How to open a bank in Europe: licensing and blockchain

Our first post about the Polybius Bank project attracted a lot of attention for Friday evening. Therefore, without delay, we continue to talk about what it means to create a modern bank in Europe.

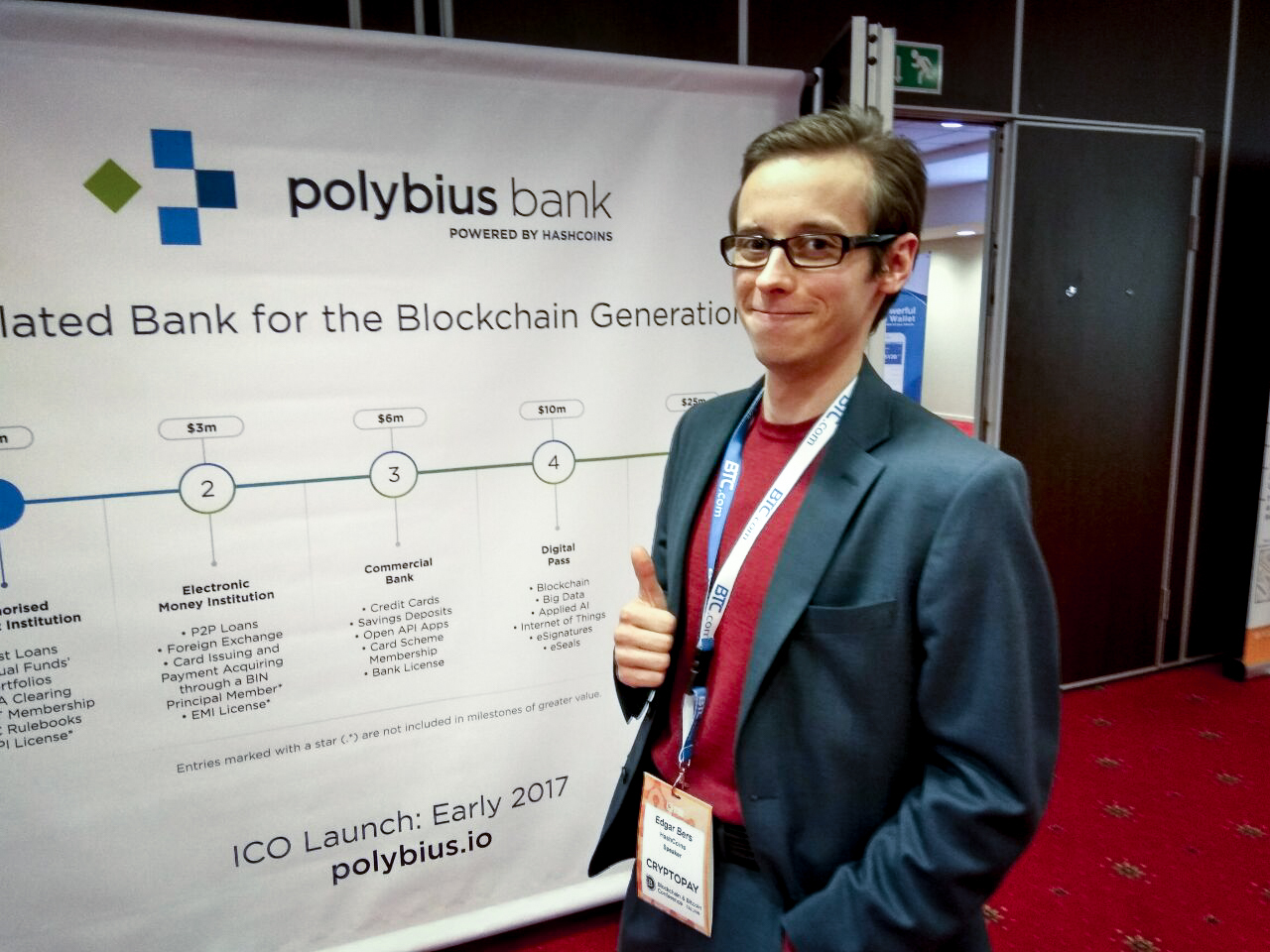

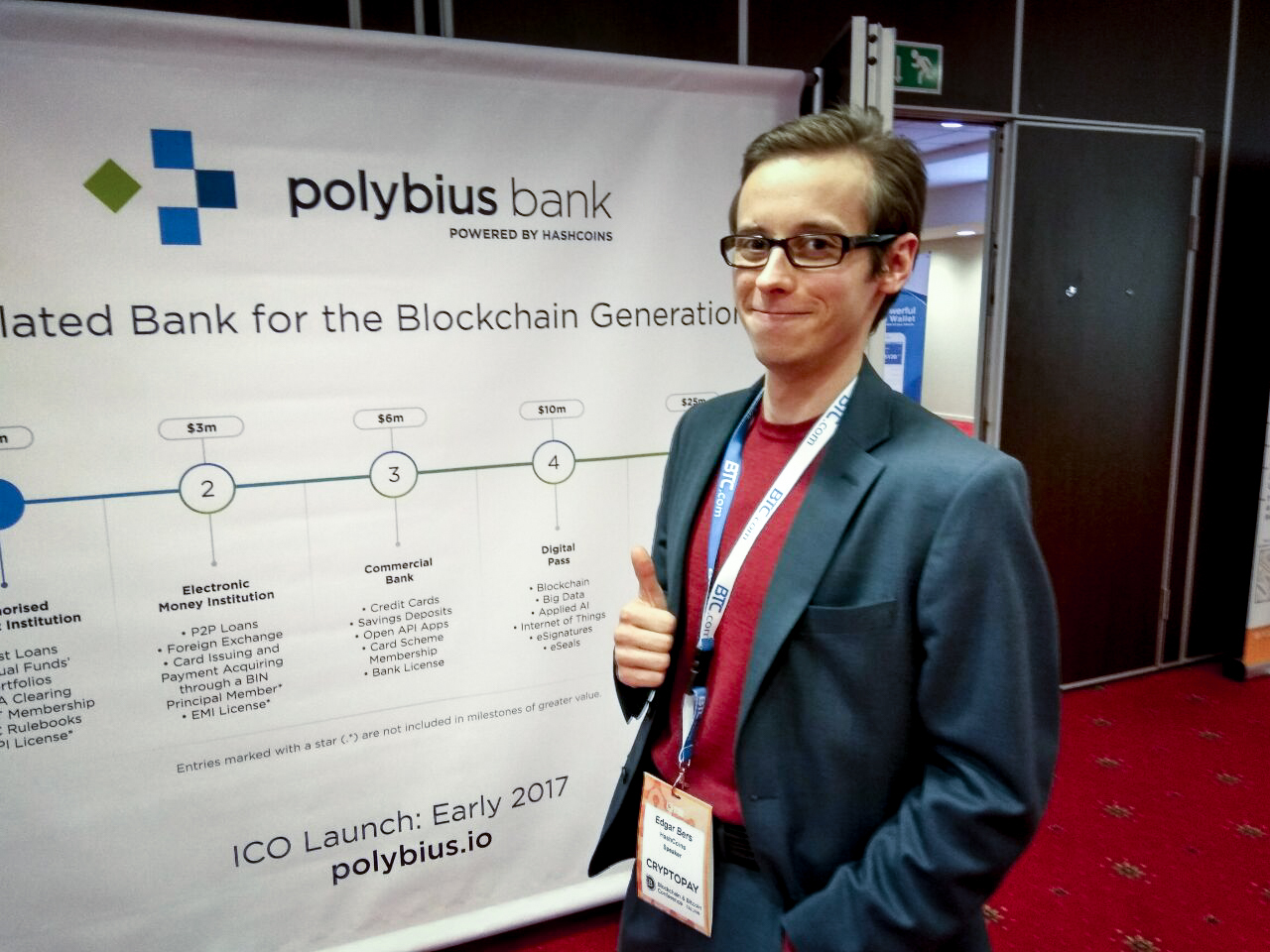

The website bits.media interviewed our speaker Edgar Burs in which he described in detail the bank registration process and spoke about the types of licenses of financial institutions. Among other things, it answers the questions asked in the comments to the first article.

- How did the idea of a bank like Polybius originate from the very beginning?

')

I live in Estonia. Estonia is now known as one of the most digitized countries in the world, we even have the concept of e-residency. And here we are already accustomed to the fact that all services and services are available online. In Estonia, everything is digital. The idea is that opening a bank account should be no more difficult than registering an email: fill in an online form, go through online authentication - and go ahead. In real life, everything is still not so rosy.

Banks still look like analog dinosaurs: huge commissions, working hours, weekends, lots of manual labor, and more. Looking at this, any technically advanced person could not help but think about how to change this situation. Thus, the emergence of a modern digital bank was a matter of time - when, roughly speaking, those who have the experience, knowledge and desire to make modern digital products, will meet with those who have financial expertise, banking experience and an understanding of what can and can not improve under the conditions of the existing regulations.

- How can the efficiency of banks be improved?

As usual, the main factor is the human factor. In modern banks there are too many literally extra people. People who are engaged in checking and conducting transactions. Managers and clerks who serve in the offices of clients on operations that could be carried out online. Analysts who are involved in asset management clients, studying the market and leading the auction. Even cleaners who are forced to clean every day the huge areas of these offices and branches of the bank are all bold items of expenditure from which you can and should get rid of.

Even skilled labor can already be replaced by robots: for example, JP Morgan’s new development analyzes financial documents, which previously required 360,000 hours of work by lawyers and loan managers per year - this is equivalent to full employment of two hundred employees who do not receive the smallest salaries then add up to the cost of services of the bank itself.

Another thing is that to do this is not so simple. In fact, it can be said that it is necessary to reinvent the bank - and we know for sure that it is easier and cheaper to do it from scratch than to change a large structure that has been established for decades. So the idea of “Polybius” appeared: a digital bank created from the very beginning and using all possible technologies of 2017.

- So, in the "Polybius", too, everything will be digital?

All that can be digitized - we digitize. We will strive to digitize even that which cannot be digitized. Bank payments are not rocket science, but simply data exchange. All transactions are the creation, transfer and storage of electronic messages. The skeleton of the bank, its idea is the transfer or creation (in the case of loans) of conditional value and storage of information about it. The first banks did not need anything for this except the table and the book of accounting (the Italian word banco means “bench, shop, table” on which the money changers were putting coins). You do not need a lot of staff.

Of course, banks also have their assets, private clients and other concerns besides payments. But there is also a huge space for optimization due to modern technologies. Human participation is still needed, but in a much smaller number: only to control the operation of robots and make critical important decisions that we are not yet ready to trust even the smartest AI.

The entire document flow in Polybius will be digital. We will use the blockchain for this: the technology itself provides a 100% guarantee that the specific information was placed there at a specific point in time, and will be there without a chance to be erased or changed.

- Will this evidence be perceived by legally relevant courts of the EU and other countries?

Yes, as soon as we pass the appropriate audit. When we conduct an ICO, launch a banking platform, including storing data in the blockchain, register the Charter and other important legal papers, we will need to confirm that all of this complies with European laws. To do this, we turn to an audit in the Central Bank of one of the countries of the European Union. Most likely, it will be the Central Bank of Finland or the Central Bank of Lithuania. The state banks of both these countries position themselves as the most focused on the introduction and adaptation of modern technologies. In particular, Lithuania explicitly declares as a state - to become the leader of the fintek segment in the global division of labor, therefore both central banks are as loyal as possible to new technologies, including the blockchain.

Regardless of the country chosen, the Central Bank will conduct a thorough and meticulous audit of our bank: from the front-end to the back-end - from the digital and legal side of the issue. Including, of course, the security of the blockchain as a repository of information. Roughly speaking, the regulator will climb with the flashlight into the darkest corners in order to study the compliance of Polybius Bank with European standards of regulation.

- Are you sure that the blockchain in a real bank will not embarrass them?

It is not important for the regulator where and how we store data: at least on napkins, at least on the blockchain, if the process of adding, encrypting and storing records meets the standards adopted by legislators. And after the audit is completed, regardless of the Central Bank of which country it will hold, our software will be automatically licensed for banking activities throughout the EU.

All our activities, starting with ICO and including the actual launch and operation of the bank, are governed by EU laws.

The project team consists of people with great expertise in both the technology and banking sectors. All our faces can be seen on the Polybius website .

- How long can an audit take?

From two months. While there will be an audit, we will deal directly with the construction of the bank: hiring people, building partnerships and solving many other corporate issues.

- How much is the creation of a bank?

The cost of creating a financial institution depends on the type chosen. There are only three of them.

Accordingly, the budget for the launch of "Polybius" is $ 6 million. To collect these funds, we launch ICO - a digital analog IPO, but instead of shares we issue smart contracts for sale, guaranteeing investors a share in the bank's profits.

The audit will begin at the end of the ICO, when we fully understand how much money we manage to launch Polybius and what type of institution we need to audit. A year later, the bank should cover at least current expenses at the expense of income and begins to generate income for investors who have acquired tokens.

- What is ICO?

ICO is a modern way of financing digital projects and technological solutions. This is crowdfunding based on cryptocurrencies. Investors do not acquire bank shares, but digital tokens, which are a smart contract in which the necessary obligations are stated. ICO will allow you to obtain licenses, pass an audit, hire employees, develop or buy the necessary technologies, conduct an advertising campaign and work through the first year and a half before reaching the operating profit.

- Why ICO? Why is traditional crowdfunding not suitable?

We are a digital bank and focus on digital solutions. Unlike traditional crowdfunding, which includes a platform commission, ICO is cheaper: which means that more funds remain for developers.

But the main thing is the availability of smart contracts. In ordinary crowdfunding, the interaction of the baker and the recipient of money is a one-time: made money - received the goods, the product. The smart contract ensures continuous cooperation: acquired Polybius tokens represent a digital obligation in the form of a smart contract to pay dividends to their owners.

At the same time the token itself has its own value. Roughly speaking, having financed a new type of pencil on Kickstarter, and having bought them for a dollar, in a year you are unlikely to sell them for the same dollar. And certainly not sell for two. And it will be possible to resell the token. It can grow in value. It has a value in the form of a recorded obligation to receive a share of the bank’s profits (dividends). And they are more comfortable to manage. Each person has a paper contract with the bank at home, which you do not use in practice and are unlikely to even read. A Polybius token will be stored in the Ethereum blockchain. Nobody can fake it or destroy it. In this case, you can dispose of them remotely.

- How to make money for investors? How much money do I need to make money on it?

We make a bank for people, so the minimum cost of entry is only $ 10, this is the cost of one token. People sometimes spend no less on various digital subscriptions per month. A couple of paid services per month - and already 10 bucks come. Even a beer to go to drink in Tallinn in the evening after work will cost no less. At the same time, the value of the token is much higher: it will not expire in a year, and it will have value as long as the “Polybius Bank” project exists and functions. And as the bank grows, both the profit on the token and the value at which it can be resold will grow. Thus, this is an investment in its pure form: you invest in it once, and then it works for you. We will allocate for dividends on tokens 20% of the bank's profits, which will be distributed depending on the contribution among all investors who participated in the ICO.

Each of our investors can create their own bank account and get their own digital ID.

ICO starts this spring. The exact date will be announced soon. In order not to miss this event, and to have time to purchase tokens in the first weeks, while there will be bonuses, subscribe to the newsletter with a notification on the website polybius.io

The website bits.media interviewed our speaker Edgar Burs in which he described in detail the bank registration process and spoke about the types of licenses of financial institutions. Among other things, it answers the questions asked in the comments to the first article.

- How did the idea of a bank like Polybius originate from the very beginning?

')

I live in Estonia. Estonia is now known as one of the most digitized countries in the world, we even have the concept of e-residency. And here we are already accustomed to the fact that all services and services are available online. In Estonia, everything is digital. The idea is that opening a bank account should be no more difficult than registering an email: fill in an online form, go through online authentication - and go ahead. In real life, everything is still not so rosy.

Banks still look like analog dinosaurs: huge commissions, working hours, weekends, lots of manual labor, and more. Looking at this, any technically advanced person could not help but think about how to change this situation. Thus, the emergence of a modern digital bank was a matter of time - when, roughly speaking, those who have the experience, knowledge and desire to make modern digital products, will meet with those who have financial expertise, banking experience and an understanding of what can and can not improve under the conditions of the existing regulations.

- How can the efficiency of banks be improved?

As usual, the main factor is the human factor. In modern banks there are too many literally extra people. People who are engaged in checking and conducting transactions. Managers and clerks who serve in the offices of clients on operations that could be carried out online. Analysts who are involved in asset management clients, studying the market and leading the auction. Even cleaners who are forced to clean every day the huge areas of these offices and branches of the bank are all bold items of expenditure from which you can and should get rid of.

Even skilled labor can already be replaced by robots: for example, JP Morgan’s new development analyzes financial documents, which previously required 360,000 hours of work by lawyers and loan managers per year - this is equivalent to full employment of two hundred employees who do not receive the smallest salaries then add up to the cost of services of the bank itself.

Another thing is that to do this is not so simple. In fact, it can be said that it is necessary to reinvent the bank - and we know for sure that it is easier and cheaper to do it from scratch than to change a large structure that has been established for decades. So the idea of “Polybius” appeared: a digital bank created from the very beginning and using all possible technologies of 2017.

- So, in the "Polybius", too, everything will be digital?

All that can be digitized - we digitize. We will strive to digitize even that which cannot be digitized. Bank payments are not rocket science, but simply data exchange. All transactions are the creation, transfer and storage of electronic messages. The skeleton of the bank, its idea is the transfer or creation (in the case of loans) of conditional value and storage of information about it. The first banks did not need anything for this except the table and the book of accounting (the Italian word banco means “bench, shop, table” on which the money changers were putting coins). You do not need a lot of staff.

Of course, banks also have their assets, private clients and other concerns besides payments. But there is also a huge space for optimization due to modern technologies. Human participation is still needed, but in a much smaller number: only to control the operation of robots and make critical important decisions that we are not yet ready to trust even the smartest AI.

The entire document flow in Polybius will be digital. We will use the blockchain for this: the technology itself provides a 100% guarantee that the specific information was placed there at a specific point in time, and will be there without a chance to be erased or changed.

- Will this evidence be perceived by legally relevant courts of the EU and other countries?

Yes, as soon as we pass the appropriate audit. When we conduct an ICO, launch a banking platform, including storing data in the blockchain, register the Charter and other important legal papers, we will need to confirm that all of this complies with European laws. To do this, we turn to an audit in the Central Bank of one of the countries of the European Union. Most likely, it will be the Central Bank of Finland or the Central Bank of Lithuania. The state banks of both these countries position themselves as the most focused on the introduction and adaptation of modern technologies. In particular, Lithuania explicitly declares as a state - to become the leader of the fintek segment in the global division of labor, therefore both central banks are as loyal as possible to new technologies, including the blockchain.

Regardless of the country chosen, the Central Bank will conduct a thorough and meticulous audit of our bank: from the front-end to the back-end - from the digital and legal side of the issue. Including, of course, the security of the blockchain as a repository of information. Roughly speaking, the regulator will climb with the flashlight into the darkest corners in order to study the compliance of Polybius Bank with European standards of regulation.

- Are you sure that the blockchain in a real bank will not embarrass them?

It is not important for the regulator where and how we store data: at least on napkins, at least on the blockchain, if the process of adding, encrypting and storing records meets the standards adopted by legislators. And after the audit is completed, regardless of the Central Bank of which country it will hold, our software will be automatically licensed for banking activities throughout the EU.

All our activities, starting with ICO and including the actual launch and operation of the bank, are governed by EU laws.

The project team consists of people with great expertise in both the technology and banking sectors. All our faces can be seen on the Polybius website .

- How long can an audit take?

From two months. While there will be an audit, we will deal directly with the construction of the bank: hiring people, building partnerships and solving many other corporate issues.

- How much is the creation of a bank?

The cost of creating a financial institution depends on the type chosen. There are only three of them.

- The first type: an authorized payment institution. In fact, a simple payment system. Its creation, including the entire development, costs approximately $ 1.5 million.

- The second type: electronic money institution, an electronic money institution. Creating a "own Paypal" is worth $ 3 million.

- The third type: commercial bank. The cost of opening a bank ranges from $ 6 million, including operating expenses for the first year of operation, before the bank becomes self-sufficient.

Accordingly, the budget for the launch of "Polybius" is $ 6 million. To collect these funds, we launch ICO - a digital analog IPO, but instead of shares we issue smart contracts for sale, guaranteeing investors a share in the bank's profits.

The audit will begin at the end of the ICO, when we fully understand how much money we manage to launch Polybius and what type of institution we need to audit. A year later, the bank should cover at least current expenses at the expense of income and begins to generate income for investors who have acquired tokens.

- What is ICO?

ICO is a modern way of financing digital projects and technological solutions. This is crowdfunding based on cryptocurrencies. Investors do not acquire bank shares, but digital tokens, which are a smart contract in which the necessary obligations are stated. ICO will allow you to obtain licenses, pass an audit, hire employees, develop or buy the necessary technologies, conduct an advertising campaign and work through the first year and a half before reaching the operating profit.

- Why ICO? Why is traditional crowdfunding not suitable?

We are a digital bank and focus on digital solutions. Unlike traditional crowdfunding, which includes a platform commission, ICO is cheaper: which means that more funds remain for developers.

But the main thing is the availability of smart contracts. In ordinary crowdfunding, the interaction of the baker and the recipient of money is a one-time: made money - received the goods, the product. The smart contract ensures continuous cooperation: acquired Polybius tokens represent a digital obligation in the form of a smart contract to pay dividends to their owners.

At the same time the token itself has its own value. Roughly speaking, having financed a new type of pencil on Kickstarter, and having bought them for a dollar, in a year you are unlikely to sell them for the same dollar. And certainly not sell for two. And it will be possible to resell the token. It can grow in value. It has a value in the form of a recorded obligation to receive a share of the bank’s profits (dividends). And they are more comfortable to manage. Each person has a paper contract with the bank at home, which you do not use in practice and are unlikely to even read. A Polybius token will be stored in the Ethereum blockchain. Nobody can fake it or destroy it. In this case, you can dispose of them remotely.

- How to make money for investors? How much money do I need to make money on it?

We make a bank for people, so the minimum cost of entry is only $ 10, this is the cost of one token. People sometimes spend no less on various digital subscriptions per month. A couple of paid services per month - and already 10 bucks come. Even a beer to go to drink in Tallinn in the evening after work will cost no less. At the same time, the value of the token is much higher: it will not expire in a year, and it will have value as long as the “Polybius Bank” project exists and functions. And as the bank grows, both the profit on the token and the value at which it can be resold will grow. Thus, this is an investment in its pure form: you invest in it once, and then it works for you. We will allocate for dividends on tokens 20% of the bank's profits, which will be distributed depending on the contribution among all investors who participated in the ICO.

- On the first day of ICO, tokens will be sold with a 25% bonus on top, over the next four weeks, bonuses will gradually decrease.

- If you are afraid to miss the first day of ICO and wish to reserve tokens with the maximum bonus, please contact us by mail info@polybius.io

Each of our investors can create their own bank account and get their own digital ID.

ICO starts this spring. The exact date will be announced soon. In order not to miss this event, and to have time to purchase tokens in the first weeks, while there will be bonuses, subscribe to the newsletter with a notification on the website polybius.io

Source: https://habr.com/ru/post/402871/

All Articles