Tesla Inc. has become the most expensive car manufacturer in the USA

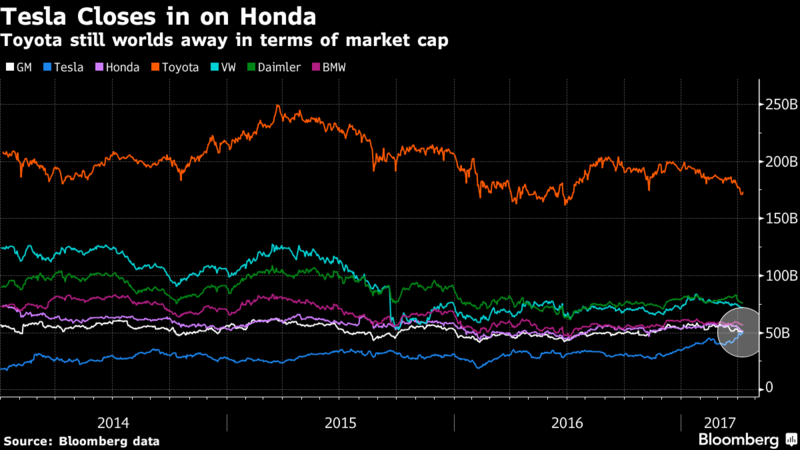

Company Ilona Mask Tesla Inc. (previously Tesla Motors) was able to bypass the capitalization of General Motors Co., becoming the most expensive car manufacturer in the United States. Earlier this week, Tesla shares rose in price by 3.3%, which raised the capitalization of this company to $ 51.17 billion. At the end of the day, on Monday, Tesla surpassed General Motors by $ 64 million. Now the manufacturer of electric vehicles is only $ 1 billion from Honda Motor Co., a company located on the fifth position in the list of the five largest car manufacturers in the world.

The increase in the share price speaks about investor confidence in Tesla, now they agree with Mask on the gradual replacement of conventional cars. “Tesla is associated by many with optimism, feeling, freedom, challenge and other emotions that, in our opinion, cannot be repeated by other companies,” said Alexander Potter, an analyst at Piper Jaffray Cos.

A week earlier, this company bypassed the capitalization of Ford Motors, the company that ranked third in the ranking of the most expensive US automakers. Now Ford’s capitalization is about $ 45 billion.

')

Investor enthusiasm is not affected even by the fact that Tesla Inc. this year may not bring profit, but incur losses in the amount of almost $ 1 billion. At the same time, GM's expected profit this year will be about $ 9 billion, Ford's expected profit is $ 6.3 billion. Mask company continues to be unprofitable.

"The cost of the company should determine the financial success, and our financial performance is quite good," - said Ford Vice President Joseph Hinrchisch, responsible for the work of his company in North and South America.

After the stock price growth, Tesla ranked sixth in the world in terms of capitalization. The first five places are owned by Toyota Motor Corp., Daimler AG, Volkswagen AG, BMW AG and Honda. The capitalization of Toyota now amounts to about $ 172 billion, so in order to take first place, Tesla must really try.

“The market is more concerned about Tesla’s success in other markets than real profit and revenue,” said David Winston, an analyst at Morningstar Inc. - “Right now there is nothing that could slow down Tesla. They can get around Honda. ”

For a long time, Tesla has been considered by investors as a company that is able to dominate the market for electric cars and batteries. At the same time, sales of GM and Ford are slowing down a bit, which reduces profitability. In 2009, GM declared itself bankrupt, so the government had to save the company. However, a little later this company managed to return to the market again.

By the way, Tesla delivered only 80,000 electric vehicles last year, which is nothing compared to 10 million cars sold by GM. Until now, Tesla is considered a luxury electric vehicle supplier, but the Model 3 sedan can change that. This electric car is more available, its cost is about $ 35,000. Batteries last for about 350 kilometers. Despite the fact that GM wins in the market due to the price of the competitor Tesla Model 3, the car Chevrolet Bolt, the overall situation is in favor of the company Mask.

“Even if the launch of the Model 3 on the sale goes sluggish, we believe that buyers and shareholders will not be too strict,” says analyst firm Piper Jaffray.

It is likely that the success of another creation of Ilona Mask - the company SpaceX - has an impact on the price of Tesla's shares.

Source: https://habr.com/ru/post/403093/

All Articles