Practical case: why block exchange service may be needed for the stock trading service

Since March 30, the online platform for stock trading Liquid.pro has begun to record applications for options sent to the Moscow stock exchange in the public blockchain of our platform Waves . In this article, we will explain why Liquid.pro is the blockchain and how this service used the distributed registry technology in its work.

After the events of 2014, the relatively small Russian stock market became shallower. This was largely due to the departure from the market of foreign investors. As a result, the volume of transactions decreased and since then has not shown a significant increase. The reduction in net profit of the Moscow Exchange at the end of 2016 by 9.6% is another proof of this. The market focused on the most liquid instruments.

The shallowing of the main stock market entailed a reduction in the market for derivative financial instruments, which include options. This type of derivatives gives option buyers the right, but not the obligation, to buy or sell a product or other asset in the future at a predetermined price. For example, a seller in April 2017, with the help of an option, reserves the right to sell dollars to a specific buyer at the rate of 60 rubles per $ 1 in August 2017. Under this scheme, the seller in April pays the buyer the cost of the option, regardless of its final decision in August.

')

In addition to the execution or non-exercise of an option, participants of the exchange can buy or sell this type of derivative financial instruments to each other.

Option bidder may:

The Black-Scholes formula is often used to calculate the value of an option on the market. An option to buy at a set price is called a call, an option to sell is a put. You can read more about this, as well as other types of derivative financial instruments here .

At the moment, on the Moscow Stock Exchange, the two most popular options are the ruble-dollar pair and the RTS index futures. While, for example, options on securities of Lukoil, Gazprom and Sberbank make up a much smaller share. With such a strongly narrowed demand, applications for other options besides the ruble-dollar pair and futures on the RTS index, with a high degree of probability will not be in special demand.

The restrictions are due not only to a relatively small market volume, but also to the regulations established by the Moscow Exchange. According to the rules, if a market participant places an order for an option, the exchange reserves a certain amount: in the case of an option, the amount of the option. Traders who work as individuals are limited in the volume of funds and cannot risk reserve reservations on a stock exchange every time, and institutional investors (banks, brokerage companies, etc.) are in turn limited by their strict capital management strategy.

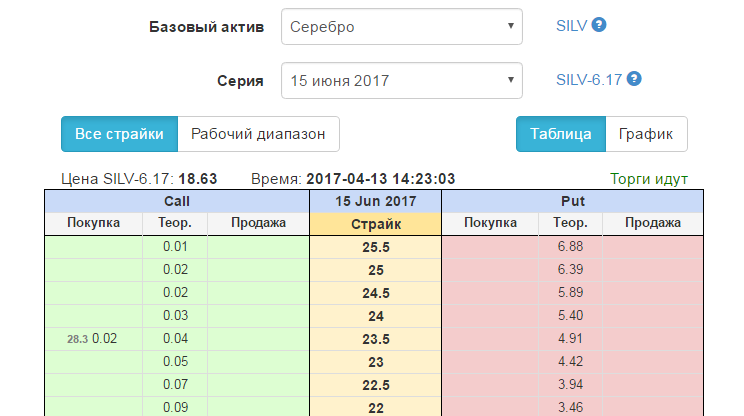

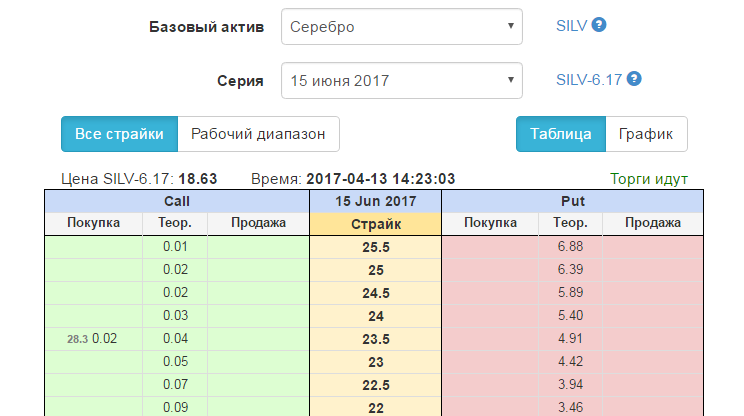

Taking into account the current situation, the option trader Alexey Kalenkovich, the founder of the Liquid.pro project, created an open platform in which market participants can demonstrate their willingness to trade options with any exercise prices - strikes that they consider expedient based on their own trading strategies. Options trading options can be a huge variety.

For example, if a market participant believes that the value of Sberbank’s shares will fall within a month, he may place an order to purchase an option to sell these securities (a put option). In this case, the trader buys a certain number of options with a higher strike and at the same time sells the same number of options with a lower strike. At the same time, both options must be open for the same asset - in this case, for Sberbank shares, and be limited to the same expiration date. This option strategy is called the “Bear Put Spread” and allows you to get a fixed amount of profit if the trader’s predictions regarding the decrease in the value of the underlying asset were correct.

At the same time, bidding for the purchase or sale of an option on the Liquid.pro site does not require the cost of collateral in the form of a reservation, as is customary on the Moscow Stock Exchange. The guarantee security is charged by the exchange only at the moment when the parties have already agreed on the terms of an option contract as part of the exchange trading service and confirmed the sending of an application to the exchange. The Liquid.pro platform gives participants the opportunity to declare intentions, but not to conclude transactions, thus providing greater freedom in trading on the Moscow Exchange options market and increasing its liquidity.

All platform participants are divided into market makers and market makers. Market makers are users who have the right to place bids on the market (quoting the market) and submitting bids on the Liquid.pro platform. In the event of a change in the price of the underlying asset (to which an option is attached), the market maker has the right to set and remove quotes from the platform at its discretion. Currently, an active set of market makers is being conducted at the Liquid.pro site. Liquid.pro places high demands on the professional competencies of this category of users. One of the market makers is the founder of the site, Alexey Kalenkovich, who forms his own analytics on the options market for marketkeepers.

Marketers are the main participants of the platform who have the right to choose the quotes they are interested in and transfer them to exchange orders after receiving confirmation of the market maker. So far, marketers are mostly individuals, but there are also participants from institutional investors.

Liquid.pro is only an informational function and does not interact with the Moscow Exchange directly. Translation of Liquid.pro orders into exchange orders is carried out automatically due to the technological connection of the service with the participants' trading terminals at the API level. The possibilities of automating interaction with the service of stock trading, available to both market makers and market makers, are listed in the API section .

The decision to use blockchain technology was born to the Liquid.pro team in December 2016. Before the leadership of the service of stock trading was a question to join the existing blockchain or create your own. Liquid.pro management chose to integrate the existing distributed registry and turned to our Waves team.

Three teams took part in the implementation of the blockchain: Liquid.pro, Waves and a team of developers involved from outside.

The task of the blockchain Liquid.pro is to register in the encrypted format all confirmed option bids sent to the Moscow Exchange. Each operation is recorded both in the Liquid.pro system and in the public blockchain. Each user Liquid.pro has an identification number. After the client Liquid.pro has entered its unique ID among the general list of applications sent to the Moscow Exchange, only the user’s applications are highlighted in green. The platform algorithm checks the client ID with the hashed request in the blockchain. The platform ID is generated for each client automatically using the platform algorithm and therefore the uniqueness of such an identifier is guaranteed.

Liquid.pro's blockchain concept is based on the traditional exchange rule, according to which any participant can get information about the subject, date and time of all transactions. Blockchain Liquid.pro allows each user to identify among the general list only their own applications, without the ability to identify participants in other transactions.

Registration of any operations in the public blockchain is not free. Waves is no exception. Blockchain platform takes a fee for each transaction in the amount of 0.001 Waves. For this reason, the management of Liquid.pro decided to register in the distributed registry only those applications that have economic sense for the participants: they have already been sent for execution to the Moscow Exchange. To certify the fact of sending orders to the exchange, the PoS consensus is used, provided by the Waves blockchain nodes. At the same time, for blocking options orders between Liquid.pro users, the blockchain is not yet used.

A record of the registration of the fact of sending an application to the Moscow Exchange is made to the registry automatically. Each Liquid.pro system participant has the appropriate software installed - Connector, which interacts with the payment terminals - exchange software systems used by the participants of the exchange trading service. Data exchange at the software level occurs with a software package, such as QUIK, as well as with similar trading terminals. The chain looks like this: data about the application sent to the Moscow Exchange are first transmitted from Connector to QUIK (or to the interface of a similar software package), and are simultaneously recorded in the Waves blockchain. When a member wants to see a list of deals, he checks with Waves using his ID.

There are 2 separate information flows through the Liquid.pro site:

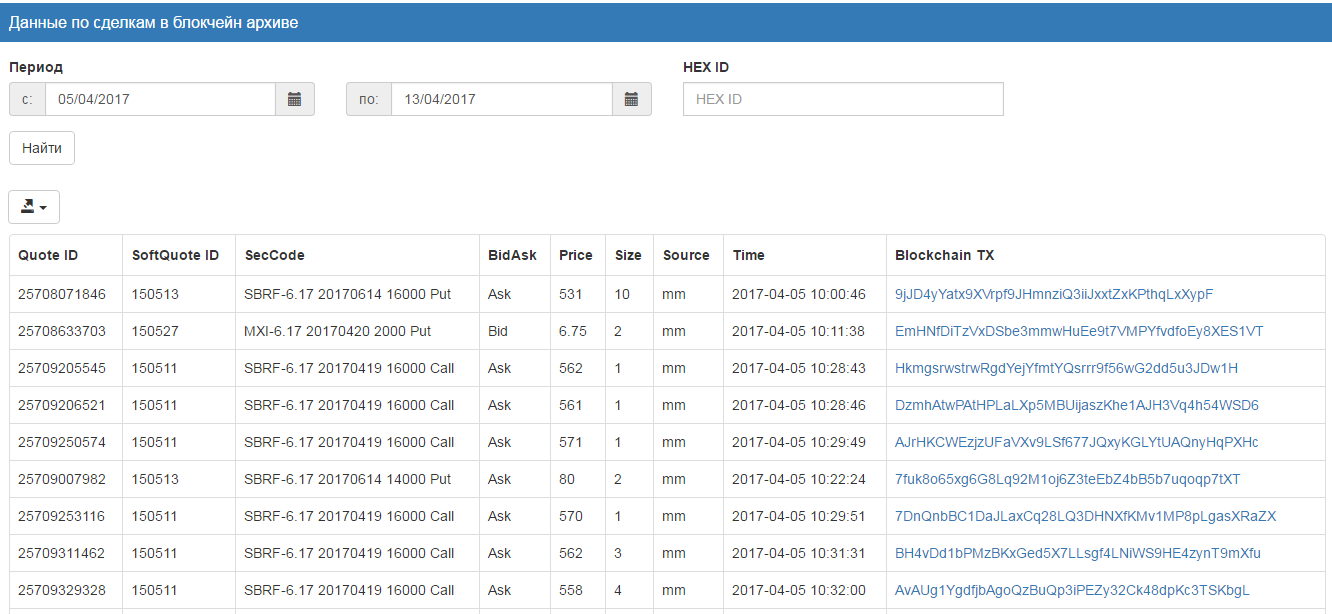

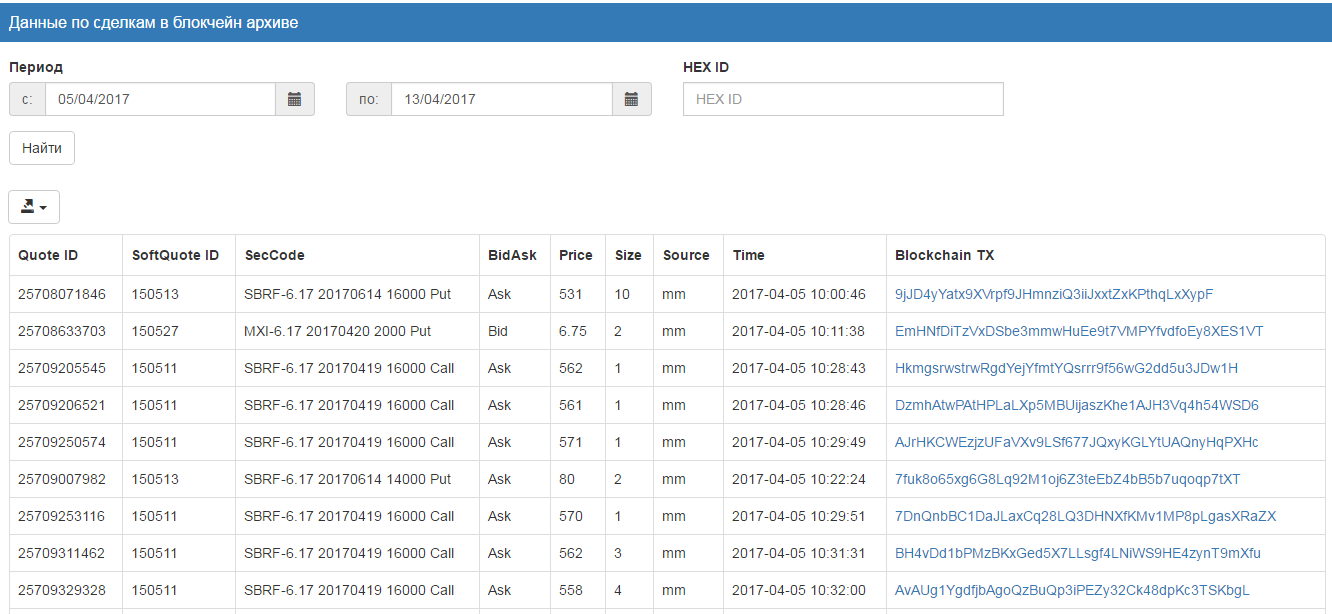

The interface of the blockchain Liquid.pro, in which records of applications sent to the Moscow Exchange are displayed in encrypted form, is a table with 9 columns:

We, in the team of the Waves platform, believe that blockchain solutions within the Liquid.pro service can continue to evolve. In the future, the stock trading service can use the distributed registry technology to optimize the settlement processes between participants in operations: traders, brokers, depository, clearing organizations and the exchange.

Background and nature of the Liquid.pro service

After the events of 2014, the relatively small Russian stock market became shallower. This was largely due to the departure from the market of foreign investors. As a result, the volume of transactions decreased and since then has not shown a significant increase. The reduction in net profit of the Moscow Exchange at the end of 2016 by 9.6% is another proof of this. The market focused on the most liquid instruments.

The shallowing of the main stock market entailed a reduction in the market for derivative financial instruments, which include options. This type of derivatives gives option buyers the right, but not the obligation, to buy or sell a product or other asset in the future at a predetermined price. For example, a seller in April 2017, with the help of an option, reserves the right to sell dollars to a specific buyer at the rate of 60 rubles per $ 1 in August 2017. Under this scheme, the seller in April pays the buyer the cost of the option, regardless of its final decision in August.

')

In addition to the execution or non-exercise of an option, participants of the exchange can buy or sell this type of derivative financial instruments to each other.

Option bidder may:

- Buy the right to purchase an asset;

- Sell the right to buy an asset;

- Buy the right to sell an asset;

- Sell the right to sell an asset.

The Black-Scholes formula is often used to calculate the value of an option on the market. An option to buy at a set price is called a call, an option to sell is a put. You can read more about this, as well as other types of derivative financial instruments here .

At the moment, on the Moscow Stock Exchange, the two most popular options are the ruble-dollar pair and the RTS index futures. While, for example, options on securities of Lukoil, Gazprom and Sberbank make up a much smaller share. With such a strongly narrowed demand, applications for other options besides the ruble-dollar pair and futures on the RTS index, with a high degree of probability will not be in special demand.

The restrictions are due not only to a relatively small market volume, but also to the regulations established by the Moscow Exchange. According to the rules, if a market participant places an order for an option, the exchange reserves a certain amount: in the case of an option, the amount of the option. Traders who work as individuals are limited in the volume of funds and cannot risk reserve reservations on a stock exchange every time, and institutional investors (banks, brokerage companies, etc.) are in turn limited by their strict capital management strategy.

Taking into account the current situation, the option trader Alexey Kalenkovich, the founder of the Liquid.pro project, created an open platform in which market participants can demonstrate their willingness to trade options with any exercise prices - strikes that they consider expedient based on their own trading strategies. Options trading options can be a huge variety.

For example, if a market participant believes that the value of Sberbank’s shares will fall within a month, he may place an order to purchase an option to sell these securities (a put option). In this case, the trader buys a certain number of options with a higher strike and at the same time sells the same number of options with a lower strike. At the same time, both options must be open for the same asset - in this case, for Sberbank shares, and be limited to the same expiration date. This option strategy is called the “Bear Put Spread” and allows you to get a fixed amount of profit if the trader’s predictions regarding the decrease in the value of the underlying asset were correct.

At the same time, bidding for the purchase or sale of an option on the Liquid.pro site does not require the cost of collateral in the form of a reservation, as is customary on the Moscow Stock Exchange. The guarantee security is charged by the exchange only at the moment when the parties have already agreed on the terms of an option contract as part of the exchange trading service and confirmed the sending of an application to the exchange. The Liquid.pro platform gives participants the opportunity to declare intentions, but not to conclude transactions, thus providing greater freedom in trading on the Moscow Exchange options market and increasing its liquidity.

All platform participants are divided into market makers and market makers. Market makers are users who have the right to place bids on the market (quoting the market) and submitting bids on the Liquid.pro platform. In the event of a change in the price of the underlying asset (to which an option is attached), the market maker has the right to set and remove quotes from the platform at its discretion. Currently, an active set of market makers is being conducted at the Liquid.pro site. Liquid.pro places high demands on the professional competencies of this category of users. One of the market makers is the founder of the site, Alexey Kalenkovich, who forms his own analytics on the options market for marketkeepers.

Marketers are the main participants of the platform who have the right to choose the quotes they are interested in and transfer them to exchange orders after receiving confirmation of the market maker. So far, marketers are mostly individuals, but there are also participants from institutional investors.

Liquid.pro is only an informational function and does not interact with the Moscow Exchange directly. Translation of Liquid.pro orders into exchange orders is carried out automatically due to the technological connection of the service with the participants' trading terminals at the API level. The possibilities of automating interaction with the service of stock trading, available to both market makers and market makers, are listed in the API section .

What for the service blockchain Waves

The decision to use blockchain technology was born to the Liquid.pro team in December 2016. Before the leadership of the service of stock trading was a question to join the existing blockchain or create your own. Liquid.pro management chose to integrate the existing distributed registry and turned to our Waves team.

Three teams took part in the implementation of the blockchain: Liquid.pro, Waves and a team of developers involved from outside.

The task of the blockchain Liquid.pro is to register in the encrypted format all confirmed option bids sent to the Moscow Exchange. Each operation is recorded both in the Liquid.pro system and in the public blockchain. Each user Liquid.pro has an identification number. After the client Liquid.pro has entered its unique ID among the general list of applications sent to the Moscow Exchange, only the user’s applications are highlighted in green. The platform algorithm checks the client ID with the hashed request in the blockchain. The platform ID is generated for each client automatically using the platform algorithm and therefore the uniqueness of such an identifier is guaranteed.

Liquid.pro's blockchain concept is based on the traditional exchange rule, according to which any participant can get information about the subject, date and time of all transactions. Blockchain Liquid.pro allows each user to identify among the general list only their own applications, without the ability to identify participants in other transactions.

Registration of any operations in the public blockchain is not free. Waves is no exception. Blockchain platform takes a fee for each transaction in the amount of 0.001 Waves. For this reason, the management of Liquid.pro decided to register in the distributed registry only those applications that have economic sense for the participants: they have already been sent for execution to the Moscow Exchange. To certify the fact of sending orders to the exchange, the PoS consensus is used, provided by the Waves blockchain nodes. At the same time, for blocking options orders between Liquid.pro users, the blockchain is not yet used.

A record of the registration of the fact of sending an application to the Moscow Exchange is made to the registry automatically. Each Liquid.pro system participant has the appropriate software installed - Connector, which interacts with the payment terminals - exchange software systems used by the participants of the exchange trading service. Data exchange at the software level occurs with a software package, such as QUIK, as well as with similar trading terminals. The chain looks like this: data about the application sent to the Moscow Exchange are first transmitted from Connector to QUIK (or to the interface of a similar software package), and are simultaneously recorded in the Waves blockchain. When a member wants to see a list of deals, he checks with Waves using his ID.

There are 2 separate information flows through the Liquid.pro site:

- Market data. Liquid.pro receives market information from the Moscow Exchange and automatically generates a list of orders for the service.

- Data on the executed bids (Execution). This data flow goes through market participants submitting and confirming orders, which are then transmitted to the exchange through trading terminals and simultaneously recorded in Waves.

The interface of the blockchain Liquid.pro, in which records of applications sent to the Moscow Exchange are displayed in encrypted form, is a table with 9 columns:

- Application ID (Quote ID);

- The order number set by the market maker on Liquid.pro (the “soft” order ID is SoftQuote ID);

- The name of the issuer of the underlying asset - the stock (for example, SBRF or GAZR), the type of option (call or put), the cost of exercising the option (strike) and the date of exercising the option;

- Type of deal buy or sell (Bid or Ask);

- Option cost in rubles (Price);

- The number of option contracts in one application (Size);

- The source of the request (for example, mm is a market maker);

- Application time (Time);

- Hash link to order parameters (Blockchain TX) placed in the Waves Explorer .

We, in the team of the Waves platform, believe that blockchain solutions within the Liquid.pro service can continue to evolve. In the future, the stock trading service can use the distributed registry technology to optimize the settlement processes between participants in operations: traders, brokers, depository, clearing organizations and the exchange.

Source: https://habr.com/ru/post/403127/

All Articles