To understand the future of the financial services industry, you need to stop thinking in the framework of fintech

The problem, however, is not only that businesses still have not “caught up” with the main trends, not to mention the study of the wide opportunities that regtech or integrated banking solutions offer for business.

Fintech trends do not allow us to predict the future, but often they only represent a momentary business opportunity that allows achieving sharp growth for no apparent reason.

There is a huge community in the world today from more than 7.2 thousand FINTECH start-ups that bring undoubted benefits in various market segments, such as democratization of international money transfers, cross-border payment solutions , eliminating barriers for businesses, inclusiveness through the creation of identification tools. on the blockchain and many others.

On the other hand, every entrepreneur is a businessman, and every startup is a risky business enterprise, pursuing some real goal of reaching the level of self-sufficiency and ultimately making profit. Trying to assess business opportunities, entrepreneurs, among other things, resort to forecasting, by evaluating the size of the market, potential demand and industry trends in various segments, and also look at role models that successfully work in one or another segment of interest.

')

Why does the world need more than a thousand payment companies?

We turn our attention to the field of payments. Its main role models are Stripe, Square Cash, PayPal, M-Pesa, AliPay, and Venmo. Thanks to their success, more than 1,000 payment companies are already operating in the world. And indeed, why not take advantage of this opportunity? In the end, in the third quarter of 2016, PayPal’s revenues from processing mobile payments amounted to about $ 26 billion, a 56% increase from last year. Gains from mobile payments account for 29% of the company's total quarterly volume. According to the forecasts of its main director, Daniel Schulman, work with payments in this segment will allow PayPal to earn $ 100 billion in profits in the next 12 months.

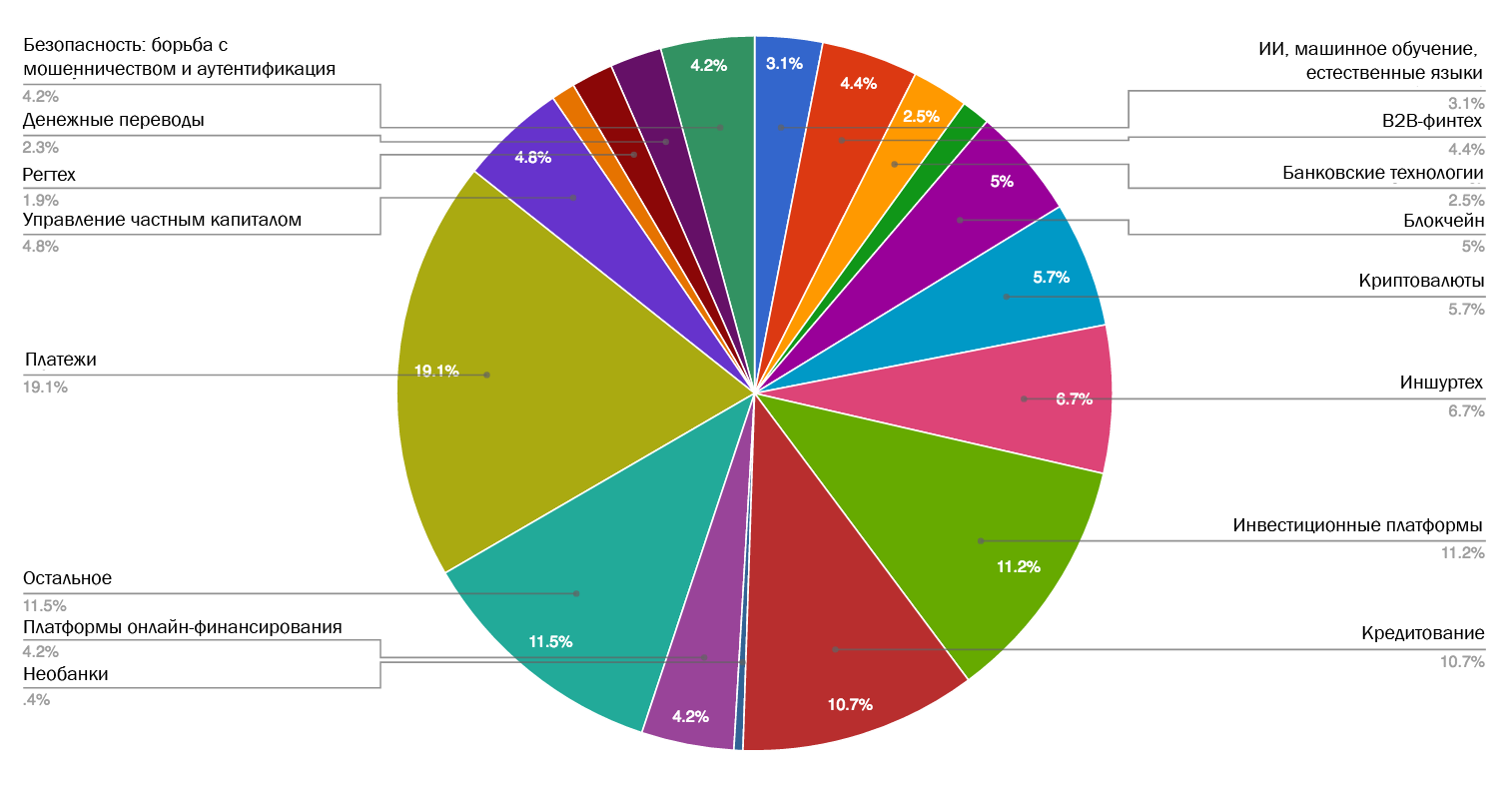

Not surprisingly, payments, loans and financing remain both very popular and well-funded segments. According to the LTP MEDICI database , such segments of the payment sphere as mobile wallets and payments represent the largest piece of the “payment pie”: more than 34% of the players in this sphere are engaged in this very direction.

Source: MEDICI

Against the background of a very clearly traced and common for all industries focus on mobile technology, participation in the mobile payment market, apparently, promises an obvious profit. Despite the long-awaited wow effect of mobile payments, start-ups in this area still appear with enviable regularity, ignoring the quite logical question of whether consumers really need another payment application in their phones. Is the experience offered by each new mobile payment method fundamentally and radically different from other applications available in this segment? Are there really new blue oceans in front of us? The answers to these questions are likely (or even certain) to be negative.

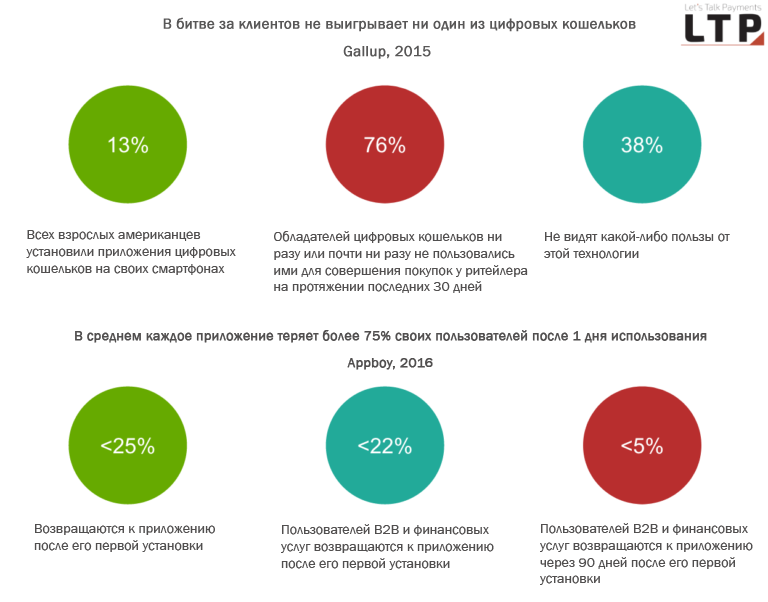

Speaking of consumers, according to a 2015 Gallup study, only 13% of all adult Americans at the time of the survey had installed digital wallet applications on their smartphones. Moreover, 76% of owners of digital wallets have never or almost never used them to make purchases from a retailer during the past 30 days. Today, disconnected experience and individual islands of mobile payment solutions are rather an obstacle to the development of the entire segment.

Moreover, applications for the most part have problems with retaining users: estimates show that <25% of users return to the application after its initial installation, and the total customer retention rate drops to 11% during the week after installation. After 45 days, this figure decreases to 5%, falling to a level of 4.1% after 90 days.

We will not go into the long-standing business model of FINTECH start-ups, and especially those that represent the lending segment . I also will not deal with slowly but surely developing banking applications that almost caught up with other applications in terms of convenience and offering not only the basic functionality of managing credit / debit accounts, but also many other qualitatively implemented ideas that enable them to win their market share. Markets like India are ahead: the technologies and business models that have spread in them deserve special attention.

And still there is no evil without good

It is necessary, however, to recognize that the activities of the Fintech community have made possible many significant achievements. Here are some of them:

- Reassessing the role of the user interface and user perception of products in the financial services industry

- Democratization of financial products ( investment applications )

- Fintech solutions in the field of cross-border payments make it possible to expand business by reducing costs

- The emergence of new strategies for maintaining client files (alternative mechanisms for assessing credit rating and data processing)

- Cheaper international money transfers

- Using behavioral science to create advanced security solutions

- Smooth payment integration driving e-commerce growth

- Other

To understand where the world is moving in general and the financial sector in particular, watch for intersectoral leaders

As mentioned earlier, trying to understand what is happening around on the basis of analyzing the situation in the Fintech sphere alone is the same as looking into space: the starlight reaching us appeared a long time ago and far away from us, and therefore now we are actually seeing objects as They were some time ago. In the same way, modern saturation of the payments market is an indicator of the success of pioneers who started their activities a decade ago. All this, however, does not mean that mobile payments currently represent the most promising opportunity.

So what should we do to better understand the direction in which the sphere of financial services is developing. Who will rule the ball, institutional banking or fintech startups? One of the possible options is to pay attention to the progress in the areas that create the basis for the independent growth of financial services - information technology, computer computing and others like them. In other words, the question is how the underlying hardware and software technologies change and who contributes to these changes or implements them.

Let's look at some examples of “unrelated” with the subject of changes occurring in different industries and indicating which trends are gaining momentum and why:

Phasing out physical interfaces in favor of voice and virtual reality

Recently, there have been a number of changes that drastically move relationships between businesses and consumers beyond screens and physical interfaces. More importantly, these changes do not come from the financial world. Let's look at a few examples of companies promoting alternative interactive interfaces:

Apple

This is a remarkable patent for a home voice control system and other related developments. Pay Finders' Brian Rommele made a detailed analysis of this curious patent, examining the future evolution of Siri using one of the examples given in its text. It describes the situation in which Siri answers the doorbell and acts as an intermediary between the hosts and guests.

“We have before us seriously improved Siri, whose behavior is largely based on the context and use of the blackboard architecture for interaction. We see Apple’s solid approach to developing spatial-voice control technology for the home. The patent describes several other scenarios that significantly expand the capabilities of Siri, ”Rommele explains.”

Amazon

Most recently, Amazon released a voice device with a screen and a camera, which was soon examined by experts almost under a microscope. The device combines the features:

- Alexa Voice Assistant

- Fire tablet

- Chime Platforms

- Rekognition Platforms

- SnapTell / Flow Platforms

Amazon also makes its voice control technology widely available , giving developers access to the same tools that make Alexa digital assistant work. These features are provided by the Amazon Lex platform, which combines speech and text recognition with interactive interactions. It was first announced at the end of 2016 and was then “at the preliminary stage”, but according to new Reuters data , it is currently being distributed to developers.

Google Assistant is quickly becoming overwhelmed with functionality and getting smarter, understanding more and more and expanding the set of tasks it performs. Google Assistant will be able to chat with other helpers and work with calendars. Among other things, Rommele notes the fact that Google Home will have its own open platform for developers and access for 70 different manufacturers, creating products in the segment of smart homes.

Moreover, most recently, on May 18, there were reports that Google was working to the top to add the “room presence” feature on YouTube VR as part of the update for the Daydream application and the platform as a whole. New functionality has not yet been launched, but its opening is planned for a later date this year. Once launched, YouTube users will be able to do such things as chatting in a general voice chat and watching panoramic videos together. This unique experience will be aimed at creating a feeling of sharing content with people in the same room together. Users will enter the common room with the ability to view panoramic videos. Each of them will be presented with its own three-dimensional avatar.

Facebook, in turn, makes a big bet on augmented reality - an emerging technology that creates the effect of overlaying useful virtual information over the real world, which can eventually replace smartphones with something like glasses or a pair of contact lenses.

Examples of the use of new interfaces in the insurance and financial sector:

- Voice recognition technology is already becoming popular in the insurance industry. According to Chipin , in early January of this year, Fukoku Mutual Life decided to replace 34 of its employees with IBM Watson Explorer AI, able to analyze and interpret unstructured text, audio and video data to calculate the amount of insurance claims.

- In December 2016, Capital One became the first financial institution to use the services of Cortana. The company is actively investing in voice technology in order to improve the efficiency of its services. Capital One clients will now be able to manage their funds through a lively and manual data entry dialogue with Cortana.

One company went around the world to provide unparalleled computing power and its core business is not financially related.

For a long time, the main advantage underlying the superiority of fintech startups over institutional solutions was the technological component. However, just a few days ago, even the superiority of fintech was questioned by a company that had very little to do with financial services or fintech. It's about IBM.

"Blue Giant" announced the creation of a prototype processor first commercial quantum computer. This is the industry’s first attempt to create a commercially available quantum computer of a universal purpose for business and science. Professionals emphasize that the platform capable of “thinking” outside the space of zeros and ones is already capable of solving problems that were previously considered too complex for classical computer systems. This means that now she will be able to solve problems from such areas as pharmaceuticals, AI, financial services and logistics, which we hadn’t even thought about before.

While technologies like AI can find patterns hidden deep in vast amounts of data, quantum computers will be able to find solutions to important problems where there are no patterns as such, and the number of possible options to be considered is too large to be processed using classic computers. As part of this initiative, IBM invites interested parties to join it in exploring new opportunities that this completely different approach to computing can provide.

At this point, the IBM Q project team has successfully created and tested two of its most powerful universal processors for quantum computing — an achievement before which even Watson's capabilities are dying: the quantum register of a general purpose processor consists of 16 qubits , while a test sample is offered to business users from register to 17 qub. In the blink of an eye, a large technology corporation took the lead in a competitive race, taking away all the advantages that startups had recently had from regtech, AI, robo-advancing, trading and investment platforms and any other segments whose innovation is based on their ability to process and extract value from huge arrays of structured and unstructured complex data.

“The significant engineering improvements announced today will enable IBM to expand the capabilities of future processors to 50 or more qubits and demonstrate computing power that goes beyond the classic computers available today. - commented on the development of Arvind Krishna, director of IBM Research and Hybrid Cloud, - These powerful updates of our quantum systems provided by the IBM Cloud will allow us to open new horizons and practical applications, the study of which is almost impossible when using classic computers alone. "

A few conclusions from the examples above

- The following significant developments in the field of financial services or fintech will not always be associated with the discoveries made within these industries , but rather with the environments underlying any solutions - that is, hardware and software technologies. The next major leap will be made by technology companies that define modern standards and progress in increasing the computing power and availability of these new opportunities for commercial use.

- Start-ups from any segments whose competitive advantage in one form or another is based on processing data and extracting useful elements from it should consider entering a completely different level of computational capabilities . They should also understand how interactive interfaces are developed to provide useful services through the right choice of channels. This, in particular, is about such segments as AI solutions, regtech, investments, trading, robot-advisors (about the future of the latest JPMorgan experts have already expressed their doubts).

- Traditional interfaces are tested for strength by influential players such as Amazon, Google, Facebook, Apple . As an alternative to physical interfaces, giants are working on voice assistants and VR. Assistants connected to a single information space are becoming smarter and overgrown with functionality, including starting to better understand natural speech and recognize images. A bet on physical interfaces and mobile technologies can no longer guarantee the preservation of relevance against the background of the development of voice solutions. Facebook’s obsession with the idea of eliminating smartphones and its desire to conquer virtual space can lead to classic interfaces and solutions designed for them ultimately go out of style.

Source: https://habr.com/ru/post/402831/

All Articles