Short guide to the world of blockchain consortia

1. Partnership with startups

2. Own development team inside the organization

3. Joining the consortium

The results of a recent survey conducted by LTP with Infosys Finacle show that 30% of banks and financial institutions participating in it chose approach number three.

')

According to the December analysis of William Magyar, author of The Business Blockchain, in the world today there are 25 international consortia that are initiators of blockchain projects in various industries. The total number of their members reaches 550 companies, while an average of 25 participants per consortium.

Consortia

R3CEV LLC is a company that develops a distributed database technology, under which more than 80 of the world's largest financial institutions work together. Conducts research in the use of blockchain-based databases in financial systems.

Ripple is a real-time gross settlement system, currency exchange and international money transfer network under one name. The Ripple Transaction Protocol (RTXP), also called the “Ripple Protocol,” is created and works on the basis of an open distributed Internet protocol, a consensus registry, and its own currency, called XRP (ripples). It supports working with its own equivalents of fiat currencies, cryptocurrency, commodities, or any other value units, such as passenger miles or mobile minutes.

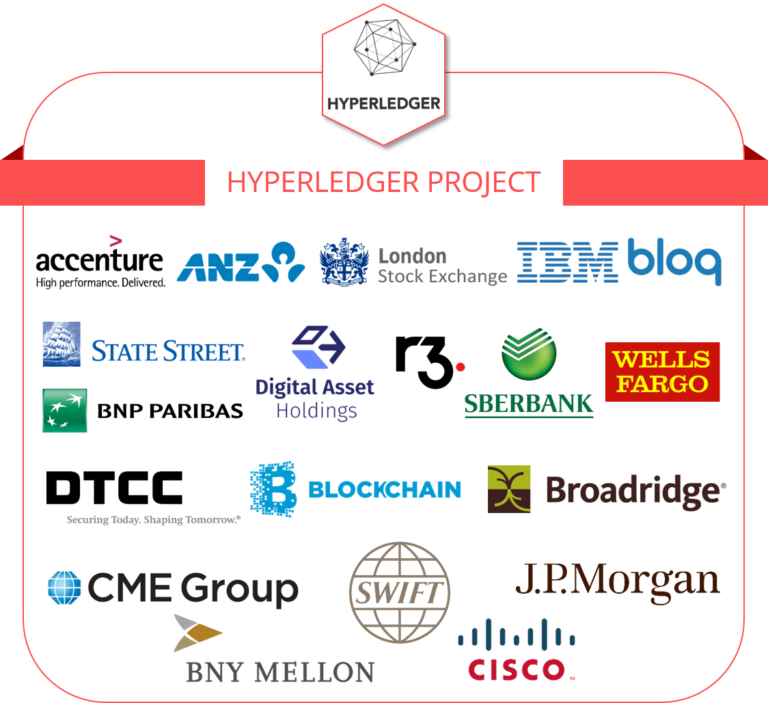

Hyperledger is a project established by the Linux Foundation in December 2015, under the auspices of which open blockchain solutions and tools are being developed. Hyperledger’s goal is to support the development of blockchain-based distributed registry technologies. The focus is on global business transactions, as well as cooperation with major technology, financial companies and suppliers. The project aims to develop and deliver to the market a wide variety of blockchains with different models of consensus and data storage, as well as services for identification, access control and work with contracts.

Digital Asset Holdings is a software company that develops and creates solutions for the financial services industry based on distributed registry technology. Its software links together business logic and legal processes with cryptographic signature streams, and ensures that transactions are recorded in closed and open distributed registries or traditional databases, depending on the requirements of specific cases. The company offers its software for various market segments, such as loans, securities, derivatives and foreign exchange transactions. Her clients are companies of various types, including banks, dealers, stock exchanges, central securities depositories, custodians, clearing agents and many other key participants in the international financial infrastructure.

Similarities and differences of these platforms

| Criterion | Hyperledger | R3 CEV | Ripple | Digital Asset Holdings |

|---|---|---|---|---|

| Membership scheme | Three levels: Premier, ordinary and associate members | Simple membership | Regional Clusters. Example: RC Cloud in Japan | Sells software to banks, dealers, exchanges, clearing and depository organizations and others. |

| Membership fee | $ 250 thousand per year for the level of premieres, $ 5-50 thousand per year for ordinary members and free membership for associates. | Fixed consultancy fees | Determined in each case individually | Determined in each case individually |

| The main direction of work | General purpose blockchain | Traditional financial transactions and agreements | Payments | Capital markets, post-trading calculations |

| Key products | Three frameworks: IBM-Fabric, Soramitsu-Iroha and Intel-Sawtooth Lake | Corda - distributed registry for fixing and managing financial agreements | Integration of basic services for corporate payments and one-time transfers | A digital asset platform using distributed registry technology for synchronized exchange of financial markets data and processes between their individual participants |

| Investments | Collective open source project financed by membership fees | Project sponsors get a stake in Corda’s subsidiary | The sponsors are Santander Innoventures, Standard Chartered Bank, Accenture, Digital Currency Group and others. | The sponsors are JP Morgan, Goldman Sachs, ABN AMRO, BNP Paribas, IBM and Deutsche Borse and others. |

Google trend analysis

Consortia, as a rule, are venture projects that are not inclined to scream publicly about the work they are doing. To assess the level of public interest in the subject, we conducted a small analysis of the popularity of keywords related to the consortia described earlier, comparing the popularity of the relevant terms in queries over the past three years. The y-axis represents the relative popularity of search terms in comparison with the most popular search queries around the world in the corresponding period of time.

It should be noted that the search phrase digital asset does not necessarily indicate the corresponding consortium. Nevertheless, we used it, because of all the available phrases it is closest to the name digital asset holdings.

These data should be viewed as a rough indicator of the general public’s interest, including financial services professionals and decision-makers. It should, however, be noted that the recent surge in interest in Ripple is associated with increased public attention to the rising cost of XRP, the local currency of the network.

The unexpected XRP leap allows us to draw some conclusions about how consumers look at the consortium approach. The case of Ripple may be the first and only one in which the supplier of corporate technologies received support from small and not having each other close ties of individual investors. Perhaps the explanation of the reasons for this support should be sought not in the sphere of fundamental or technical analysis, but in the most ordinary human emotions: fear, uncertainty and doubt. Nevertheless, this situation has greatly helped the promotion of the company's initiatives on the market.

In this regard, a scenario is possible in the future, in which the success of consortia will be closely linked to their reputation in the eyes of the general public, whose representatives will not take any part in the activities of these complex financial systems.

Source: https://habr.com/ru/post/402829/

All Articles