Chinese WeChat continues to successfully promote payments within the messenger

An ecosystem is the golden hen of any service or product. Now Internet projects are seeking to increase the amount of time online for their user, offering him more and more new features. Among the first, this trend was picked up by social networks: the expansion and refinement of existing functions, the introduction of money transfer systems, the revision of its own fundamental rules (in the case of Twitter), and so on.

Popular messengers do not lag behind their older brothers and that year they abandoned the policy of asceticism, which was popular at the beginning of the decade: Viber develops user correspondence functions, although initially focused on VoiP services, Telegram, on the contrary, adds the possibility of a voice call. All this is seasoned with a chat-bots system , which, it would seem, have sunk into oblivion ten years ago with the public chat rooms themselves. But the main feature of the past few years has been the introduction of an internal payment system. For example, about a year ago, a similar service was launched on the social network VKontakte.

')

The Chinese service WeChat is expected to follow the trends, but it went further than its counterparts in the market, learning from the experience of social networks, its competitors and other projects. So, the instant messenger recently introduced a global search system directly from WeChat, so that its users do not have to go beyond the project ecosystem. Another innovation - bots applications that are being introduced following the example of Facebook. But sometimes instead of following the trends, the Chinese create them. The system of internal payments appeared in WeChat in 2014.

What is WeChat and what can it do

WeChat is a text and voice messaging system from the Chinese company Tencent. The first release of the application took place in 2011. WeChat supports all current platforms: iOS, Android, Windows Phone, as well as Blackberry and Symbian. The total number of users is estimated at 800 million people, most of whom are from China.

WeChat, like many products of the Middle Kingdom, do not see anything wrong with borrowing successful decisions from Western colleagues. So, the voice and video calls, money transfers and even filters for photo processing (hi, Instagram) have already been introduced into the messenger.

The creators of the application do everything to ensure that users spend as much time as possible in WeChat. The Chinese can boast, for example, the successful implementation and promotion of the money transfer system within the application. The possibility of paying bills and transferring funds without leaving the application came to many Chinese people and WeChat set a kind of record last winter: during the celebration of the Chinese New Year, which, by the way, lasts 15 days, more transactions were made via WeChat than with PayPal for the whole of 2015. This is due to the Chinese tradition of sending a "red envelope" - a certain amount of money, not always large, as a New Year's gift to relatives and friends.

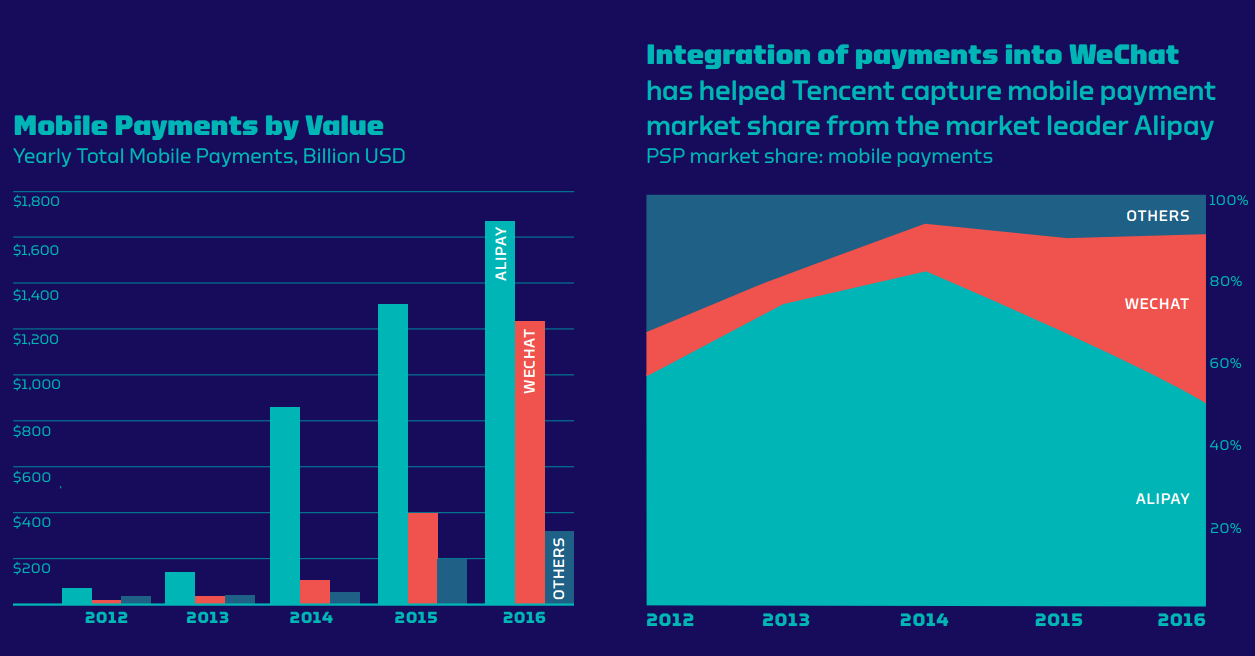

Speaking of WeChat and its successes on the path of fintech and payments, another Chinese giant, AliPay, comes to mind. However, according to some indicators, the Chinese messenger is superior to the Alibaba payment service, and the further development and introduction of new functions will only strengthen its position both in its native China and in foreign markets. Some figures from the study "Social Networks, E-Commerce Platforms" ( Full PDF 1.5 Mb , Hihglights PDF 0.53 Mb ), which was published in April 2017.

In 2015, AliPay was used by 450 million people monthly, translating, on average, $ 2,921 each. The WeChat audience then numbered 697 million people, who, on average, transferred $ 568 each. However, in 2016 the average transfer amount in WeChat grew by 168%, to $ 1,526 per user.

The image is clickable. Two graphics, reflecting the situation in the Chinese market of mobile payments over the past five years. It is seen that in 2016, WeChat made a sharp jump and won a significant share of AliPay.

If we recall the previously mentioned tradition of sending "red envelopes", then in 2017 WeChat only improved its performance: Chinese users made 46 billion transactions under the guise of "red envelopes", showing an increase in the popularity of this service by 43% compared to 2016. The creators of WeChat ideally used the cultural tradition of their country. The mailing of “red envelopes” via WeChat was so pleasing to users that many of them first made an account for themselves and tied bills specifically to send out presents and make their loved ones happy.

Increasing expansion

The Chinese messenger does not plan to dwell exclusively on the user segment. So, WeChat plans to press AliPay in the Asian market. Messenger with its money transfer system plans to enter the market of Thailand and India. These countries were chosen primarily because of their popularity with Chinese tourists. According to statistics, almost half of online purchases are made by users of the Middle Kingdom using a smartphone. But it is obvious that the plans of WeChat and expansion among the main population of these countries.

Also in the plans of the Chinese messenger to increase the presence of chat bots for making payments. About one hundred companies already use such services and another five hundred are under connection. Corporate payment bots are not an innovation. The Facebook Messenger, for example, has been running the MasterCard bot for quite some time, but the Chinese seem to be at the forefront of innovation.

“In China, everything is done via WeChat. Email for them is outdated. This service has registered 1.1 billion accounts for 750 million active users. All China uses WeChat. In the West, only Facebook and e-mail are still available, ”said Wyre CEO Michael Danworth.

WeChat can get widespread in Russia

A few weeks ago in the domestic media there were news that did not attract the proper attention. In early May, Roskomnadzor blocked a number of messengers and resources that refused to recognize themselves as ORI. These include resources Opera, Line, Vimeo and Chinese WeChat.

But already on May 11, the Kommersant publication reported that Roskomnadzor removed the lock from WeChat . The Chinese messenger for the week managed to resolve all issues with the regulator, agreed to cooperate with the authorities and secured the release of the lock on the territory of the Russian Federation. Given that the Chinese are always very selective in their efforts and seize the markets in stages, not trying to “bite more than they can swallow”, we can say that WeChat has plans in the territory of the Russian Federation.

Tencent, owner of WeChat, already has assets in the Russian Internet space. The company is one of the shareholders of the local Internet giant Alisher Usmanov Mail.ru Group. Yes, the Chinese company owns about 7.4% of ordinary shares and 1% of the voting (according to data for 2015), but this can be regarded as evidence of cautious interest in the Russian market. Operational unlocking, as well as the presence of the Russian version of the site WeChat confirmation of this.

Of course, WeChat will be difficult to compete with VKontakte or other popular Western messengers, but Tencent can always try to play a direct payment card on AliExpress bypassing the official application. Also, the system of money transfers within messengers while in the territory of the Russian Federation is in its infancy: only Mail.ru Group makes tentative steps in its social networks, OK and VKontakte. The appearance of such functions in Viber or Telegram is possible, but WeChat already has three years of experience in this field and has processed billions of payments, surpassing even PayPal in this indicator.

Whatever the Chinese from WeChat do, it will be good for Western and Russian users. The Chinese should make Facebook giants move, and in the case of the Russian Federation, the Mail.ru Group and, for example, the authors of Viber and Telegram. Because in the future they will bring with their messenger a run-in and convenient money transfer service that is compatible with the world's largest trading platform in the form of AliExpress and without the childhood illnesses inherent in raw technology.

Source: https://habr.com/ru/post/402851/

All Articles