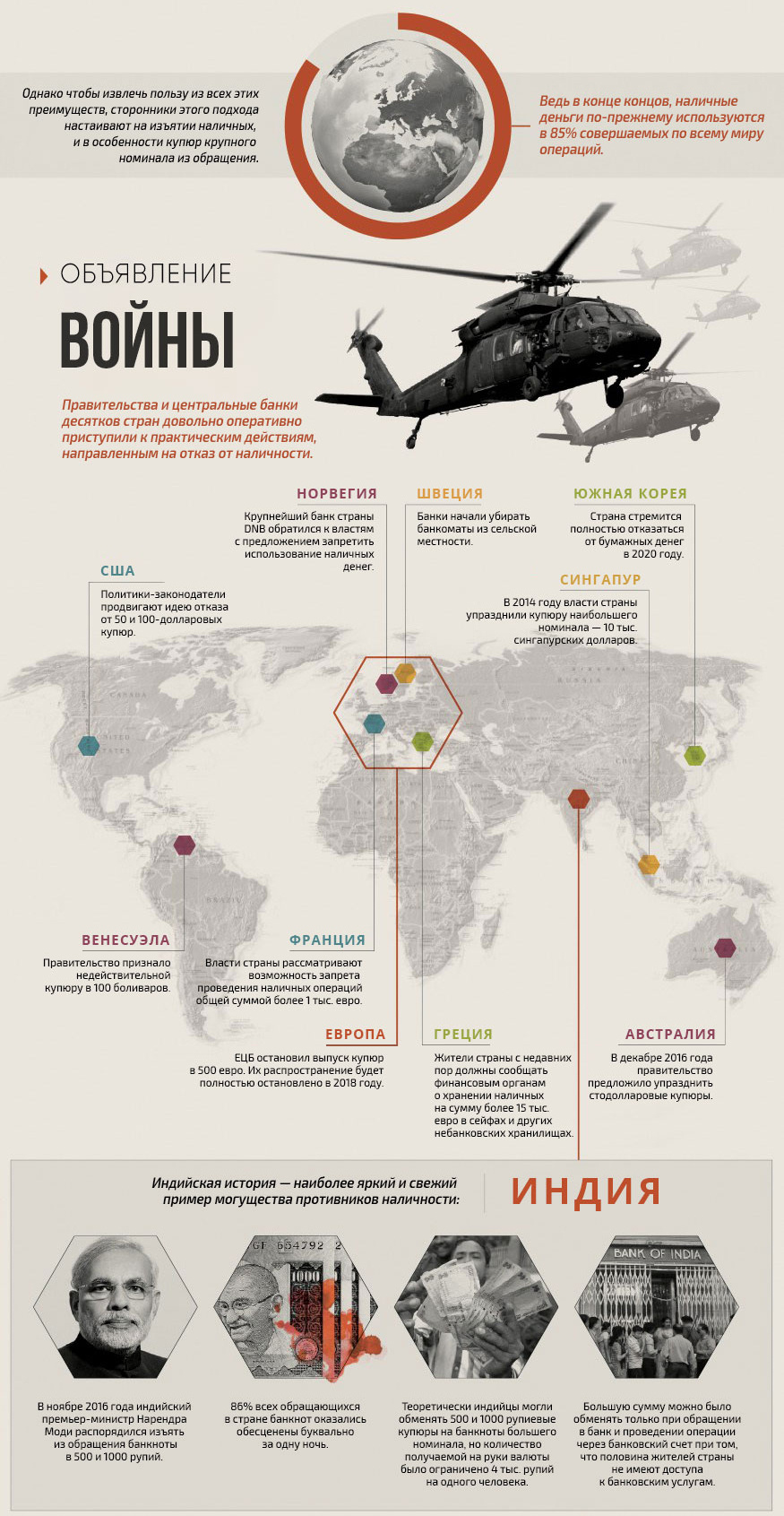

However, in order to benefit from all these advantages, supporters of this approach insist on withdrawing cash, and especially large denominations, from circulation. After all, in the end, cash is still used in 85% of operations worldwide.

The governments and central banks of dozens of countries have rather quickly begun practical actions aimed at refusing cash.

Here are a few examples: Australia, Singapore, Venezuela, the United States and the European Central Bank — all of these countries have either already withdrawn large bills from circulation, or are seriously considering this measure. Other countries such as France, Sweden and Greece focused on limiting cash transactions, reducing the number of ATMs in rural areas and limiting the amount of cash allowed for storage outside the banking system. Finally, some countries have gone even further: South Korea plans to completely abandon paper currency by 2020.

However, the “War on Cash” is now strongly associated with the image of long lines in India. In November 2016, Indian Prime Minister Narendra Modi ordered the withdrawal of 500 and 1 thousand rupees banknotes from circulation, making overnight 86% of all banknotes circulating in the country invalid. Despite the fact that, theoretically, the Indians had the right to exchange 500 and 1000 rupee banknotes for banknotes of higher denomination, the amount of currency received per hand was limited to 4 thousand rupees per person. The exchange of more money was possible only when contacting the bank and conducting a transaction through a bank account. All this happened in the country, 50% of whose inhabitants do not have access to banking services.

According to data from the country, there are currently 112 deaths associated with Indian demonetization. Some people committed suicide, but most of these deaths are elderly people, who spent hours or days long on the defensive lines waiting in the bank to exchange money.

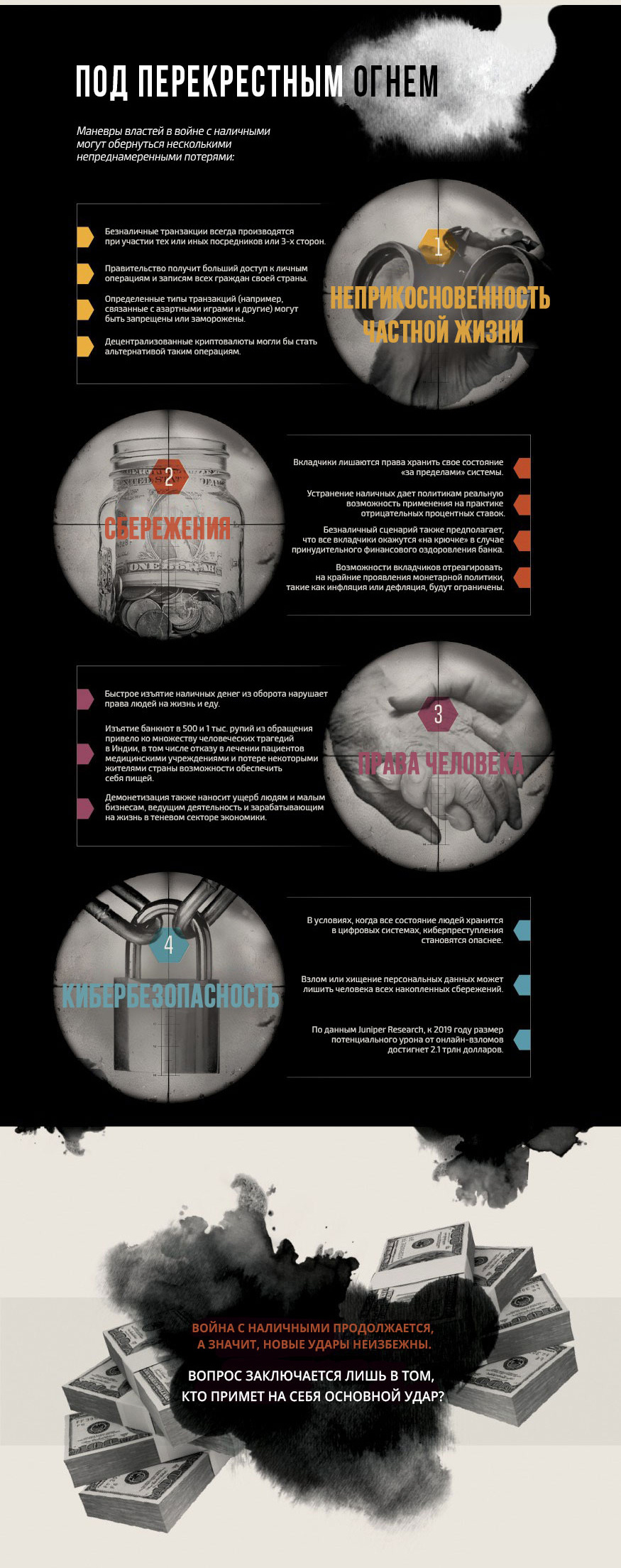

The authorities' maneuvers in the cash war can result in several unintended losses:

Privacy

Saving

Human rights

Cyber security

The war against cash continues, which means that new strikes are inevitable. The question is just who will take the brunt?

Global War of Cash

Legislators around the world are seeking to eliminate the use of cash notes and coins in their countries. This movement is often called the “War of Cash”. Mostly 3 parties participate in it:

')

1. Initiators

Who!

National governments and central banks.

What for?

Waiver of cash will simplify tracking of all types of operations, including those committed by criminals.

2. Opponents

Who!

Criminals and terrorists

Why against?

Large denomination banknotes simplify the execution of illegal transactions and allow you to maintain anonymity.

3. Civilian population

Who!

Ordinary citizens

What does they have to do with it?

The forced abolition of physical forms of cash will have undesirable consequences for the economy and social freedoms.

Is cash still reigning a point?

Cash always ruled the ball, but closer to the end of the 90s, new technologies appeared that made non-cash operations more practical. These are technologies such as:

- Online banking

- Smartphones

- Payment technologies

- Encryption

By 2015, the number of cashless transactions made worldwide reached a figure of 426 billion transactions, which is 50% more than in 2010.

| Year | Number of non-cash transactions |

|---|---|

| 2010 | 285.2 billion |

| 2015 | 426.3 billion |

- Online banking (Visa, Mastercard, Interac)

- Smartphones (Apple Pay)

- Intermediary Companies (Paypal, Square)

- Cryptocurrencies (Bitcoin)

First blows

The success of these new technologies formed the basis of a lawmakers initiative to digitize all monetary transactions.

Here are their arguments in favor of a cashless society:

The withdrawal of large denomination banknotes complicates the activities of terrorists and drug traffickers, as well as money laundering or tax evasion.

- One million dollars in the form of hundred dollar bills weighs only 1 kilogram.

- Every year, criminals move 2 trillion dollars to all countries of the world.

- The bill in denominations of $ 100 is the most popular in the world. There are 10 billion such bills in circulation worldwide.

Regulators get more control over the economy.

- Improving the methods of tracking money allows you to collect more taxes.

- It also assumes the presence of intermediaries in all operations.

- Central banks can determine the size of the interest rate and seek to use it in practice to encourage or hinder spending, which allows you to control inflation. In addition, zero or negative interest rates become possible.

Cashless transactions are faster and more efficient /

- Costs of banks will decrease, since they will not have to keep records, storage and processing of cash.

- Simplified compliance control and reporting.

- According to some experts, cash is a “burden” for the economy, as they “eat up” up to 1.5% of GDP.

However, in order to benefit from all these advantages, supporters of this approach insist on withdrawing cash, and especially large denominations, from circulation. After all, in the end, cash is still used in 85% of operations worldwide.

Declaration of war

The governments and central banks of dozens of countries have rather quickly begun practical actions aimed at refusing cash.

Here are a few examples: Australia, Singapore, Venezuela, the United States and the European Central Bank — all of these countries have either already withdrawn large bills from circulation, or are seriously considering this measure. Other countries such as France, Sweden and Greece focused on limiting cash transactions, reducing the number of ATMs in rural areas and limiting the amount of cash allowed for storage outside the banking system. Finally, some countries have gone even further: South Korea plans to completely abandon paper currency by 2020.

However, the “War on Cash” is now strongly associated with the image of long lines in India. In November 2016, Indian Prime Minister Narendra Modi ordered the withdrawal of 500 and 1 thousand rupees banknotes from circulation, making overnight 86% of all banknotes circulating in the country invalid. Despite the fact that, theoretically, the Indians had the right to exchange 500 and 1000 rupee banknotes for banknotes of higher denomination, the amount of currency received per hand was limited to 4 thousand rupees per person. The exchange of more money was possible only when contacting the bank and conducting a transaction through a bank account. All this happened in the country, 50% of whose inhabitants do not have access to banking services.

According to data from the country, there are currently 112 deaths associated with Indian demonetization. Some people committed suicide, but most of these deaths are elderly people, who spent hours or days long on the defensive lines waiting in the bank to exchange money.

Under crossfire

The authorities' maneuvers in the cash war can result in several unintended losses:

Privacy

- Non-cash transactions are always made with the participation of certain intermediaries or 3 parties.

- The government will have greater access to personal transactions and records of all citizens of their country.

- Certain types of transactions (for example, related to gambling and others) may be prohibited or frozen.

- Decentralized cryptocurrencies could be an alternative to such operations.

Saving

- Investors are deprived of the right to keep their status “outside” the system.

- The elimination of cash gives politicians a real possibility of applying negative interest rates in practice.

- The non-cash scenario also assumes that all depositors will be “on the hook” in case of a forced financial recovery of the bank.

- The ability of depositors to respond to extreme monetary policies, such as inflation or deflation, will be limited.

Human rights

- Rapid withdrawal of cash from circulation violates people's rights to life and food.

- The withdrawal of banknotes of 500 and 1 thousand rupees from circulation led to a multitude of human tragedies in India, including the refusal to treat patients with medical institutions and the loss of the ability of some people in the country to provide themselves with food.

- Demonetization also harms people and small businesses that operate and earn a living in the shadow sector of the economy.

Cyber security

- In an environment where all human condition is stored in digital systems, cybercrime becomes more dangerous.

- Hacking or stealing personal data can deprive a person of all accumulated savings.

- According to Juniper Research, by 2019 the size of the potential damage from online hacking will reach 2.1 trillion dollars.

The war against cash continues, which means that new strikes are inevitable. The question is just who will take the brunt?

Source: https://habr.com/ru/post/403911/

All Articles